Depreciation

- Meaning

‘Depreciation’ means decline in the value of a fixed asset due to use, passage of time or obsolescence.

2. Depreciation and Other Similar Terms

The term depreciation covers depletion, amortization and obsolescence.

- Depletion The term depletion is used in respect of natural resources or wasting assets like mines, quarries oil reserves etc. There occurs an erosion in the value of these natural resources due to the extraction of these resources which is called as depletion. The main difference between depletion a depreciation is, depletion is concerned with the exhaustion of economic resources but depreciation relates to usage of an asset.

- Amortisation term amortization rerefers towriting-off the value of intangible assets like patents, copyrights, trademarks, goodwill etc., which can be utilized only for a specified time period.

- Obsolescence Decline in the economic value of the assets due to innovation or improve technique or equipment and market decline or to change in taste and fashion, is reffered to the obsolescence.

In short,

Depreciation- Fixed assets except for land

Depletion- Natural resources like mines

Amortisation- Intangible assets like patent

Obsolescence- Plants machinery and irwentory

Causes of Depreciation

Various causes of depreciation, spelt out as part of the definition of depreciation in AS-6 are as follows:

- Physical wear and tear

- Passage or efflux of time

- Expiry of legal rights

- Obsolescence

- Abnormal reasons

Need for Depreciation

- Matching of cost and revenue

- Consideration of Tax

- True and fair financial position

- Compliance with the law

Factors Affecting the Amount of Depreciation

- Cost of Assets

- Estimated Net Residual Value (NRV)

- Estimated useful life

Methods of Calculating Depreciation

- Straight Line Method Under this method, a fixed and equal amount in the form depreciation, according to a fixed percentage on the original cost, is written-off each year over the expected useful life of the asset. It is also known as original cost method or fixed instalment method. It is the earliest and widely used methods of providing depreciation.

The depreciation under this method is calculated by using the following formula:

Depreciation=Cost of Assets – Estimated NRV

……………………………………………………..

Estimated Useful Life

If the annual depreciation amount is given, then we can calculate the rate of depreciation, with the following formula:

The rate of Depreciation=Annual Depreciation on Amount

……………………………………………………….

Cost of Asset * 100

2. Written down the method under this method, depreciation is changed over the book value of the asset. It involves charging a fixed rate on the written down value. The amount of depreciation goes on reducing year after year. As the book value keeps on reducing by the amount charge, it is also known as reducing balance method or diminishing balance method.

Under the written down value method, the rate of depreciation is computed by using the following formula:

Methods of recording depreciation

- Charging depreciation to asset account under this method, depreciation is directly charged to the asset account, i.e. depreciation is deducted from the depreciation cost of the asset (credited to the asset account) and changes (or debited) to profit and loss account.

Journal Entries

For Recording Purchase of Asset

Asset A/c Dr

To Cash/Bank/Vendor A/c

(Being the asset purchased)

For Providing Depreciation

Depreciation A/c Dr

To Asset A/c

(Being the depreciation provided)

For Closing Depreciation Account

Profit and Loss A/c Dr

To Depreciation A/c

(Being the transfer of depreciation account to profit and loss account)

Treatment in balance sheet under this method, the fixed asset appear its net book value/ written down value (i.e., cost less depreciation charged till date) on the assets side of balance sheet and not at its original (historical) cost.

- Creating Provision for depreciation account/ accumulated depreciation account under this method, a separate account named as ‘provision for depreciation’ ‘of accumulated depreciation’ account is created and the annual depreciation is transferred to this account.

Journal Entries

For Recording Purchase of Asset

Asset A/c Dr

To Bank/Cash/Vendor A/c

For Providing Depreciation

Depreciation A/c Dr

To Provision for Depreciation A/c

For Closure of Depreciation Account

Profit and loss A/c Dr

To Depreciation A/c

Treatment in balance sheet in the balance sheet, the fixed asset continues to appear at its original cost on the asset side. The depreciation charged till that date appears in the provision for depreciation account, which is shown either on the ‘liabilities side’ of the balance sheet or by way of deduction from the original cost of the asset concerned on the asset side of the balance sheet.

