[docxpresso file=”https://www.imperialstudy.com/wp-content/uploads/2019/02/ch1.odt” comments=”true” SVG=”true”]

Category: Accountancy

-

TS Grewal Accountancy Class 12th Solutions

TS Grewal Accountancy Class 12th Solutions PDF Download Latest Edition Solution of TS Grewal Accounts for class 12th commerce.

- TS Grewal Accountancy Class 12th Solutions Part 1

- TS Grewal Accountancy Class 12th Solutions Part 2

- TS Grewal Accountancy Class 12th Solutions Part 3

-

Class 11th Accounts Notes Free CBSE Revision Notes

Get Accountancy Class 11th Book Notes with free PDF Download. Here you will find all accounts Class 11 key points. these notes help you with the revision of account chapters before exams. We prepared this notes from TS Grewal Class 11th Accountancy Book. With all Techniques to solve accounts Problem Questions easily.

CBSE Class 11th Accountancy Notes:

- Introduction to accounting Notes Class 11th Accountancy.

- Theory Base of Accounting Notes Class 11th Accountancy.

- Source Documents and Accounting Equation Notes Class 11th Accountancy

- Journal and Ledger Notes Class 11th Accountancy.

- Trial Balance Notes Class 11th Accountancy.

- Depreciation Notes Class 11th Accountancy.

- Bills of Exchange Notes Class 11th Accountancy

- Rectification of Errors Notes Class 11th Accountancy.

- Financial Statement I (Without Adjustments) Notes Class 11th Accountancy

- Financial Statement II (With Adjustments) Notes Class 11th Accountancy

- Financial Statements of Non-for-Profit Organisations Notes Class 11th Accountancy

- Accounts from Incomplete Records Notes Class 11th Accountancy

-

Accounts from Incomplete Records Notes Class 11th Accountancy

Accounts from Incomplete Records

Meaning

Accounting records which are not maintained in accordance with the principles of double entry system are known as accounts from incomplete records or single entry system of accounting.

Features of Incomplete Records

- Unsystematic method

- Maintenance of personal accounts

- Maintenance of cash book

- No uniformity

- Dependence on original vouchers

- Less degree of accuracy

- Suitability

Advantages and Uses of Single Entry System

It is observed that many businessmen keep incomplete records because of the following reasons:

- Adequate knowledge of accounting principles not required

- Less expensive

- Less time consumed

- Convenient

- Suitable for small concerns

Limitations of Single Entry System

Limitations of single entry system are

- The arithmetical accuracy of accounts under single entry system cannot be ensured as trial balance cannot be prepared.

- Correct ascertainment and evaluation of financial results of business operations cannot be made.

- A problem in raising funds from outsiders and planning for future business activities may arise as analysis of profitability, liquidity and solvency of the business cannot be done.

- Filling of insurance claim with an insurance company by the owner in case of loss of inventory by fire or theft becomes difficult.

- Convincing the income tax authorities about the reliability of the computed income becomes difficult.

- Avoiding misappropriation of assets may become difficult as assets accounts are not maintained and it may be difficult to keep full control.

- Correct profit earned or loss incurred during the accounting period is not known as trading and profit and loss account cannot be prepared.

Profit Ascertainment/Statement of Profit or Loss under Single Entry System

Every business firm wishes to ascertain the results as operations to assess its efficiency, success and failure. This gives rise to the need for preparing the financial statements to disclose.

- The profit made or loss sustained by the firm due a given period.

- The amount of assets and liabilities as at the closing date of the accounting period.

This can be done in two ways:

- Preparing the statement of affairs as at the beginning and at the end of the accounting period called statement of affairs or net worth methods.

- Conversion method, i.e. by preparing trading the profit and loss account and the balance sheet putting the accounting records in proper order. Conversion method is not in syllabus. Therefore, it has been discussed.

Statement of Affairs or Net Worth Method

A statement of affairs is a statement of all assets and liabilities. It is a statement in which assets are shown on one side and the liabilities on the other, just as in case of a balance sheet. The difference between the totals of the two sides is the capital. Under this method, statement of assets and liabilities as at the beginning and at the end of the relevant accounting period is prepared, ascertain the amount of change in the capital during the period.

A statement of affairs is similar to, though not the same as a balance sheet.

Statement of Affairs (Format)

As at..

It is the total of liabilities side is deducted from the total of assets side of the statement of affairs, the balance will be taken as capital.

It is based on the accounting equation as

Capital = Assets – Liabilities

- Preparation of Statement of Profit or Loss

Once the amount of capital, both at the beginning and at the end is computed with the help of statement of affairs, a statement of profit or loss is prepared to ascertain the exact amount of profit or loss made during the year.

The difference between the opening and closing capital represents its increase or decrease which is to be adjusted for withdrawals made by the owner or any fresh capital introduced by him during the accounting period in order to arrive at the amount of profit or loss made during the period.

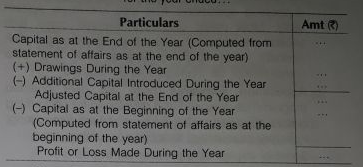

Statement of Profit or Loss (Format)

For the year ahead..

The same computation can be done in the form of an equation as follows:

Profit or Loss = Capital at the End – Capital at the Beginning + Drawings During the year – Capital Introduced During the year

-

Financial Statements of Non-for-Profit Organisations Notes Class 11th Accountancy

Financial Statements of Non-for-Profit Organisations

Meaning

Not-for-profit organizations also are known as non-profit organizations refer to the organizations that are set for the welfare of the society and are set-up as charitable institutions which function without any profit months. Non-profit organizations are separate legal entity not owned by any individual or enterprises. Examples, non-profit organisations are clubs, hospitals, libraries, schools, societies for promotion of sports, arts and culture etc.

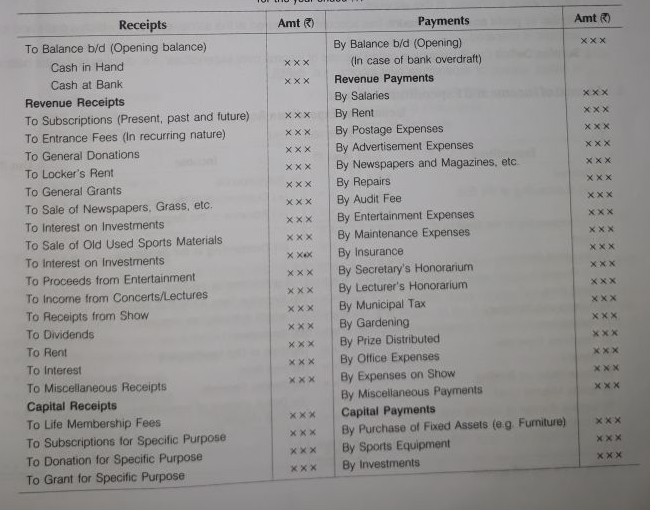

- Receipts and Payments Account

The receipts and payments account is the summary of cash and bank transactions which helps in the preparation of income and expenditure account. It is prepared at the end of the accounting period and is summary of cash book, classifying receipts and payments under various heads along with cash and bank balances in the beginning and at the end of the accounting period.

