TS Grewal Accountancy Class 11 Solutions

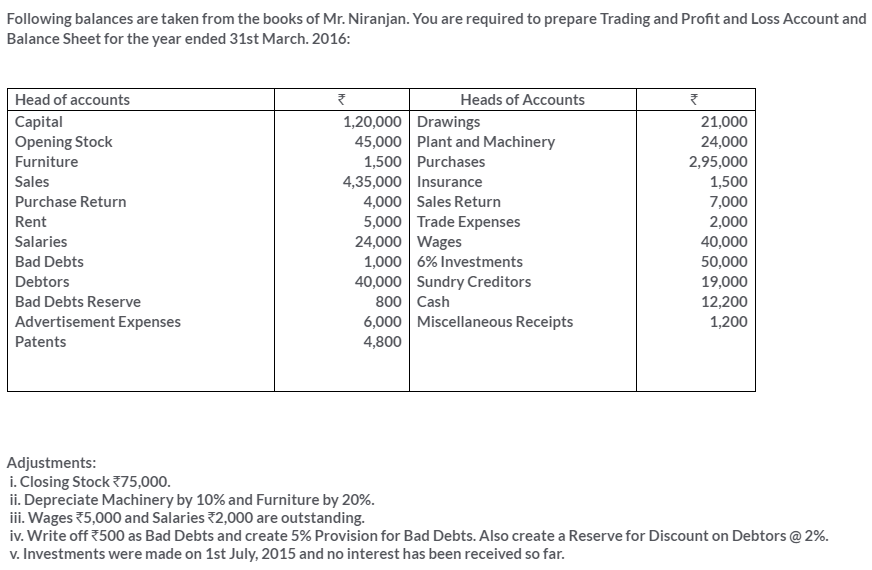

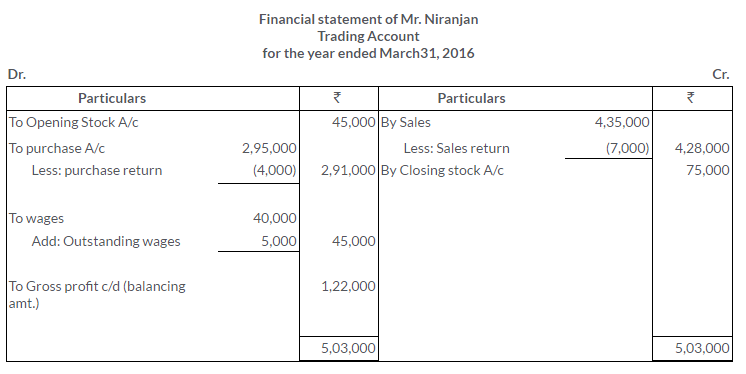

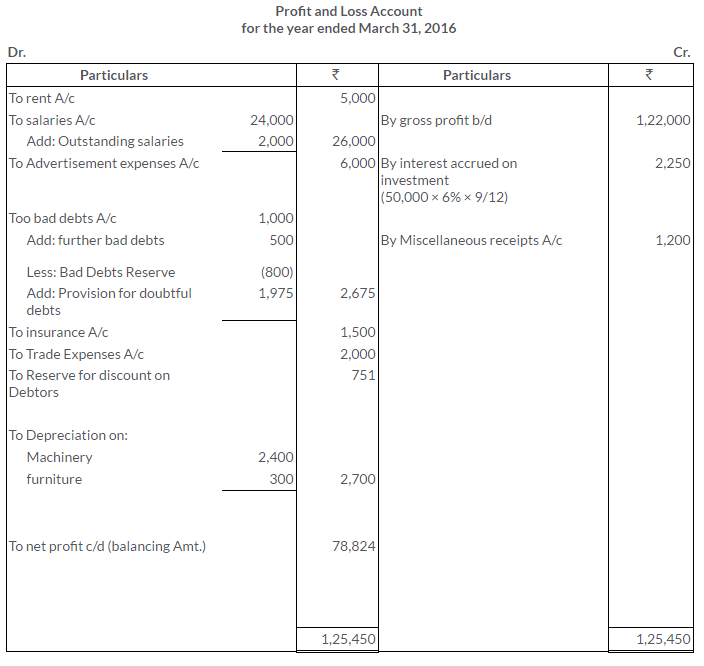

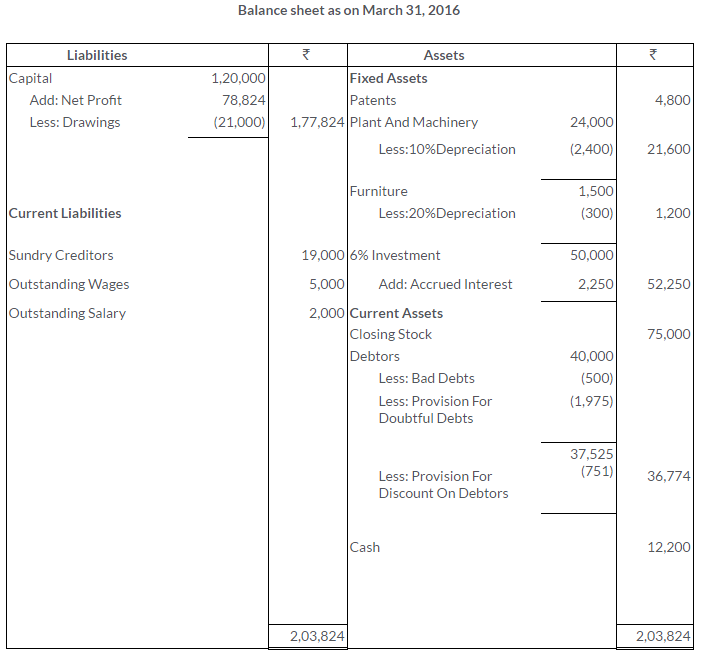

Solutions of TS Grewal’s Double Entry Book Keeping Class 11 (Accountancy) Read Online Or PDF Download, Provider By ImperialStudy For Class XI Commerce Students To get TS Grewal Book Solution (Accountancy)

Chapter 2 – Basic Accounting Terms Solution of TS Grewal’s Class 11

Chapter 5 – Accounting Equation Solution of TS Grewal’s Class 11

Chapter 6 – Accounting Procedures – Rules of Debit and Credit Solution of TS Grewal’s Class 11

Chapter 7 – Origin of Transactions – Source Documents and Preparation of Voucher Solution of TS Grewal’s Class 11

Chapter 8 – Journal and Ledger Solution of TS Grewal’s Class 11

Chapter 9 – Special Purpose Books I – Cash Book Solution of TS Grewal’s Class 11

Chapter 10 – Special Purpose Books II – Other Books Solution of TS Grewal’s Class 11

