TS Grewal Solutions for Class 11 Accountancy Chapter 11 – Bank Reconciliation Statement

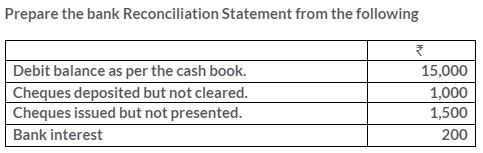

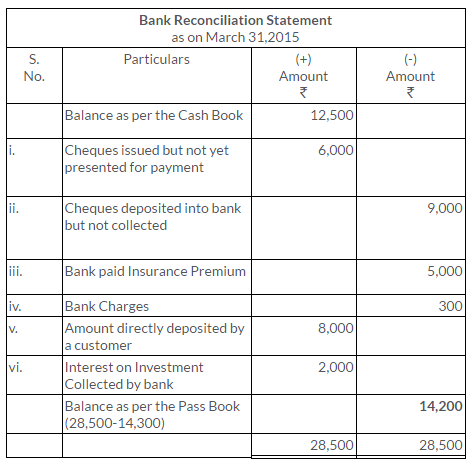

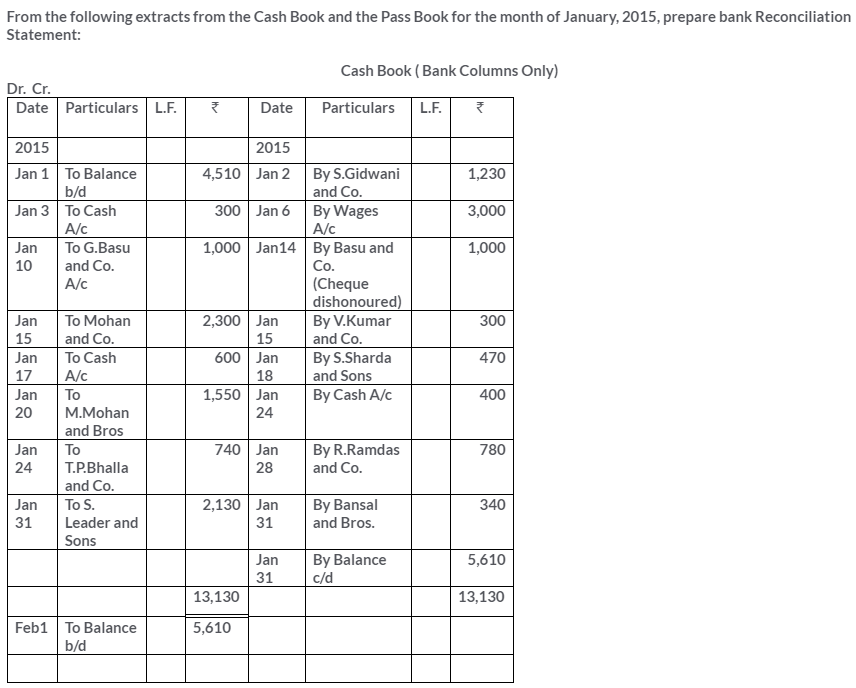

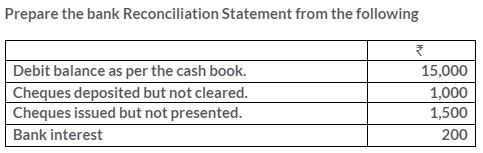

Question 1.

Solution:

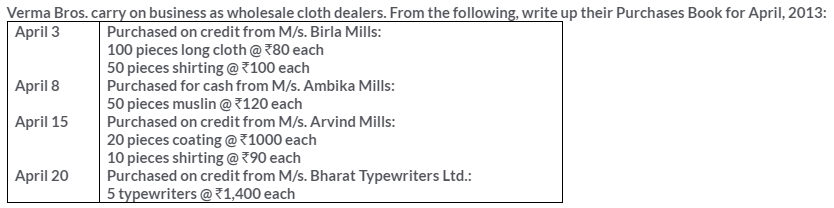

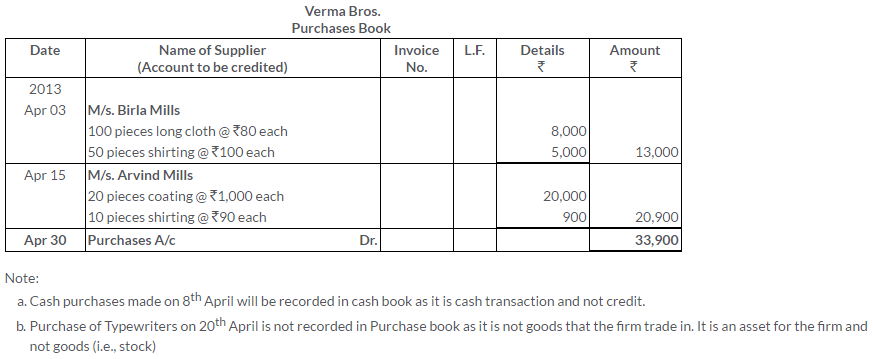

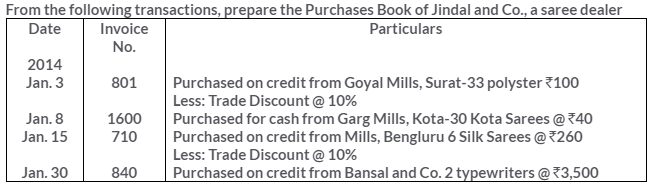

Question 2.

Solution:

Question 3.

On 31st March, 2015, Cash Book showed a balance of Rs.15,000 as cash at bank, but the Bank Pass Book of the same date showed that cheques for Rs.1,850, Rs.1,000 and Rs.1,750 respectively had not been presented for payment; also cheques amounting to Rs.4,100 paid into the account had not yet been cleared. Find by means of a Bank Reconciliation Statement the balance shown in the Pass Book.

Solution:

Question 4.

Mr. Ram Behari has his account at Punjab National Bank, Delhi. According to his Cash Book, his bank balance on 31st March, 2015 was Rs.72,950. He sent cheques for Rs.90,075 to his bank for collection but cheques amounted toRs. 43,769 were not collected by that date. Out of the cheques issued by him in payment of his debts, cheques for Rs.29,344 were not presented for payment. Prepare Bank Reconciliation Statement and determine the balance as shown by his Pass Book.