Receipts are recorded on the debit side and payments are recorded on the credit side of the account. The account is maintained on cash basis of accounting.

Every receipt and payment, whether capital revenue and irrespective of the period is recorded in this account. The purpose of preparing this account is to ascertain cash in hand and cash at bank at the end of the year.

Salient Features of Receipts and Payments Account

- Nature Receipts and payments account is a real account in nature. It is basically a summary of the cash book. Cash receipts are recorded on the debit side, while cash payments are entered on the credit side.

- Period in this account, all receipts and payments irrespective of the period to which they pertain are shown.

- Capital and revenue all cash receipts and cash payments whether of capital nature or of revenue nature are included.

- Distinction No distinction is made in receipts/payments made in cash or through bank. With the exception of the opening and closing balances, the total amount of each receipt and payment is shown in this account.

- Adjustment of non-cash items Non-cash items such as depreciation, outstanding expenses, accrued income etc., are not shown in this account.

- Opening and closing balance it begins with opening balance of cash in hand and cash at bank (or bank overdraft) and close with the year-end balance of cash in hand/cash at bank (or bank overdraft). In fact, the closing balance in this account (difference between the total amount of receipts and payments) which is usually a debit balance reflects cash in hand and cash at bank unless there is a bank overdraft.

Limitations of Receipts and Payments Account

- No adjustments as the receipts and payments account is not prepared on accrual basis, therefore no adjustments are made in it.

- Does not show income and expenditure income and expenditure is not shown by this account.

- No particular accounting period Receipts and payment account does not show the amount received or paid only for a particular period.

Format of Receipts and Payments Account

Receipts and Payments Account

For the year ended..

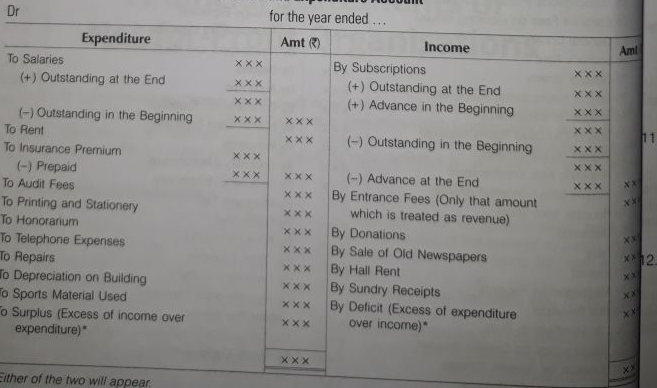

- Income and Expenditure Account

It is the summary of income and expenditure for the accounting year. Income and expenditure account in nominal account in nature and serves the same purpose and the profit and loss account of a business organisation does. Income and expenditure account is prepared at the end of accounting period to ascertain net operating results. All the revenue items relating to the current period are shown in this account, the expenditure and losses on the expenditure side and incomes and gains on the income side of the account. It shows the operating results in the form of surplus (i.e. excess of income over expenditure) or deficit (i.e. excess expenditure over income) which is transferred to the capital fund shown in the balance sheet. The income and expenditure account is prepared on the accrual basis.

Features of Income and Expenditure Account

- Nature it is a nominal account.

- No capital items No capital items are entered in this account.

- Debit and credit sides its debit side includes all the expenses pertaining to the particular period and certain side includes all the incomes pertaining to the same period.

- Opening and closing balances no opening and closing balances are recorded in it.

- Only current period items No item either revenue or expenditure, pertaining to the past period or the future period is entered in this account.

- Similar to profit and loss account this account is prepared in the same manner in which a profit and loss account is prepared.

- Surplus/Deficit Credit balance is called ‘excess of income over expenditure’, i.e. surplus and debit balance is called ‘excess of expenditure over income’, i.e. deficit.

The format of Income and Expenditure Account

Income and Expenditure Account

For the year ended..

- Either of the two will appear.

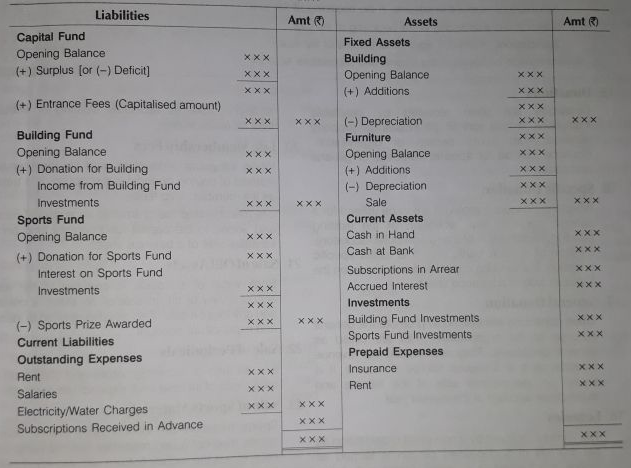

- Balance Sheet

Balance Sheet is prepared by not-for-profit organisation to ascertain the financial position of the organisation. It is prepared on the same pattern as that of the business entities. Balance sheet is prepared at the end of the accounting period after preparing income and expenditure account.

Sometimes, balance sheet needs to be prepared at the beginning of the year in order to find out the opening balance of the capital/general fund. The balance sheet shows assets on the right hand side and liabilities are shown on the left hand side along with capital fund or gener.al fund.

The capital fund or general fund is in place of the capital and the surplus or deficit as per incomes and expenditure account shall be added to/deducted from this fund.

- Format of Balance Sheet

Balance Sheet

As at..

- Fund Based Accounting

The accounting where receipts and incomes relating to a particular fund are credited to that particular fund and payments and expenses are debited to that particular fund, it is known as fund based accounting.

These funds are created for specific purposes, e.g. prize fund, sports fund, library fund, building fund, endowment fund etc. If the fund account has a credit balance, it is shown in the balance sheet on the liabilities side. If the fund account has a debit balance, i.e. the fund is less than the balance, it is transferred to the debit of income and expenditure account.