Chapter 11 – Bank Reconciliation Statement Solution of TS Grewal’s Class 11

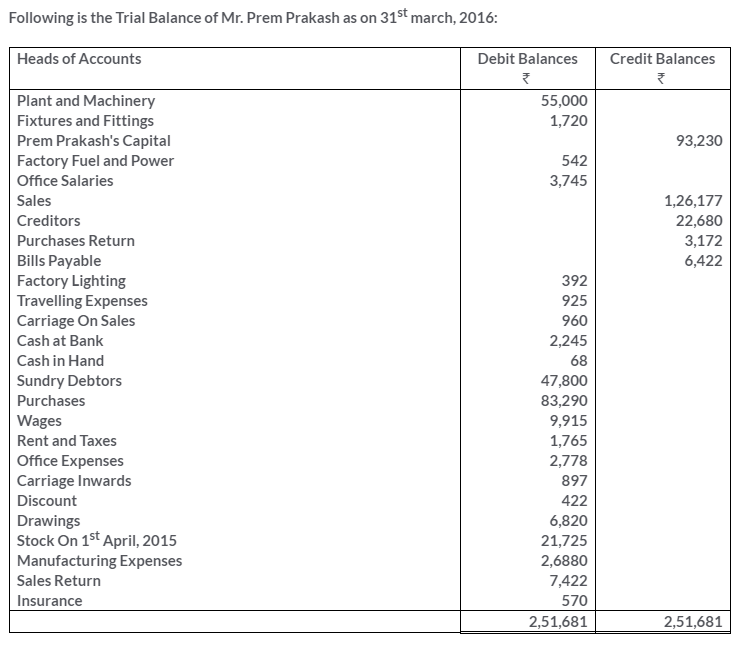

Chapter 12 – Trial Balance Solution of TS Grewal’s Class 11

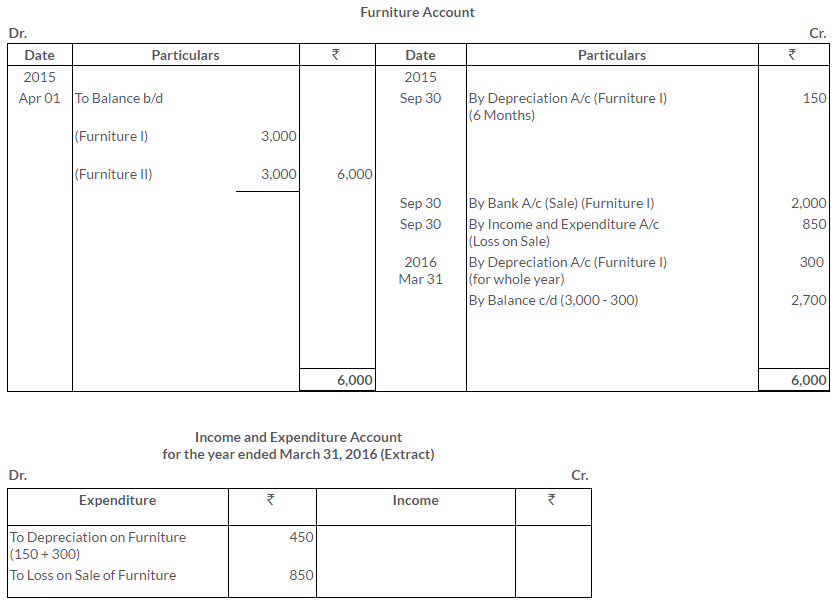

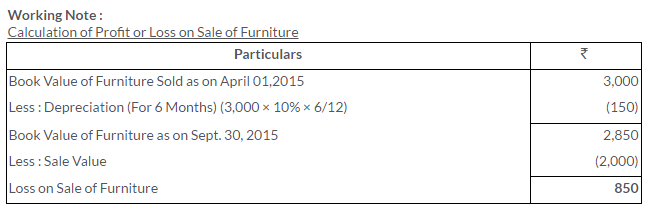

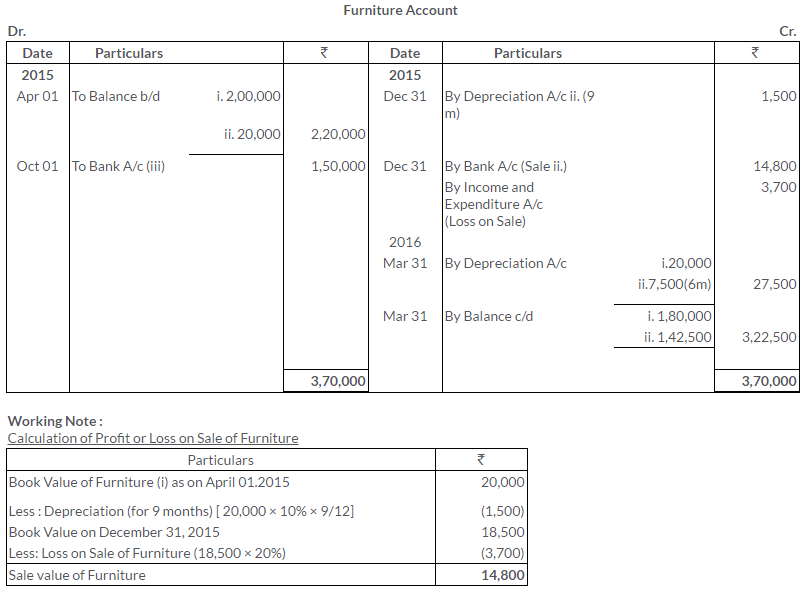

Chapter 13 – Depreciation Solution of TS Grewal’s Class 11

Chapter 15 – Accounting for Bills of Exchange Solution of TS Grewal’s Class 11

Chapter 16 – Rectification of Errors Solution of TS Grewal’s Class 11

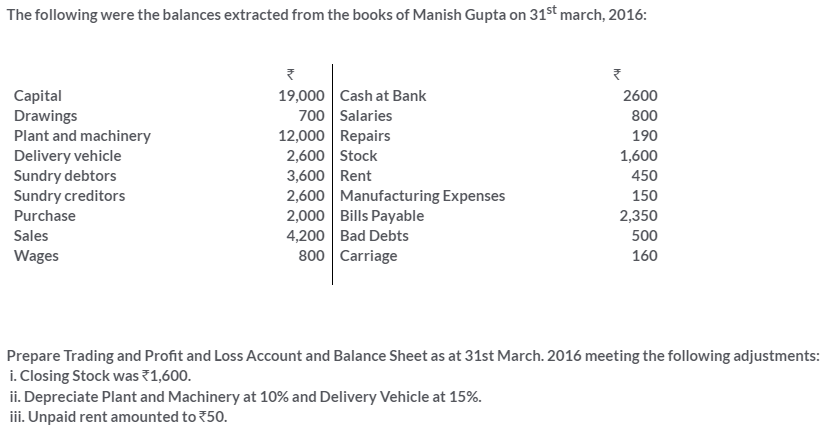

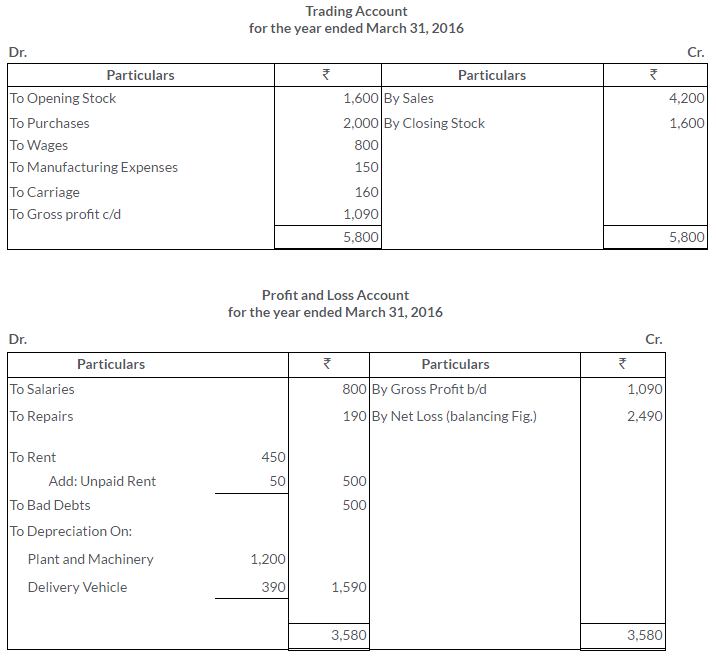

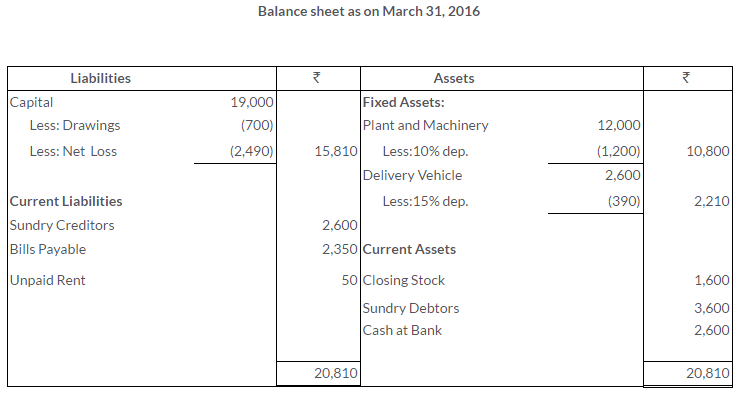

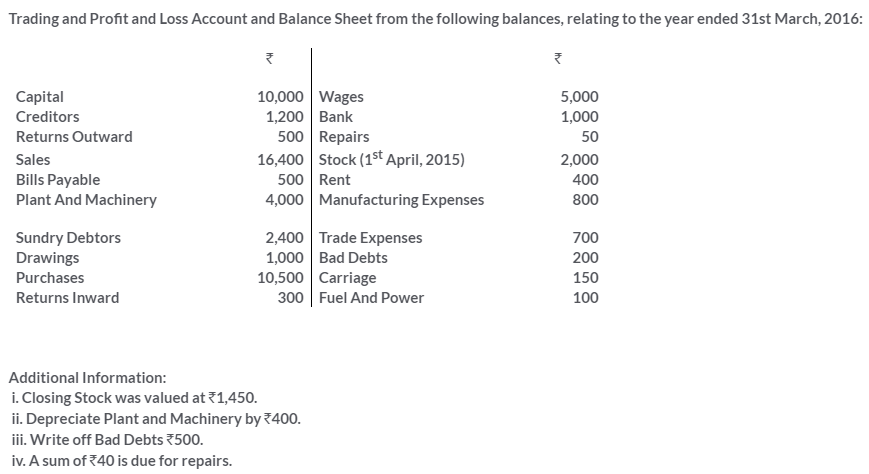

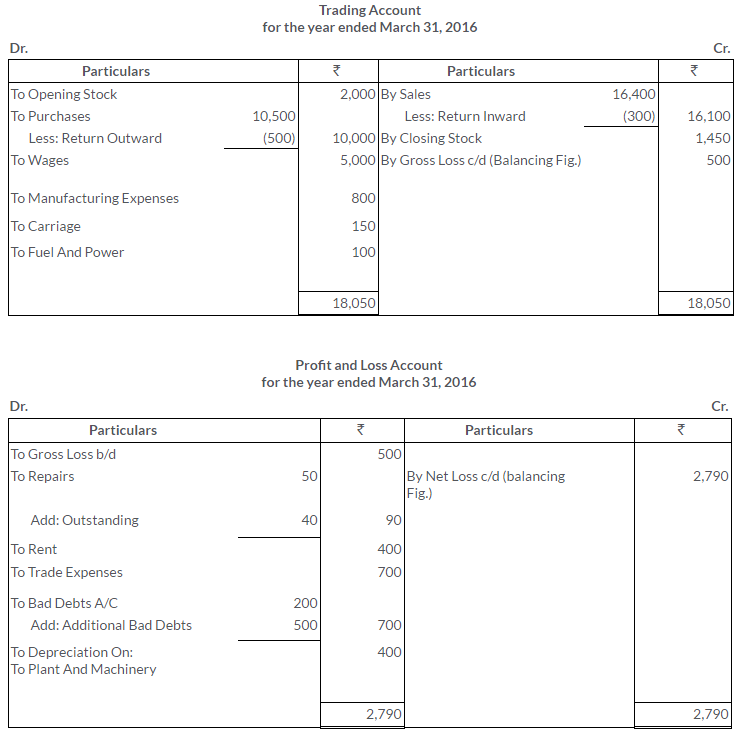

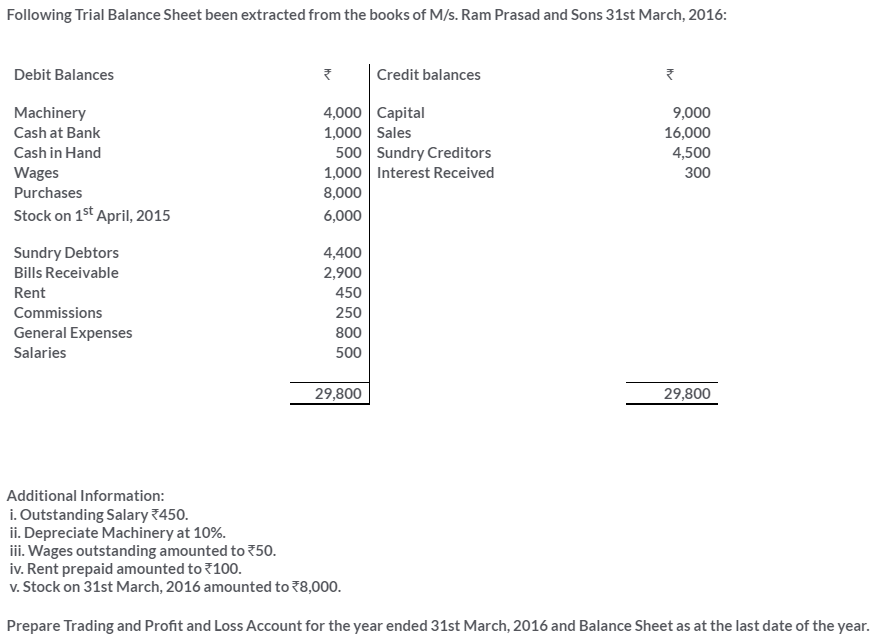

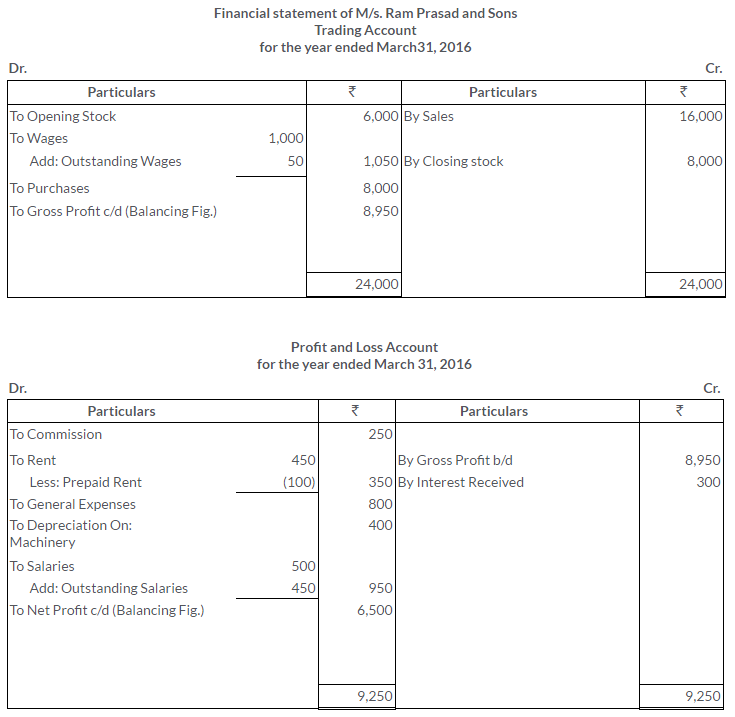

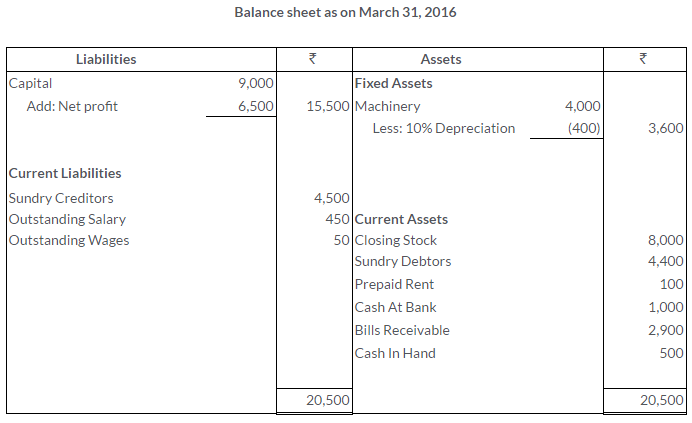

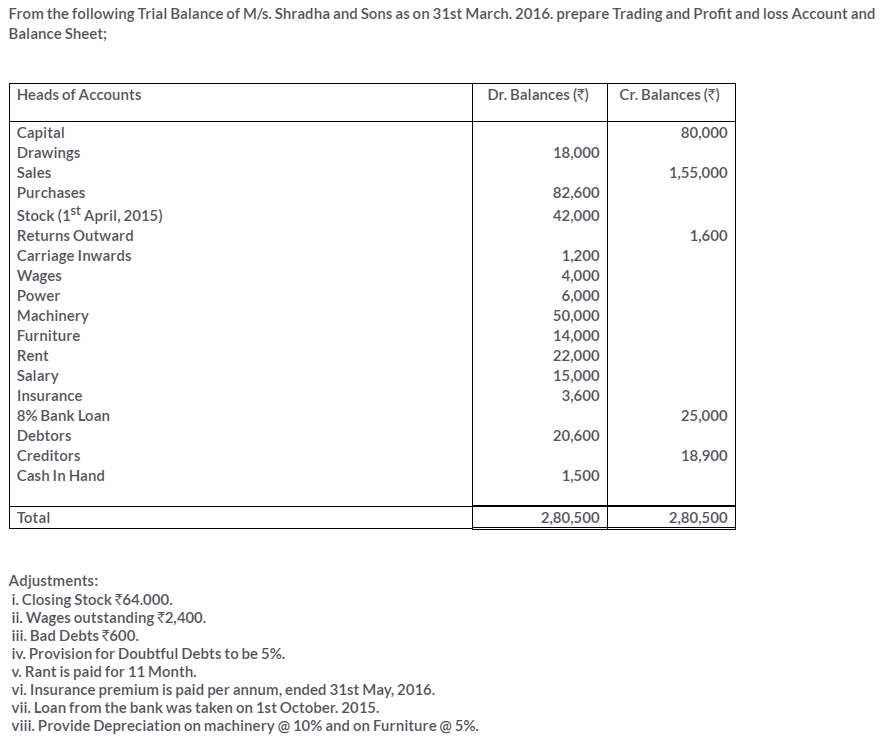

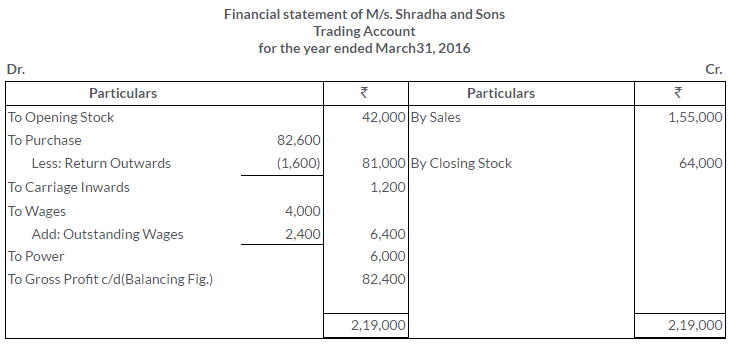

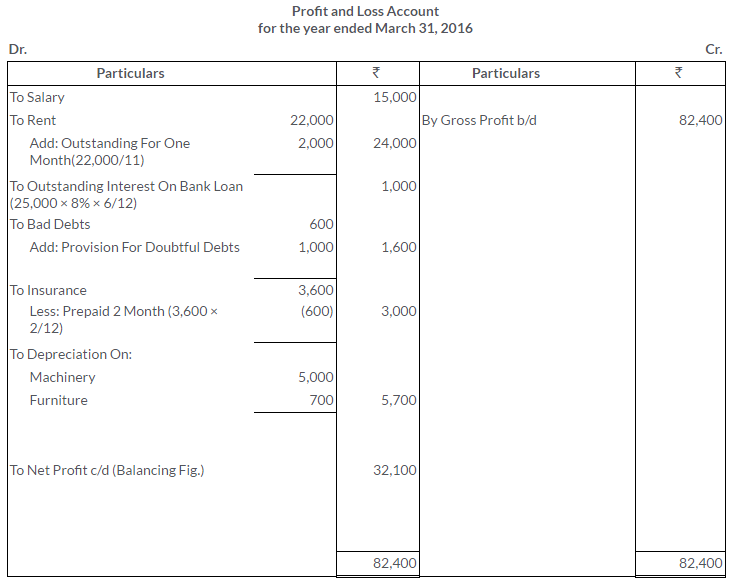

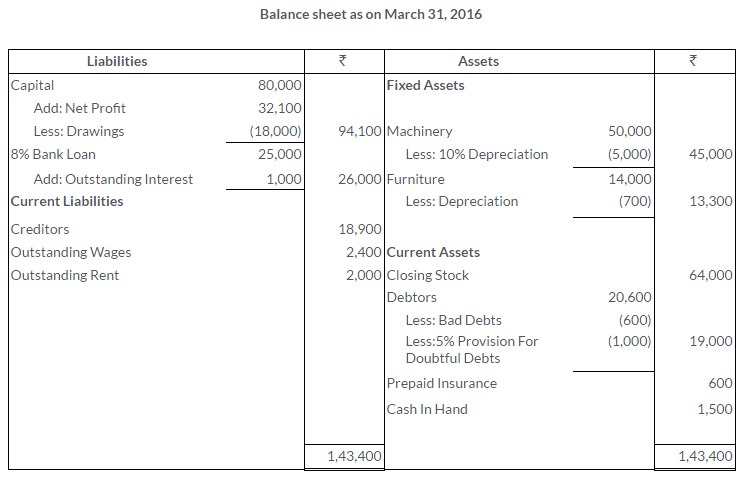

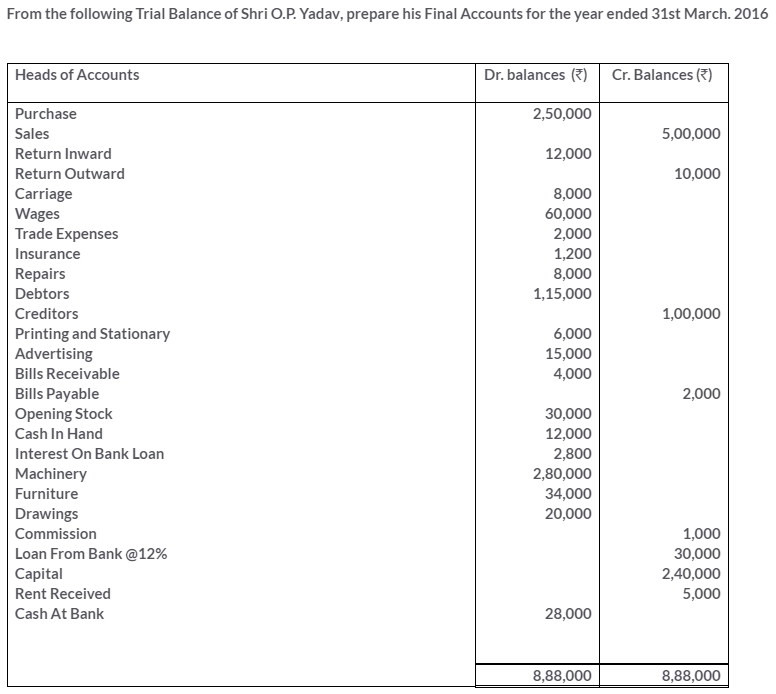

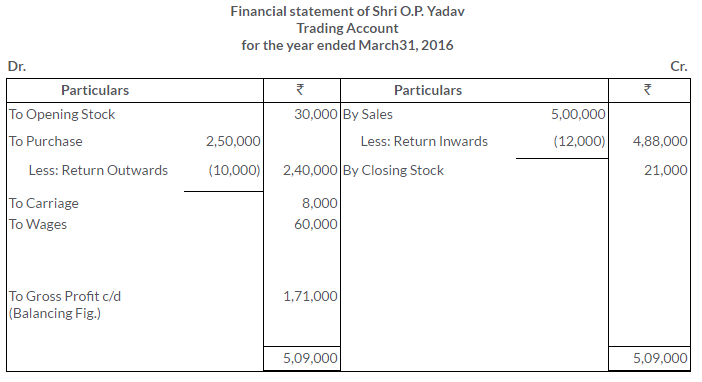

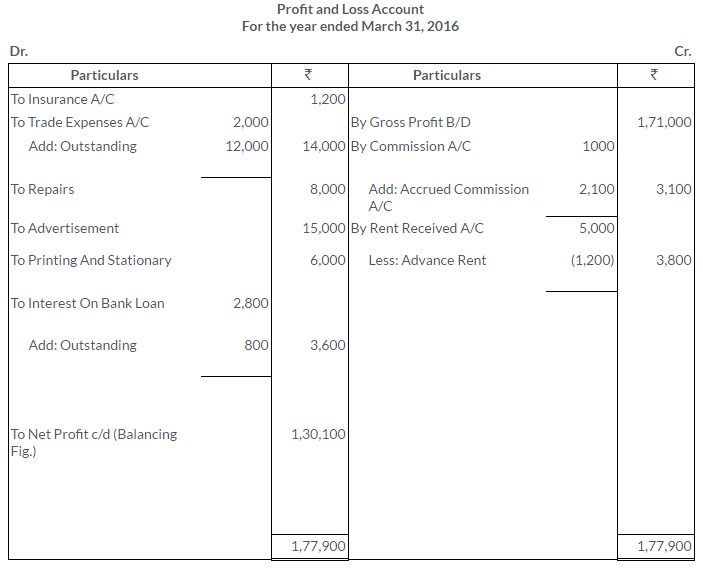

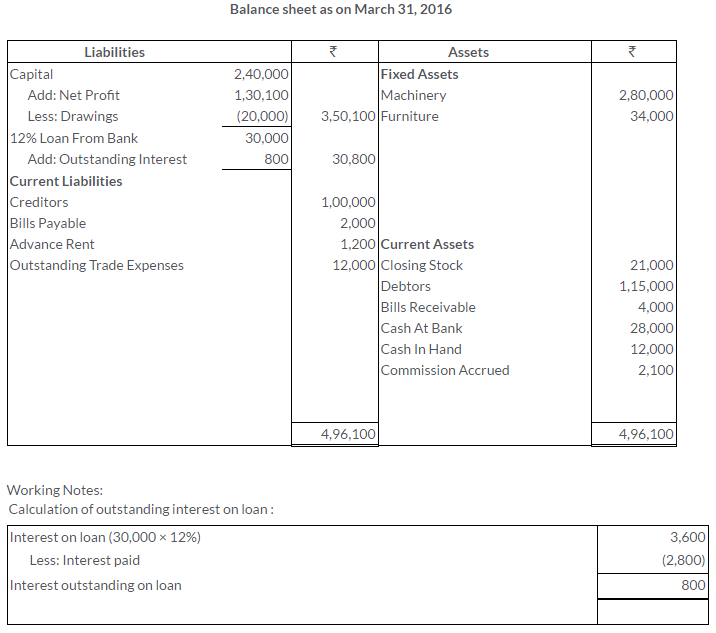

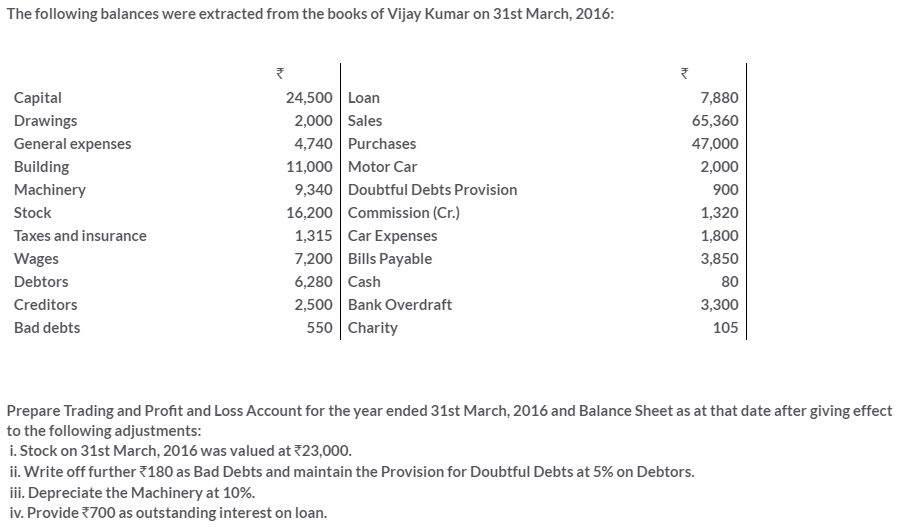

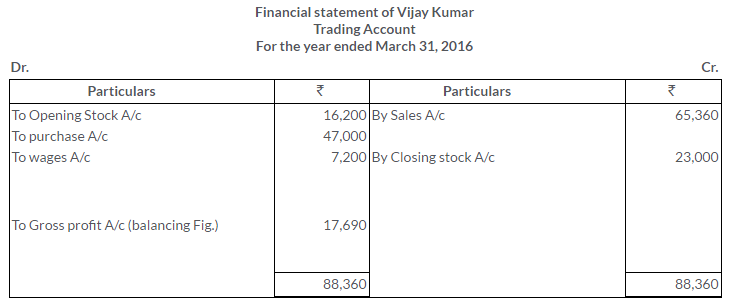

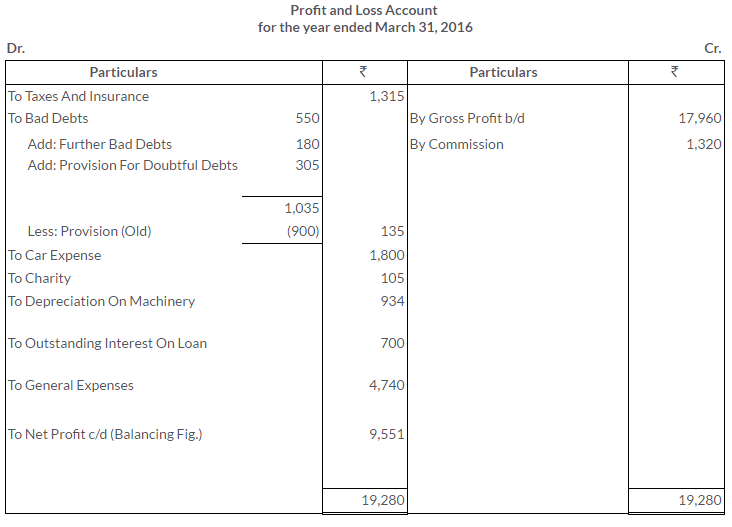

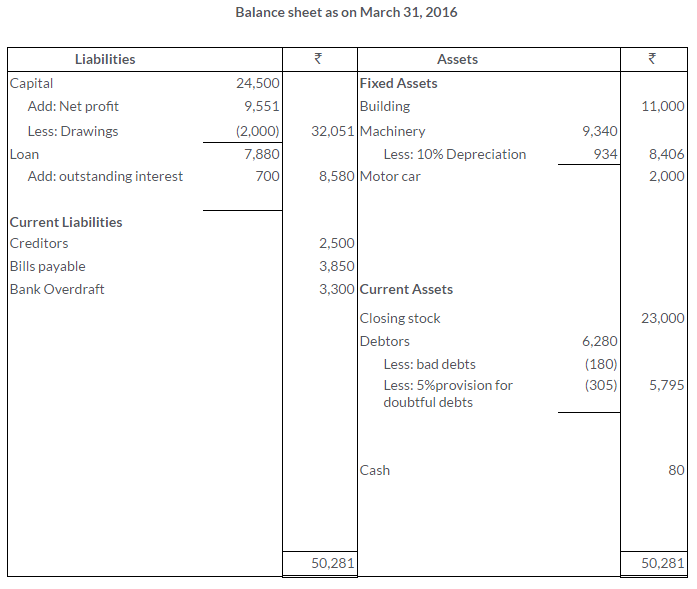

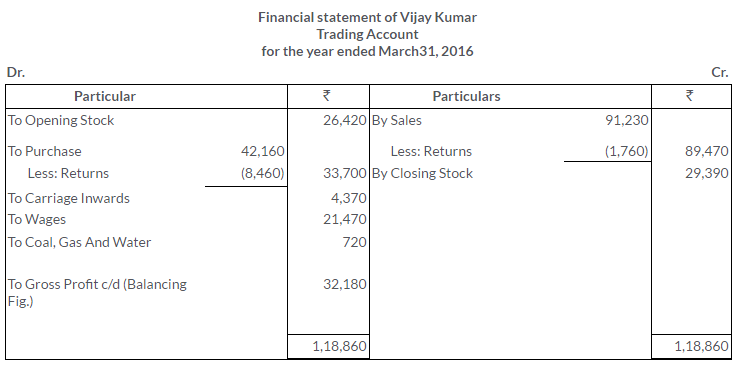