Solution:

Question 5.

On 31st March, 2015, Cash Book of Mahesh showed debit bank balance of Rs.75,000. When compared with the Bank Statement, following facts were discovered. 30th March, two cheques of Rs.5,000 and Rs.7,000 were deposited in the bank but were not realised till date. On 28th March, three cheques of Rs.6,000, Rs.8,000 and Rs.12,000 were issued but none of these were presented to the bank for payment. On 31st March, bank credited Rs.1,250 as interest but this was not recorded in the Cash Book. Similarly, bank had charged Rs.150 as bank charges but this was not recorded in the Cash Book Prepare Bank Reconciliation Statement on 31st March, 2015.

Solution:

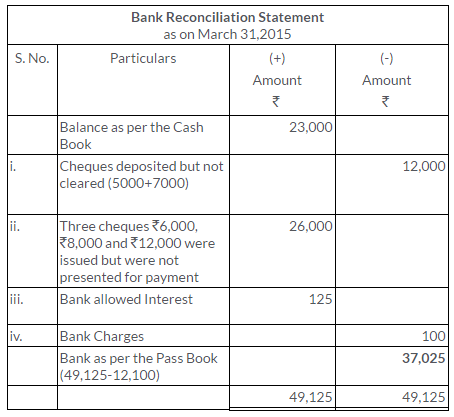

Question 6.

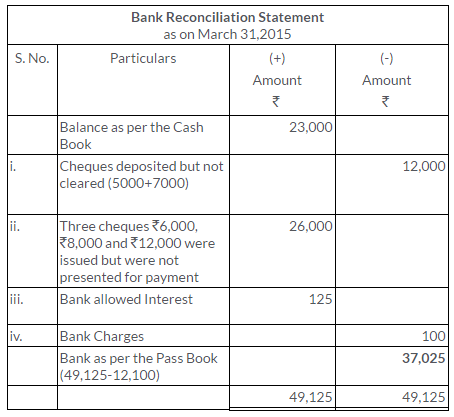

Cash Book of a merchant showed bank balance of Rs.23,000 on 31st March, 2015. On go’ through the Cash Book, it was found that two cheques for Rs.5,000 and Rs.7,000 deposited the month of March were not credited in the Pass Book till 2nd April, 2015 and three cheques for Rs.6,000, Rs.8,000 and Rs.12,000 issued on 28th March, were not presented payment till 3rd April, 2015. In addition to this, bank had credited merchant for Rs.125 interest and had debited him for Rs.100 as bank charges for which entries in Cash Bo were not recorded. Prepare Bank Reconciliation Statement as on 31st March, 2015.

Solution:

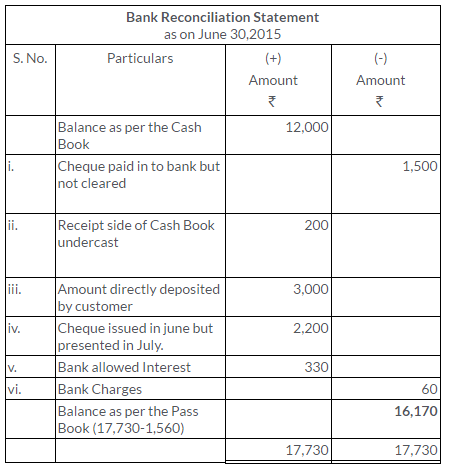

Question 7.

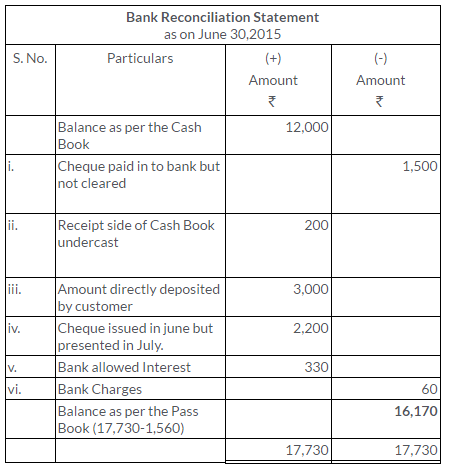

On 30th June, 2015, bank column of the Cash Book showed balance of Rs.12,000 but the Pass Book showed a different balance due to the following reasons:

i. Cheques paid into the bank Rs.8,000 but out of these only cheques of 6,500 credited by bankers.

ii. The receipt column of the Cash Book under cast by Rs.200.

iii. On 29th June, a customer deposited Rs.3000 directly in the Bank Account but it was entered in the Pass Book only.

iv. Cheques of Rs.9,200 were issued of which Rs.2,200 were presented for payment on 15th July.

v. Pass Book shows a credit of Rs.330 as interest and a debit of Rs.60 as bank charges. Prepare Bank Reconciliation Statement as on 30th June, 2015.

Solution:

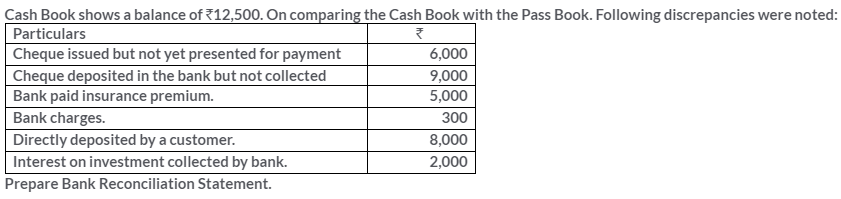

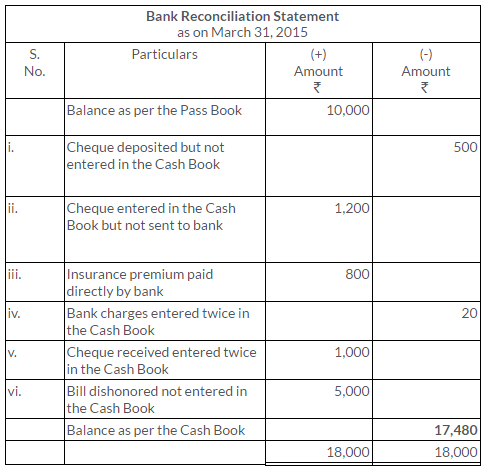

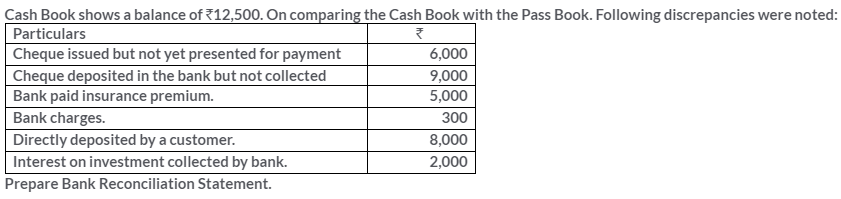

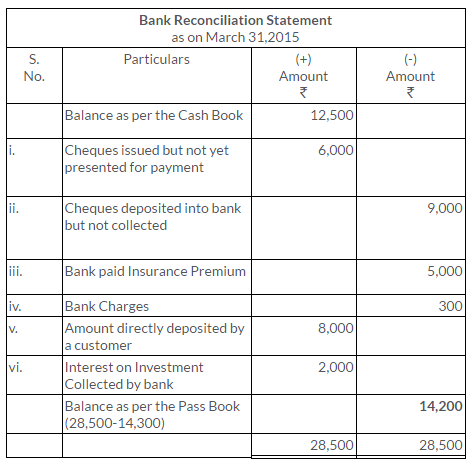

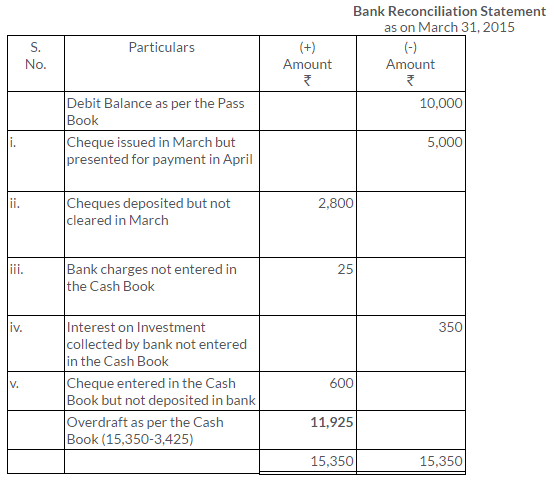

Question 8.

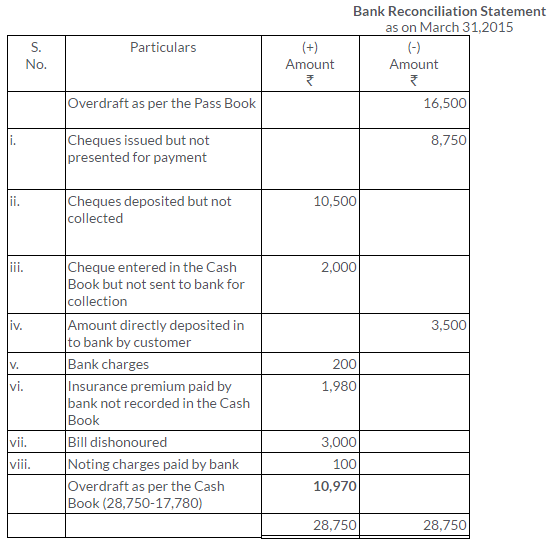

Solution:

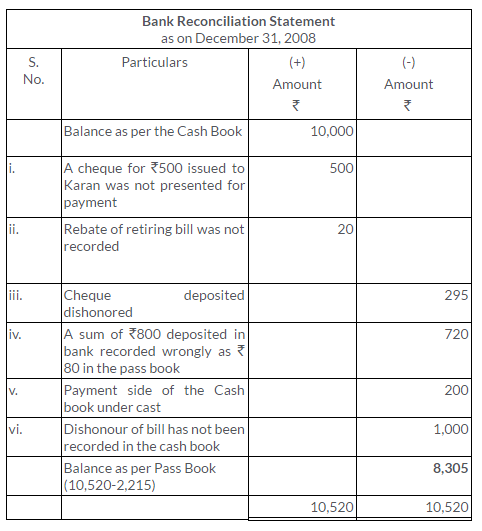

Question 9.

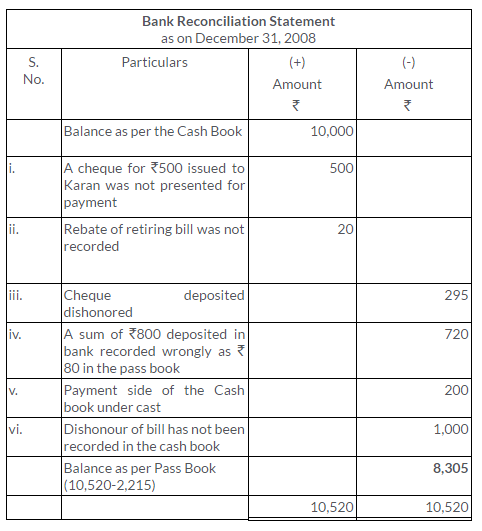

From the following particulars, prepare Bank Reconciliation Statement as on 31st December, 2008:

i. Debit balance as per Cash Book Rs.10,000.

ii. A cheque for Rs.500 issued in favour of Karan has not been presented for payment.

iii. A bill for Rs.700 retired by bank under a rebate of Rs.20, the full amount of the bill was credited in the Cash Book.

iv. A cheque for Rs.295 deposited in the bank has been dishonoured.

v. A sum of Rs.800 deposited in the bank has been credited as Rs.80 in the Pass Book.

vi. Payment side of the Cash Book has been under cast by Rs.200.

vii. A bill receivable for Rs.1,000 (discounted with the bank in November 2008) dishonoured on 31st December, 2008.

Solution:

Question 10.

On examining the Bank Statement of Green Ltd., it is found that the balance shown on 31st March, 2015, differs from the bank balance of Rs.23,650 shown by the Cash Book on that date. From a detailed comparison of the entries it is found that:

i. Rs.2,860 is entered in the Cash Book as paid into the bank on 31st March, 2015 but not credited by the ba until the following day.

ii. Bank charges of Rs.70 on 31st March, 2015 are not entered in the Cash Book.

iii. A bill for Rs.5,500 discounted with the bank is entered in the Cash Book without recording the discount charges of Rs.270.

iv. Cheques totaling Rs.16,720 were issued by the company and duly recorded in the Cash Book before 31st March, 2015 but had not been presented at the Bank for payment until after that date.

v. On 25th March, 2015, a debtor paid Rs.1,000 into the Company’s Bank in settlement of his account but no entry was made in the Cash Book of the company in respect of this.

vi. No entry has been made in the Cash Book to record the dishonor on 15th March, 2015, of a cheque for Rs.550 received from Ram Babu. Prepare a Bank Reconciliation Statement as on 31st March, 2015.