- Classification of Funds

Funds may be classified as

- Unrestricted Funds

- Restricted Funds

Various types of restricted funds are as follows:

- Endowment fund

- Annuity fund

- Loan fund

- Fixed assets fund

- Prize fund

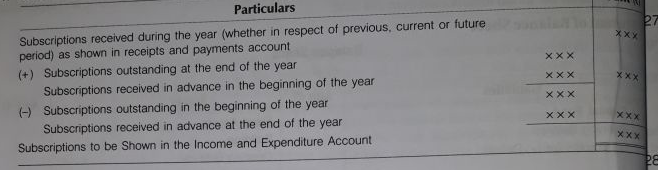

Subscriptions

It is the membership fee paid by the members on annual basis. It is the main source of income of non-prime organisations. Subscriptions relating to the current year whether received or not, are shown in the credit side and income and expenditure account. Subscriptions not received, i.e. outstanding are shown on the assets side and balance sheet. Subscriptions received in advanced for the following year are shown on the liabilities side in the balance sheet.

Table Showing Calculation of Subscriptions

Donation

Donations are often received by charitable institutions. It is a sort of gift in cash or properly received from some person or organisation. Donation can be for specific purposes or general purposes.

Specific Donation

When the donations received are to be utilized for a specific purpose say, extension of the existing building, construction of a new computer laboratory, creation of a book bank, etc. it is called specific donation. It should be capitalized and shown on the liabilities side of a balance sheet.

General Donation

When donations are utilized to promote the general purpose of the organisation, they are called as general donations. They are treated as revenue receipts, as it is a regular source of income. It is shown on the income side of the income and expenditure account of the current year.

Legacies

The amount received by a non-profit organisation as per the will of a deceased person is termed as legacy. It is treated as a capital receipt and shown on the liabilities side. However, legacies of small amount may be treated as income and shown on the income side of the income and expenditure account.

Entrance Fees

Entrance fee also known as admission fee is paid only once by the member at the time of becoming a member. As entrance fee is paid by a member only once, it is argued that it should be treated as a capital receipt and transferred to capital fund. However, it should be treated as revenue receipt and credited to the income and expenditure account, when the amount is small to cover the expenses of admission. NCERT guidelines advocate treating of entrance fees as revenue item.

Life Membership Fees

When lump sum amount is paid by the member instead of paying periodic, subscription, it is treated as life member-ship fees.

Life membership fee is treated as a capital received and added to the capital fund/general fund on the liabilities side of a balance sheet.

- Sale of Old Assets

Book value of an asset is credited to the asset account. Any profit on sale of an asset is credited and loss on sale of an asset is debited to income and expenditure account.

Sale of Periodicals

It is an item of recurring nature and shown in the credit side of income and expenditure account.

Sale of Sports Material

Sports materials are consumable assets. Sales sports material (used material like old balls, bills net etc.) is the regular feature with any sport club is usually shown as an income in the income and expenditure account.

Payment of Honorarium

Honorarium is the amount paid to the person who is not an employee of the institution and has voluntary undertaken a service. It is debited to income and expenditure account.

Endowment Fund

It is a fund arising from a bequest or gift, the income of which is devoted for a specific purpose. Hence, it is a capital receipt and shown on the liabilities of the balance sheet as an item of a spend purpose fund.

Government Grants

Various institutions like schools. Colleges, public hospitals etc., depend on government grants for their activities. Grants which are recurring in nature are treated as revenue receipt and credited to income and expenditure account. However, grants of capital nature such as building grant are treated as capital receipt and transferred to building account.

Special Funds

Certain special funds are created for certain purpose/activities, e.g. prize funds, match, fund, sports fund, etc. The income earned from such funds is added to the respective fund and not credited to income and expenditure account and also the expenses incurred on such specific purposes are also deducted from the special fund.

Special Receipts

When there is a receipt of amount by non-profit organisations for special occasions, it is referred to as special receipts. Such amounts are credited to a separate account and expenses against these receipts are debited to it. The balance is transferred to the credit side of income and expenditure account.

Sale of Old Newspapers

Amount which is realized by selling of old newspapers is treated as income and credited to income and expenditure account.

Revenue Receipts

Revenue receipts are shown on the credit side of income and expenditure account, e.g. rent, interest on investment, proceeds from concerts, shows, etc.

Revenue Expenses

Revenue expenses are the expenses which are incurred for performing day-to-day activities or expenses which are recurring in nature, e.g. salary, rent, etc. It also includes expenses incurred on the maintenance of fixed assets, e.g. repairs, depreciation etc.

Capital Expenditure

Capital expenditures are shown on the assets side of balance sheet, e.g. expenditure on purchases of books, furniture, medicines, postage, etc.

Calculation of the Cost of Consumable Goods

Consumable goods are the items which are consumed during the year such as stationery, sports material, foodstuff, medicines, postage etc.

Non-Profit organisations have stock of consumable goods at the end of the year. The income and expenditure account will show correct surplus/deficit, only if the goods consumed are debited to income and expenditure account and closing stock is shown in the balance sheet.The amount of goods consumed during the year is calculated as follows:

- Preparation of the Income and Expenditure Account and the Balance Sheet from the Receipts and Payments Account with the Additional Information

Step 1 Prepare the opening balance sheet to find out the opening balance of capital fund (in case it is not given), taking into account the opening cash and bank balances given in receipts and payments account and other assets and liabilities given in additional information. The difference between the assets and liabilities is the capital fund or general fund or accumulated fund.

Step 2Identify from the receipts side, i.e. debit side of the receipts and payments account, the revenue receipts and the capital receipts.

- Capital receipts are shown in the appropriate assets and liabilities account and then incorporated in the balance sheet.

- Record the revenue receipts on the income side, i.e. credit side of income and expenditure account, after making suitable adjustments so that all revenue receipts for the current year are shown.

Step 3From the receipts and payments account, identify the revenue and capital payments from the payments side, i.e. credit side.

- Capital payments are shown in the appropriate assets and liabilities account and then incorporated in the balance sheet.

- Record the revenue payments on the expenditure side, i.e. debit side of the income and expenditure account, for the current year after making necessary adjustments.

Step 4There are certain items which do not appear in receipts and payments account but are to be recorded in income and expenditure account. They are depreciation on fixed assets- it is to be shown on the debit side, loss on sale of fixed assets- to be shown on the debit side, profit on sale of fixed assets-to be shown on the credit side.

Step 5 Surplus/Deficit in the income and expenditure account is calculated and transferred to the capital fund shown in the balance sheet. Excess of incomes over expenditure is surplus and excess of expenditure over incomes is deficit.

Step 6 Prepare closing balance sheet by taking into consideration the opening balance of assets, liabilities and opening capital fund, surplus/deficit, purchase and sale of assets during the year.

-

Financial Statement II (With Adjustments) Notes Class 11th Accountancy

Financial Statement II (With Adjustments)

- Needs for Adjustments in Preparing the Final Accounts

The purpose of making various adjustments is to ensure that the final accounts must reveal the true profit or loss and true financial position of the business.

- It helps us to record those adjustment which were left or committed and were not recorded in the accounts.