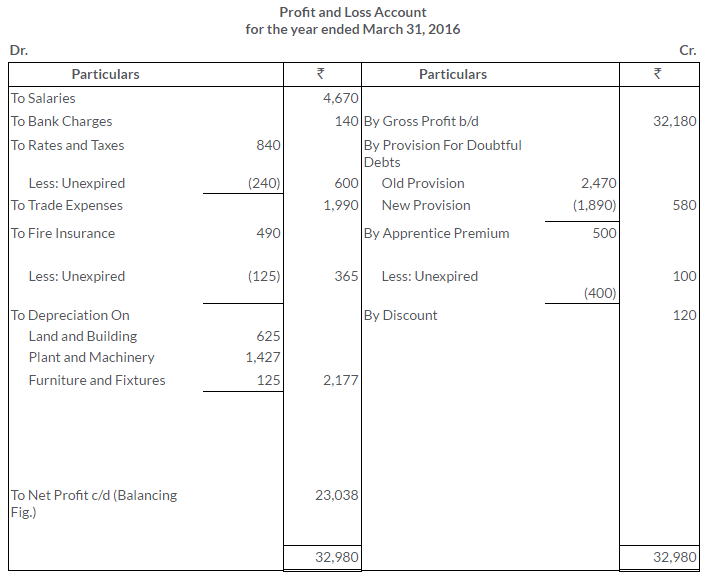

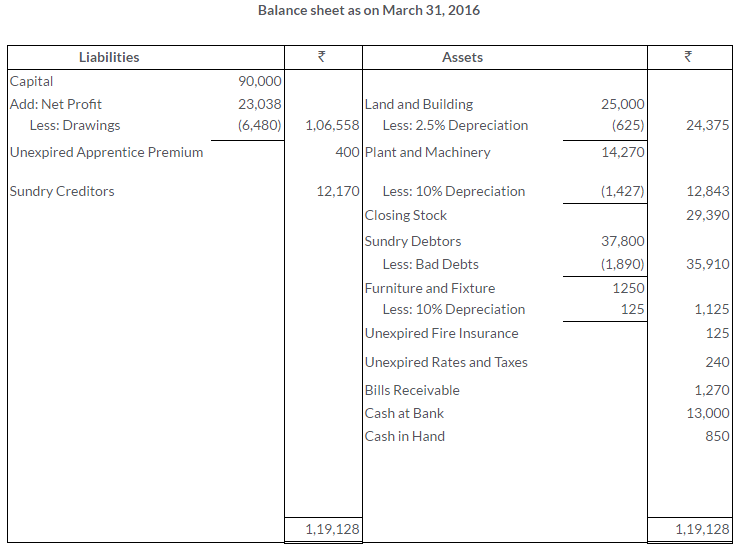

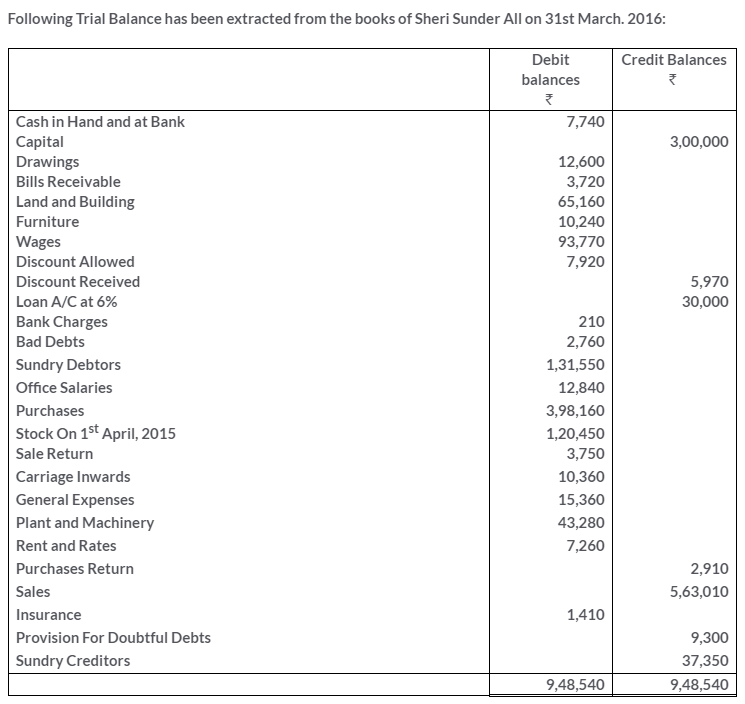

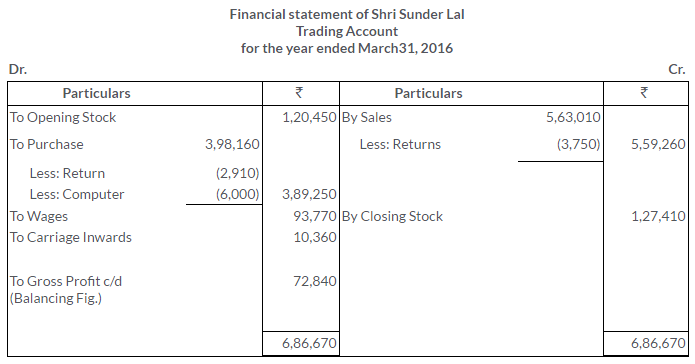

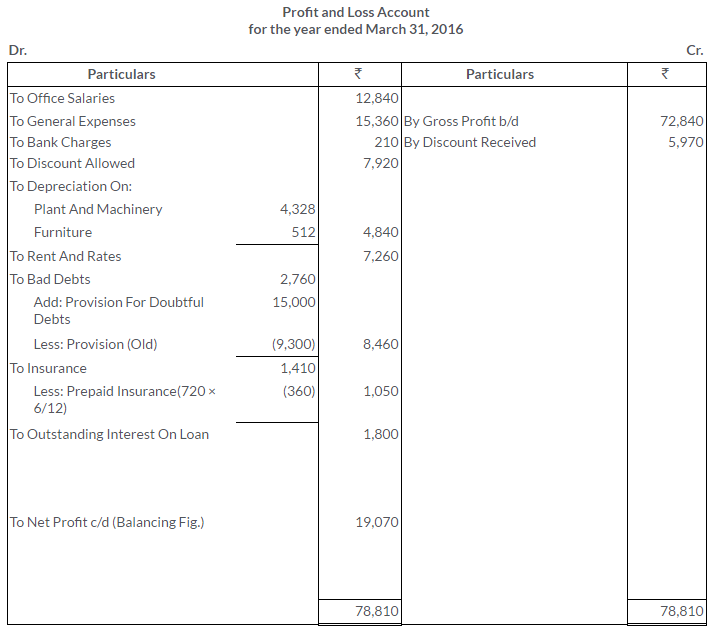

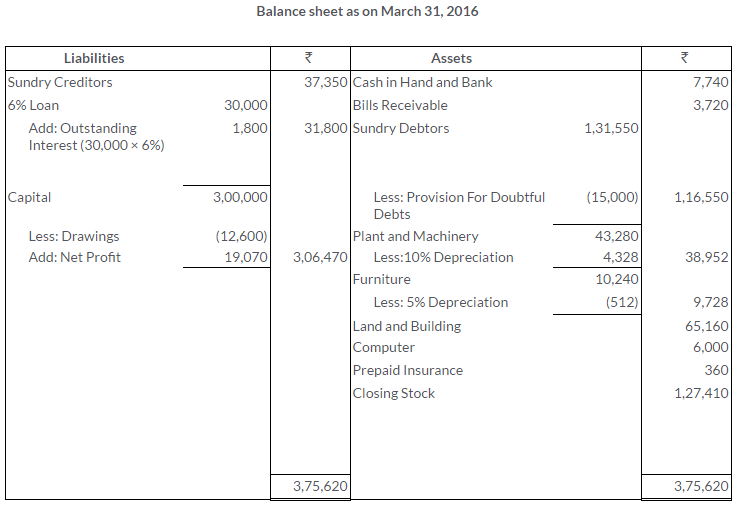

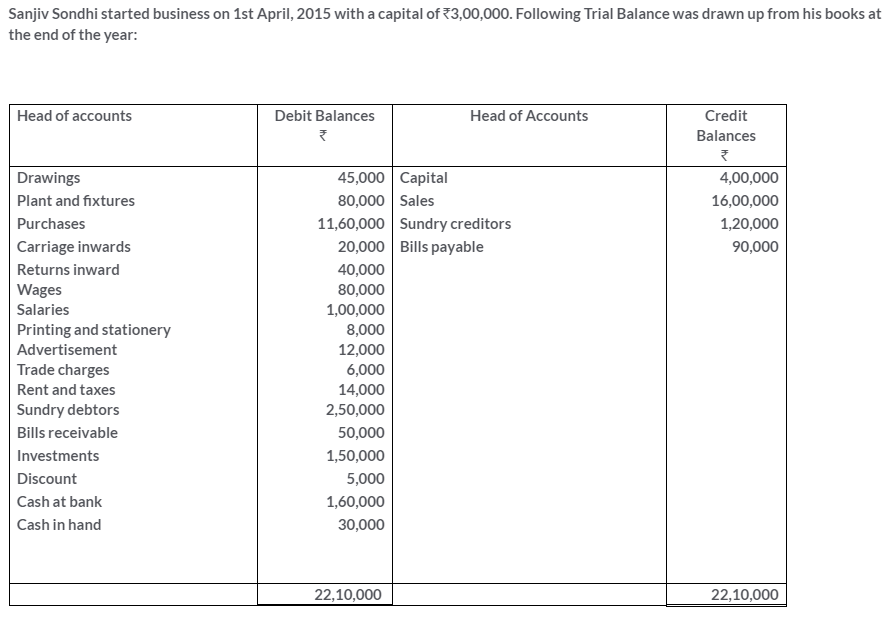

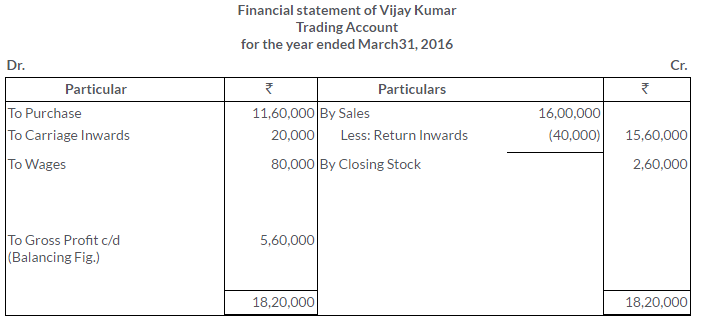

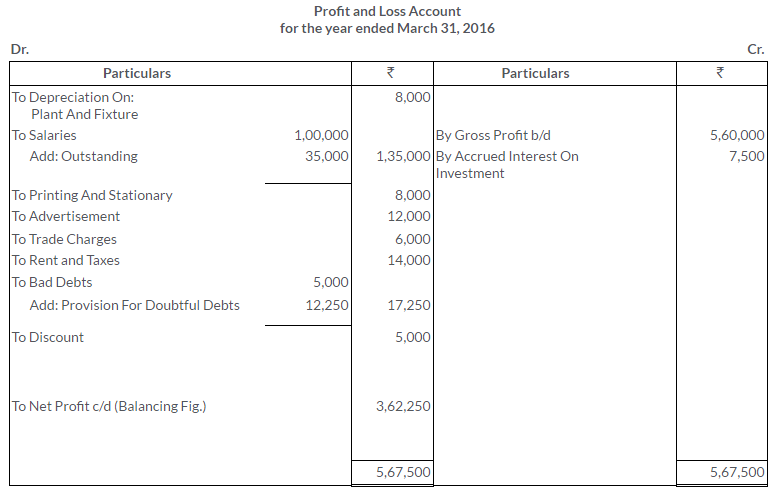

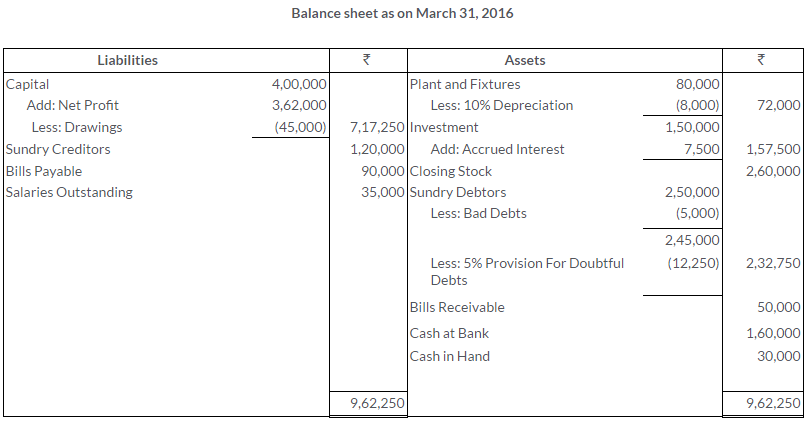

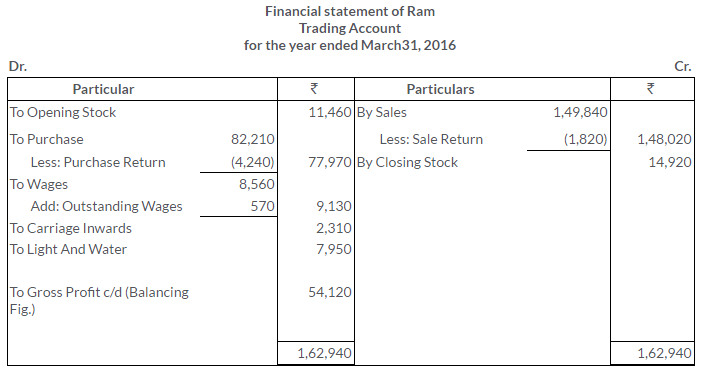

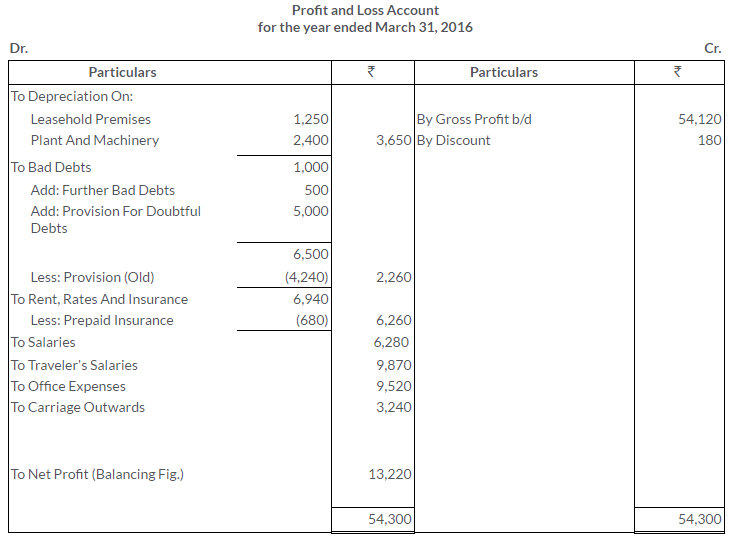

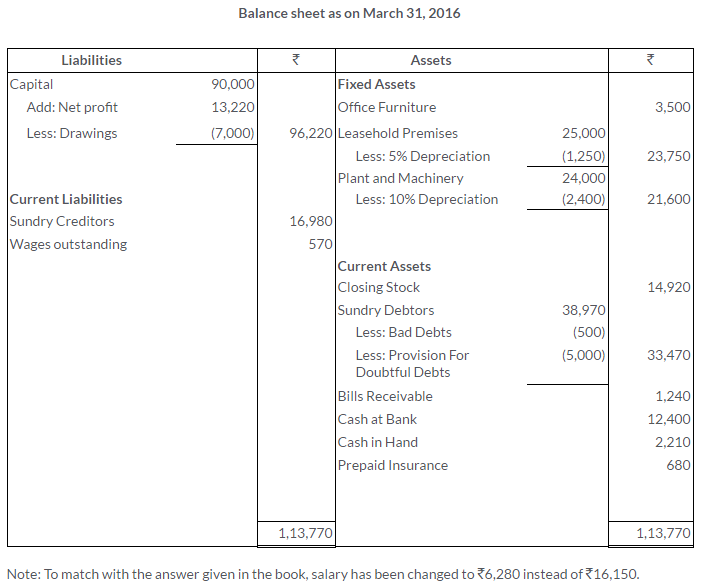

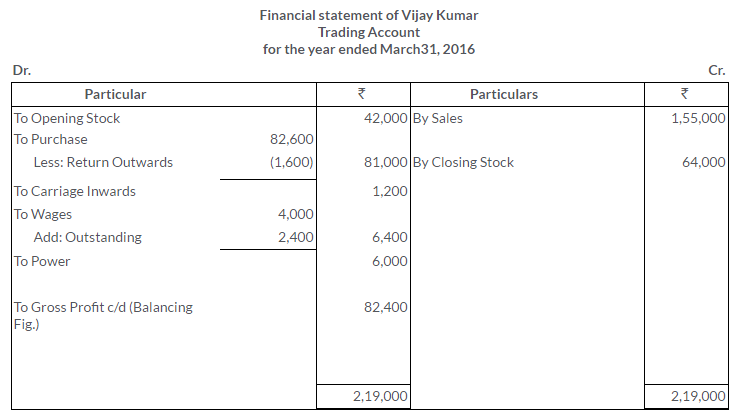

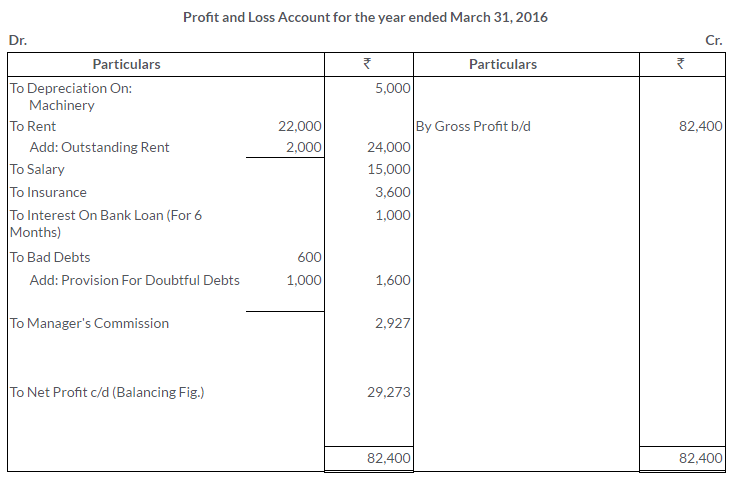

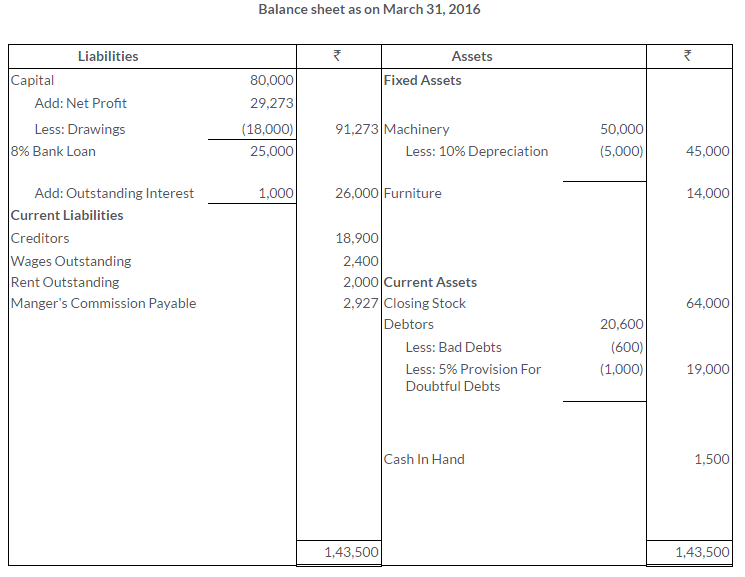

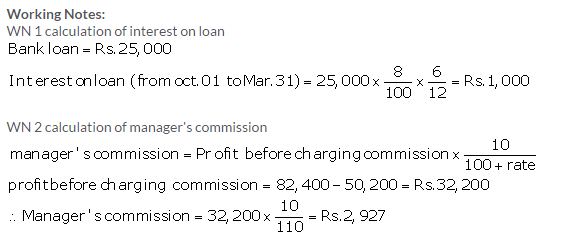

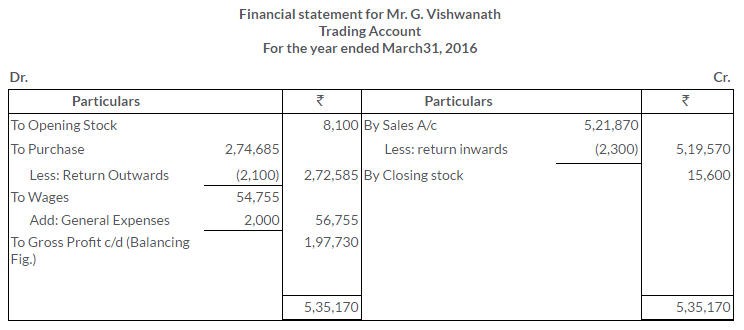

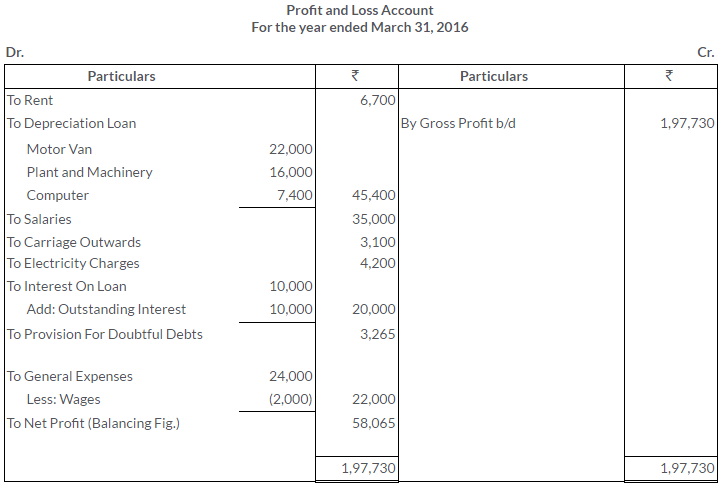

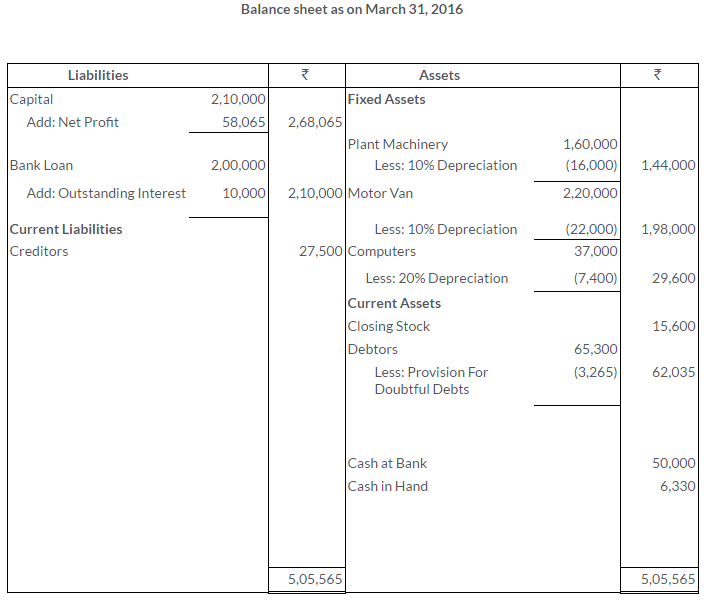

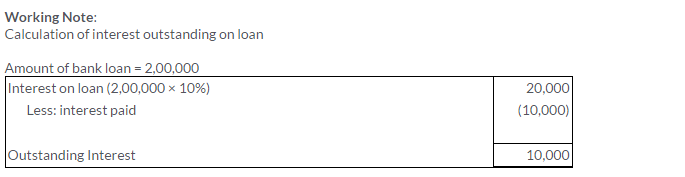

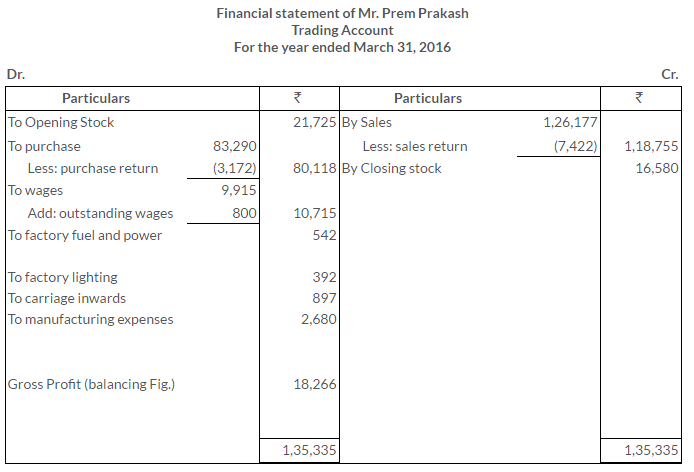

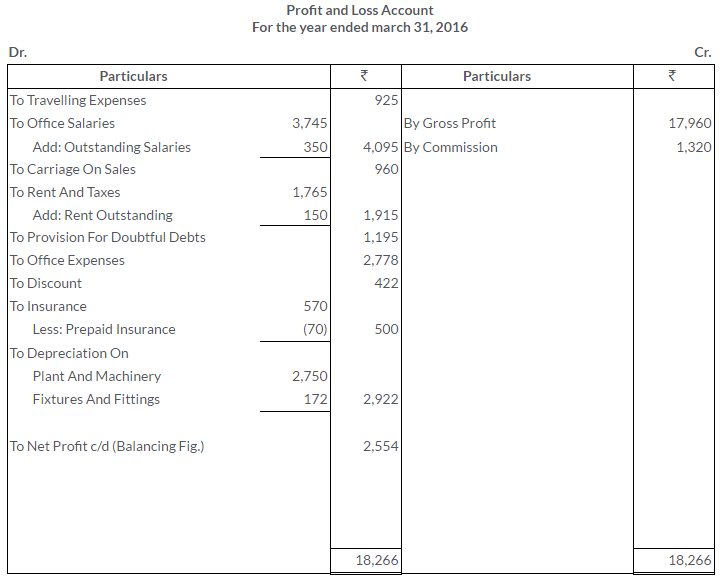

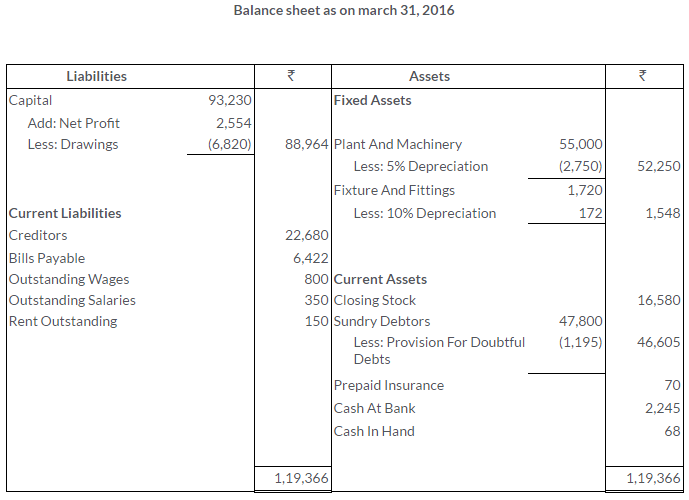

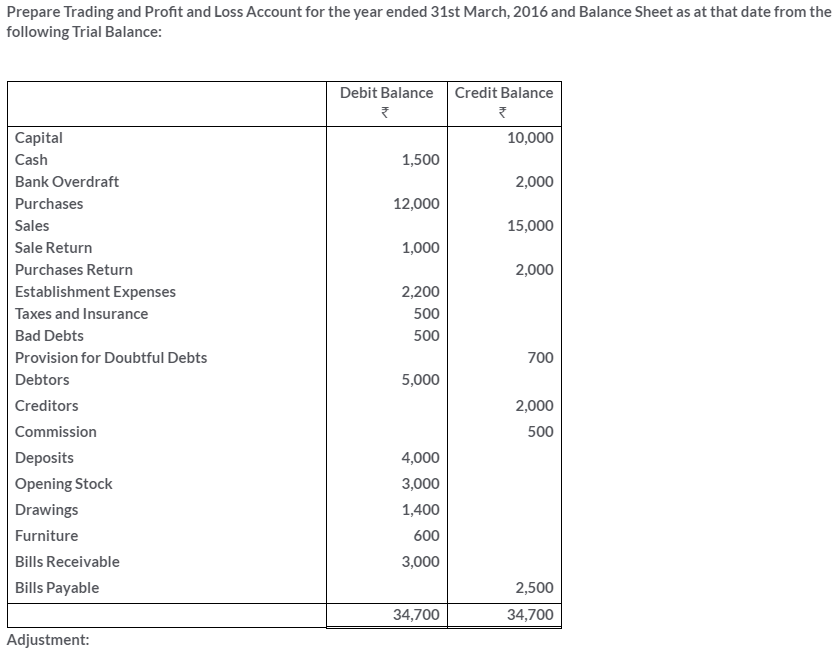

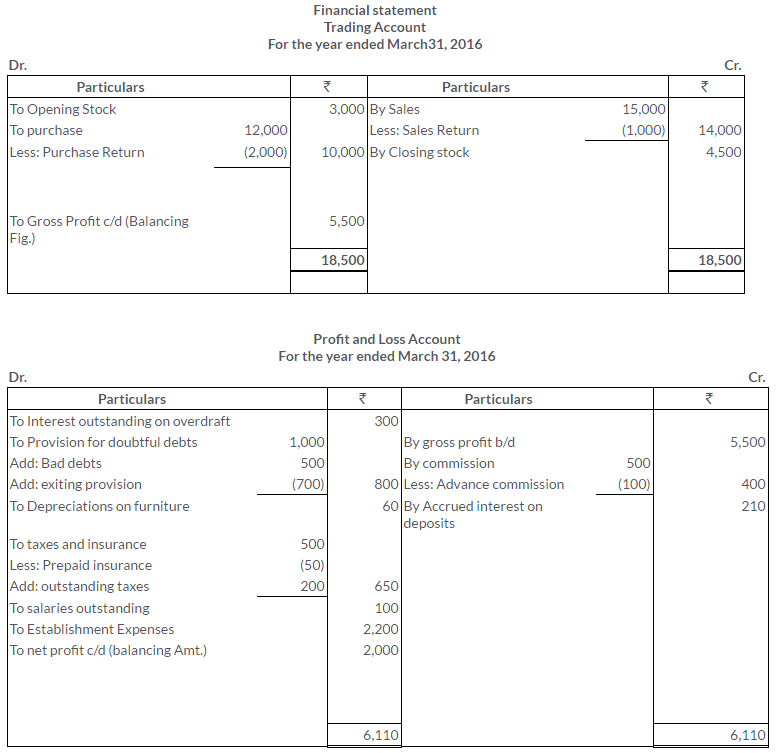

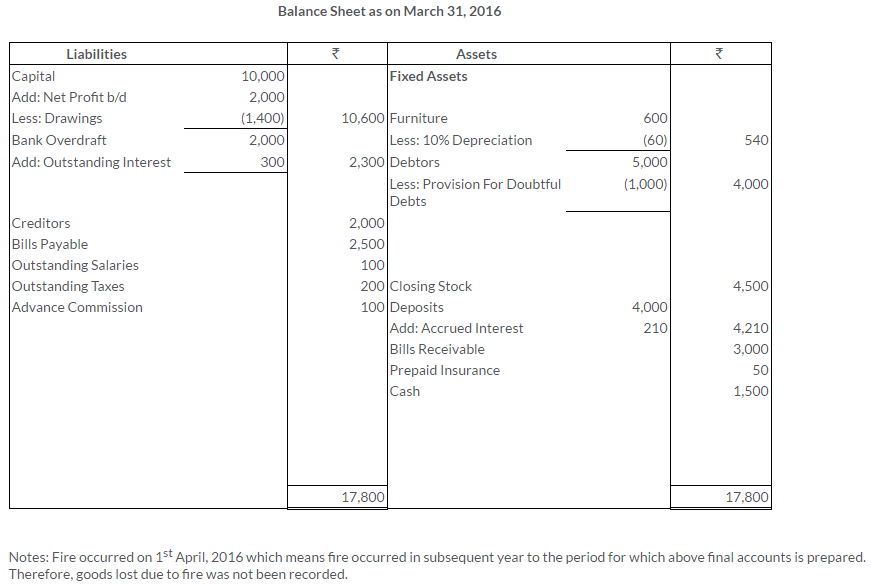

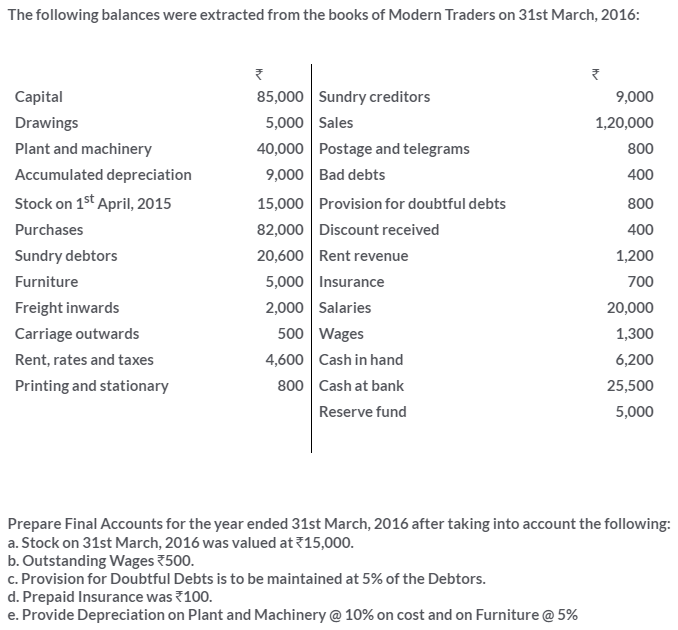

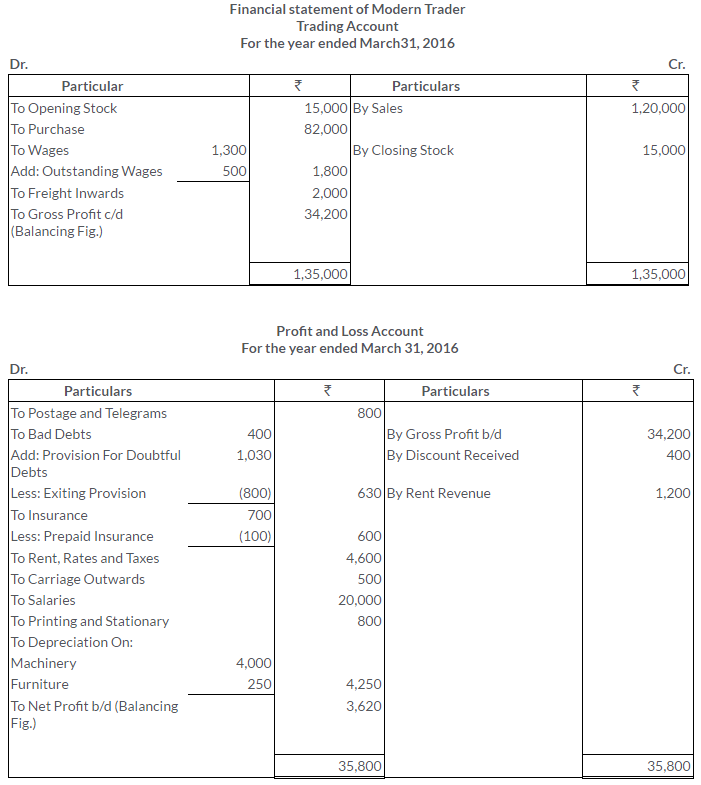

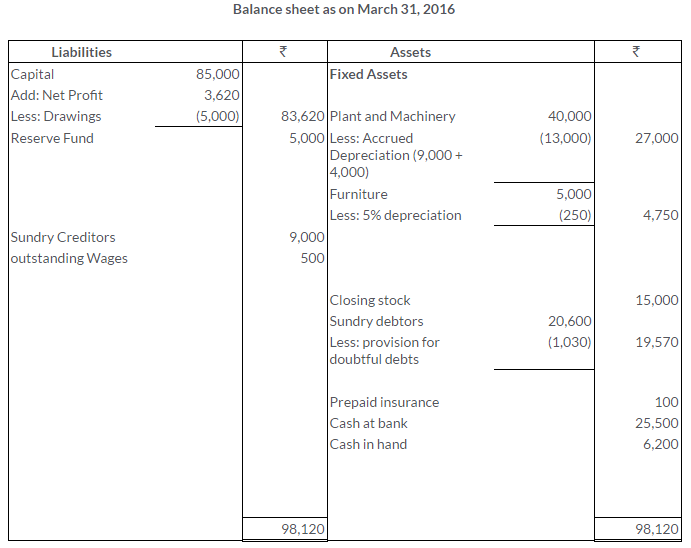

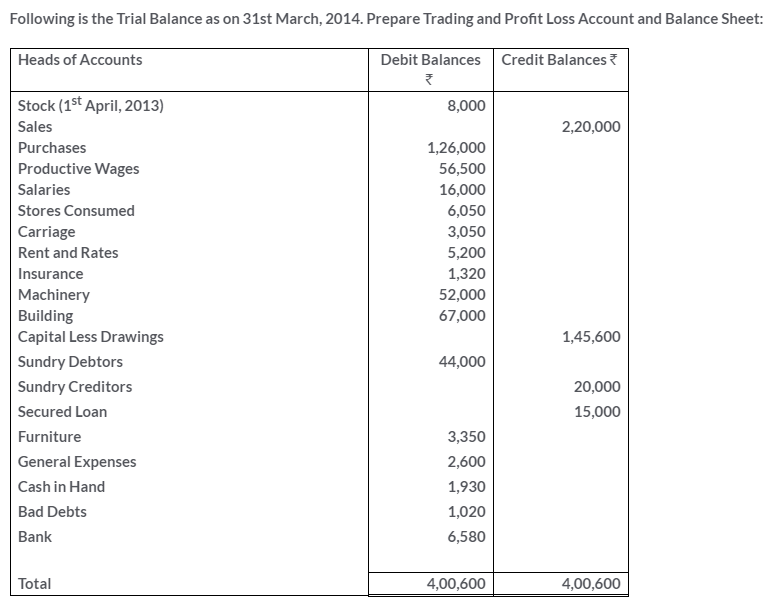

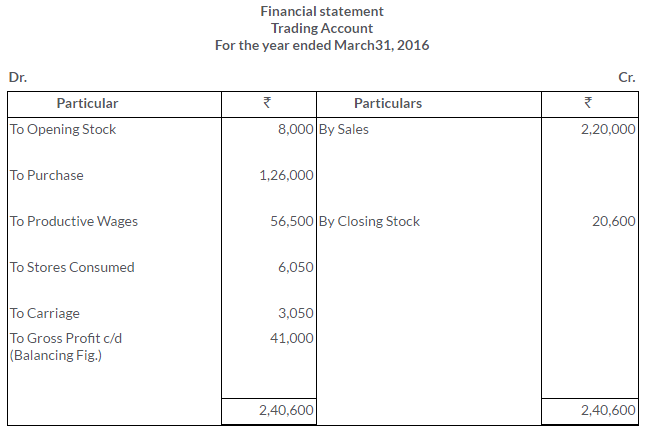

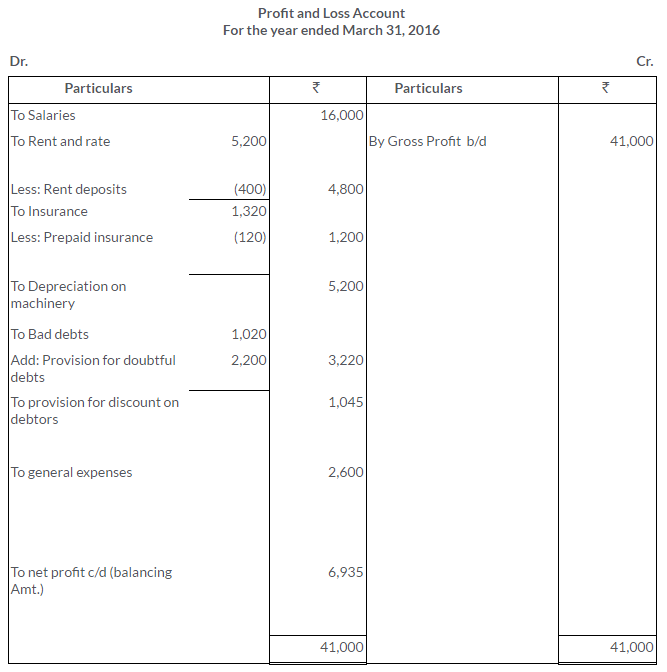