Solution:

Question 11.

Prepare Bank Reconciliation Statement from the following particulars on 31st July, 2015:

i. Balance as per the Pass Book Rs.50,000.

ii. Three cheques for Rs.6,000, Rs.3,937 and Rs.1,525 issued in July, 2015 were presented for payment to the bank in August, 2015.

iii. Two cheques of Rs.500 and Rs.650 sent to the bank for collection were not entered in the Pass Book by 31st July, 2015.

iv. The bank charged Rs.460 for its commission and allowed interest of Rs. 100 which were not mentioned in the Bank Column of the Cash Book.

Solution:

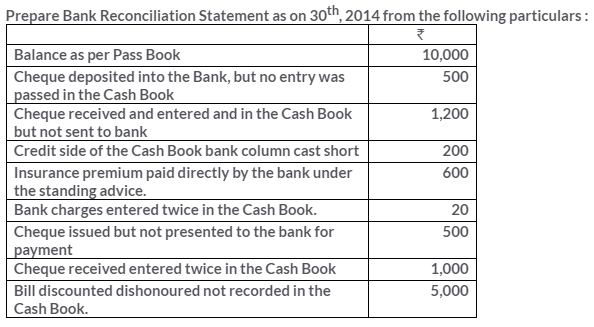

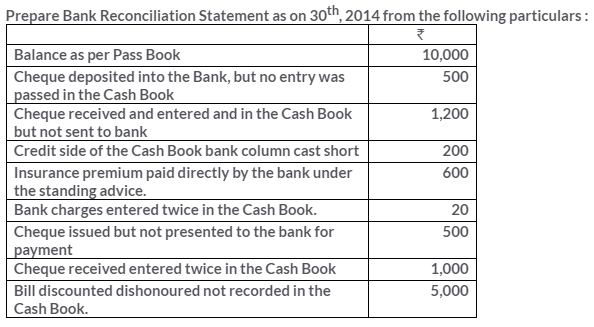

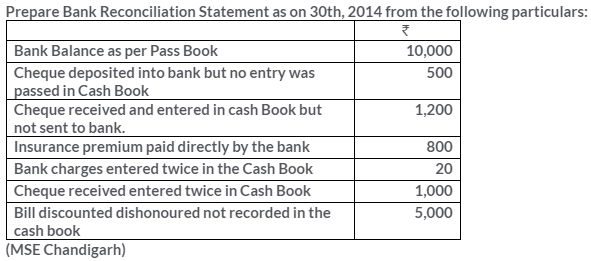

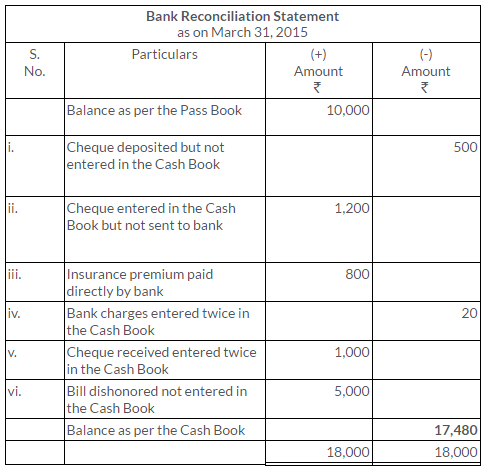

Question 12.

Solution:

Question 13.

Draw Bank Reconciliation Statement showing adjustment between your cash book and pass book as on 31st March, 2011:

i. On 31st March, 2011 your pass book showed a balance of Rs.6,000 to your credit.

ii. Before that date, you had issued cheques amounting to Rs.1,500 of which cheques of Rs.900 have been presented for payment.

iii. A cheque of Rs.800 paid by you into the bank on 29th March, 2011 is not yet credited pass book.

iv. There was a credit of Rs.85 for interest on Current Account in the pass book.

v. On 31st March, 2011 a cheque for Rs.510 received by you and was paid into bank the same was omitted to be entered in cash book.

(MSE Chandigarh 2012)

Solution:

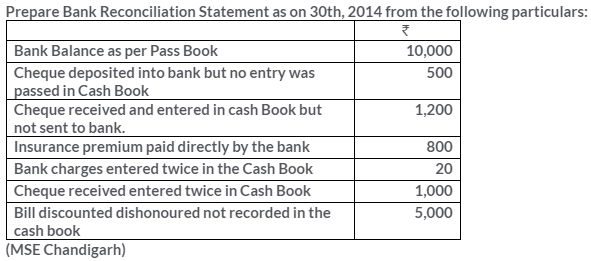

Question 14.

Solution:

Question 15.

From the following particulars, prepare a Bank Reconciliation Statement of Govil as on 31st March, 2015: Balance as per Pass Book on 31st March, 2015 is Rs.8,500. Rs.5,100 were issued during the month of March but out of these, cheques for Rs.1,200 were presented in the month of April, 2015 and one cheque for Rs.200 was not presented for payment. Cheque and cash amounting to Rs.4,800 were deposited in the bank during March but credit was given for Rs.3,800 only. A customer had deposited Rs.800 into the bank directly. The bank has credited Covil for Rs.200 as interest and has debited him for Rs.90 as bank charges, for which there are no corresponding entries in the Cash Book.

Solution:

Question 16.

Bank Statement of a customer shows bank balance of 62,000 on 31st March, 2015. On comparing it with the Cash Book the following discrepancies were noted:

i. Cheques were paid into the bank in March but were credited in April: P-Rs. 3,500; Q-Rs.2,500; R-Rs.2,000.

ii. Cheques issued in March were presented in April: X-Rs. 4,000; Q-Rs. 4,500.

iii. Cheque for Rs.1,000 received from a customer entered in the Cash Book but was not banked.

iv. Pass Book shows a debit of Rs.1,000 for bank charges and credit of Rs.2,000 as interest.

v. Interest on investment Rs.2,500 collected by the bank appeared in the Pass Book. Prepare Bank Reconciliation Statement showing the balance as per Cash Book on 31st March, 2015.

(MSE Chandigarh 2003, Modified)

Solution:

Question 17.