- A proper recording of adjusting entries assists us to separate all the financial transactions into a year-wise category.

- Recording of adjusting entries provides us the room for making various provisions which are made at the end of year, after assessing the entire year’s performance.

The Item which Usually Need Adjustments

- Closing stock

Accounting Treatment

Adjusting Entry Trading Account Balance Sheet Closing Stock A/c Dr To Trading A/c

(Being the closing stock recorded in the books)

Shown on the credit side. Shown on the assets side under current assets. - Outstanding Expenses

Accounting Treatment

Adjusting Entry Trading Account Profit and Loss Account Balance Sheet Concerned Expenses A/c Dr To Outstanding Expenses A/c

(Being the unpaid expenses provided)

(If it is a direct expenses, e.g. wages) Added to the concerned expenses on the debit side.

(If it is an indirect expenses, e.g. salaries) Added to the concerned expenses on the debit side.

Shown on the liabilities side as a current liability. - Prepaid/Unexpired Expenses

Accounting Treatment

Adjusting Entry Trading Account Profit and Loss Account Balance Sheet Prepaid Expenses A/c Dr

To Concerned Expenses A/c

(Being concerned expenses paid in advance)

(If it is a direct expenses, e.g. wages) Deducted from the concerned expenses on the debit side.

(If it is an indirect expenses, e.g. insurance premium) Deducted from the concerned expenses on the debit side.

Shown on the assets side as a current assets. Accrued Income

Accounting Treatment

Adjusting Entry Profit and Loss Account Balance Sheet Accrued Income A/c Dr To Concerned Income A/c

(Being concerned income receivable)

Added to the respective income on the credit side. Shown on the assets side as a current asset. - Income received in Advance

Accounting Treatment

Adjusting Entry Profit and Loss Account Balance Sheet Concerned Income A/c Dr To Income Received in Advance A/c

(Being adjustment for unearned income)

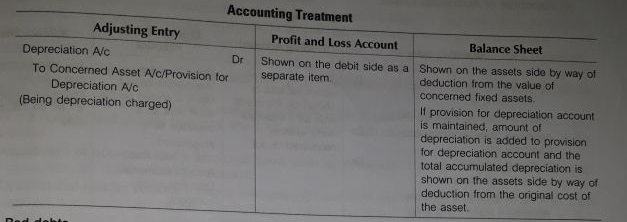

Deducted from the concerned income on the credit side. Shown on the liabilities side. - Depreciation

Accounting Treatment

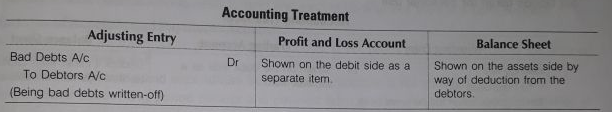

- Bad debts

Accounting Treatment

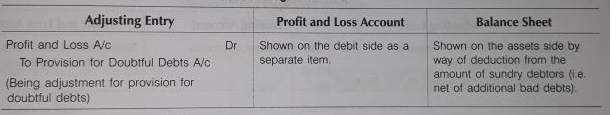

- Provision for doubtful debts

Accounting Treatment

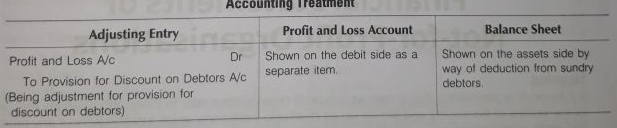

- Provision for discount on debtors

Accounting Treatment

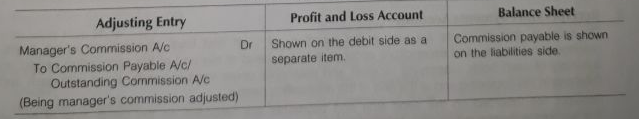

- Manager’s Commission

Accounting Treatment

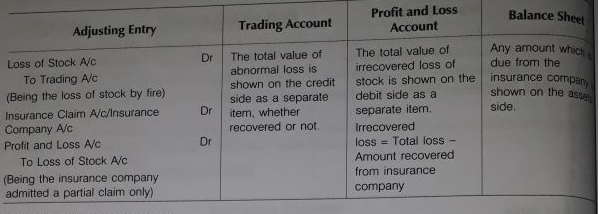

- Abnormal or Accidental Losses

Accounting Treatment

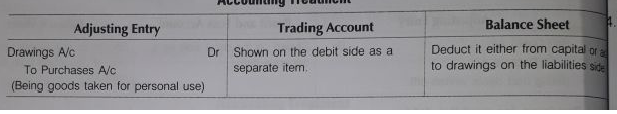

- Goods taken for personal use

Accounting Treatment

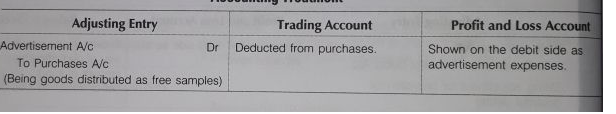

- Goods distributed as free samples

Accounting Treatment

-

Financial Statement I (Without Adjustments) Notes Class 11th Accountancy

Financial Statement I (Without Adjustments)

- Meaning

Financial statements are the final products of an accounting process which begins with the identification of accounting information and recording it in the books of primary entry. Financial statements are prepared by following the accounting concepts and conventions. These are the statements prepared at the end of accounting period and give information about the financial position and preformed of an enterprise.

A complete set of financial statements include

- Balance sheet (or position statement) which shows the financial position of an enterprise at a particular point of time.

- Trading and profit and loss account (or income statement) which shows the financial performance of business operations during an accounting period.

- Schedules and notes to accounts forming a part of balance sheet and profit and loss account.

Objectives and Importance of Financial Statement

The basic objectives of preparing financial statements are

- To present a true and fair view of the financial performance of the business.

- To present a true and fair view of the financial position of the business.

Various other objectives and importance of financial statements are as follows:

- Helps in determination of gross profit/gross loss

- Helps in determination of net profit/ net loss

- Comparison with the previous years

- Calculation of rations

- Maintaining provisions and reserves

Users of Financial Statements

Internal Users

- Owners

- Management

- Employees and workers

External Users

- Creditors

- Investors

- Banks and financial institutions

- Government its authorities

- Other parties

- Researchers

Income Statement

Income statement is prepared at the close of the year discloses the manner in the amount of profit and loss is arrived at, Income statement is divided in trading account and profit and loss account.

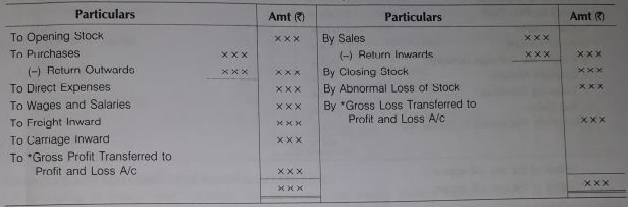

- Trading Account

Trading account is the first stage is the preparation of the final accounts. The trading account ascertains the rest from basic operational activities of the business.