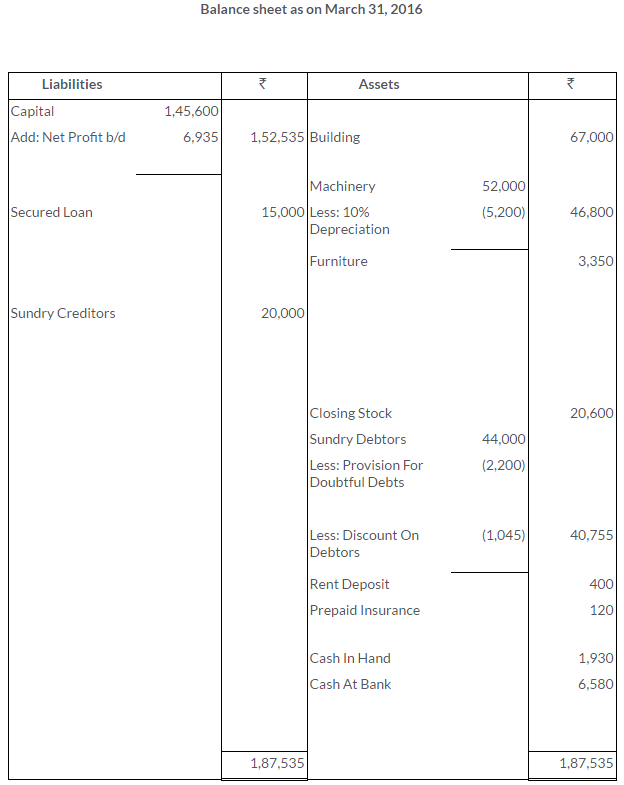

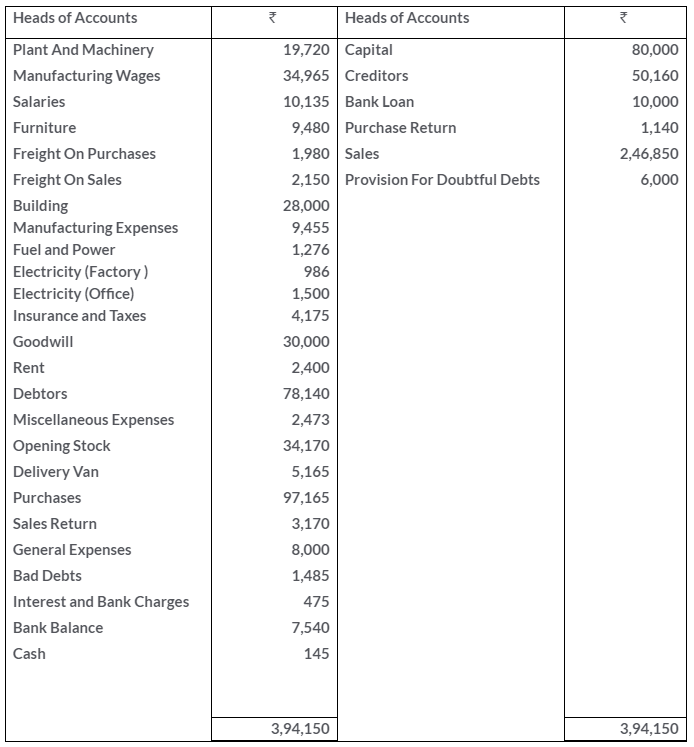

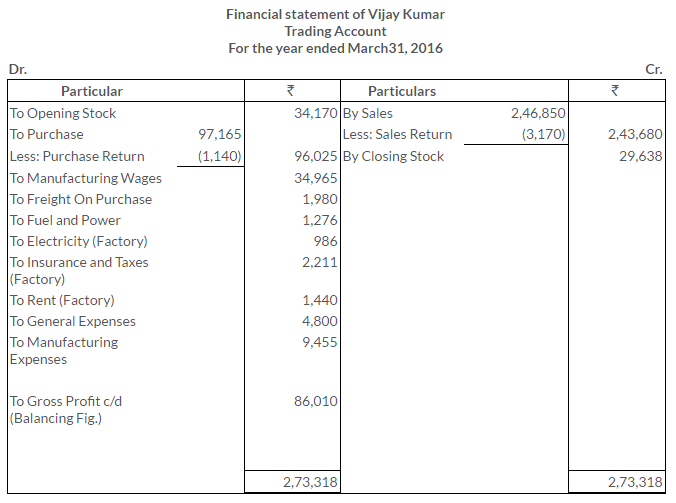

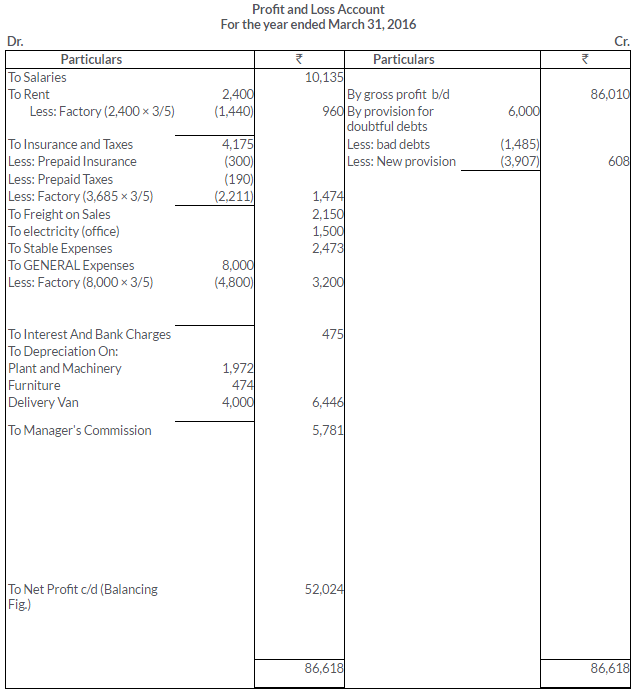

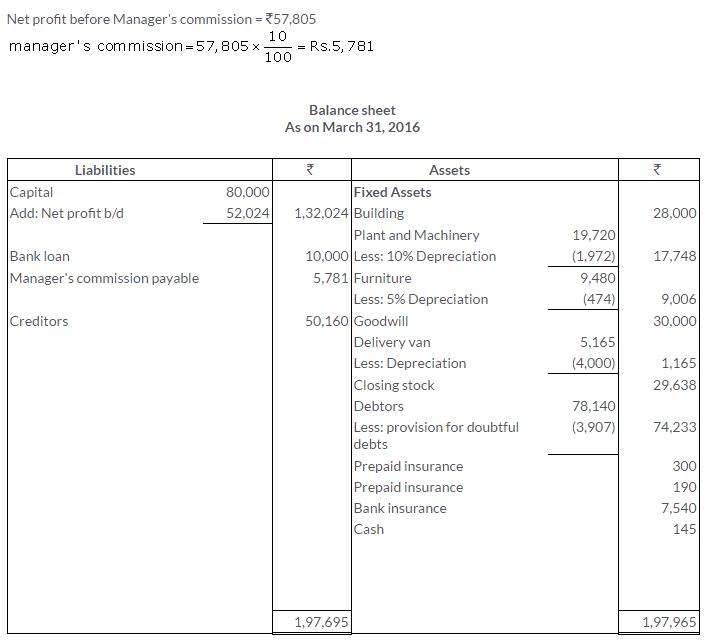

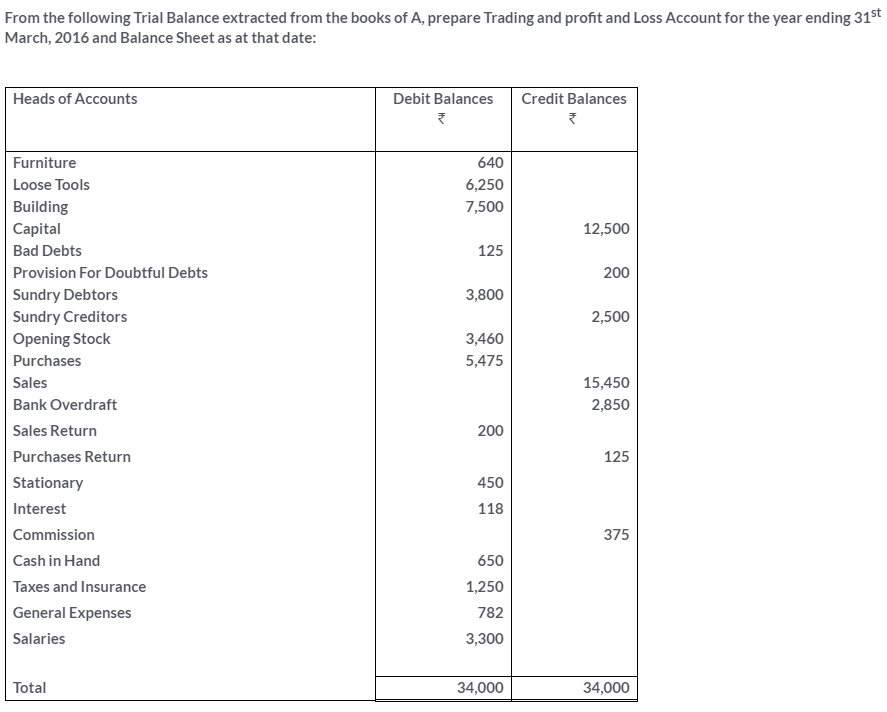

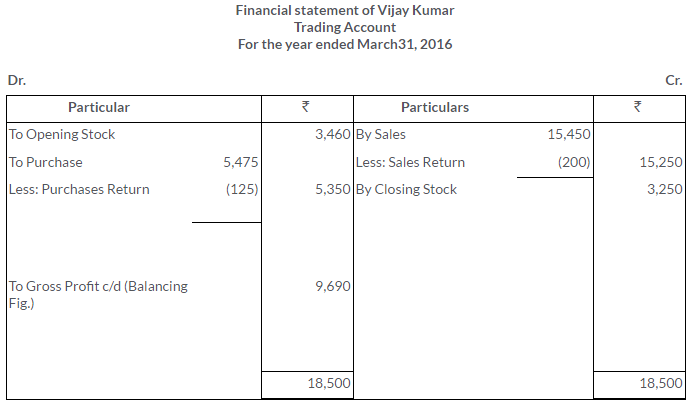

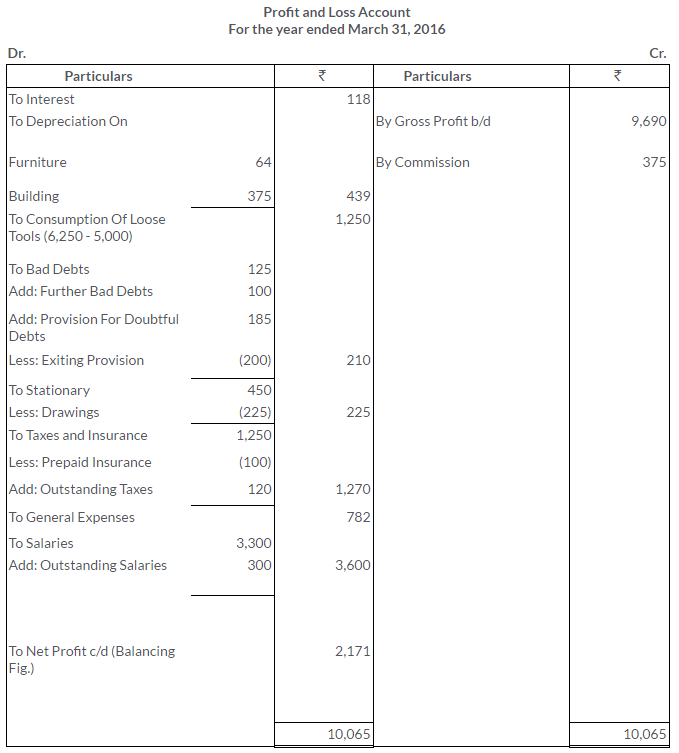

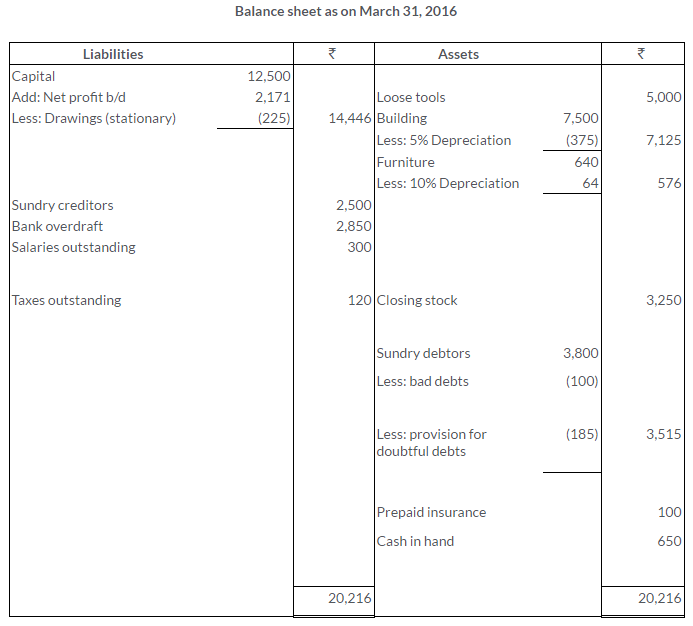

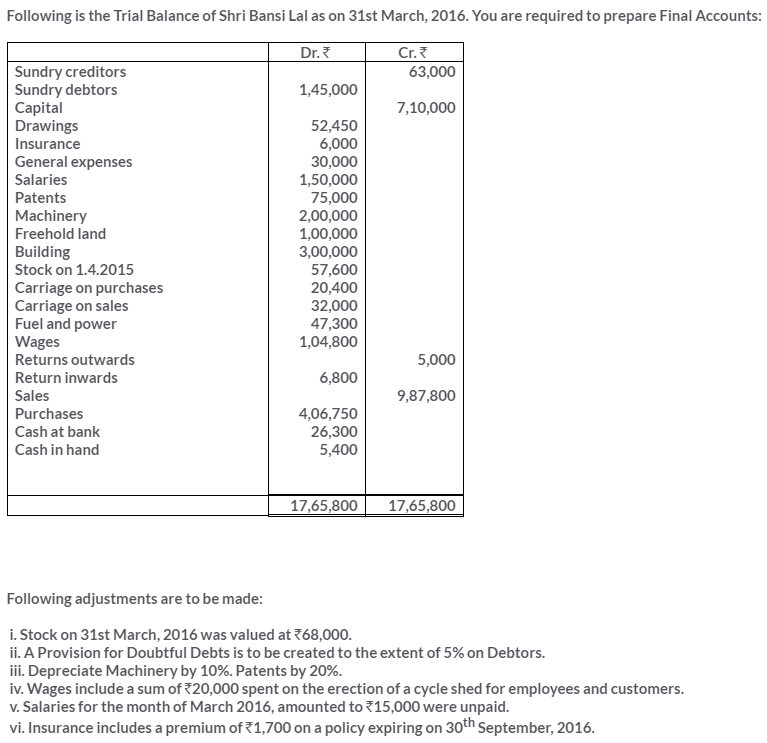

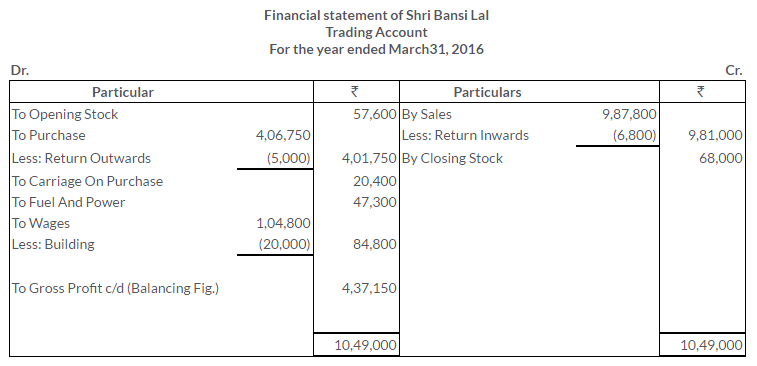

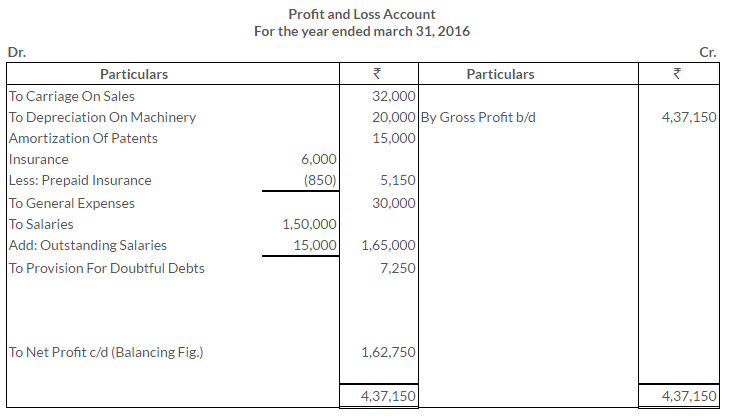

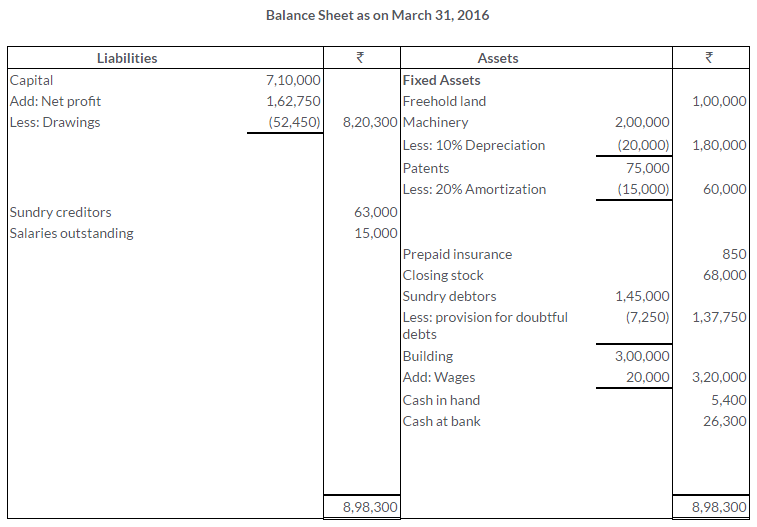

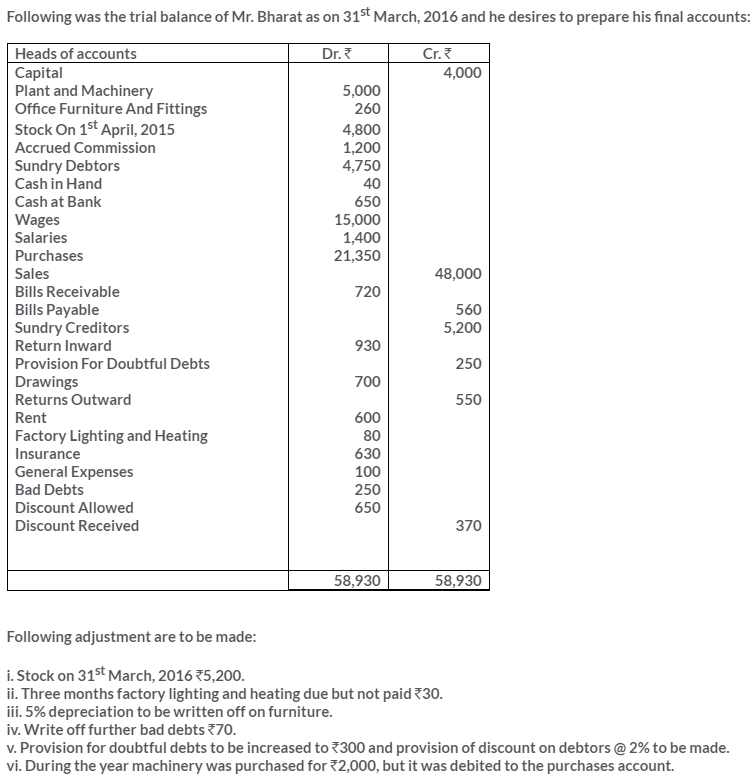

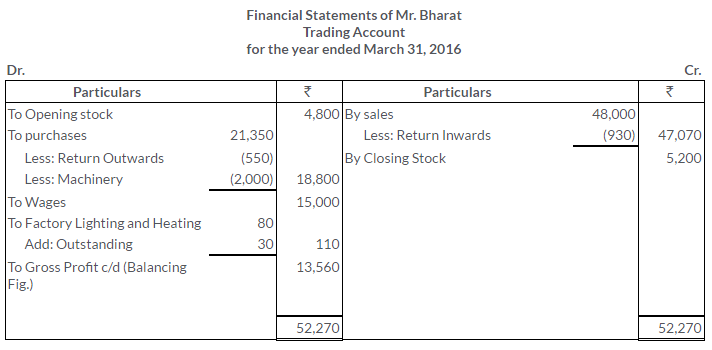

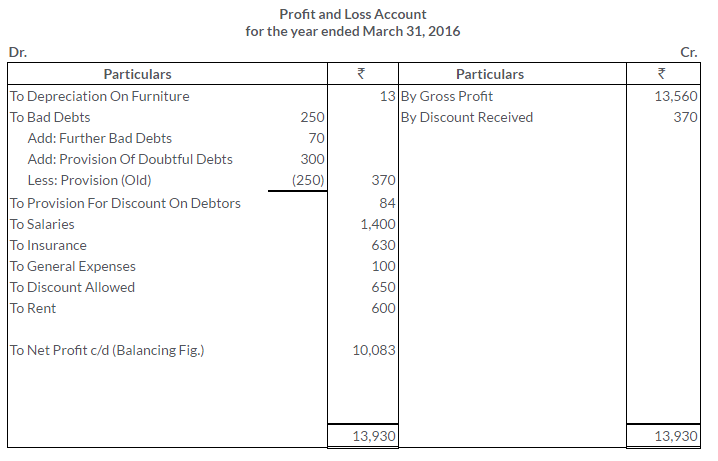

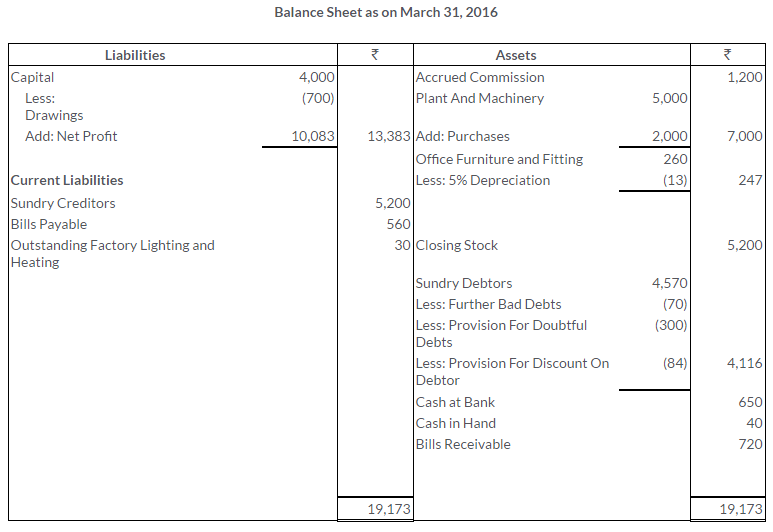

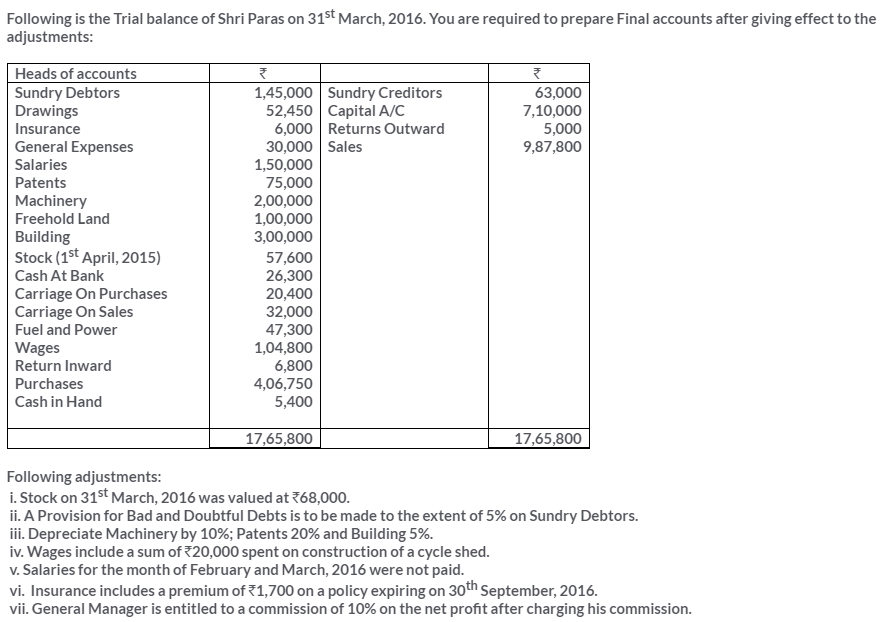

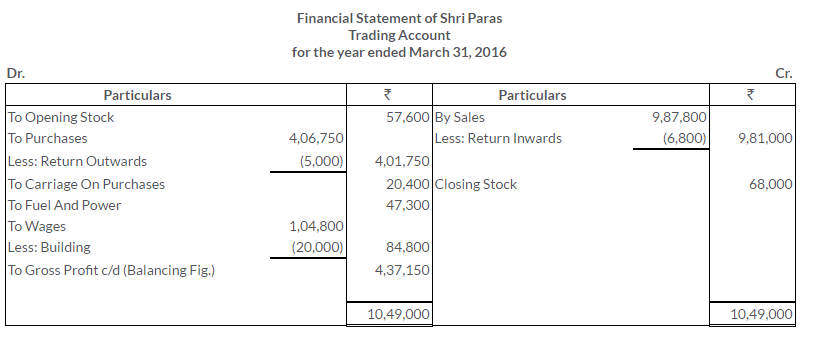

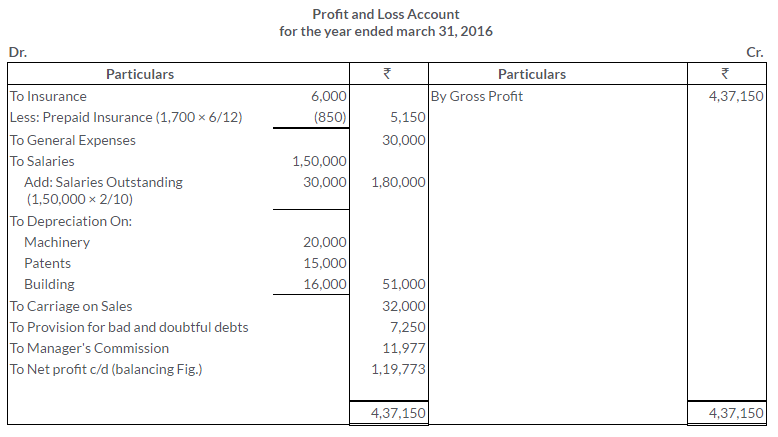

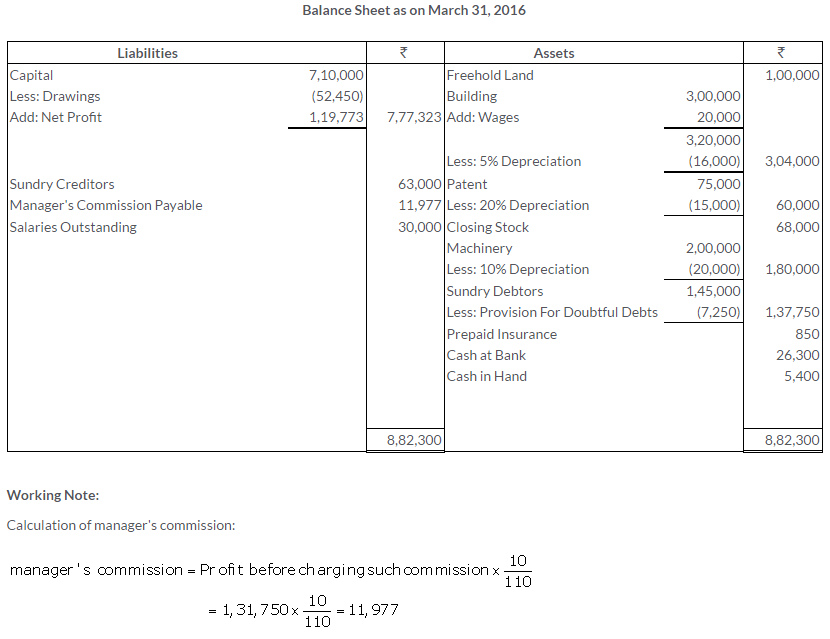

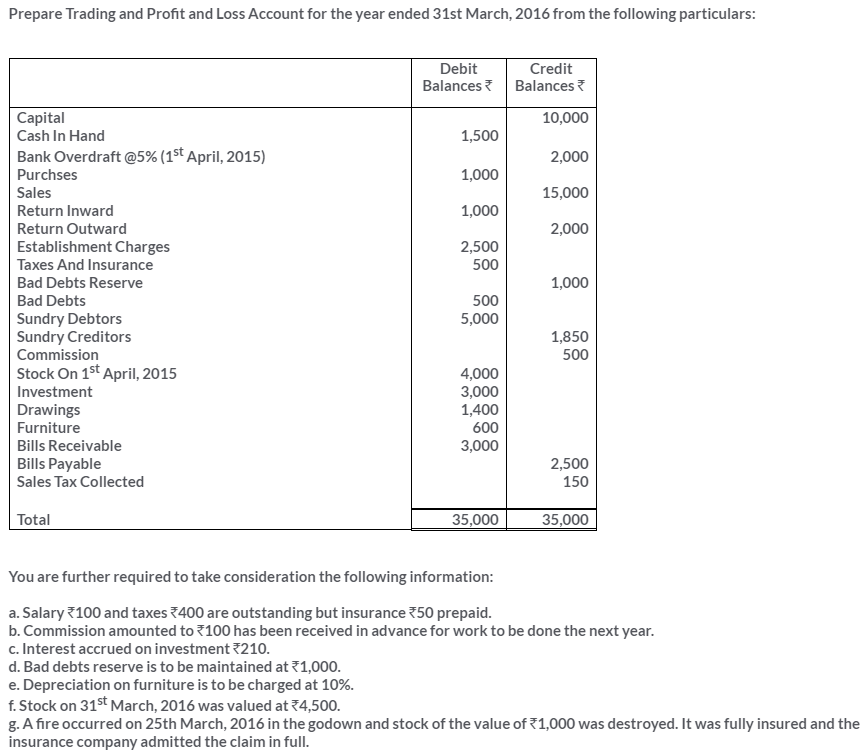

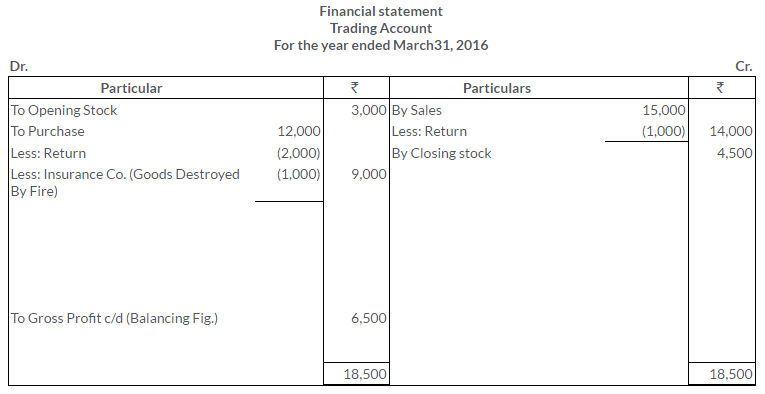

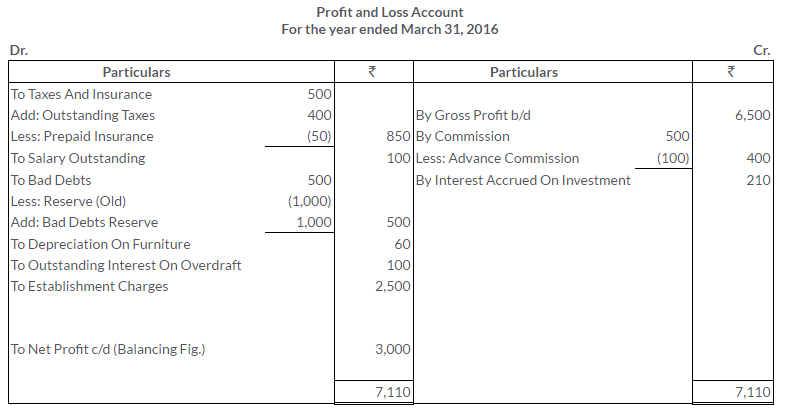

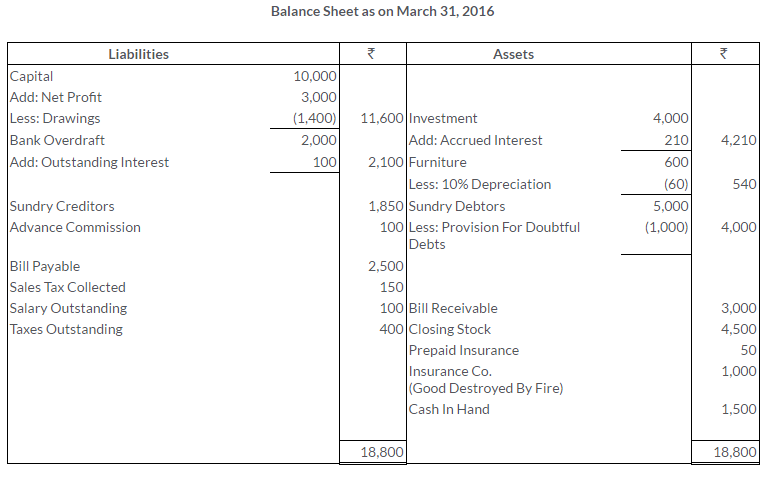

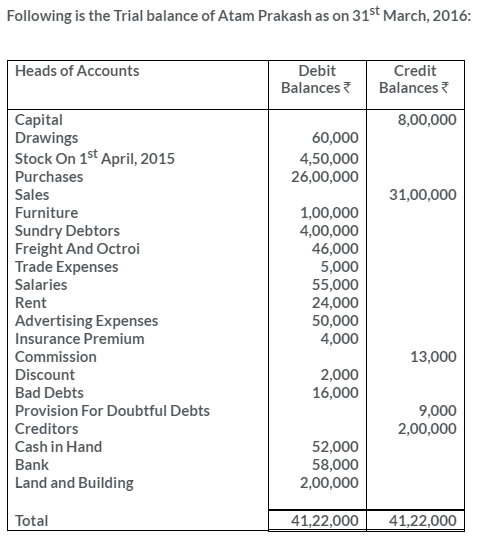

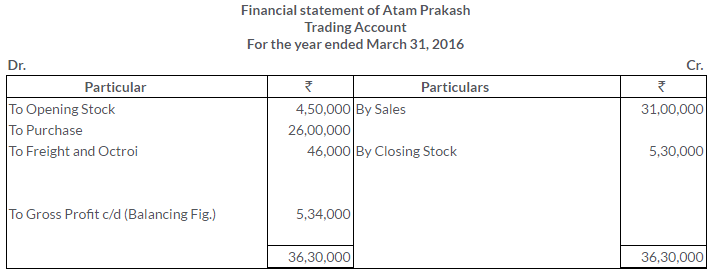

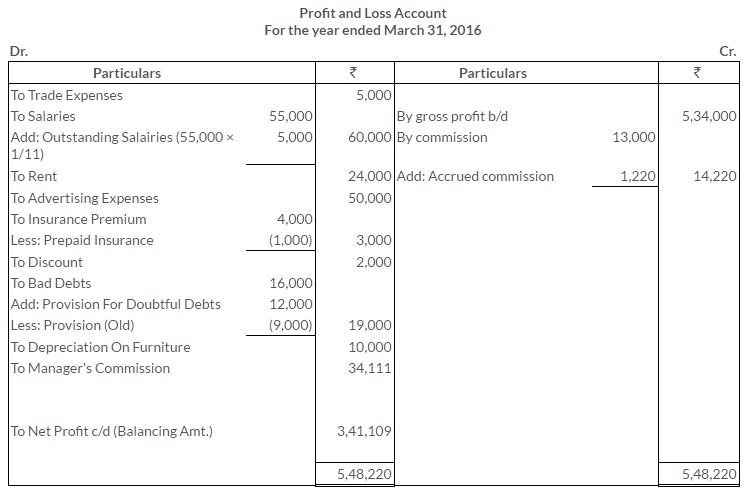

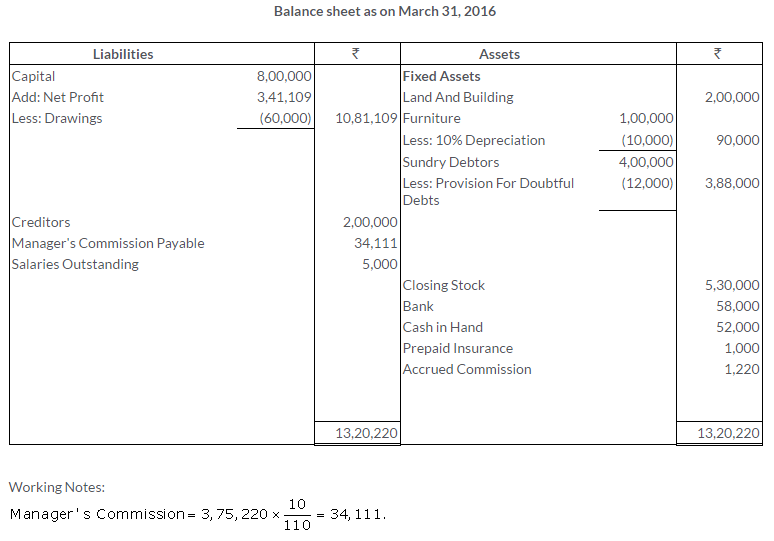

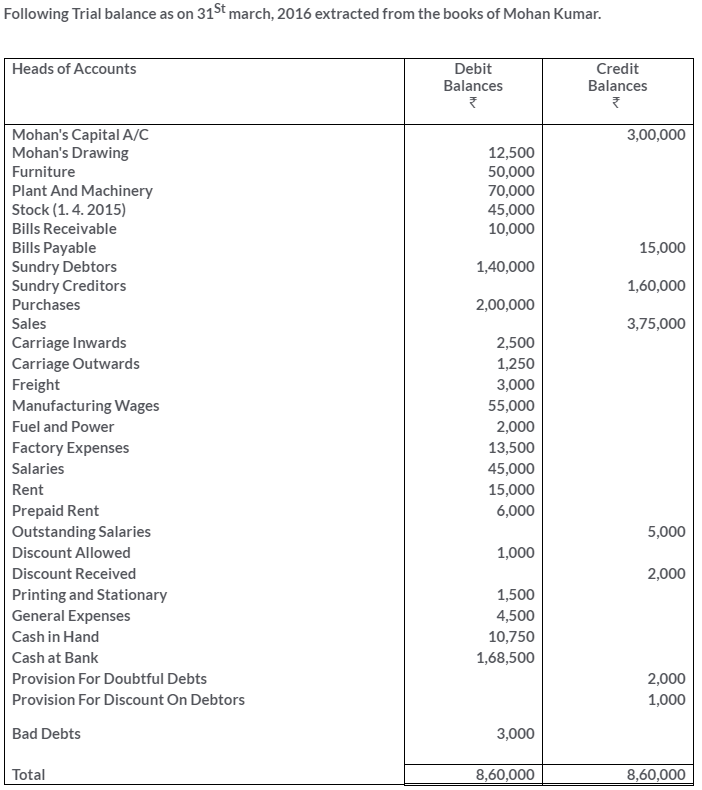

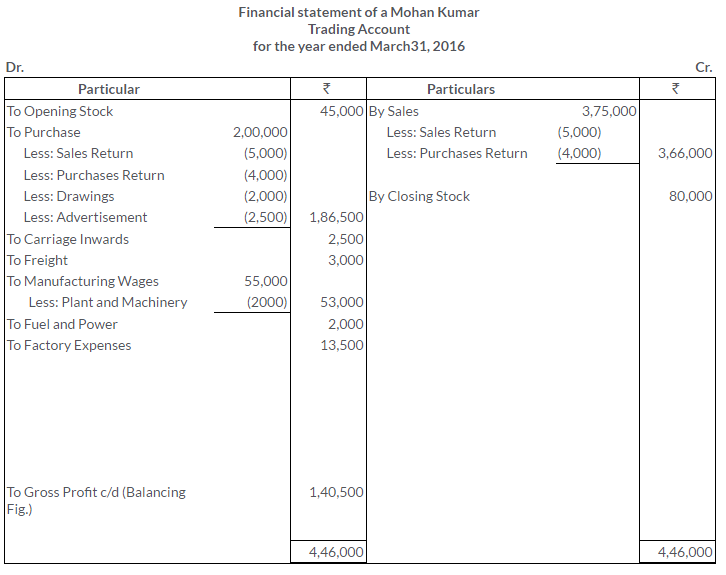

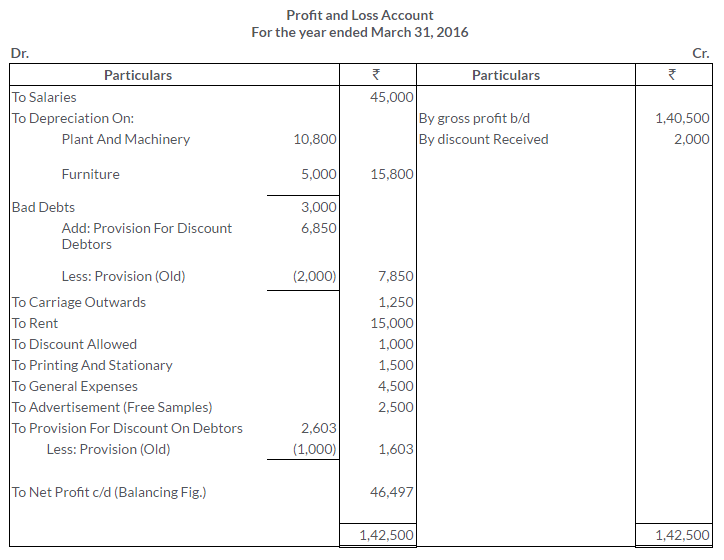

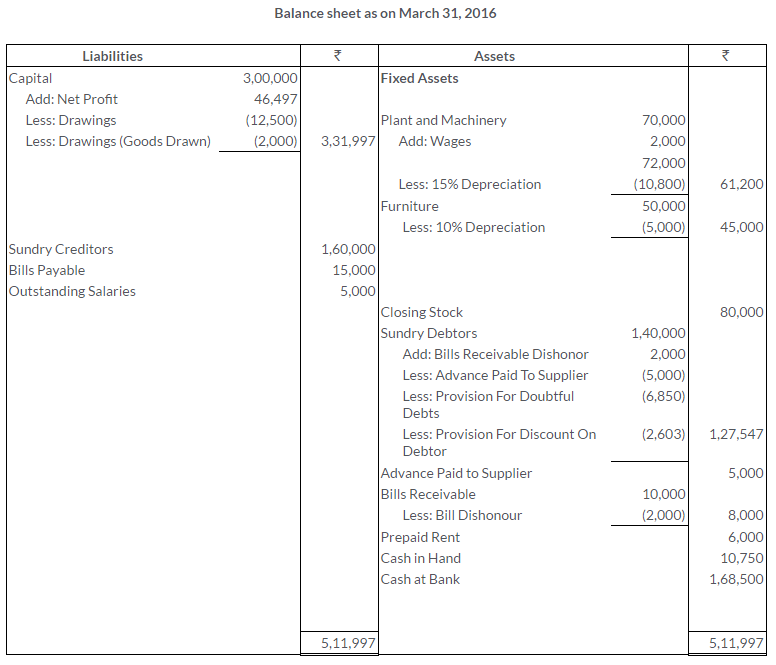