On 1st January, 2015, Naresh had an overdraft of Rs. 40,000 as shown by his Cash Book in the bank column. Cheques amounting to Rs.10,000 had been deposited by him but were not collected by the bank by 1st January, 2015. He issued cheques of Rs.7,000 which were not presented to the bank for payment up to that day. There was also a debit in his Pass Book of Rs.600 for interest and Rs. 500 for bank charges. Prepare a Bank Reconciliation Statement.

Solution:

Question 18.

On 31st March, 2015, Cash Book of B. Babu showed an overdraft of Rs.18,000 with the Bank of India. This balance did not agree with the balance as shown by the Bank Pass Book. You find that Babu had paid into the bank on 26th March, four cheques for Rs.10,000, Rs.12,000, Rs.6,000 and Rs.8,000. Out of these the cheque for Rs.6,000 was credited by the bank in April, 2015. Babu had issued on 24th March three cheques for Rs.15,000, Rs.12,000 and Rs.7,000. The first two cheques were presented to the bank for payment in March, 2015 and the third cheque in April, 2015.

You also find that on 31st March, 2015 the bank had debited Babu’s Account with Rs.500 for interest and Rs.20 as charges, but Babu had not recorded these amounts in his books. Prepare Bank Reconciliation Statement as on 31st March, 2015 and ascertain the balance as per Bank Pass Book.

Solution:

Question 19.

On 31st March, 2015, Cash Book of a merchant showed bank overdraft of Rs.1,72,985. On comparing the Cash Book with Bank Statement, following discrepancies were noted:

i. Cheques issued for Rs.60,000 were not presented in the bank till 7th April, 2015.

ii. Cheques amounting to Rs.75,000 were deposited in the bank but were not collected.

iii. A cheque of Rs.15,000 received from Mahesh Chand and deposited in the bank was dishonored but the non-payment advice was not received from the bank till 1st April, 2015.

iv. Rs.1, 50,000 being the proceeds of a bill receivable collected appeared in the Pass Book but not in the Cash Book.

v. Bank charges Rs.1,500 and interest on overdraft Rs.8,500 appeared in the Pass Book but not in the Cash Book.

Prepare Bank Reconciliation Statement and show what balance the Bank Pass Book would indicate on 31st March, 2015.

Solution:

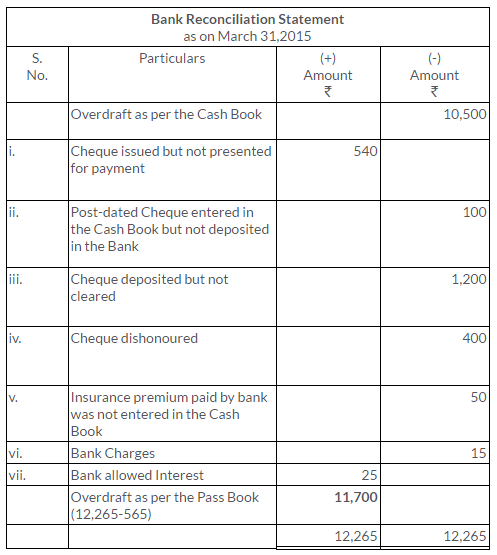

Question 20.

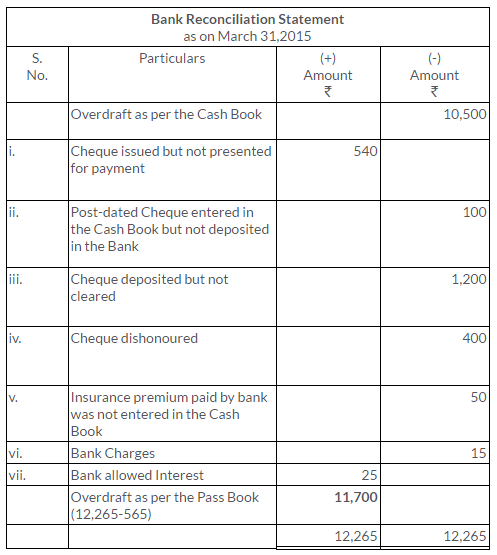

Prepare Bank Reconciliation Statement from the following: On 31st March, 2015, a merchant’s Cash Book showed a credit bank balance of 10,500 but due to the following reasons the Pass Book showed a difference:

i. A cheque of Rs.540 issued to Mohan has not been presented for payment.

ii. A post-dated cheque for Rs.100 has been debited in the bank column of the Cash Book but under no circumstances was it possible to present it.

iii. Four cheques of Rs.1,200 sent to the bank have not been collected so far. A cheque Rs.400 deposited in the bank has been dishonoured.

iv. As per instructions, the bank paid Rs.50 as Fire Insurance premium but the entry has not been made in the Cash Book.

v. There was a debit in the Pass Book of Rs.15 in respect of bank charges and a credit of Rs.25 for interest on Current Account but no record exists in the Cash Book.

Solution:

Question 21.

Tiwari and Sons find that the bank balance shown by their Cash Book on 31st March, 2015 is Rs.40,500 (credit) but the Pass Book shows a difference due to the following reasons:

i. A cheque for Rs.5,000 drawn in favour Manohar has not yet been presented for payment.

ii. A post-dated cheque for Rs.900 has been debited in the bank column of the Cash Book.

iii. Cheques totaling Rs.10,200 deposited with the bank have not yet been collected and a cheque for Rs.4,000 has been dishonoured.

iv. A bill for 10,000 was retired by the bank under a rebate of 150 but the full amount of the bill was credited in the bank column of the Cash Book.

Prepare a Bank Reconciliation Statement and find out the balance as per the Pass Book.

(KVS 2005, Modified)

Solution:

Question 22.

From the following particulars of a trader, prepare a Bank Reconciliation Statement 31st March, 2015:

i. Bank overdraft as per Cash Book Rs.52,100.

ii. During the month, the total amount of cheques for Rs.94,400 were deposited into the bank but of these, one cheque for Rs.11,160 has been entered into the Pass Book on 5th April

iii. During the month, cheques for Rs.89,580 were drawn in favour of creditors. Of them, one creditor for Rs.38,580 encashed his cheque on 7th April whereas another for Rs.4,320 have not yet been encashed.

iv. As per instructions the bank on 28th March paid out 10,500 to a creditor but by mistake, the same has not been entered in the Cash Book.

v. According to agreement, on 25th March, a debtor deposited directly into the Rs.9,000 but the same has not been recorded in the Cash Book.

vi. In the month of March, the bank without any intimation, debited his account for Rs.120 as bank charges and credited the same for Rs.180 as interest.