Trading account is prepared to know the gross profit earned or gross loss incurred during the accounting period. Entries or items of debit side are opening side, purchases and other direct expenses and on credit side sales and closing stock are recorded.

The excess of sales over purchases and direct expenses is called gross profit, if the amount of purchase including direct expenses is more than the sales revenue, the resultant figure is gross loss.

The computation of gross profit can be shown in the form of equation as

Gross Profit = Net Sales – Cost of Goods Sold

Where, Net Sales = Total Sales – Sales Return

Cost of Goods Sold = Opening Stock + Net Purchases + Direct Expenses – Closing Stock

Net Purchases = Total Purchases – Purchases Return

- Format of Trading Account

Profit and Loss Account

For the year ended..

Dr Cr

- Either gross profit or gross loss shall appear.

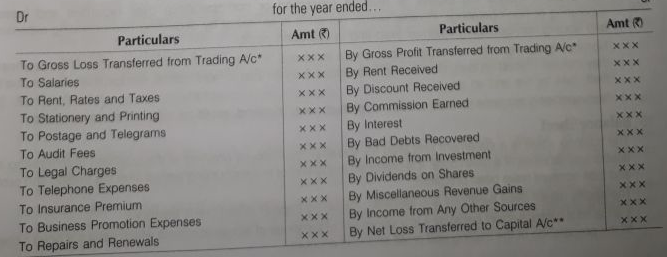

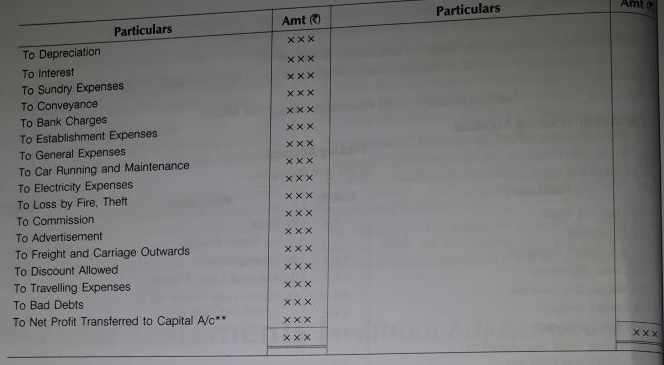

- Profit and Loss Account

Profit and loss account is prepared after the preparation of trading account. It shows the financial performance of a business during an accounting period. It prepared to as certain the net profit earned or net loss incurred by the business entity during an accounting period.

Balance of trading account (gross profit or gross loss) is transferred to profit and loss account. The indirect expenses are transferred to the debit side of the profit and loss account. All revenues/gains other than sales are transferred to the credit side of the profit and loss account.

It the total of the credit side of the profit and loss account is more than the total of the debit side, the difference is the new profit for the period, of which is being prepared.

On the other hand, if the total of the debit side is more than the total of the credit side, the difference is the net loss incurred by the business firm.

In an equation form, it is shown as follows:

Net Profit = Gross Profit + Other Incomes – Indirect Expenses

- Format of Profit and Loss Account

Profit and Loss Account

For the year ended..

- Either of the two will appear.

- Either of the two will appear.

Operating Profit and Net Profit

- Operating Profit it is the profit earned through normal operations and activities of the business. Operating profit arises as a result of carrying out operating activities. Operating activities are the principle revenue producing activities of the enterprise and are those activities that are not investing or financing activities, means the excess of operating revenue over operating expenses or it is the excess of gross profit own operating expenses. It is also known as Earnings Before Interest and Tax (EBIT).

It is calculated as

Operating Profit = Net Sales – Operating Cost

Or

= Net Sales – (Cost of goods sold + Administration and office expenses + Selling and distribution expenses)

Or

= Net Profit + Non-Operating Expenses – Non-Operating Income

Operating expenses include office and administrative expenses, selling and distribution expenses, case discount allowed, interest on bill payable and other short-term debts, bad debts and so on.

Net Profit = Sales (Cash and Credit) – Sales Return

- Net Profit means the excess of revenue (operating or non-operating) over expenses and losses (operating and non-operating). In other words, net profit is arrived at by deducting non-operating expenses and adding non- operating incomes form and in operating profit.

Non- Operating expenses are expenses which are incidental or indirect to the main operations of the business, they include interest on loan, charities and donations, loss on sale of fixed assets, extraordinary losses due theft, loss by fire and so on

Non- Operating incomes includes receipt of interest, rent, dividend, profit on sale of fixed assets etc.

Also Check out: TS Grewal Solutions for Adjustments in Preparation of Financial Statements Class 11 Accountancy Chapter 18

Balance Sheet

The balance sheet is a statement prepared for showing the financial position of the business summarizing the assets and liabilities at a given date. It is prepared at the end of the accounting period after the trading and profit and loss account have been prepared.

The assets reflect debit balances and liabilities (including capital) reflect credit balances.

It is called a balance sheet because it is a statement of balances of ledger accounts.

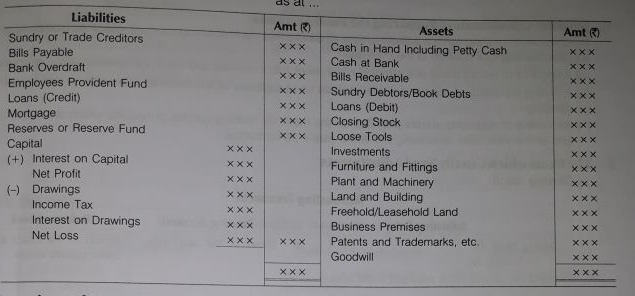

- Format of Balance Sheet

Balance Sheet

As at..

Grouping and Marshalling of Assets and Liabilities

- Grouping of assets and liabilities the term grouping means putting together items of similar nature under a common heading. The various item appearing in the balance sheet can also be properly grouped, e.g. the balance of accounts of cash, bank, debtors etc. can be grouped and shown under the heading of ‘current assets’.

- Marshalling of assets and liabilities Marshalling refers to the arrangement of assets and liabilities in a particular order. In a balance sheet the assets and liabilities are arranges either in the order of liquidity or permanence.

- Order of performance In case of performance, the most permanent assets or liabilities are out on the top in a balance sheet and thereafter they are arranged in their reducing level of permanence.

In other words, in case of assets, the ones which are to be used permanently in the business and are not meant to be sold are written first, e.g. goodwill and the ones which are most liquid are written last, e.g. cash in hand.