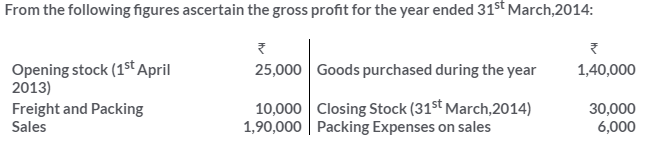

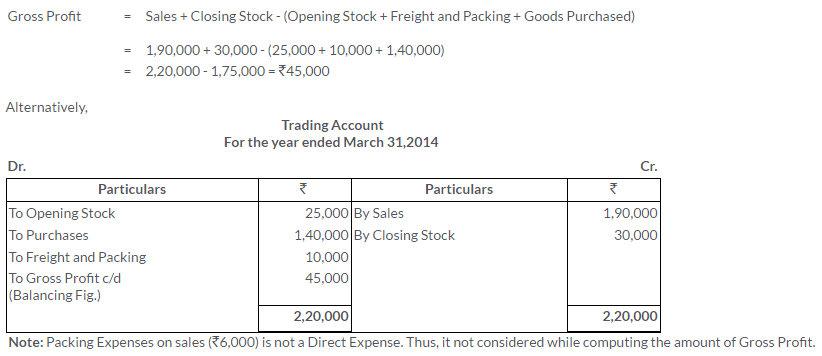

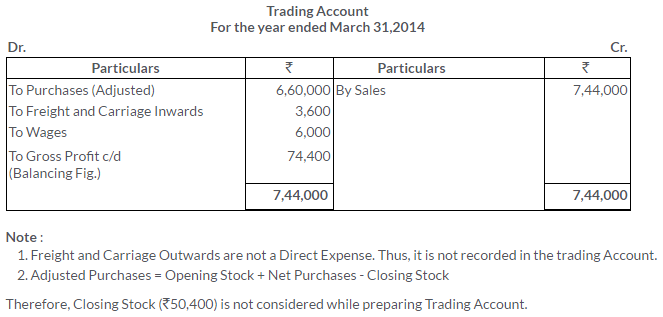

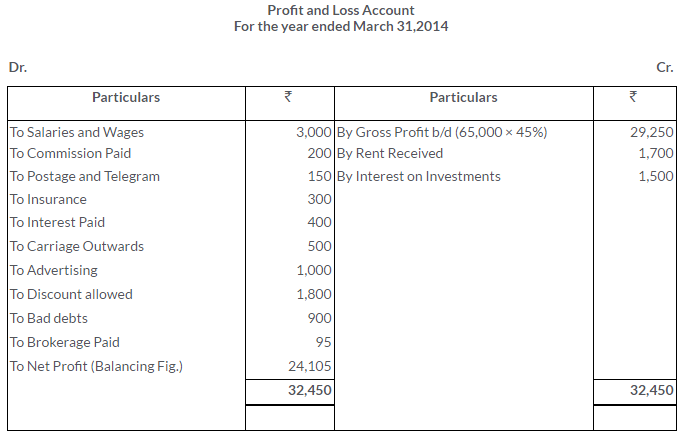

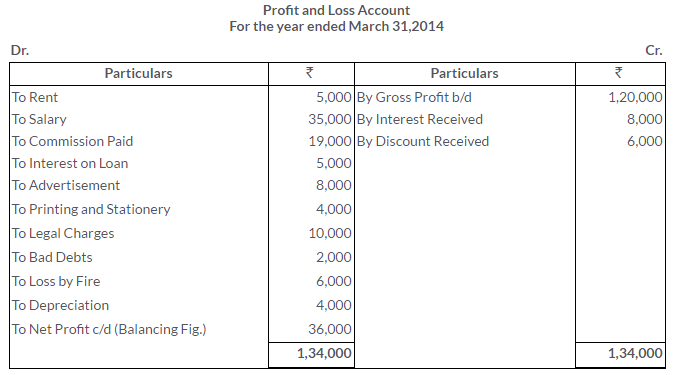

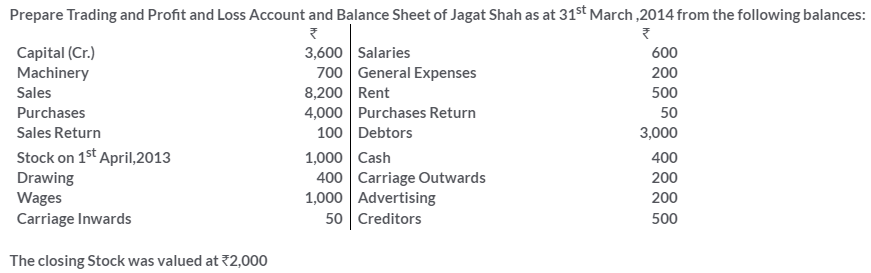

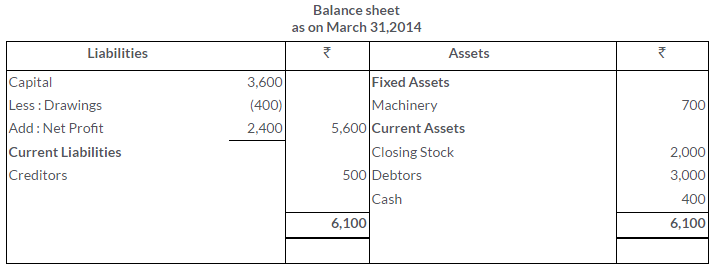

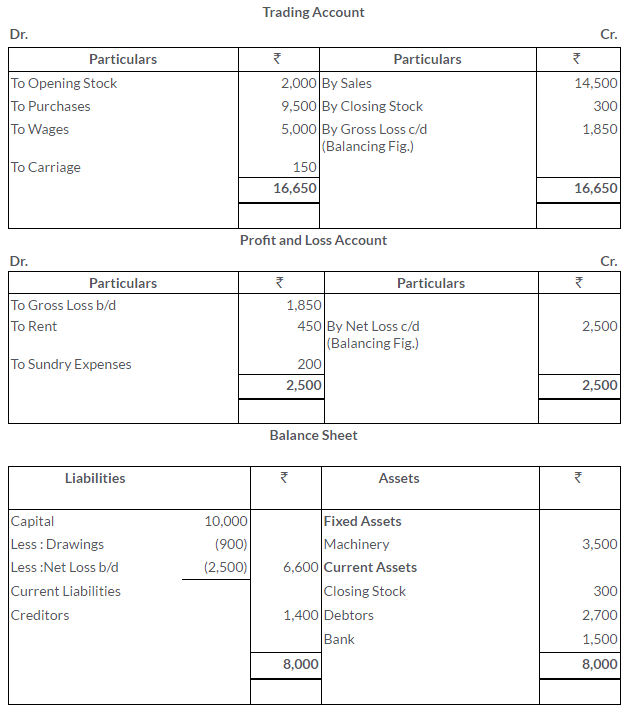

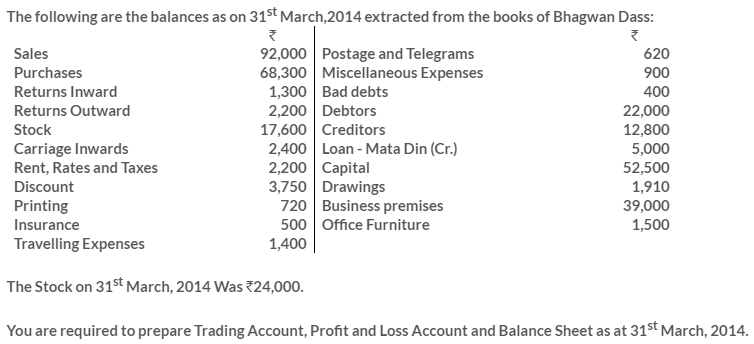

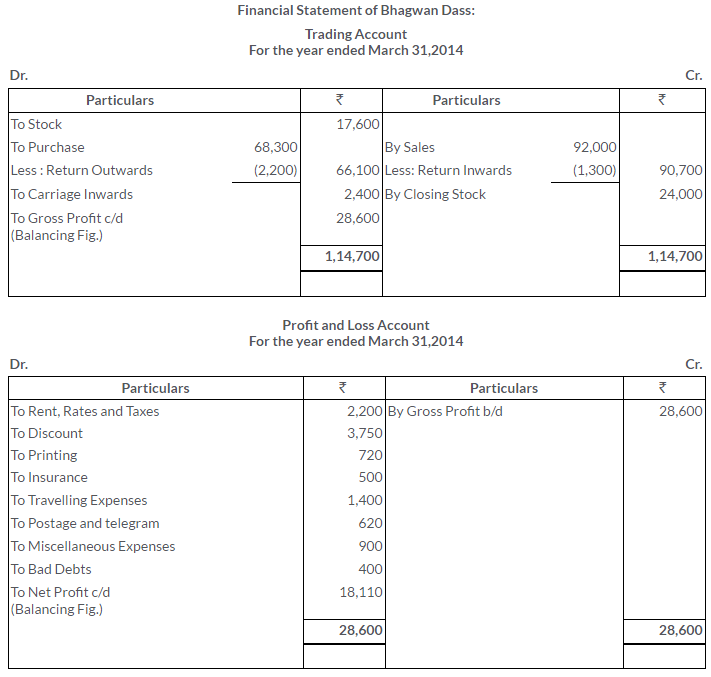

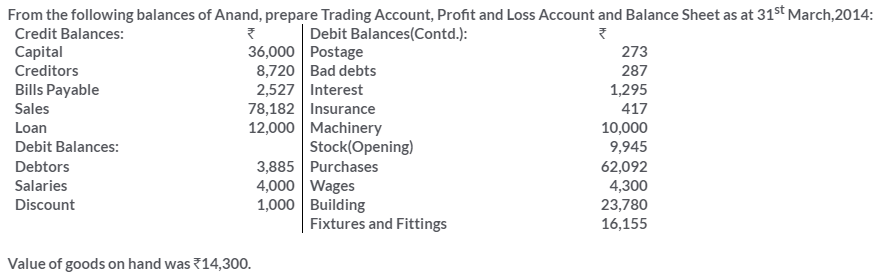

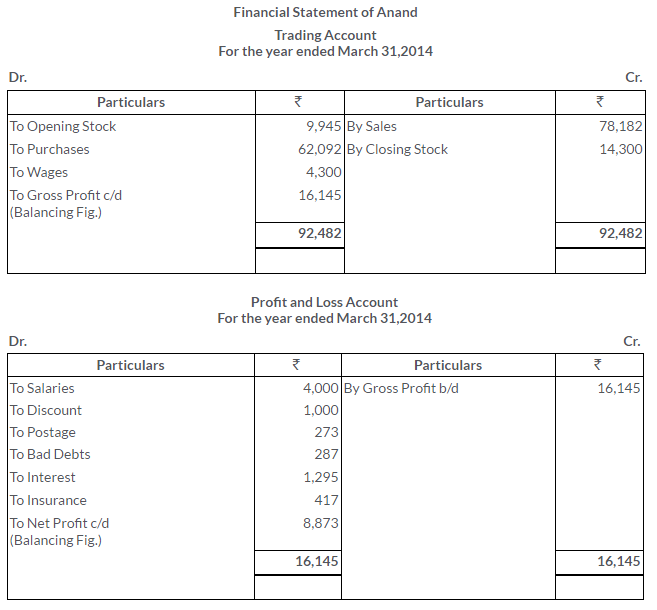

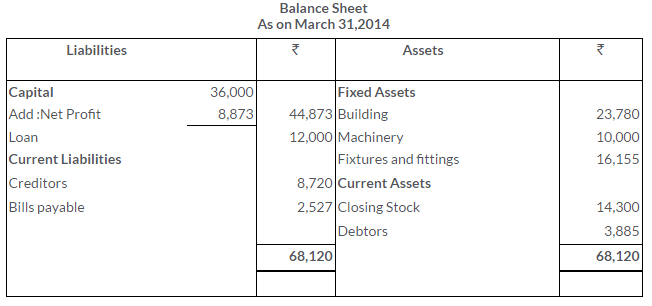

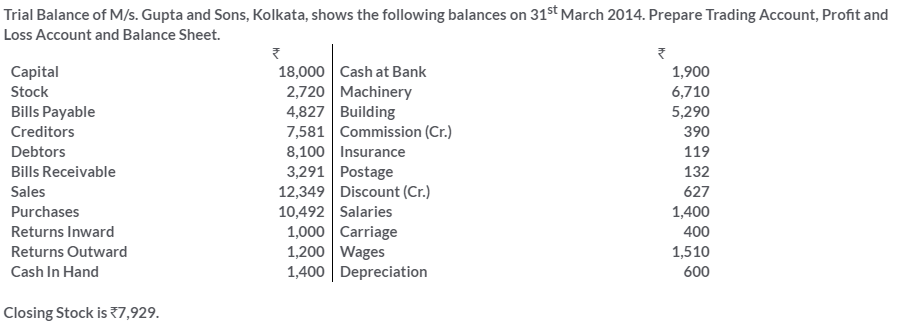

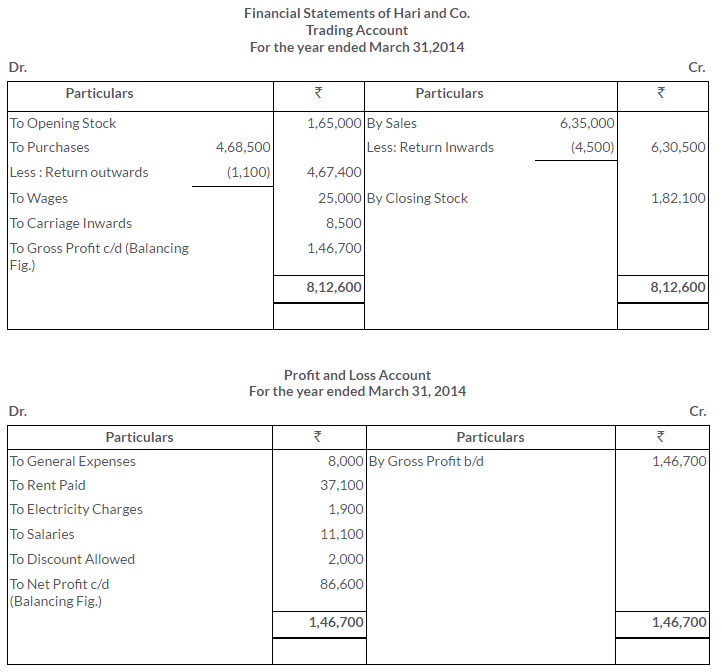

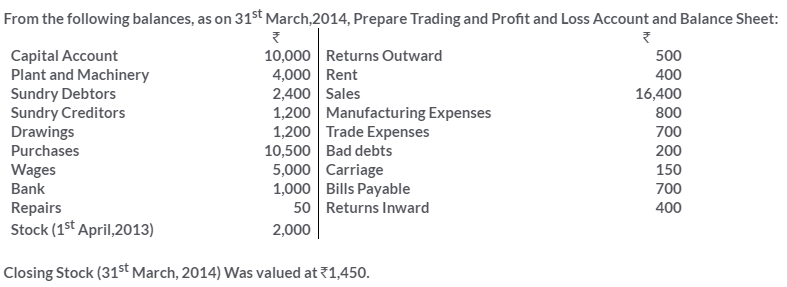

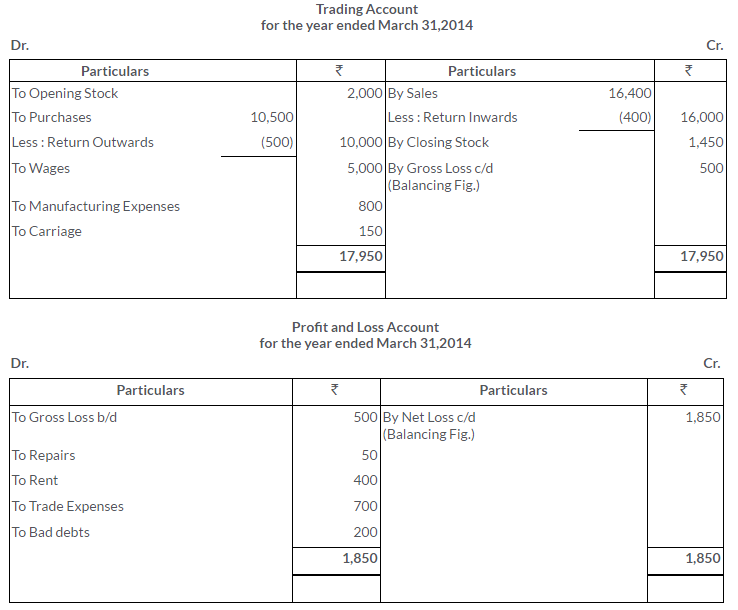

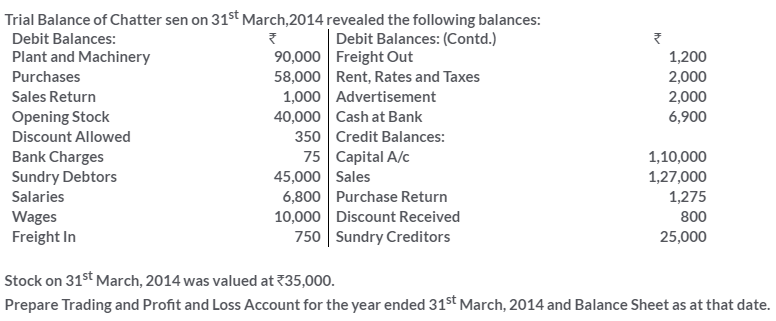

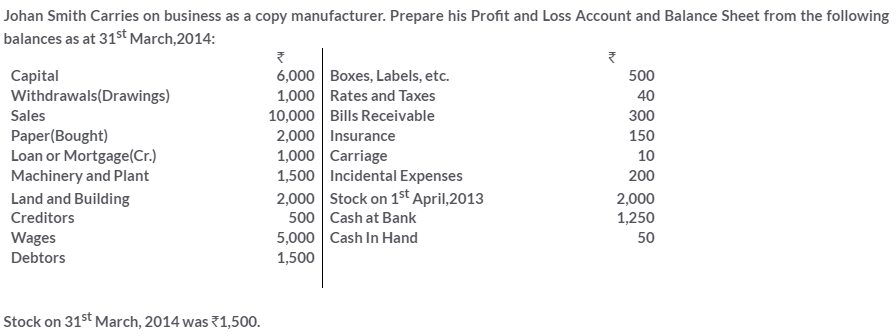

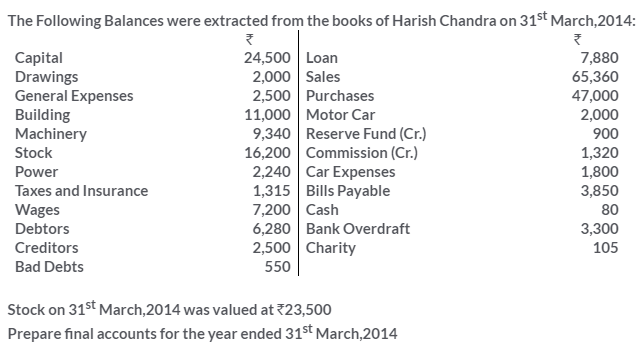

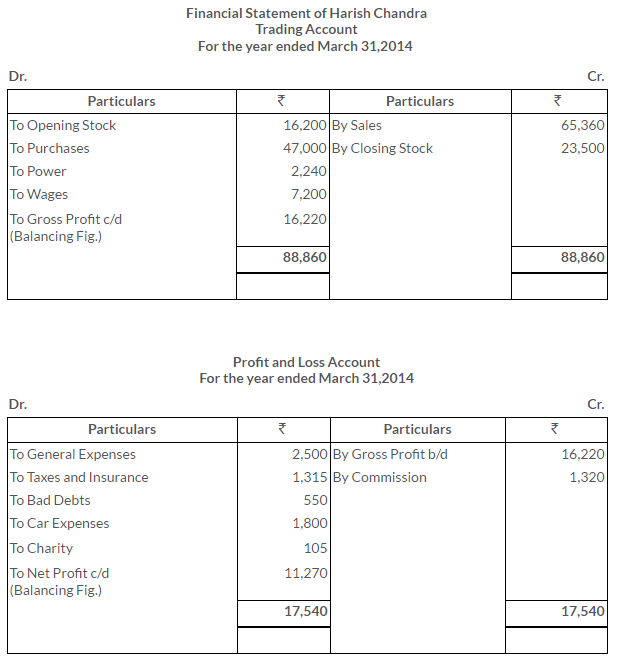

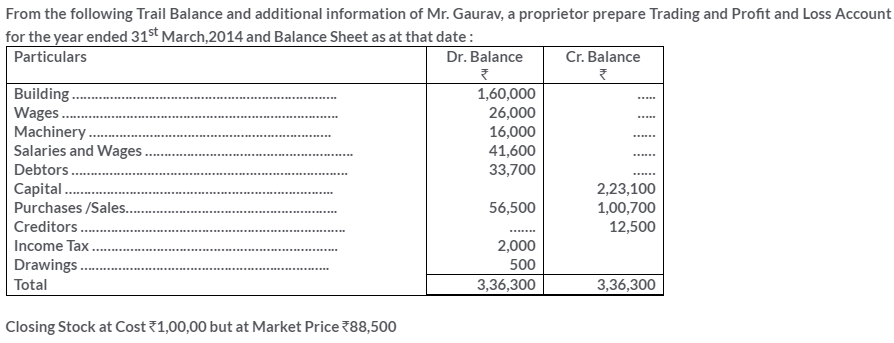

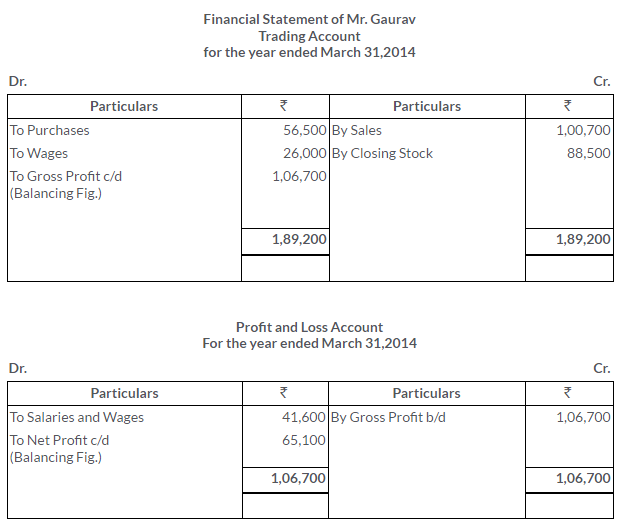

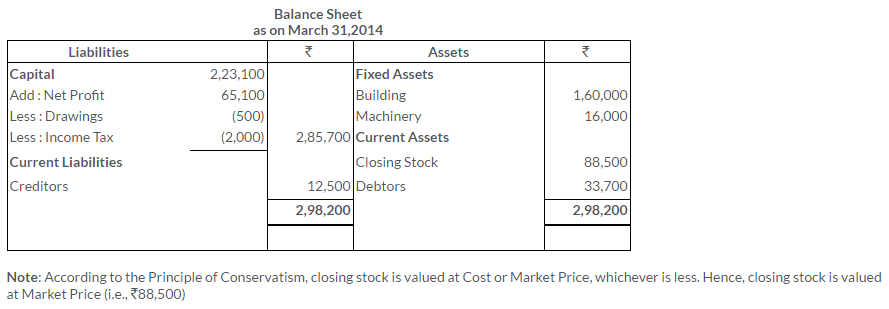

Chapter 17 – Financial Statements of Sole Proprietorship Solution of TS Grewal’s Class 11

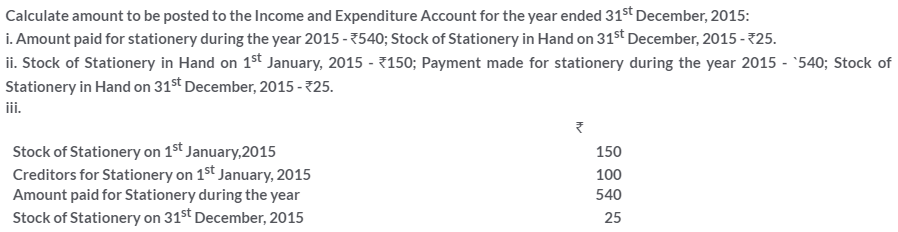

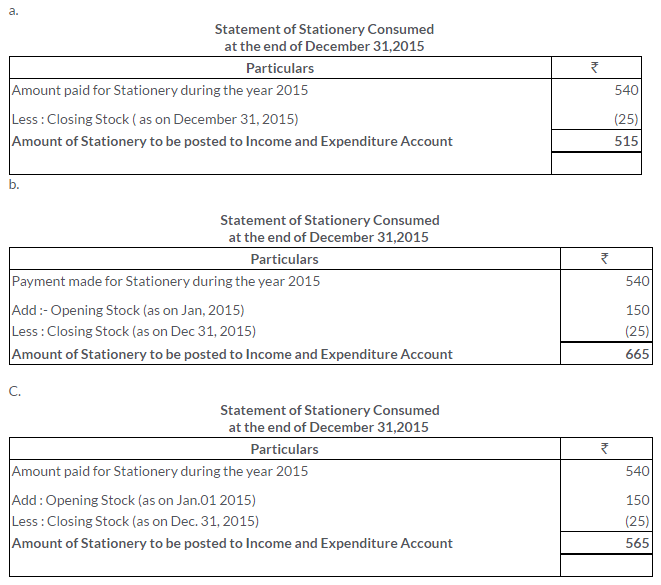

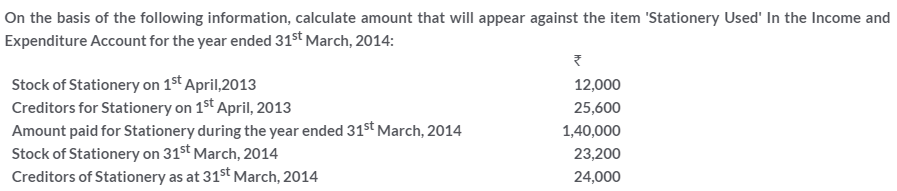

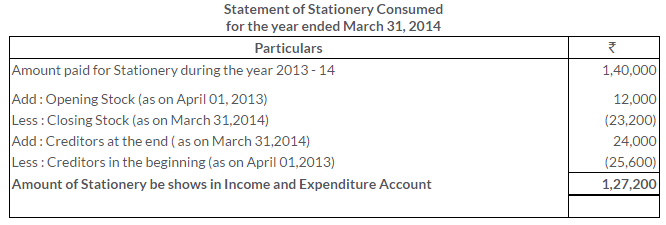

Chapter 18 – Adjustments in Preparation of Financial Statements Solution of TS Grewal’s Class 11