Solution:

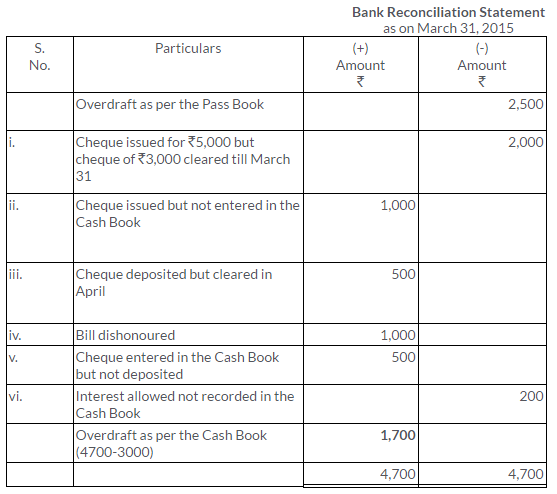

Question 23.

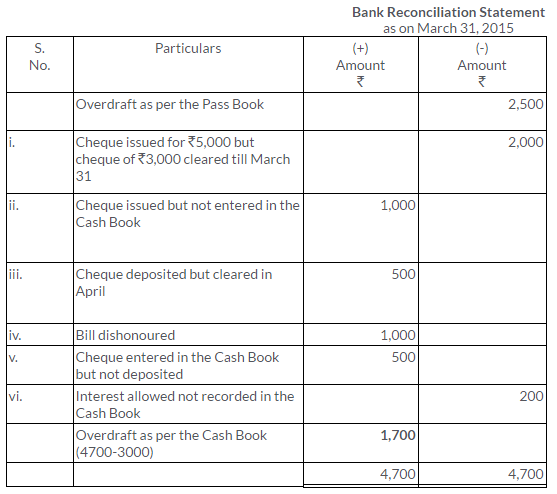

Prepare Bank Reconciliation Statement from the following particulars as on 31st March, 2015, when Pass Book shows a debit balance of Rs.2,500:

i. Cheque issued for Rs.5,000 but up to 31st March, 2015 only Rs.3,000 could be cleared.

ii. Cheques issued for Rs.1,000 but omitted to be recorded in the Cash Book.

iii. Cheques deposited for Rs.5,500 but cheques for Rs.500 were collected on 4th April, 2015.

iv. A discounted Bill of Exchange dishonoured Rs.1,000.

v. A Rs.500 debited in Cash Book but omitted to be banked.

vi. Interest allowed by bank Rs.200 but no entry was passed in the Cash Book.

(Delhi 2002, Adapted)

Solution:

Question 24.

Solution:

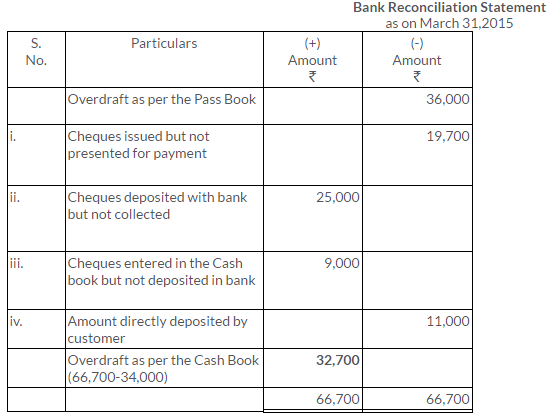

Question 25.

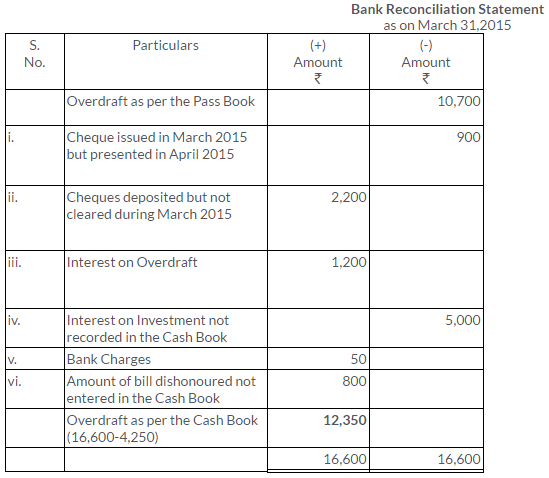

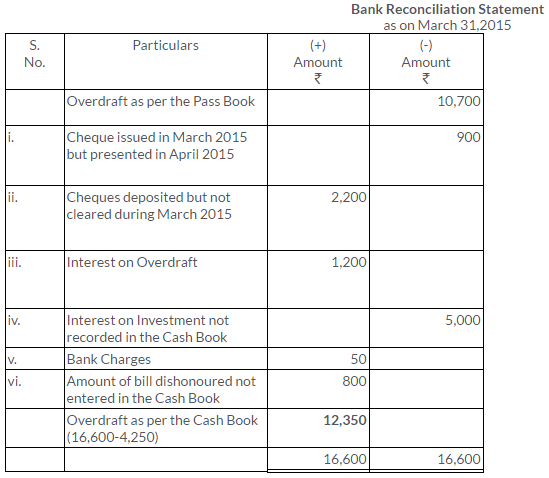

On 31st March, 2015, Bank Pass Book of Naresh and Co. showed an overdraft of Rs.10,700. From the following particulars, prepare Bank Reconciliation Statement:

i. Cheques issued before 31st March, 2015 but presented for payment after that date amounted to Rs.900.

ii. Cheques paid into the bank but not collected and credited until 31st March, 2015 amounted to Rs.2,200.

iii. Interest on overdraft amounting to Rs.1,200 did not appear in the Cash Book.

iv. Rs.5,000 being interest on investments collected by the bank and credited in the Pass Book were not shown in the Cash Book.

v. Bank charges of Rs.50 were not entered in the Cash Book.

vi. Rs.800 in respect of dishonoured cheque were entered in the Pass Book but not in the Cash Book.

Solution:

Question 26.