In case of liabilities, the payments to be made which are least urgent are written first, e.g. capital and the payments to be made which are most urgent are written last, e.g. short-term liabilities say short-term creditors (i.e. firstly capital, then long-term liabilities and at last short-term liabilities).

- Order of Liquidity ‘liquidity’ means the facility with which the assets may be converted into cash. In case of liquidity, the order is reversed.

In case of assets, the most liquid assets are written first, e.g. cash is hand and the least liquid assets are written last, e.g. goodwill.

In case of liabilities, the most urgent payments to be made are written first, e.g. short-term creditors and the least urgent payments to be made are written last, e.g. capital (i.e. firstly short-term liabilities, then long-term liabilities and in last capital).

It can be better understood with the general format of balance sheet in order of liquidity.

Methods of Preparation of Financial Statements

The financial statements, i.e. trading and profit and loss account and balance sheet can be presented in two ways:

- Horizontal from Under this form of presentation, the items are presented in ‘T’ shape, i.e. the items are shown side by side in trading and profit and loss account and also in the balance sheet. This form of preparing financial statements has been already discussed in the chapter.

- Vertical form Under vertical presentation, the final accounts are prepared in a form of statement, i.e. the items are presented in a single column with different items being shown one below the other in purposeful sequence.

-

Rectification of Errors Notes Class 11th Accountancy.

Rectification of Errors

- Meaning of Errors

Errors are unintentional omission or commission of amounts and accounts in the process of recording transactions.

- Classification of Errors

Keeping in view the nature of error, errors can be classified into the following four categories:

- Errors of commission these are the errors which are committed due to wrong positing of transactions, wrong totaling or wrong balancing of the accounts, wrong casting of the-subsidiary books or wrong recording of amount in the books of original entry. These errors affect the accuracy of trial balance.

Errors of commission can be classified into following:

- Errors of recording

- Errors of casting

- Errors of carrying

- Errors of posting

Errors of omission this kind of error arises with a transaction is partially or completely omitted be recorded in the books of accounts.

These can be of two types:

- Error of complete omission which does affect the accuracy of trial balance.

- Error of partial omission which affect accuracy of trial balance.

Errors of principle transactions recorded in contravention of the accounting principles, are known as error of principle. An error of principle may occur due to the incorrect classification of expenditure or receipt between capital and revenue as it may lead to under/ over stating of income or assets or liabilities.

This error does not affect the trial balance as amounts are placed on the correct side but in a wrong account.

- Compensating errors when two or more errors are committed in such a way that the net effect of these errors on the debits and credits of accounts is nil or nullified, such errors are called compensating errors. These errors do not affect the tallying of trial balance.

- Rectification of Errors

Rectification of errors is the procedure of rectifying the errors committed and to set right the accounting records.

These are various objectives or reasons for which the errors are rectified, they are as follows:

- For the preparation of correct accounting records.

- For ascertainment of correct net profit or loss.

- For exhibiting true financial position of the organization by preparing the balance sheet with correct data.

Rectification of Errors which do not Affect the Trial Balance or Two-sided Errors

Two-sided errors are those errors that have been committed on the both sides, i.e. debit and credit. These are the errors which do not affect the trial balance or are not disclosed by trial balance and are committed in two or more accounts.

Examples of such errors are as follows:

- Errors of complete omission.

- Errors of recording in the books of original entry.

- Errors of posting involving the posting to wrong account on correct side with correct amount.

- Errors of principle.

- Compensating errors.

These errors can be rectified by recording a journal entry giving the correct debit and credit to the concerned accounts which were affected by error.

The rectification process involves the following steps:

Step 1 Wrong Entry Write the entry which has already been passed in the books, i.e. the wrong entry.

Step 2 Reverse of wrong entry write the reverse of the above entry, the wrong entry, to notify the effect of wrong entry.

Step 3 Correct entry write the entry which should have been passed, i.e. the correct entry.

Step 4 Rectifying entry write the net effect in step 2 and step 3.

- Rectification of Errors Affecting Trial Balance or One-sided Errors

One-sided errors are those errors, which have occurred in one-side ‘debit or credit’ of an account. These are the errors which effects trial balance and affects only one account.

Examples of such errors are:

- Error due to partial omission.

- Error of casting.

- Error in carrying forward.

- Error in totaling or balancing of an account.

- Errors of posting

(other than an error of posting a correct amount in the wrong account but on the correct side).

- Omission of posting the total of a subsidiary book.

- Omission of an account from trial balance.

- Entering the balance of an account in the wrong amount column of the trial balance.

- Wrong totaling of the trial balance.

6. Rectification of Errors Depend on the stage at which the errors are located

- Before preparation of trial balance this is a stage, when errors are located and rectified after the closing of accounts, i.e. after transferring the difference in trial balance to suspense account but before the preparation of financial statements.

When one-sided errors are located after the preparation of trial balance, rectifications are carried out by passing a journal entry with the help of respective account which is affected by the error and suspense account.

A suspense account is used to complete the

double entry, as only one account is debited/credited for rectification of one-sided error. It should be noted unless otherwise stated, errors are normally rectified before the preparation of final accounts, i.e. with the help of suspense account.

- Suspense Account

Suspense account is an account used on a temporary basis for any transaction or balance that cannot be identified.

Suspense account is used for rectifying the errors which affect the trial balance, the errors which do not affect the trial balance are not rectified with the help of suspense account.

The errors are rectified by passing their double entry in the debit side or credit side of the suspense account.

- Preparation of Suspense Account

If the debit side of the trial balance exceeds the credit side, the differences is put on the credit side of the trial balance.

In this case, ‘suspense account’ will show a credit balance or if the credit side of the trial balance exceeds the debit side, the difference is put on the debit side of trial balance.

In this case, ‘suspense account’ will show a debit balance.

Opening of suspense account avoids delay in the preparation of financial statements.

- Disposal of Balance of Suspense Account

When the errors which affect the suspense account located, they are rectified with the help of the suspense account, when all such errors are located and rectified, the suspense account stands balanced.

- Treatment of Balance of Suspense Account

When the suspense account cannot be close, i.e. when the errors affecting the trial balance are still to be located and rectified, the suspense account will show outstanding balance.

The balance in the suspense account is taken to the balance sheet on the assets side if there is a debit balance or the liabilities side if there is a credit balance.

-

Bills of Exchange Notes Class 11th Accountancy

Bills of Exchange

Meaning

According to Section 5 of the Negotiable Instruments Act, 1881, a bill of exchange is defined as an instrument in writing containing an unconditional order, signed by the maker directing a certain person to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument.

A bill of exchange is generally drawn by the creditor upon his debtor, It has to be accepted by the drawee (debtor) or someone on his behalf.

Features of a Bill of Exchange

- It must be in writing.

- It is an order to make payment.

- The order to make payment is unconditional.