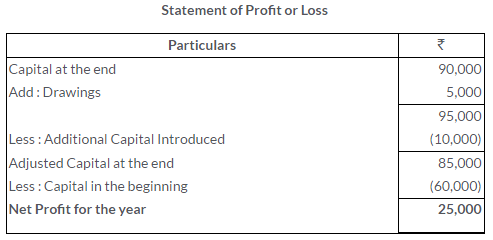

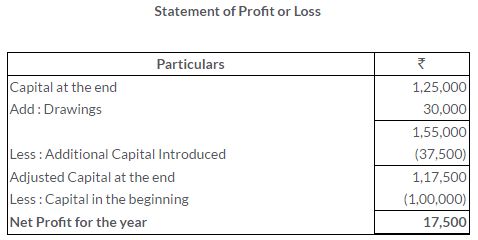

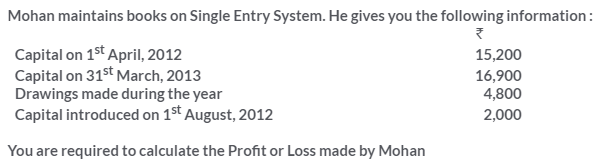

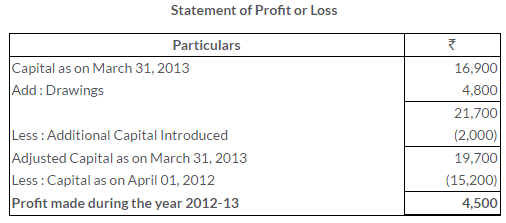

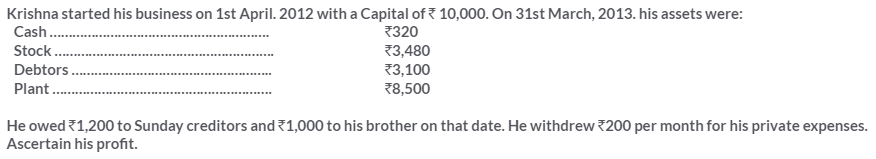

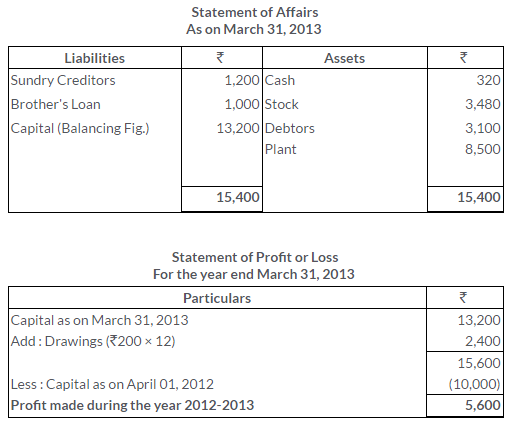

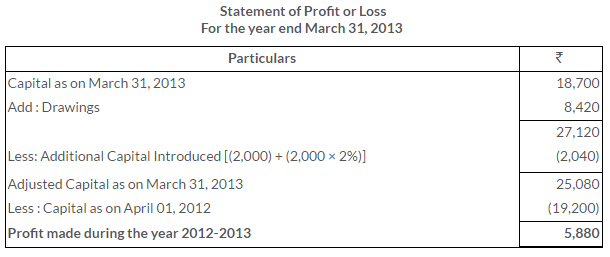

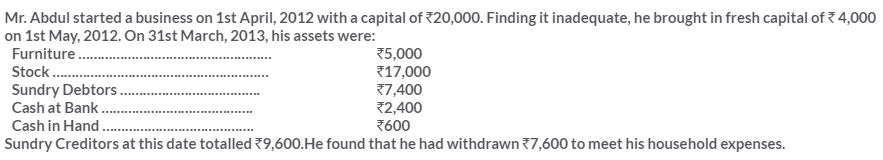

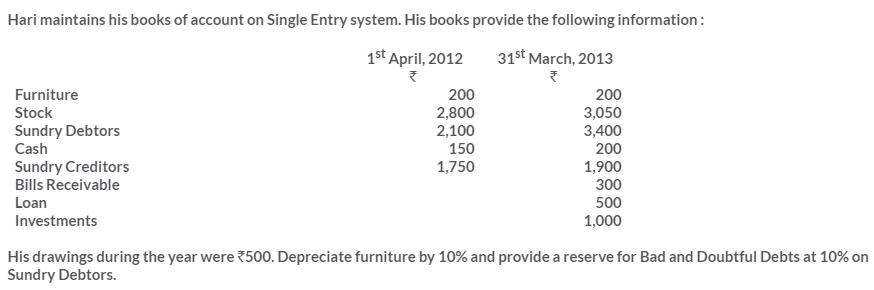

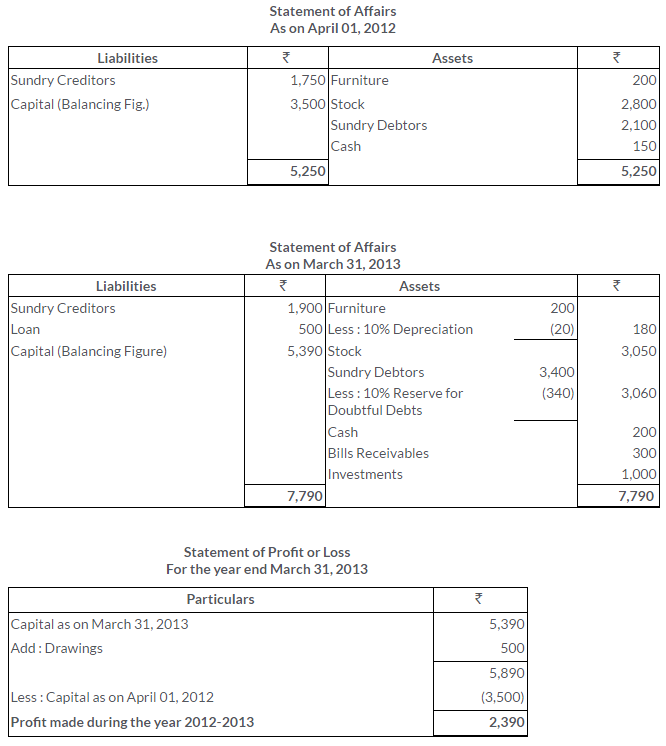

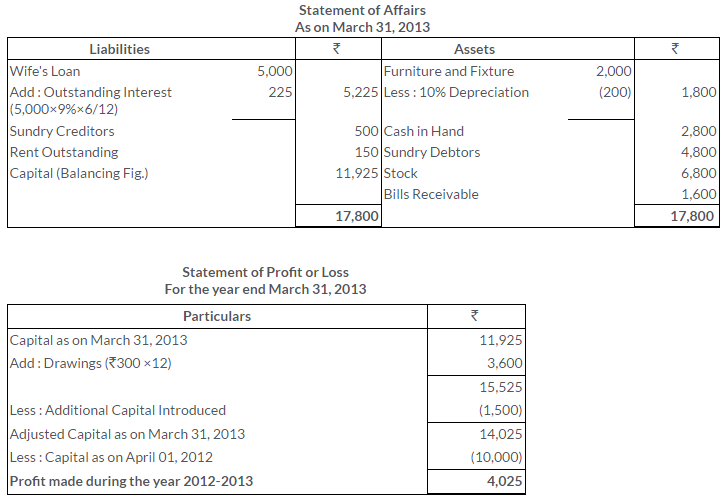

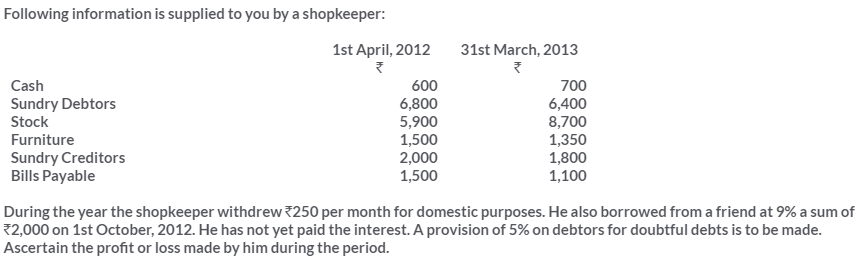

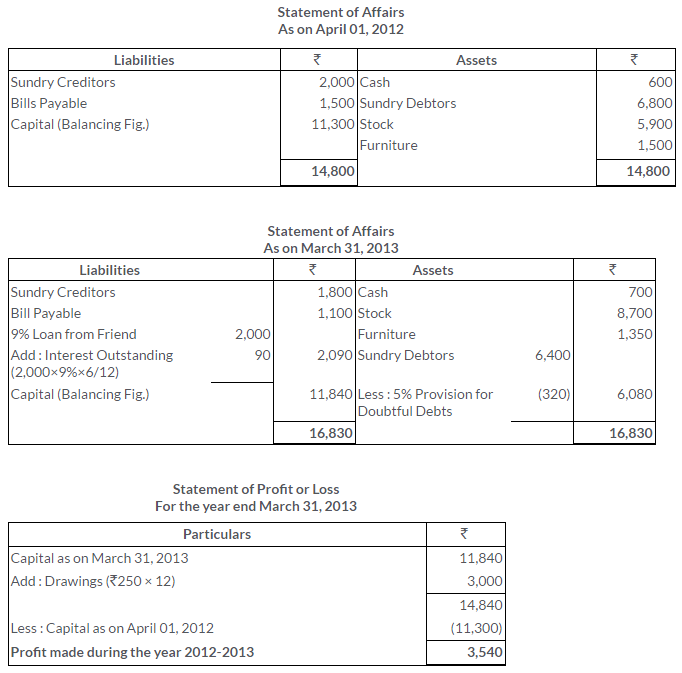

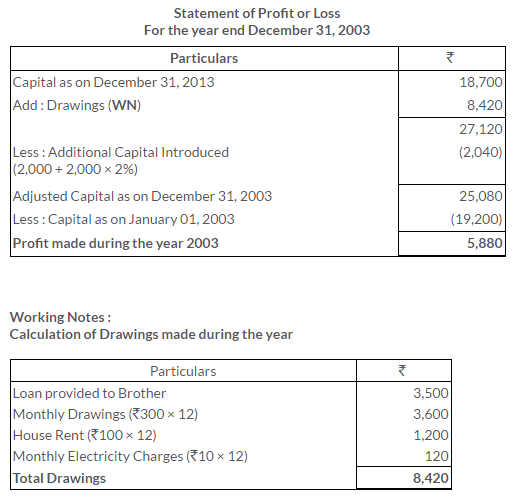

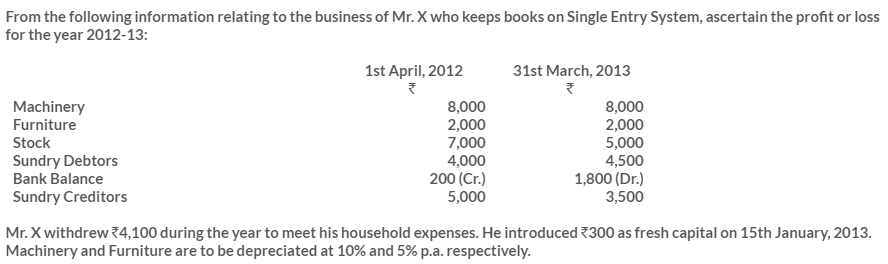

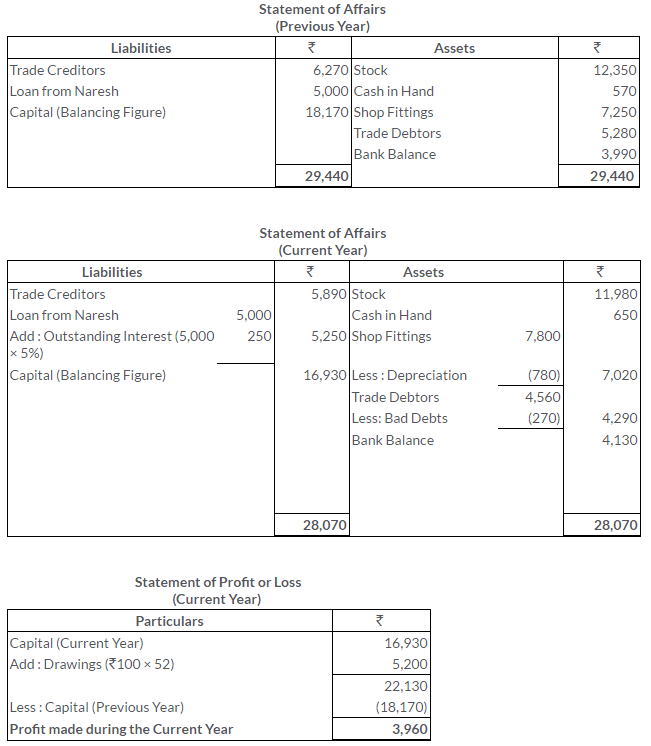

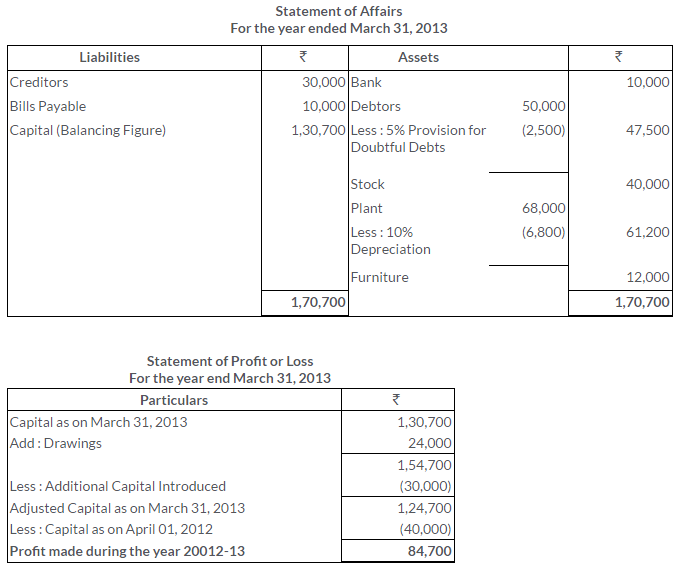

Chapter 19 – Accounts from Incomplete Records – Single Entry System Solution of TS Grewal’s Class 11