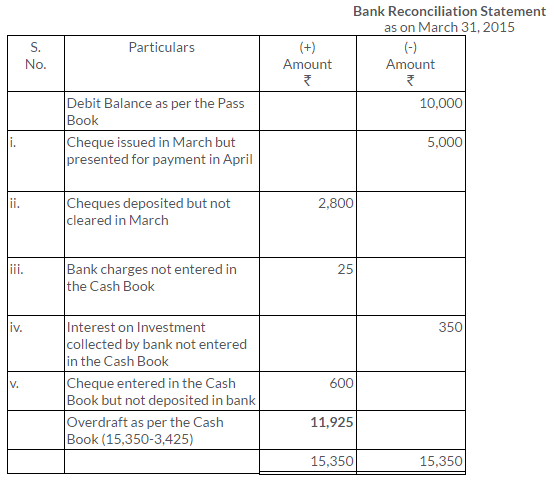

On 31st March, 2015, Pass Book of Shri Bhama Shah shows debit balance of Rs.10,000. From the following particulars, prepare Bank Reconciliation Statement:

i. Cheques amounting to Rs.8,000 drawn on 25th March of which cheques of Rs.5,000 cashed in April, 2015.

ii. Cheques paid into bank for collection of Rs.5,000 but cheques of Rs.2,200 could only be collected in March, 2015.

iii. Bank charges Rs.25 and dividend of Rs.350 on investment collected by bank could not be shown in the Cash Book.

iv. A cheque of Rs.600 debited in the Cash Book omitted to be banked.

(Delhi 2005, Modified)

Solution:

Question 27.

On checking the Bank Pass Book it was found that it showed an overdraft of Rs. 5,220 as on 31st March, 2015, while as per Ledger it was different. The following differences were noted:

i. Cheques deposited but not yet credited by the bank Rs.6,000.

ii. Cheques dishonoured and debited by the bank but not given effect to it in the Ledger Rs.800.

iii. Bank charges debited by the bank but Debit Memo not received from the bank Rs.50.

iv. Interest on overdraft excess credited in the Ledger Rs.200.

v. Wrongly credited by the bank to account, deposit of some other party Rs.900.

vi. Cheques issued but not presented for payment Rs.400.

(Delhi 2001, Modified)

Solution:

Question 28.

Prepare Bank Reconciliation Statement from the following particulars as on 31st 2015 when Pass Book shows a debit balance of Rs.2,500:

i. Cheque issued for Rs.5,000 but up to 31st March, 2015 only 3,000 could be cleared.

ii. Cheques deposited for Rs.5,500 but cheques of Rs.500 were collected on 10th April, 2015.

iii. A discounted bill of exchange dishonoured Rs.2,000.

iv. A cheque of Rs.300 debited in Cash Book but omitted to be banked.

v. Interest allowed by bank Rs.400 but no entry was passed in the Cash Book.

(KVS 2004, Modified)

Solution:

Question 29.

From the following particulars, you are required to ascertain the bank balance as appear in the Cash Book of Ramesh as on 31st October, 2014:

i. Bank Pass Book showed an overdraft of Rs.16,500 on 31st October.

ii. Interest of Rs.1,250 on overdraft up to 31st October, 2014 has been debited in the Pass Book but it has not been entered in the Cash Book.

iii. Bank charges debited in the Bank Pass Book amounted to Rs.35.

iv. Cheques issued prior to 31st October, 2014 but not presented till that date, amounted, to Rs.11,500.

v. Cheques paid into bank before 31st October, but not collected and credited up to date, were for Rs.2,500.

vi. Interest on investment collected by the bankers and credited in the Bank Pass amounted to Rs.1,800.

(KVS 2003, Modified)

Solution:

Question 30.

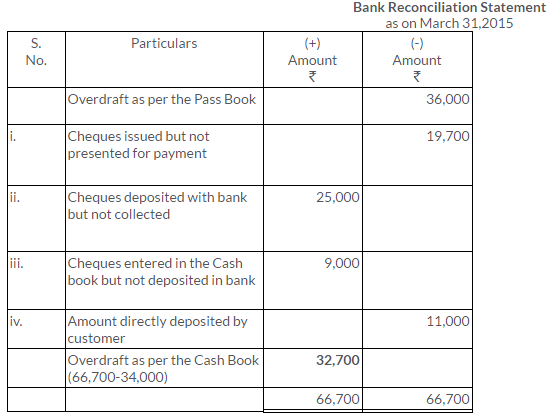

Solution:

Question 31.

Prepare Bank Reconciliation Statement as on 31st March, 2015 from the following particulars :

i. R’s overdraft as per Pass Book Rs.12,000 as on 31st March.

ii. On 30th March, cheques had been issued for Rs.70,000 of which cheques amounting Rs.3,000 only had been encashed up to 31st March.

iii. Cheques amounting to Rs.3,500 had been paid into the bank for collection but of these only 500 had been credited in the Pass Book.

iv. Bank has charged Rs.500 as interest on overdraft and the intimation of which has been received on 2nd April, 2015.

v. Bank Pass Book shows credit for Rs.1,000 representing Rs.400 paid by debtor of R direct into the bank and Rs.600 collected directly by the bank in respect of interest on R’s investment. R had no knowledge of these items.

vi. A cheque for Rs.200 has been debited in the bank column of Cash Book by R but it was not sent to the bank at all.

Solution:

Question 32.

Prepare Bank Reconciliation Statement from the following particulars and show balance as per Cash Book:

i. Balance as per Pass Book on 31st March, 2015 overdrawn Rs.10,000.

ii. Cheques drawn in the last week of March, 2015 but not cleared till 3rd April, 2015 Rs.20,000.

iii. Interest on bank overdraft not entered in the Cash Book Rs.1,500.

iv. Cheques of Rs.20,000 deposited in the bank in March, 2015 but not collected and credited till 3rd April, 2015.

v. Rs.100 insurance premium paid by the bank under a standing order has not been entered in the Cash Book.

Solution:

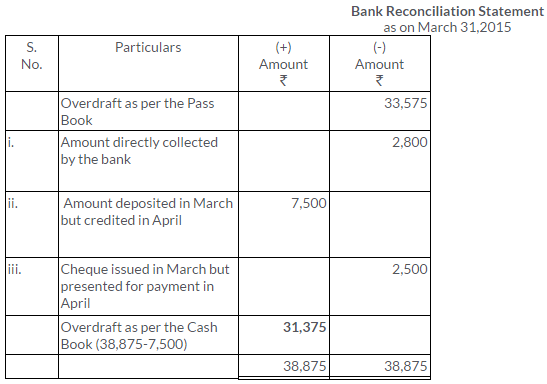

Question 33.