- The maker of the bill of exchange must sign it.

- The payment to be made must be certain.

- The date on which payment is to be made must also be certain.

- It must be payable to a certain person.

- The amount mentioned in the bill of exchange is payable either on demand or on the expiry of a fixed period of time.

- It must be stamped as per the requirement of law.

- Parties to a Bill of Exchange

There are three parties to a bill of exchange:

- Drawer The maker of the bill of exchange is the drawer, i.e. the person who draws the bill. He is the person who has granted credit to the person on whom the bill of exchange is drawn.

- Drawee the person upon whom the bill of exchange is drawn for his acceptance is a drawee. Drawee is the person to whom credit has been granted.

- Payee he is the person to whom the payment is to be made, i.e. the person in whose favour the bill is made.

Advantages of a Bill of Exchange

- Framework of relationship

- Certainity of terms and conditions

- Convenient means of credit

- Conclusive proof

- Easy transferability

Types of a Bill of Exchange

There are two types of a bill of exchange:

- Trade Bill a trade bill is a bill of exchange drawn and accepted for a trade transaction, i.e. purchase and sale of goods.

- Accommodation bill an accommodation bill is a bill of exchange accepted for mutual help.

Promissory Note

According to Section 4, of the Negotiable Instruments Act, 1861, a promissory note is defined as an instrument in writing (not being a bank note or a currency note), containing an unconditional undertaking signed by the make, to pay a certain sum of money only to or to the instrument. A promissory note does not require any acceptance because the maker of the promissory note himself promises to make the payment.

Features of a Promissory Note

- It must be in writing.

- It must contain an unconditional promise to pay.

- The sum payable must be certain.

- It must be signed by the maker.

- It must be payable to a certain person. It should be properly stamped.

Parties to a Promissory Note

There are two parties to a promissory note:

- Maker or drawer the person who makes or draws the promissory note to pay a certain amount is called maker. He is the person who has availed the credit. He is also called the promisor.

- Payee the person in whose favour the promissory note is drawn, i.e. the person to whom the payment is to be made is called the payee. He is also called the promise.

Terms Related to Accounting of Bill of Exchange

Following are the important terms related to accounting of bills of exchange:

- Term of a bill is referred to as the period the date on which a bill is drawn and the date on which it becomes due.

- Days of grace are three extra days added to the period of bill.

- Due date of a bill it is the date on which the payment of the bill is due, i.e. the date on which the term of bill expires.

- Date of maturity of a bill the date which comes after adding three days of grace to the due date of a bill is called the date of maturity.

- Bill at sight or demand the instruments in which no time for payment is mentioned are known as bill at sight. These are also known as instruments payable on demand.

A bill of exchange or promissory note is payable on demand, when no time for payment is specified, where it is expressed to be payable on demand or at sight on presentment.

- Bill after date the instrument in which time for payment is mentioned are bill after sight.

A Promissory note or bill of exchange is a time instrument when it is expressed to be a payable after specified period, on a specific day, after sight, on the happening of event which is certain to happen.

- Holder of a negotiable instrument (i.e. bill of exchange promissory note or cheque) is a person entitled in his own name to be possession thereof and to receive or recover the amount due thereon from the parties to it.

Calculation of Due Date of a Bill

The calculation of due date of a bill in various cases is calculated as follows:

Cases Due Date When the bill is made payable on a specific date. The specific date will be the due date. When the bill is made payable at a stated number of month(s) after date. That date on which the term of the bill shall expire will be the due date Calculation of due date will be in terms of calendar months, ignore the number of days in a month. When the bill is made payable at a stated number of days after date. That date which comes after adding stated number of days to the date of bill, shall be the due date. The date of bill is excluded. When the due date is a public holiday. The preceding business day will be the due date. When the due date is an emergency/unforeseen holiday. The next following day will be the due date. Calculation of the Date of Maturity in Case of Time Bills

To arrive at the date of maturity in case of time bills, three days of grace are added to the due date. This can be better explained with the help of examples given below.

When the bill is made payable at a stated number of days after date

A Bill dated 1st January 2013 is payable after 60 days after date.

The date of maturity will be 5th March, 2013

[30 days of January + 28 days of February + 2 days of March + 3 days of grace]When the bill is made payable at a stated number of months after date

A bill dated 1st January, 2013 is payable 3 months after date.

The date of maturity will be 4th April, 2013

[3 months from 1st January, 2013 is 1st April, 2013 adding 3 days of grace, the due date will be 4th April, 2013]When the maturity date falls on a day which is a public holiday

Suppose the date of maturity is 15th August, 2013 (Independence Day) it being a public holiday, it falls due on 14th August, 2013.

When the maturity date falls on a day which is an emergency/unforeseen holiday

Suppose the date of maturity falls on an unforeseen holiday, then the next working day will be taken as the date of maturity.

Accounting Treatment of Bills of Exchange and Promissory Note

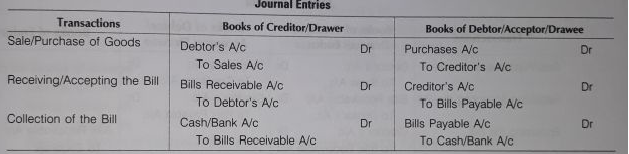

- When the bill is retained till the date of maturity

When the drawer retains the bill with him till the date of its maturity, the drawer receives the money from the drawee on the maturity date.

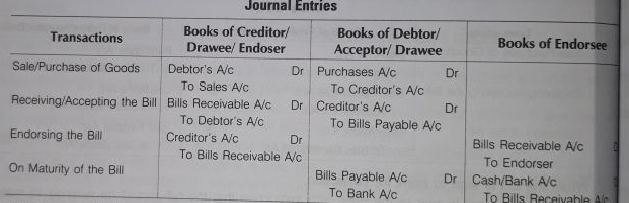

Journal Entries

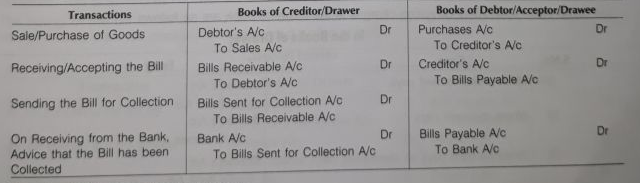

2. When the bill is sent to bank for collection

2. When the bill is sent to bank for collectionSometimes, the bill is sent to the bank with instruction that the bill should be retained till maturity and realized on its due date, i.e. the bank should keep the bill till maturity and collect is amount from the acceptor on that date, it is known as ‘bill sent for collection’. The bank credits the net proceed to the customer’s account, after charging for the service. The balance in the bills sent for collection account is shown in the balance sheet as an asset.