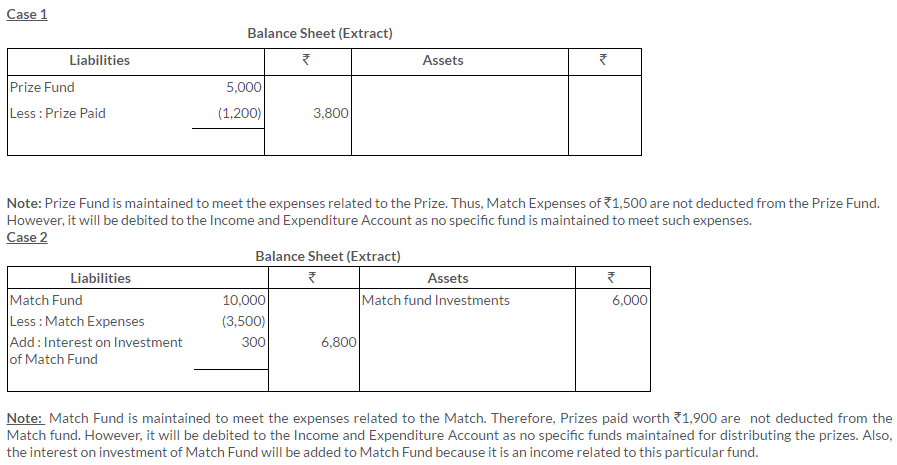

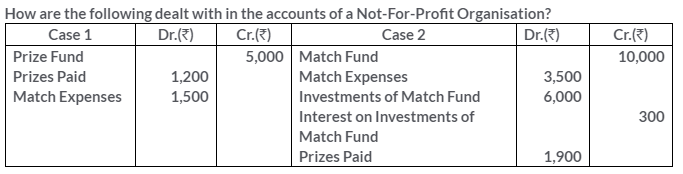

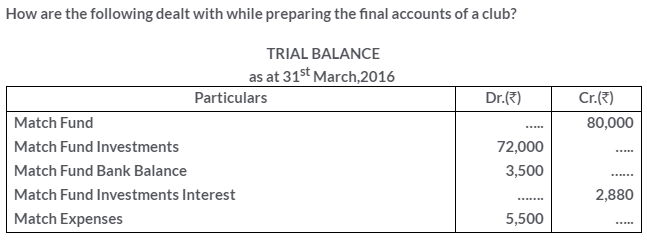

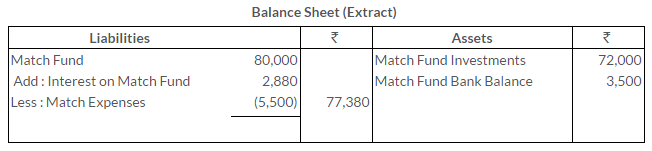

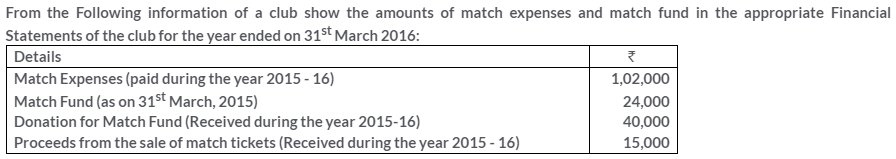

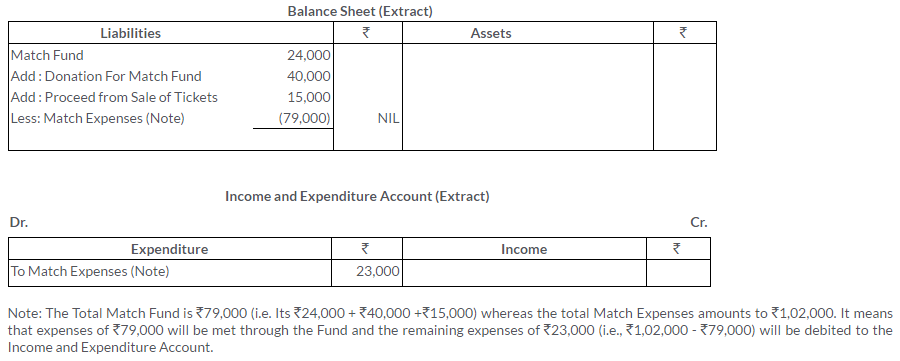

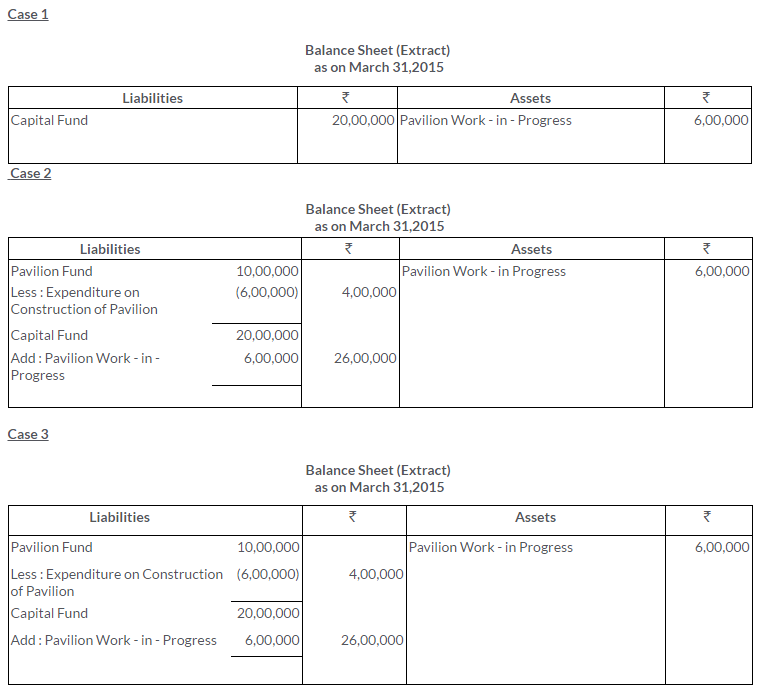

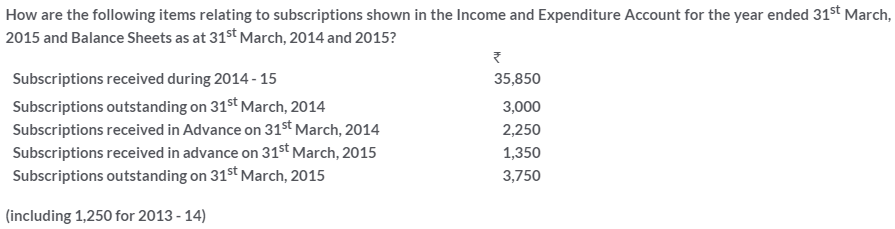

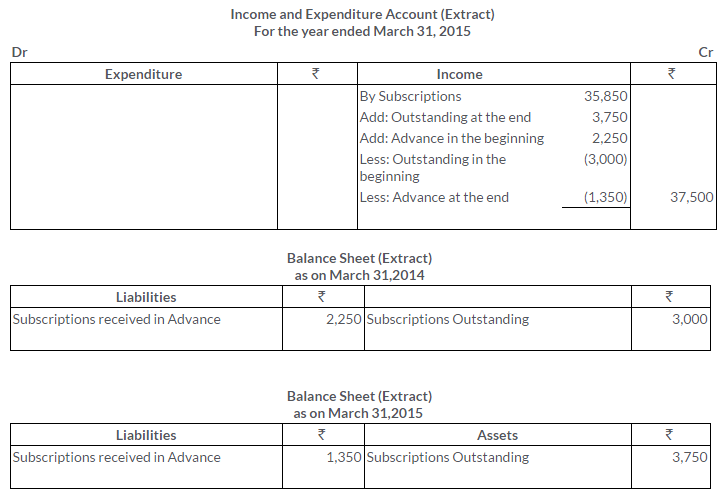

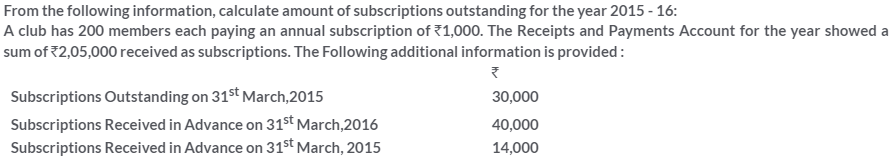

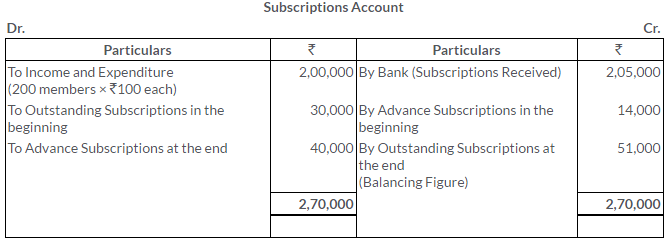

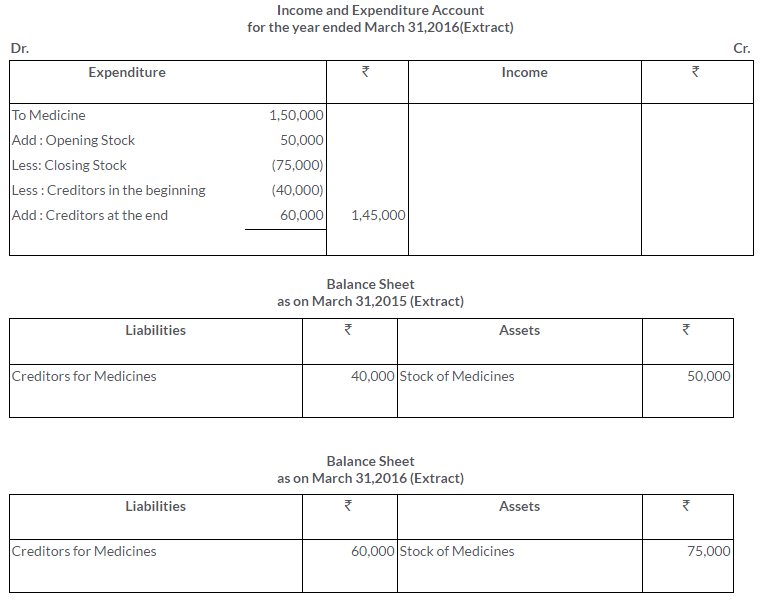

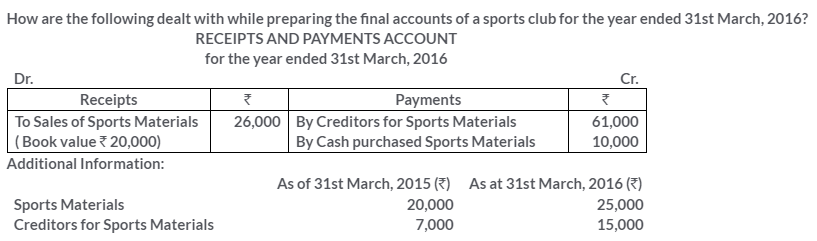

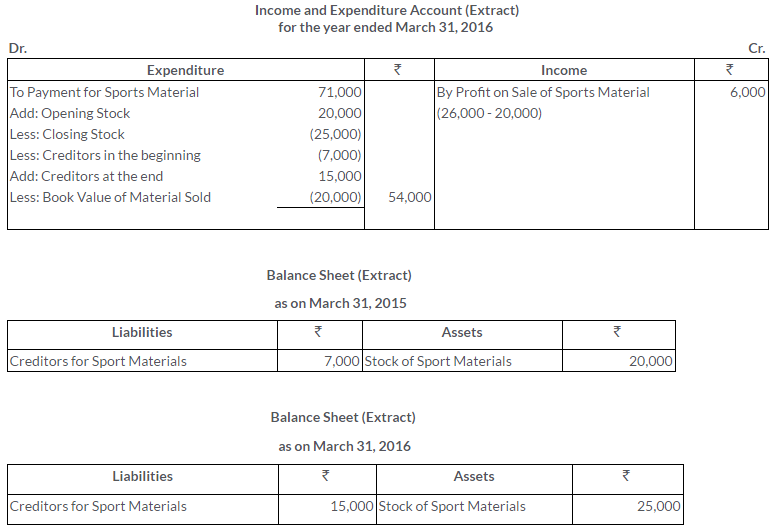

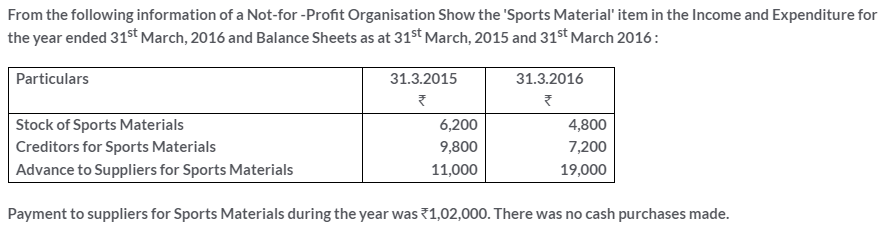

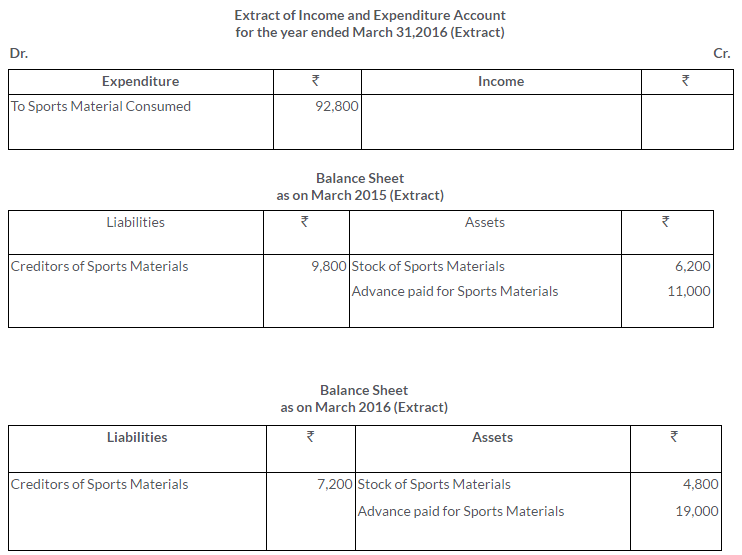

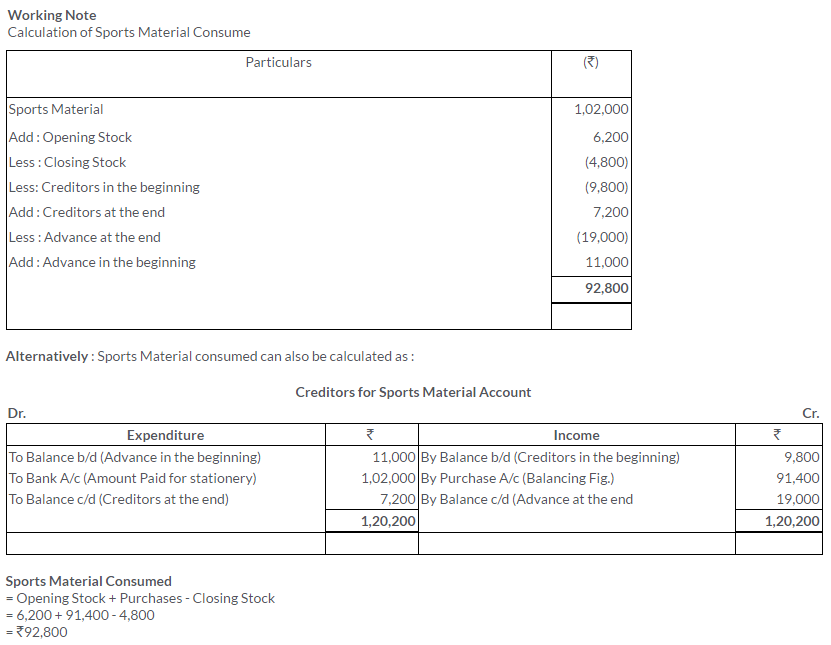

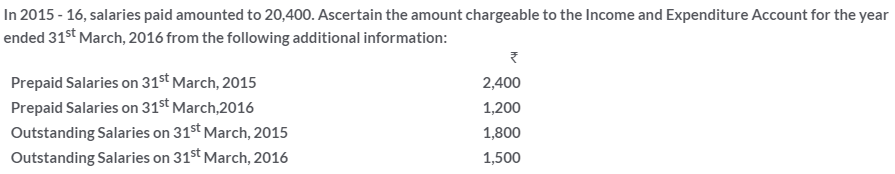

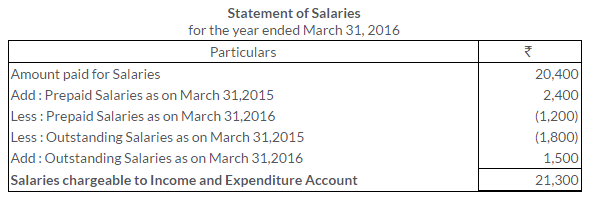

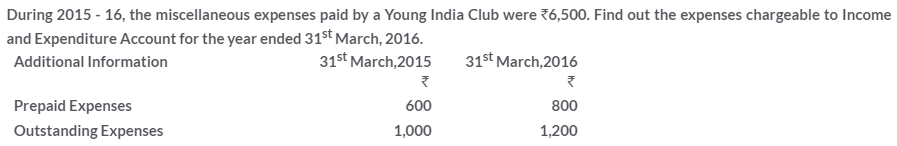

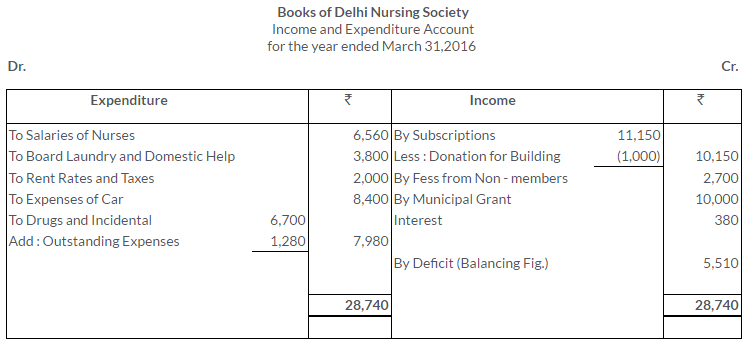

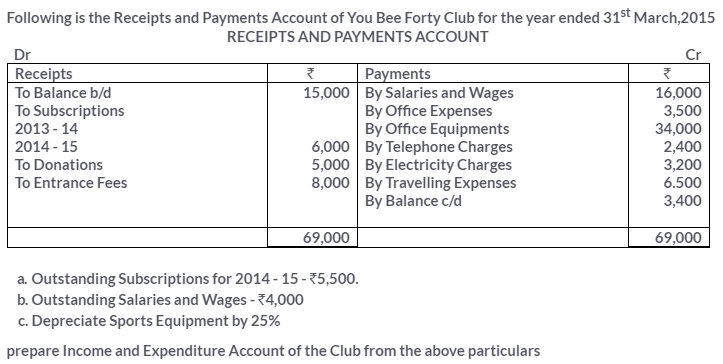

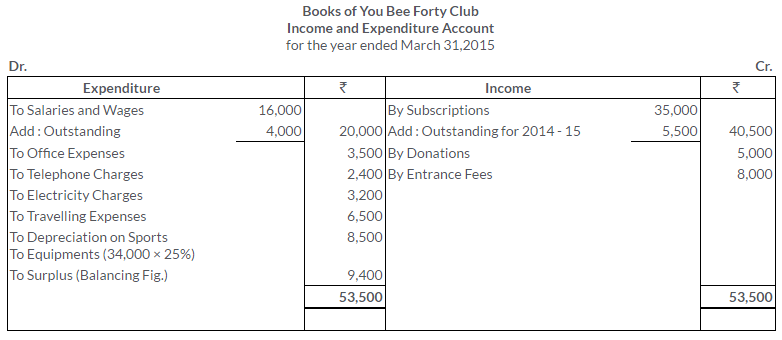

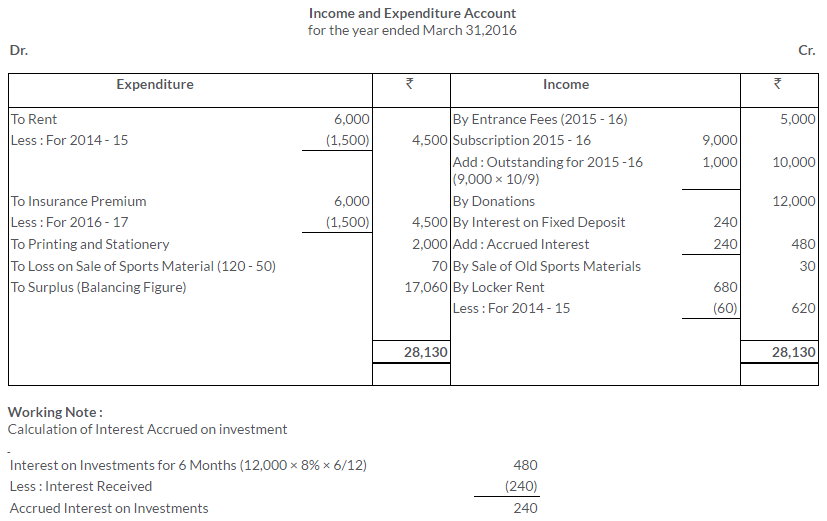

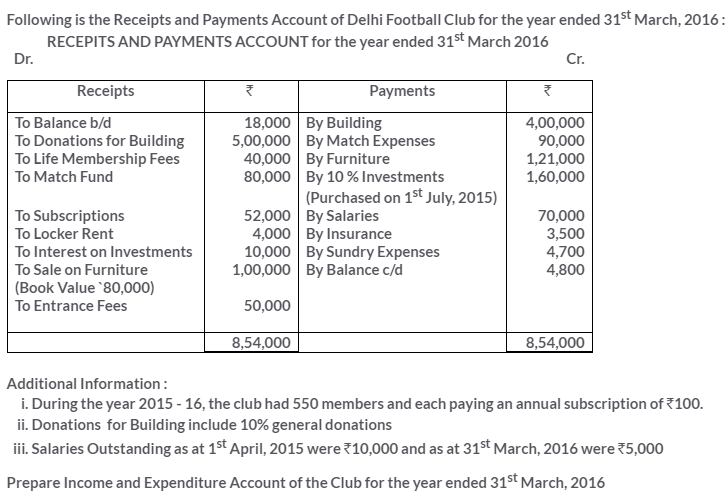

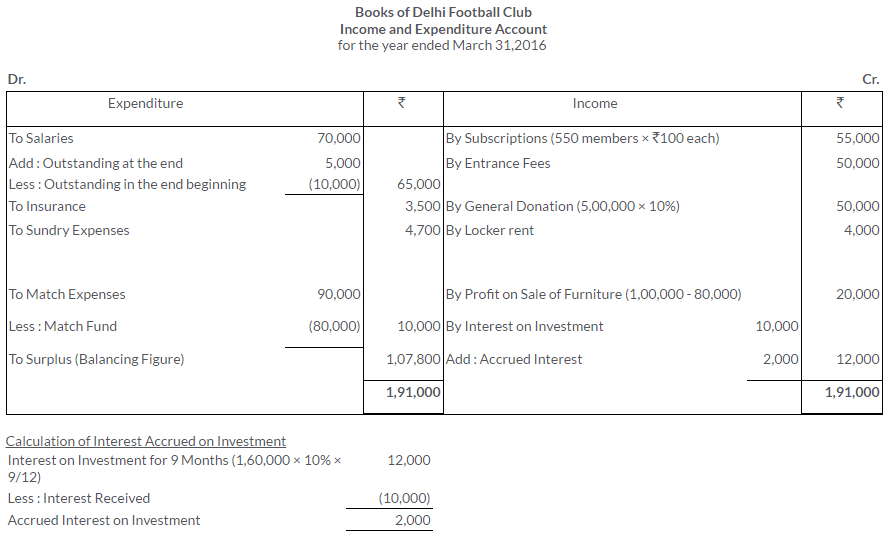

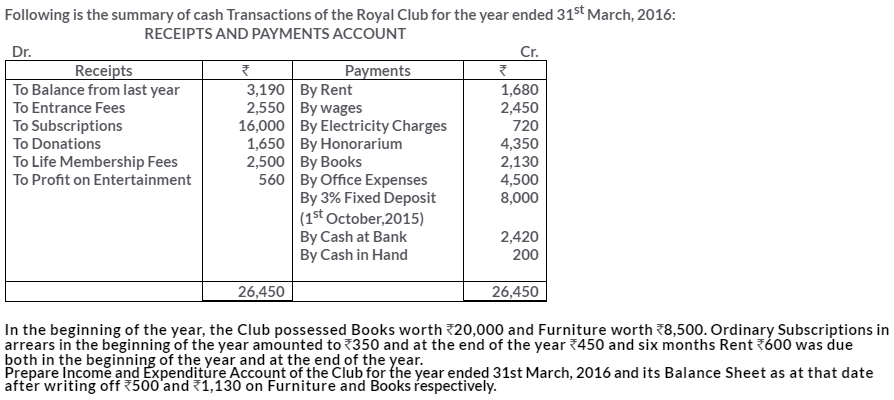

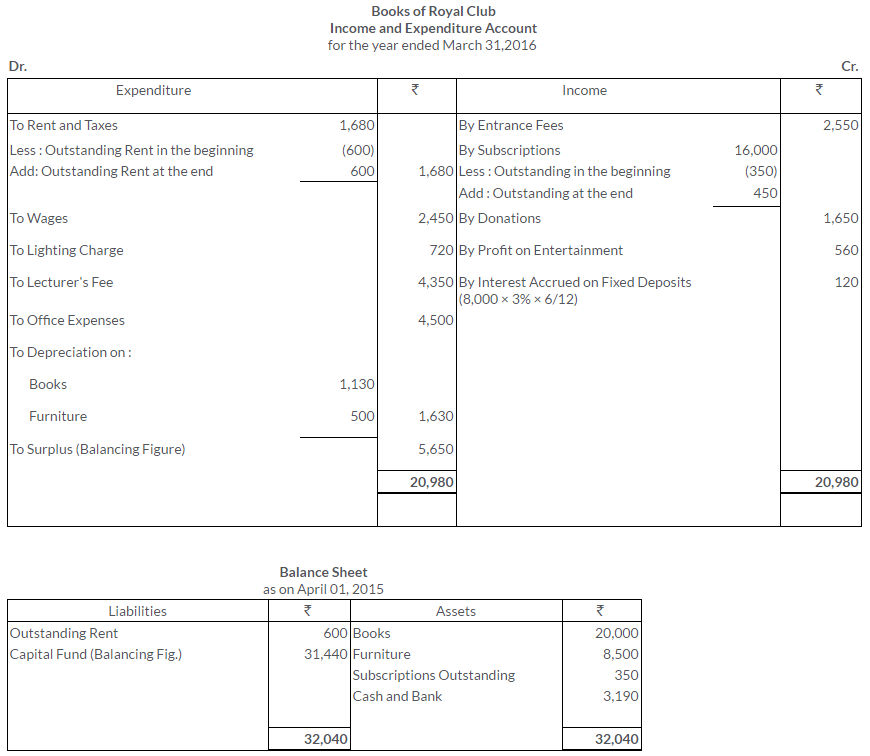

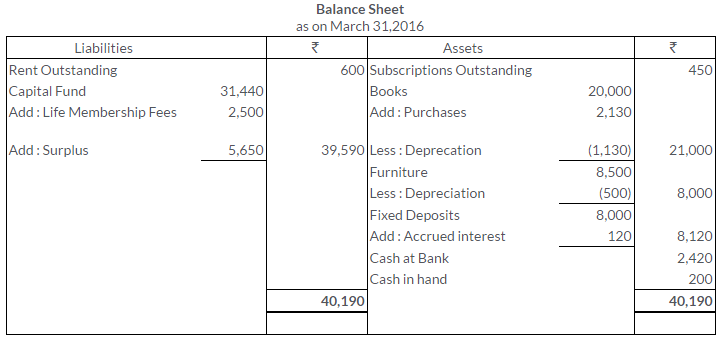

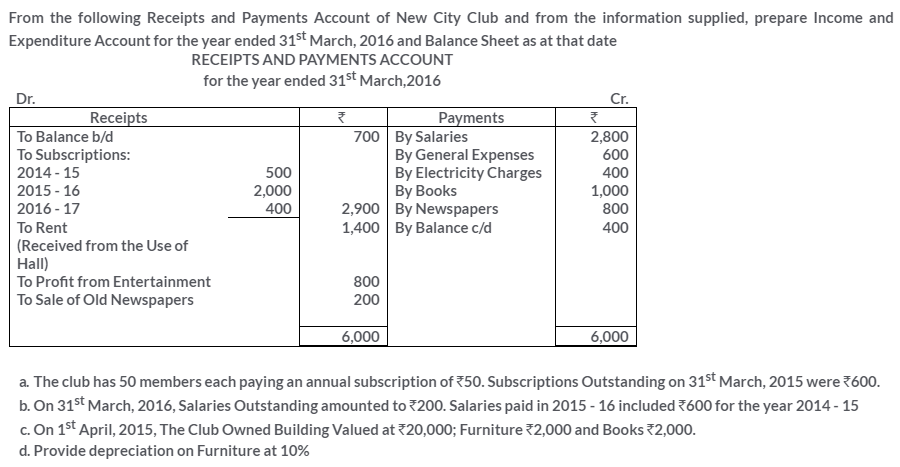

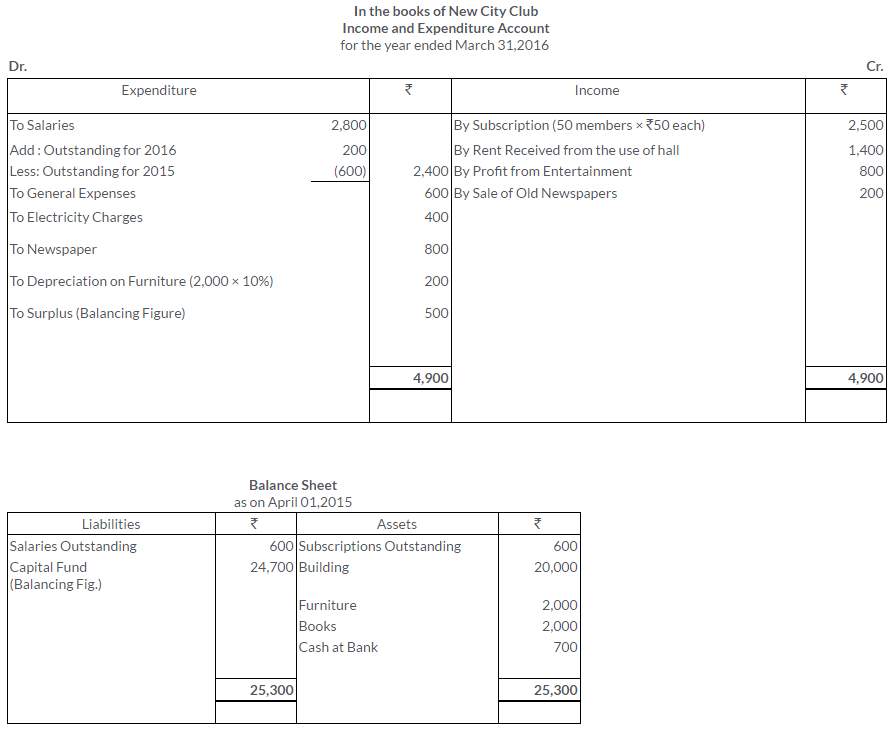

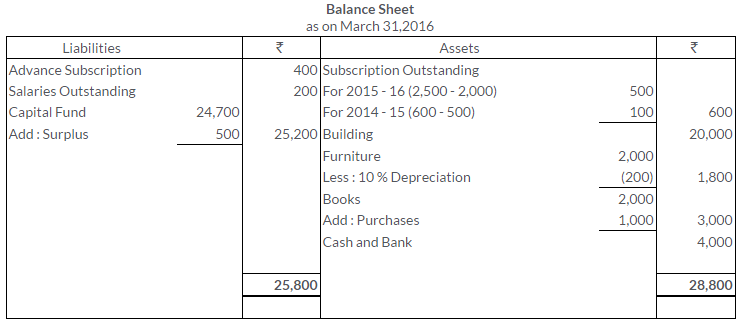

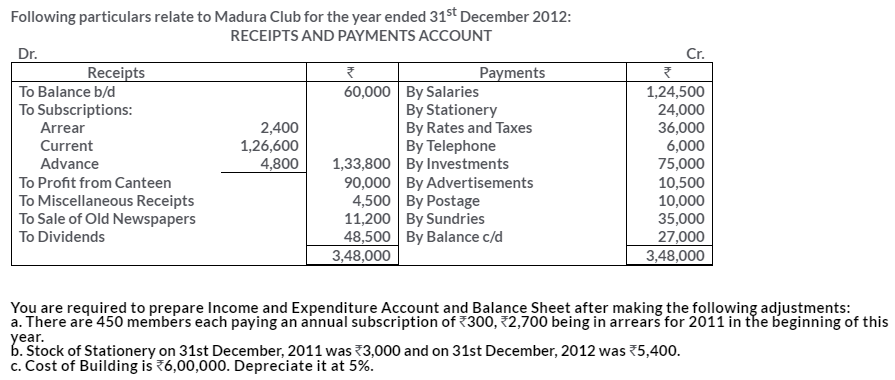

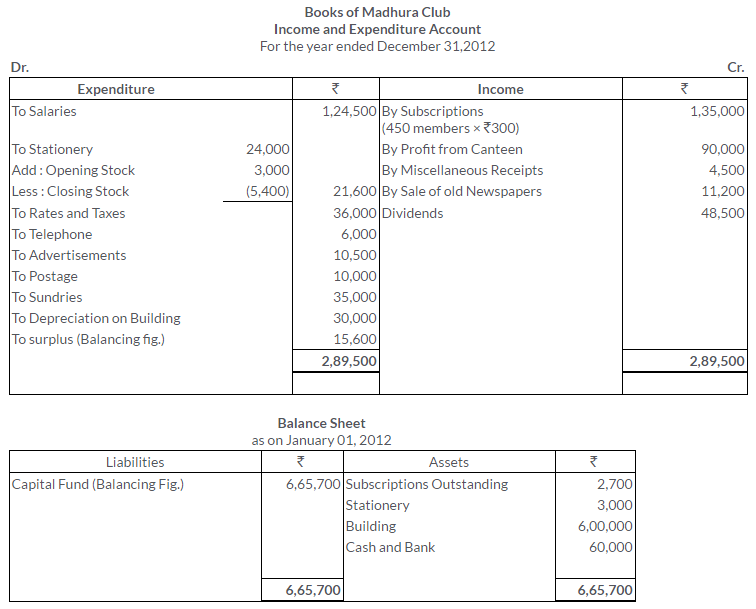

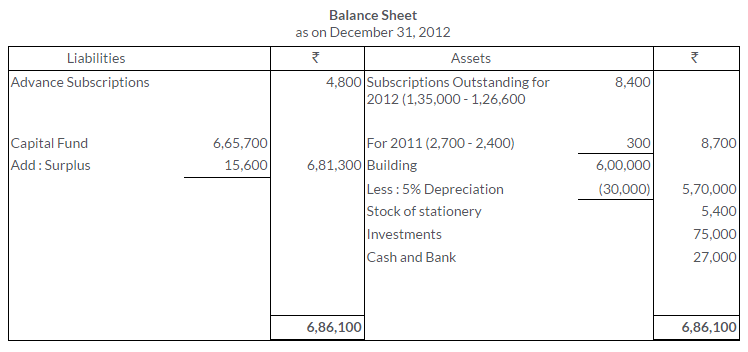

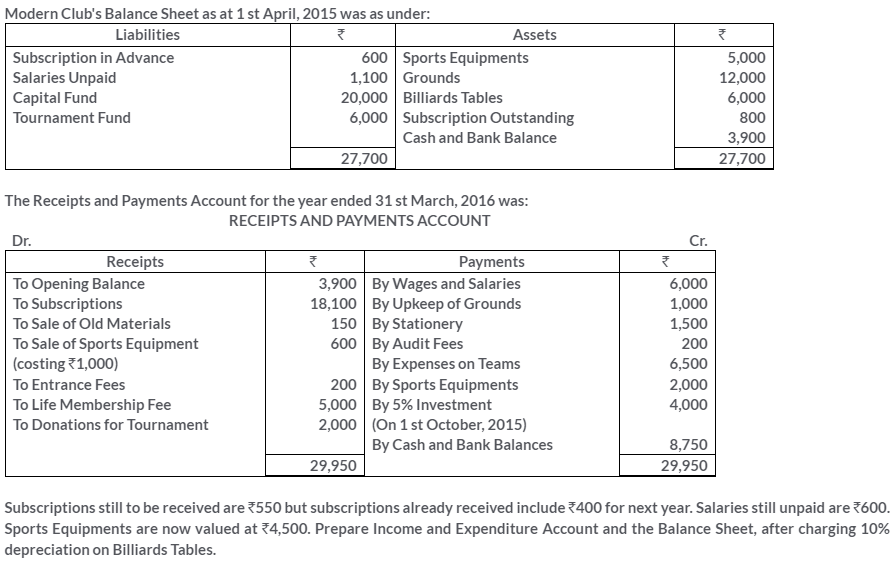

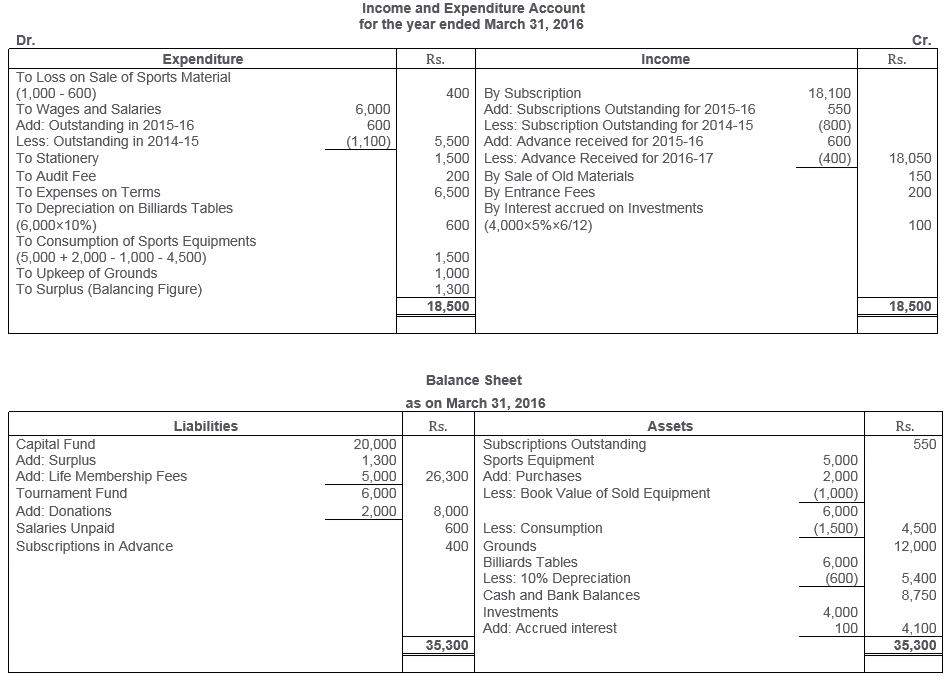

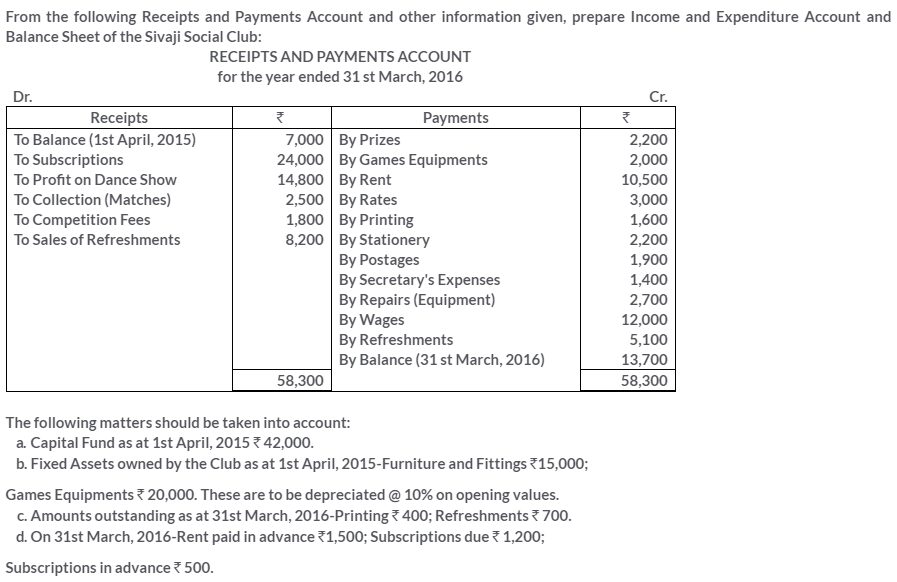

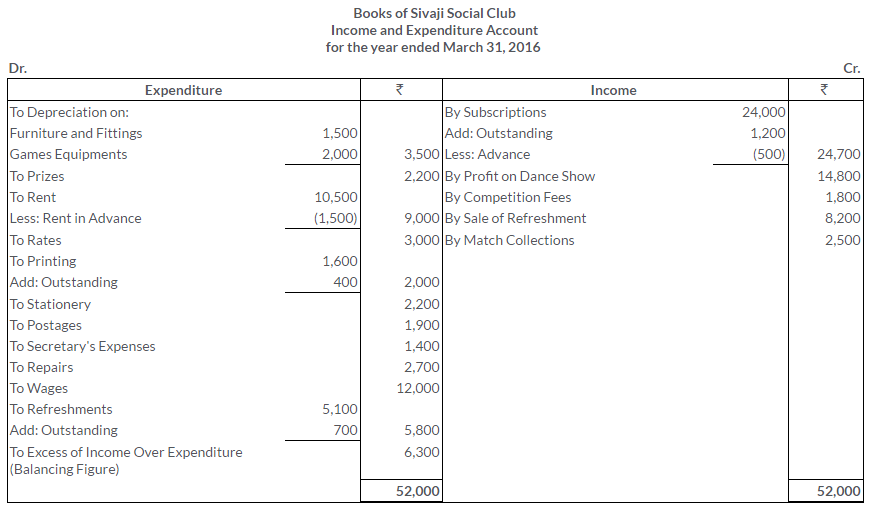

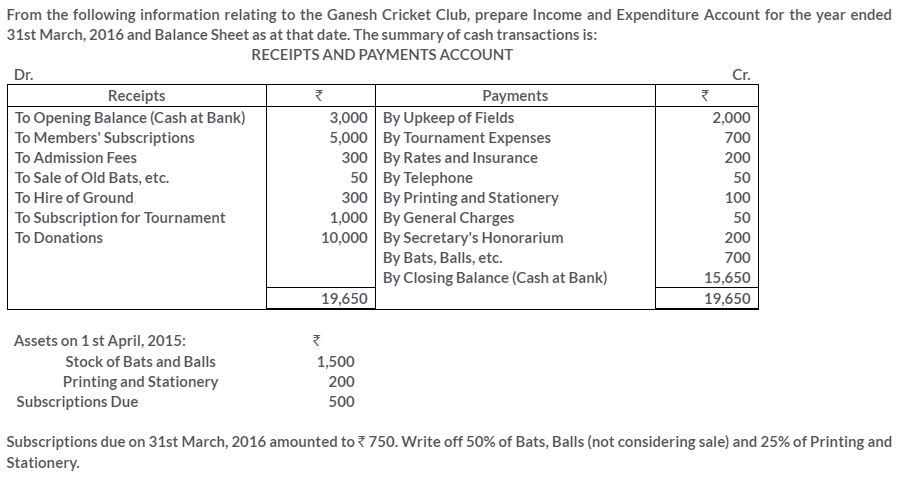

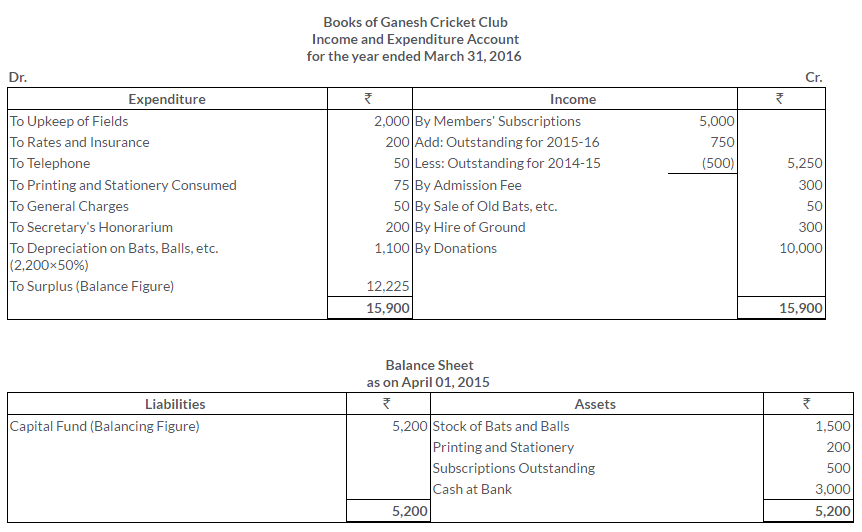

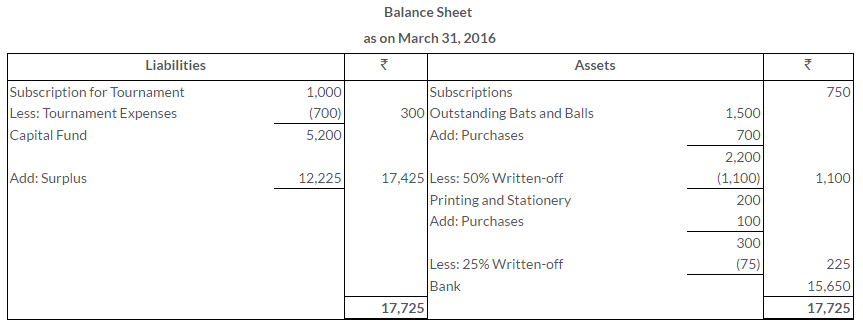

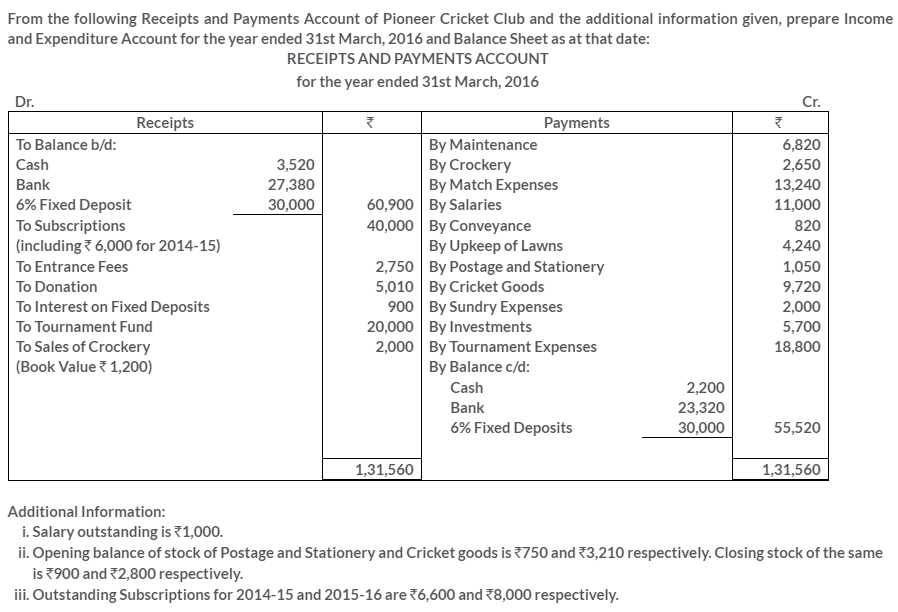

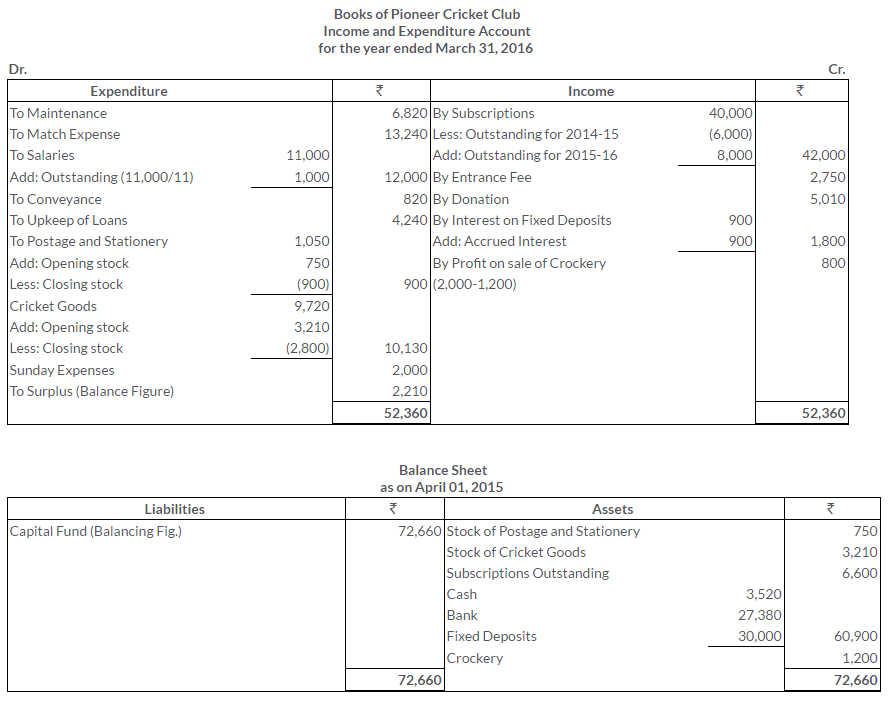

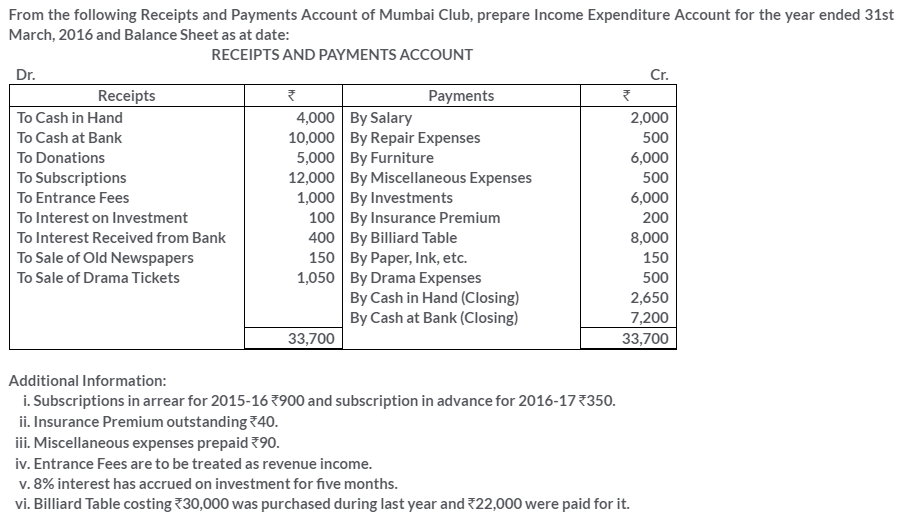

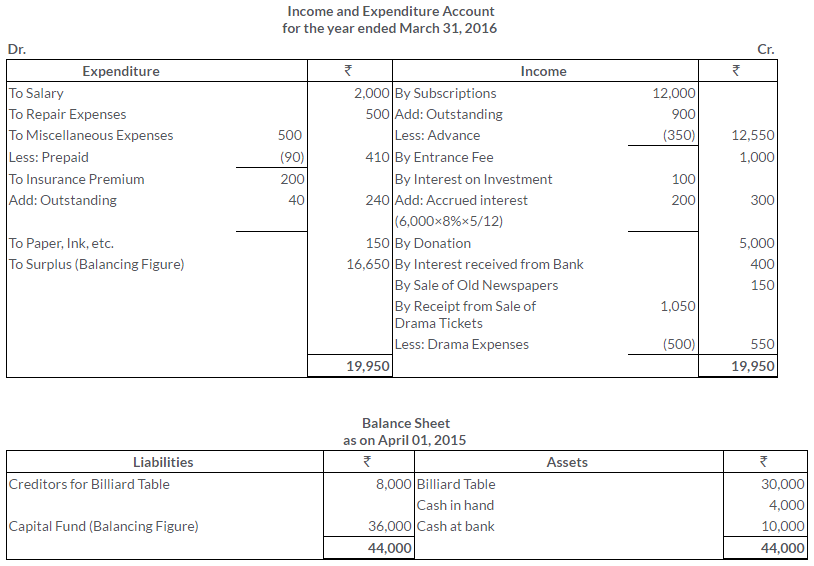

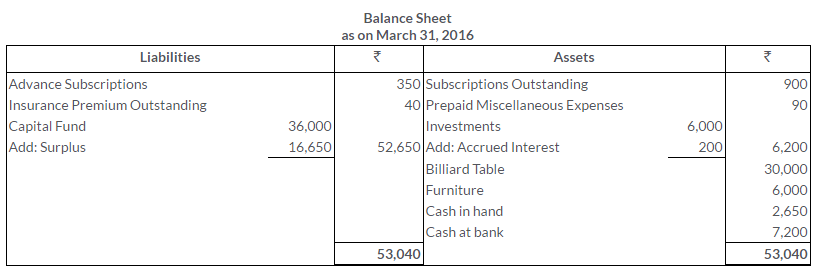

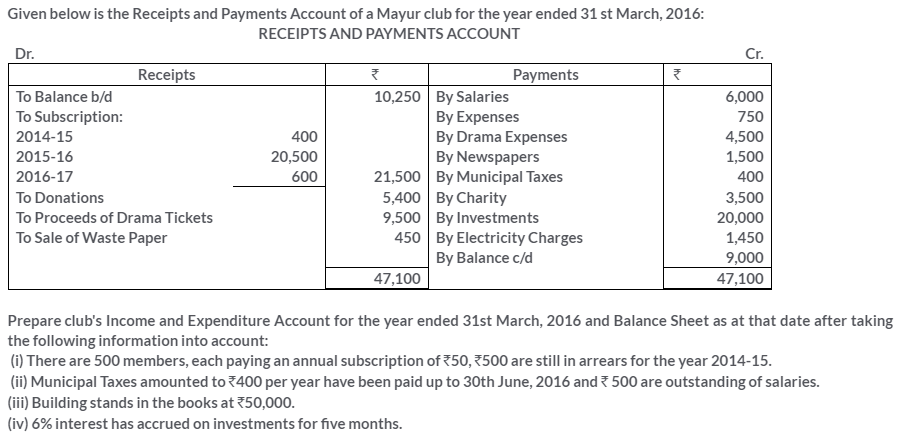

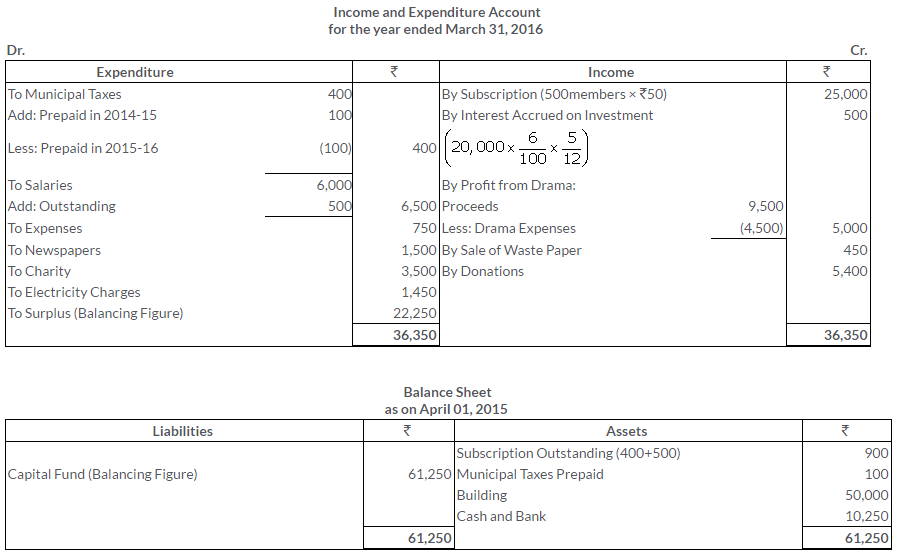

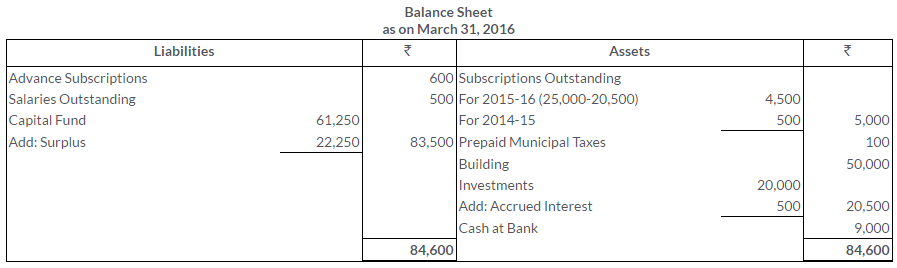

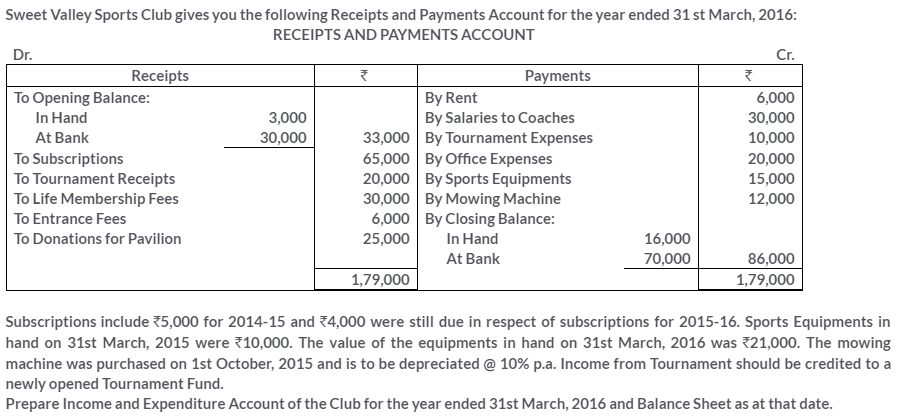

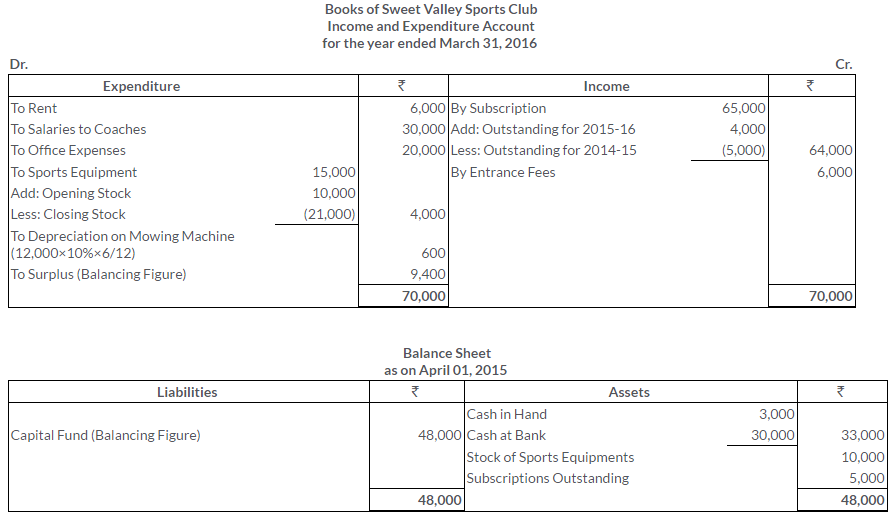

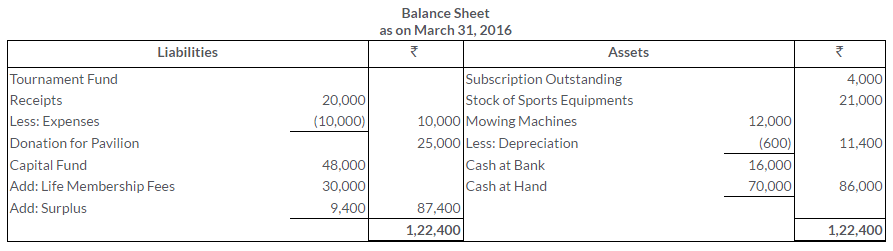

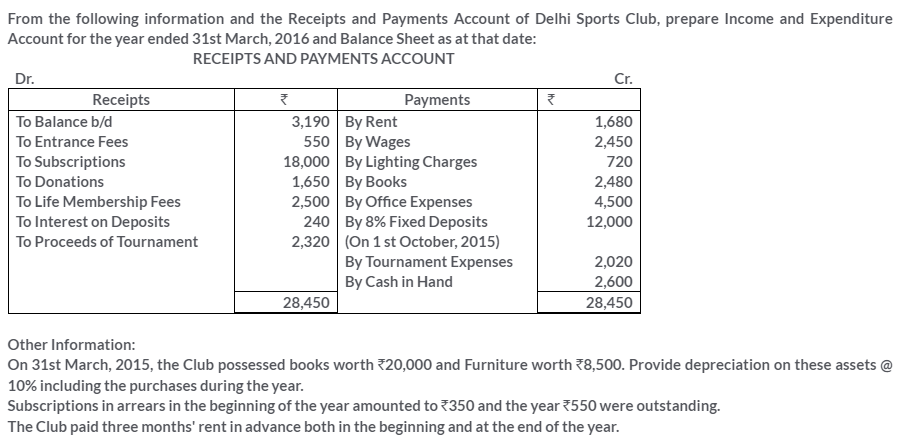

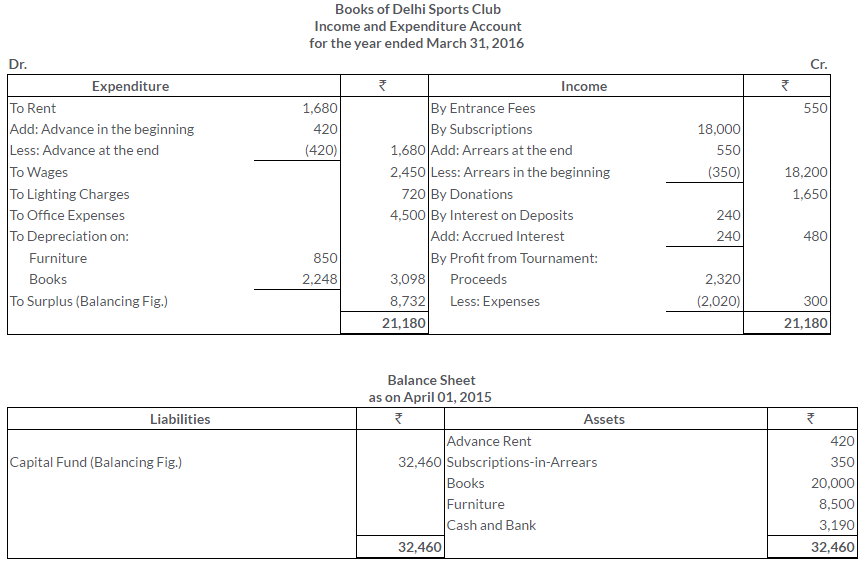

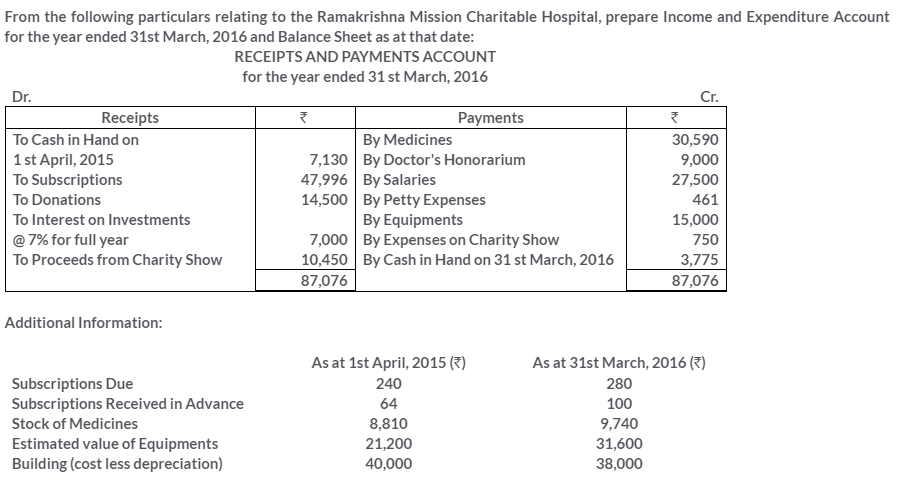

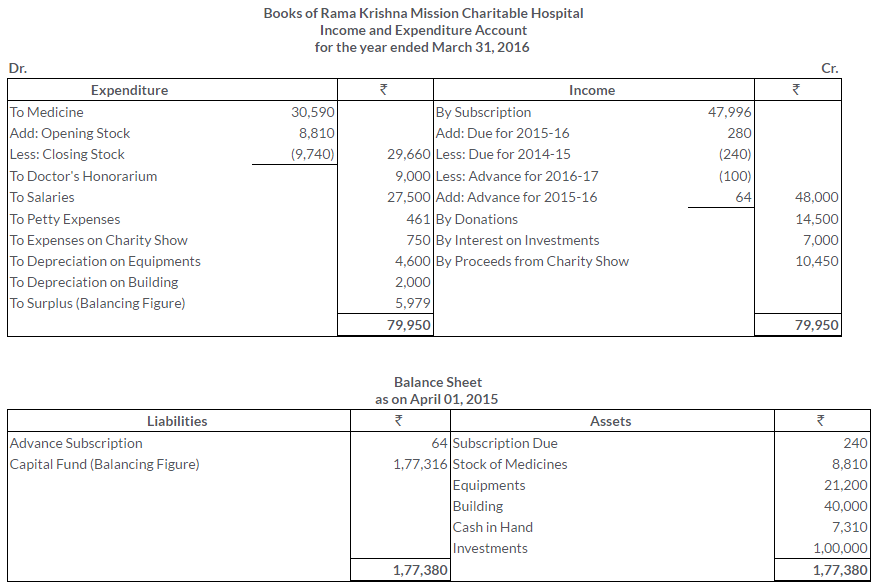

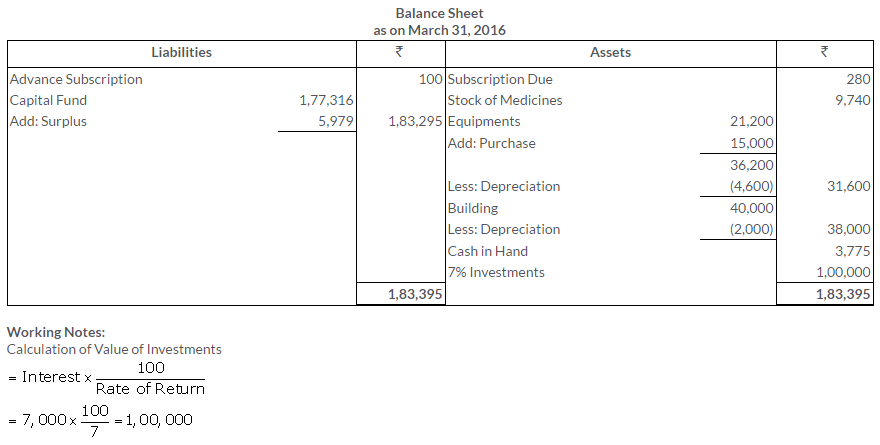

Chapter 20 – Financial Statements of Not-for-Profit Organisations Solution of TS Grewal’s Class 11

[showhide more_text=”Tags” less_text=”Hide Tags”]

ts grewal accountancy class 11 solutions, ts grewal accountancy class 11, ts grewal accountancy class 11 pdf, ts grewal solutions class 11, ts grewal accountancy class 11 solutions free download pdf, ts grewal class 11 solutions, ts grewal accountancy class 11 pdf free download, ts grewal accountancy class 11 solutions 2016, double entry bookkeeping ts grewal class 11 pdf free download, ts grewal accountancy class 11 solutions pdf, ts grewal accountancy class 11 solutions 2015, solution of ts grewal class 11, ts grewal accountancy class 11 solutions 2017, class 11 accounts ts grewal solutions, class 11 accountancy ts grewal solutions, accounts book for class 11 ts grewal pdf, class 11 ts grewal solutions, ts grewal accountancy class 11 ebook, solution of ts grewal accountancy class 11, ts grewal class 11 accounts solutions, ts grewal accountancy class 11 solutions accounting equation, ts grewal double entry bookkeeping class 11 solutions, ts grewal accountancy class 11 book free download, accounts book for class 11 ts grewal, class 11 accounts ts grewal, ts grewal class 11 solutions pdf, accountancy class 11 ts grewal solution, ts grewal accountancy class 11 solutions depreciation, solutions of ts grewal class 11, ts grewal accountancy class 11 solutions online, accounts class 11 ts grewal solutions, ts grewal class 11, ts grewal accountancy class 11 journal solutions, ts grewal accountancy class 11 solutions pdf 2015, ts grewal class 11 pdf, ts grewal class 11 solutions 2017, accounts class 11 ts grewal, ts grewal accountancy class 11 free download, ts grewal accountancy class 11 solutions chapter 8, ts grewal class 11 journal and ledger solutions, ts grewal solutions class 11 2017, depreciation class 11 ts grewal, accounts ts grewal class 11 solutions, ts grewal accountancy class 11 solutions meritnation, class 11 ts grewal solutions 2017, class 11 accounts ts grewal solutions 2017, accounts ts grewal class 11, ts grewal accountancy class 11 solutions free download, ts grewal accountancy class 11 solutions chapter 9, rectification of errors class 11 ts grewal, ts grewal accountancy class 11 depreciation solutions pdf, ts grewal solution class 11, accounts solution class 11 ts grewal, class 11 accountancy ts grewal, accountancy class 11 ts grewal solutions, solutions for ts grewal class 11, ts grewal class 11 accounts book solutions, meritnation class 11 ts grewal solutions, ts grewal class 11 accounts book pdf, meritnation class 11 accountancy ts grewal, ts grewal accountancy class 11 solutions chapter 5, ts grewal accounts class 11 solutions, ts grewal accountancy class 11 book, class 11 accounts solutions of ts grewal, ts grewal accountancy class 11 answers, double entry bookkeeping ts grewal class 11 solutions, answers of ts grewal class 11, ts grewal solutions class 11 meritnation, class 11 ts grewal, ts grewal double entry bookkeeping class 11, double entry bookkeeping ts grewal class 11 solutions pdf, ts grewal accountancy class 11 book solutions, accountancy class 11 ts grewal, ts grewal accountancy class 11 book pdf, class 11 ts grewal solutions 2016, ts grewal accountancy class 11 solutions 2017 pdf, ts grewal accountancy class 11 book price, ts grewal double entry bookkeeping class 11 pdf, ts grewal 11 class solutions, ts grewal double entry bookkeeping for class 11 solutions, ts grewal accountancy class 11 solutions 2017 edition, meritnation class 11 ts grewal, solution of accounts ts grewal class 11, class 11 ts grewal solutions 2015, ts grewal accountancy class 11 solutions download, ts grewal accountancy class 11 journal and ledger solutions, accounts ts grewal solutions class 11, ts grewal class 11 accounts book answers, ts grewal solutions class 11 2016, solutions of ts grewal accountancy class 11 meritnation, solutions to ts grewal class 11, ts grewal accountancy class 11 book download, ts grewal solutions class 11 2015, ts grewal accountancy class 11 solutions 2015 edition, accountancy class 11 ts grewal solution meritnation, ts grewal class 11 solutions 2016, double entry bookkeeping class 11 by ts grewal pdf, class 11 ts grewal pdf, ts grewal accountancy class 11 questions, download ts grewal accountancy class 11 pdf, class 11 accountancy book ts grewal, ts grewal accountancy class 11 project work, accounts ts grewal class 11 pdf, class 11 accounts ts grewal solutions 2016, solution of double entry bookkeeping ts grewal class 11, accounts book class 11 ts grewal, ts grewal accountancy class 11 book online, accounts book for class 11 ts grewal download, solutions of ts grewal accountancy class 11, ts grewal accountancy class 11 ebook free download, class 11 ts grewal solution, ts grewal accountancy class 11 pdf download, double entry bookkeeping ts grewal class 11, solutions of class 11 accounts ts grewal, ts grewal class 11 book, meritnation class 11 accounts ts grewal 2017, ts grewal accountancy class 11 solutions pdf 2016, ts grewal accountancy class 11 chapter 5 solutions, ts grewal accountancy class 11 solutions 2014, ts grewal accountancy class 11 solutions 2016 pdf, ts grewal solutions class 11 2017 edition, meritnation class 11 commerce ts grewal, class 11 ts grewal 2016 solutions, ts grewal class 11 solution, ts grewal accountancy class 11 double entry bookkeeping, ts grewal accountancy class 11 cbse pdf, meritnation class 11 accountancy ts grewal 2015, class 11 accounts ts grewal pdf, ts grewal class 11 depreciation solutions, bills of exchange class 11 ts grewal, rectification of errors class 11 ts grewal solutions, class 11 accountancy ts grewal pdf, 11 class accounts book ts grewal solutions, solution of ts grewal class 11 2017, class 11 accounts ts grewal solution, meritnation ts grewal solution class 11, ts grewal accountancy class 11 isc, ts grewal accountancy solution class 11, 11 class ts grewal solutions, ts grewal accountancy class 11 meritnation, accounts solutions class 11 ts grewal, ts grewal pdf class 11, accounts book for class 11 ts grewal solution, meritnation class 11 commerce ts grewal 2017, class 11 ts grewal accounts solution, class 11 accountancy book ts grewal pdf, ts grewal accountancy class 11 rectification of errors, accounting equation class 11 ts