- Disposal of Asset

Disposal of an asset can take place either (a) at the end of its useful life or (b) during its useful life (due to obsolescence or nay other abnormal factors.)

If the asset is sold at the end of its useful life, the amount realized on account of the sale of asset as scrap should be credited to the asset account and the balance is transferred to profit and loss account. If the sale proceeds exceed the book value of the asset, there is profit and if the sale proceeds fail short of written down value, loss in incurred.

Journal Entries

For Recording Sale of Asset

Cash/Bank A/c Dr

To Asset A/c

(Being the assets sold)

For Recording Profit/Loss on sale

- In case of Profit

Asset A/c Dr

To Profit and Loss A/c

(Being the transfer of profit on sale of asset)

- In case of Loss

Profit and loss A/c Dr

To Asset A/c

(Being the transfer of loss on sale of asset)

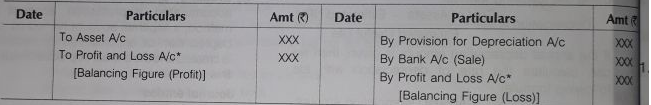

- Asset Disposal Account

The account created to provide a complete picture of all the transactions involved in sale/disposal of an asset under one account head is ‘asset disposal account’.

This account is opened when a part of asset is sold and provision for depreciation account exist.

Dr Asset Disposal Account Cr

- Provisions

The account set aside for the purpose of providing for any known liability or uncertain loss or expense, the amount of which cannot be ascertained with certainity is referred to as provision.

Examples of provisions are provision for depreciation, provision for repairs ad renewals etc.

- Importance of Provision

- To meet anticipated losses and liabilities

- To meet known losses and liabilities

- To present correct financial statements

- Accounting Treatment and Disclosure of Provision

Provision is a charge against the profit and is created by debiting and loss account. In the balance sheet, the amount of provision may be shown either

- On the assets side, by way of deduction from the concerned asset.

- On the liability side along with the current liabilities.

- Reserves

Reserves are referred to as the amount set aside from profits and retained in the business to provide for certain future needs like growth and expansion or to meet future contingencies. Examples of reserves are general reserve, workmen compensation fund, etc. Reserves are not a charge against profit but are the appropriation of profit.

- Types of Reserves

Reserves are generally classified into

- Revenue Reserves The reserve created from revenue profits which arise out of the normal operating activity of the business and are otherwise freely available for distribution as dividend are known as revenue reserves.

Revenue reserves can be classified into

- General Reserve the reserve which is not created for a specified purpose is general reserve. It is also known as free reserve or contingency reserve.

- Specific reserve These are the reserves that are created for some specific purpose and can be utilized only for that purpose.

Examples of specific reserve are given below:

-

-

- Dividend equalization reserve

- Workmen compensation reserve

- Investment fluctuation fund

- Debenture redemption reserve

-

- Capital reservethe reserves which are created out of capital profits and are not available for distribution as dividend are known as capital reserve. Capital reserves can be used for working off capital losses or issue of bonus shares in case of a company.

Examples of capital profits are premium on issue of shares of debentures, profit on sale of fixed assets etc.

- Importance of Reserves

- Reserves strength the financial position of an enterprise.

- The amount set aside as reserves may be utilized for the purpose of meeting of future contingency.

- Creation of reserves help in the expansion of business operations or for bringing uniformity in distribution of dividends.

- Creation of certain reserves is also required by law, e.g. investment allowance reserve, debenture redemption, etc.

- Accounting Treatment and Disclosure of Reserve

Reserves are not a change against profit but are the appropriation of profits. Hence, reserves are transferred to the profit and loss appropriation account. Reserves are shown under the head reserves and surplus on the liabilities of the balance sheet.