Journal Entries

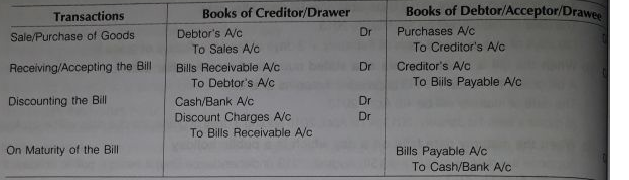

- When the bill is discounted with bank

In case, a holder of the bill is in need of money, he may discount it through the bank, to obtain cash, i.e. the holder of the bill takes amount from a bank against the bill before the due date. This process is known as discounting of the bill. The bank charges an amount for this purpose and it is termed as ‘discounting charges’.

The charges depend upon the rate of interest and the period of maturity. It is be noted, discounting charges are calculated on the remaining period of the bill, i.e. from the date of discounting till the due date. The bank gets the amount from the drawee on the due date.

Journal Entries

2. When the bill is endorsed or negotiated in favour of a creditor

2. When the bill is endorsed or negotiated in favour of a creditorTransfer of a bill of exchange or promissory note to another person is referred to as endorsement negotiation. The person receiving it becomes entitled to receive the payment. The bill can be internal endorsed by the drawer by putting his signature at the back of the bill along with the name of the panty,

Whom it is being transferred. The act of signing and transferring the bill is called endorsement.

A Bill is said to have been negotiated or endorsed, when the holder of a bill transfers the bill to a third party. The person who endorses the bill is called the endorser. The person to whom the bill is endorsed is called endorsee.

Journal Entries

Dishonour of a bill

When the drawee or acceptor of the bill fails or is unable to make the payment on the date of maturity, a bill is said to have been dishonored. The holder of the bill may present the bill through a notary public. A bill get the dishonor of the bill noted. Noting authenticated the fact of dishonour , for providing this services fess is charged by notary public which is called nothing charges.

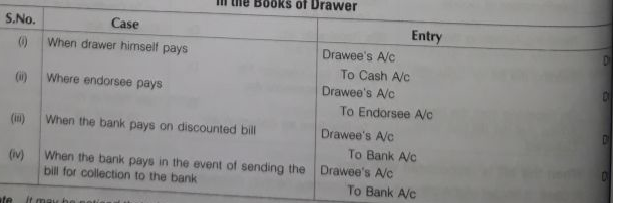

The entries recorded for noting charges in the drawer’s book as follows:

In the Books of Drawer

Note:It may be noticed that whosever pays the nothing charges. Ultimately these have to be borne by the drawee. This is because he is responsible for the dishonour of the bill and hence, he has to bear these expenses. For recording the noting charges in his books, the drawee opens noting charges account. He debits the noting charges account and credits the drawer’s account.

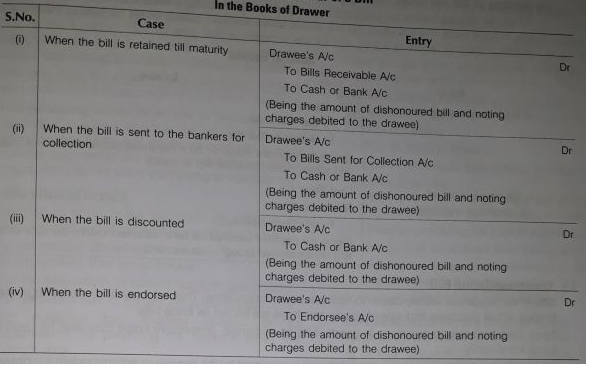

Journal Entries on Dishonour of Bill

In the Books of Drawer

In the books of drawee

Bills Payable A/C Dr

Noting Charges A/C Dr

To Drawer’s A/c

(Being the amount of dishonour bill and noting charges credited to the drawer)

Note:When the bill is dishonoured, in all the circumstances drawee or acceptor account is debited when entries are passed in the books of drawer and drawer’s and drawer’s account is always credited and bills payable account is always debited, when entries are passed in the books of drawee.

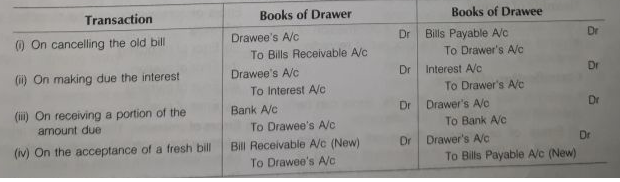

- Renew of the bill

When the acceptor of the bill is difficult to meet the obligation of the bill on maturity he may request the drawer for extension of time for payment (i.e. to substitute the old bill when a new bill), if the drawer agrees the old bill cancelled and the fresh bill with new terms of payment is drawn and duty accepted and delivered. This is termed as renewal of bill.

The noting of the bill is not required as the cancellation is mutually agreed. However, the drawer may charges interest from the drawee for the extended period of credit.

Journal Entries

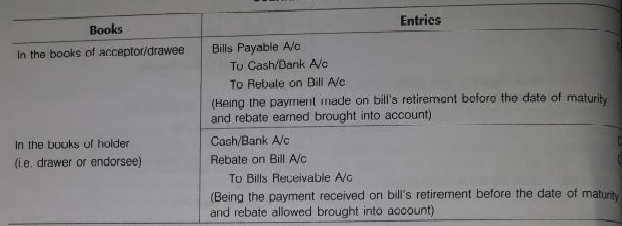

- Retiring of the bill under rebate

When the drawee makes the payment before the date of maturity, a bill is said to be referred or retiring of a bill. In such case, the holder of the bill allows some discount called rebate on bills to the drawee. For the holder of the bill, rebate is a loss and for the acceptor, it is a gain.

Journal Entries

- Accommodation Bill

Bills of exchange are usually drawn to facilitate trade transactions. That is to say bills of exchange are meant finance actual purchase and sale of goods and these are known as trade bills.

Apart from financing transactions in goods, bills of exchange, promissory notes may also be used for raised funds temporarily.

Such a bill is called an ‘accommodation bill’ as it is accepted by the drawee to accommodate the drawer. Hence, the drawer is called the ‘accommodating party’ and the drawer is called the accommodation party.

When the accommodation parties agree to raise the funds through an accommodation bill for mutual benefits. It can be done in any of the following two ways:

- The drawer and the drawee share the proceeds in an agreed ratio.

- Each draw a bill and each accepts a bill.

In the first case, the discounting charges are shared by drawer and drawee in the ratio in which they share to proceeds. But in the second case, the discount is not shared as each party retains the entire proceeds of the drawn and discounted by him. On maturity, each party meets his acceptance.

Accounting treatment of accommodation billEntries are made in the same manner as are made for on bills, no special entries are passed for accommodation bills. Also, in case, the proceeds of the bills are shared an entry for the proportionate amount of discount along with the entry for remittance.