grewal, solutions of ts grewal class 11 2016, ts grewal accountancy class 11 solutions chapter 10, class 11 ts grewal book, solution of ts grewal accounts class 11, ts grewal accountancy class 11 solutions 2014 edition, ts grewal class 11 solutions 2015, double entry bookkeeping class 11 by ts grewal, answers of class 11 accounts ts grewal, ts grewal accountancy class 11 book pdf download, solutions of ts grewal class 11 2017, accounts class 11 ts grewal solutions 2017, meritnation class 11 accountancy ts grewal solution, ts grewal accountancy class 11 solutions 2013 edition, ts grewal 2015 class 11, ts grewal accountancy class 11 solutions ch 6, ts grewal class 11 solutions chapter 14, ts grewal accountancy class 11 solutions chapter 13, ts grewal class 11 accountancy solutions, solution of ts grewal class 11 2015, bills of exchange class 11 ts grewal solutions, solutions of ts grewal accountancy class 11 2015, ts grewal accountancy class 11 solutions bills of exchange, ledger questions for class 11 ts grewal, ts grewal accountancy class 11 torrent, ts grewal double entry bookkeeping class 11 2017, class 11 ts grewal accountancy solutions, bank reconciliation statement ts grewal class 11, ts grewal accountancy class 11 model test paper, ts grewal questions class 11, meritnation class 11 ts grewal 2017, solution of ts grewal accountancy class 11 2017, class 11 ts grewal solutions pdf, ts grewal class 11 2017 solutions, ts grewal solutions class 11 pdf, ts grewal solutions for class 11, ts grewal solution of class 11, class 11 accounts ts grewal notes, ncert solutions for class 11 accountancy ts grewal, ts grewal solutions class 11 2016 edition, solutions of bank reconciliation statement of class 11 ts grewal, accounts class 11 ts grewal solutions 2016, ts grewal solution 11 class, download ts grewal class 11, double entry bookkeeping ts grewal class 11 pdf, ts grewal accounts book class 11, ts grewal class 11 questions, meritnation ts grewal class 11 solutions 2016, 11 class account book ts grewal, accounts 11 class ts grewal, ts grewal accountancy class 11 journal and ledger, ts grewal class 11 accounts, download ts grewal accountancy class 11, class 11 accountancy ts grewal solution, class 11 accountancy solutions ts grewal, solution of ts grewal accountancy class 11 2015, ts grewal accounts class 11 pdf, solutions of ts grewal class 11 accountancy, meritnation class 11 accountancy ts grewal 2017, ts grewal accountancy class 11 chapter 8, ts grewal accountancy class 11 chapter depreciation, double entry bookkeeping ts grewal solution class 11, accounting equation questions for class 11 with solutions ts grewal, ts grewal book class 11, ts grewal accountancy class 11 solutions rectification of errors, ts grewal accountancy 2015 class 11, accountancy class 11 ts grewal solution 2014, ts grewal accountancy class 11 book pdf free download, answers of double entry bookkeeping ts grewal class 11, class 11 accountancy ts grewal solutions 2017, solved ts grewal accountancy class 11, accounts class 11 ts grewal pdf, ts grewal accountancy class 11 journal solutions 2017, ts grewal accountancy class 11 hindi, ts grewal accountancy class 11 practical problems solutions, ts grewal accountancy class 11 2015 edition, accountancy class 11 ts grewal pdf, ts grewal accountancy class 11 accounting equation, class 11 accounts ts grewal 2015 solutions, ts grewal 2015 class 11 solutions, ts grewal solutions class 11 download, ts grewal accountancy class 11 new edition, ts grewal class 11 bills of exchange solutions, ts grewal class 11 solutions ch 17, ts grewal accountancy class 11 brs, ts grewal accountancy class 11 pdf in hindi, ts grewal class 11 chapter 18 solution, ts grewal solutions class 11 2015 edition, answers to ts grewal class 11, ts grewal class 11 solutions financial statements, ts grewal class 11 chapter 21 solutions, solutions of ts grewal accountancy class 11 2014 edition, ts grewal accountancy class 11 answers pdf, ts grewal solutions class 11 2014 edition, ts grewal accountancy class 11 2014 edition, ts grewal accountancy book for class 11, ts grewal class 11 accountancy solutions 2017, ts grewal class 11 solutions chapter 12, ts grewal class 11 journal solutions, ts grewal accountancy class 11 chapter 13 solutions, ts grewal class 11 chapter 12 solutions, meritnation class 11 ts grewal 2014, ts grewal accountancy class 11 online book, ts grewal accountancy class 11 solutions online 2015, questions of ts grewal accountancy class 11, ts grewal accountancy class 11 chapter 8 solutions, ts grewal class 11 solutions 2016 meritnation, ts grewal accountancy class 11 2013 edition, ts grewal accountancy class 11 in hindi, ts grewal accountancy class 11 brs solutions, ts grewal class 11 solutions chapter 18, ts grewal class 11 solutions 2013, ts grewal class 11 2017 edition, ts grewal accountancy class 11 2012, ts grewal class 11 book solutions, ts grewal class 11 solution 2017, ts grewal class 11 chapter 16 solutions, ts grewal accountancy class 11 solutions chapter 7, ts grewal class 11 2015, ts grewal accountancy class 11 chapter 20, ts grewal class 11 solutions 2017 meritnation, ts grewal accountancy class 11 solutions free, ts grewal class 11 practical problem solutions, ts grewal accountancy class 11 book in hindi, ts grewal accountancy class 11 solutions chapter 19, ts grewal accountancy class 11 solutions ch 15, ts grewal accountancy class 11 npo, ts grewal class 11 chapter 21, ts grewal class 11 depreciation, ts grewal class 11 chapter 20 solutions, ts grewal class 11 pdf 2017, solution of ts grewal accountancy class 11 chapter 5, solutions of ts grewal accountancy for class 11 2014, ts grewal accountancy class 11 solutions for bills of exchange, ts grewal class 11 chapter 8 solutions, ts grewal accountancy class 11 illustrations, ts grewal accountancy class 11 journal, ts grewal accountancy class 11 download, ts grewal class 11 2017 edition pdf, ts grewal accountancy class 11 solutions 2015 pdf, ts grewal class 11 brs solutions, brs of 11 class ts grewal, ts grewal accountancy class 11 notes, ts grewal class 11 solutions single entry system, ts grewal accountancy class 11 ebook pdf, ts grewal accountancy class 11 textbook, ts grewal class 11 2017 pdf, ts grewal accountancy class 11 solutions chapter 16, solutions of ts grewal accountancy class 11 pdf, ts grewal accountancy class 11 pdf 2015, ts grewal accountancy class 11 solutions chapter 15, ts grewal class 11 chapter 1, ts grewal accountancy class 11 2012 edition, double entry bookkeeping ts grewal class 11 pdf download, ts grewal class 11 solutions ch 16, rectification of errors class 11 solutions ts grewal, depreciation class 11 ts grewal pdf, ts grewal accountancy class 11 solutions chapter 11, ts grewal accountancy class 11 sample papers, solution of ts grewal class 11 npo, ts grewal class 11 solutions 2014, cash book class 11 ts grewal, ts grewal class 11 solutions ch 19, ts grewal accountancy class 11 chapter 18 solutions, ts grewal class 11 solutions 2017 pdf, ts grewal accountancy class 11 flipkart, ts grewal accountancy class 11 npo solutions, price of ts grewal accountancy class 11, ts grewal class 11 book pdf, ts grewal accountancy class 11 2012 edition solutions, ts grewal class 11 chapter 19 solutions, ts grewal accountancy class 11 chapter 5, ts grewal accountancy class 11 chapter 1, ts grewal class 11 ebook, ts grewal accountancy class 11 chapter 18, ts grewal accountancy class 11 solutions 2013, ts grewal class 11 solutions chapter 17, ts grewal class 11 rectification of errors solution, solutions of ts grewal class 11 chapter 18, ts grewal class 11 solutions pdf download, ts grewal class 11 adjustments, ts grewal accountancy class 11 solutions of cash book, ts grewal class 11 cbse tuts, ts grewal class 11 chapter 19, ts grewal class 11 rectification of errors, bills of exchange ts grewal class 11, ts grewal class 11 accountancy pdf, ts grewal class 11 chapter 14, ts grewal accountancy class 11 price, ts grewal accountancy class 11 guide, ts grewal accountancy class 11 solutions chapter 17, ts grewal accountancy class 11 index, ts grewal class 11 solutions 2017 chapter 18, ts grewal class 11 solutions 2017 chapter 20, ts grewal accountancy class 11 solutions in pdf, bill of exchange class 11 ts grewal solutions, ts grewal class 11 cash book solutions, ts grewal accountancy class 11 depreciation, solution of ts grewal accountancy class 11 free download, ts grewal class 11 chapter 18, ts grewal class 11 2017 meritnation, ts grewal accountancy class 11 2013 edition solutions, ts grewal class 11 solutions bills of exchange, ts grewal class 11 financial statements, ts grewal class 11 solutions chapter 19, ts grewal class 11 meritnation, ts grewal accountancy class 11 buy online, [/showhide]