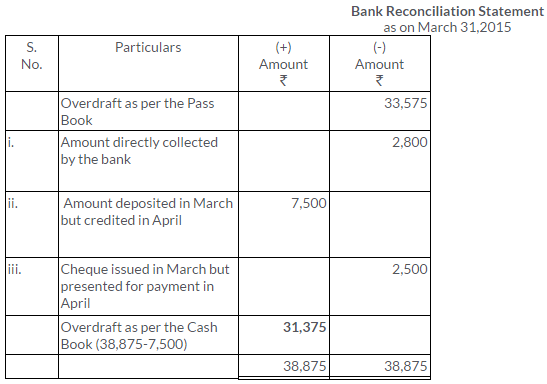

Bank Pass Book of Mr. X showed an overdraft of Rs.33,575 on 31st March, 2015. On going through the Pass Book the accountant found the following:

i. A cheque of Rs.1,080 credited in the Pass Book on 28th March, being dishonoured is debited again in the Pass Book on 1st April, 2015. There was no entry in the Cash Book about the dishonour of the cheque until 15th April.

ii. Bankers had credited his account with Rs.2,800 for interest collected by them on his behalf but the same had not been entered in his Cash Book.

iii. Out of Rs.20,500 paid in by Mr. X in cash and by cheques on 31st March, cheques amounting to Rs.7,500 were collected on 7th April.

iv. Out of cheques amounting to Rs.7,800 drawn by him on 27th March, a cheque for Rs.2,500 was encashed on 3rd April.

Prepare Bank Reconciliation Statement on 31st March, 2015.

Solution:

Question 34.

Solution:

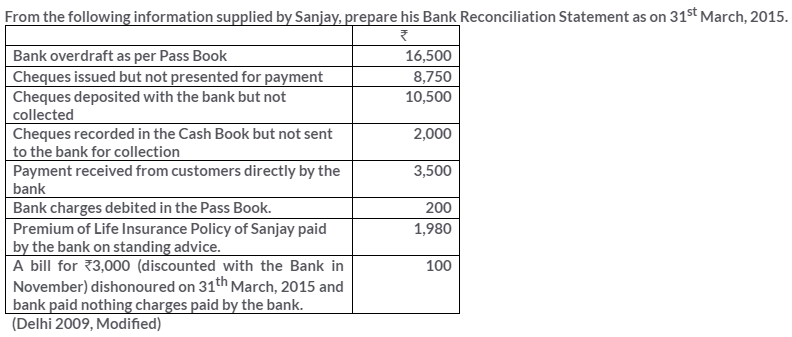

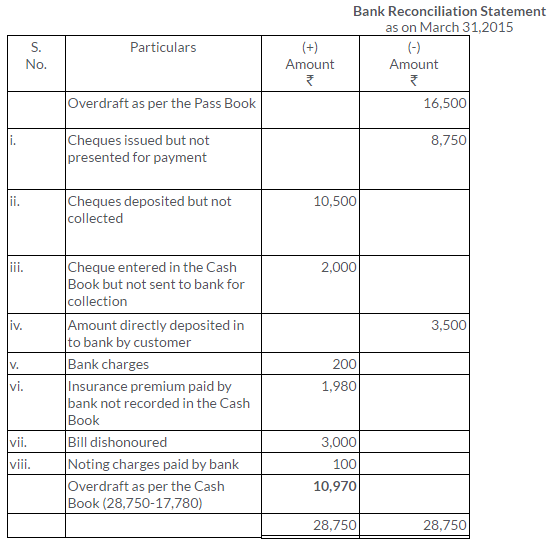

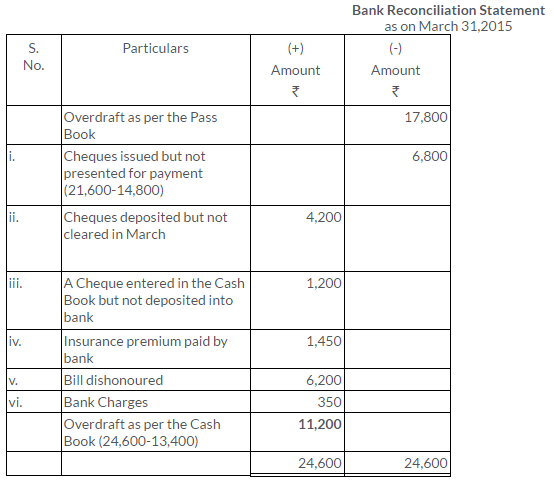

Question 35.

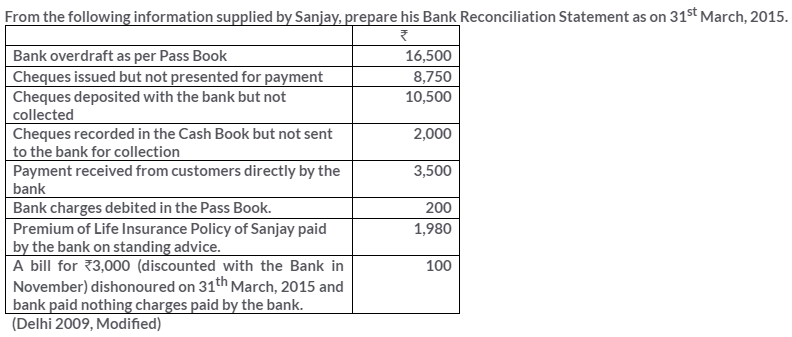

From the following information, prepare Bank Reconciliation Statement as on 31st March, 2015:

i. Debit balance shown by Pass Book Rs.17,800.

ii. Cheques of Rs.21,600 were issued in the last week of March but only cheques of Rs.14,800 were presented for payment.

iii. Cheques of Rs.10,750 were presented to the bank. Out of them, a Rs.4,200 was credited in the first week of April, 2015.

iv. A cheque of Rs.1,200 was debited in the cash book but was not presented in the bank.

v. Insurance premium paid by bank Rs.1,450.

vi. A bill of exchange of Rs.6,200 which discounted with the same was dishonoured but no entry was made in the cash book.

vii. Bank charges, charged by the bank Rs.350.

(MSE Chandigarh 2011, Modified)

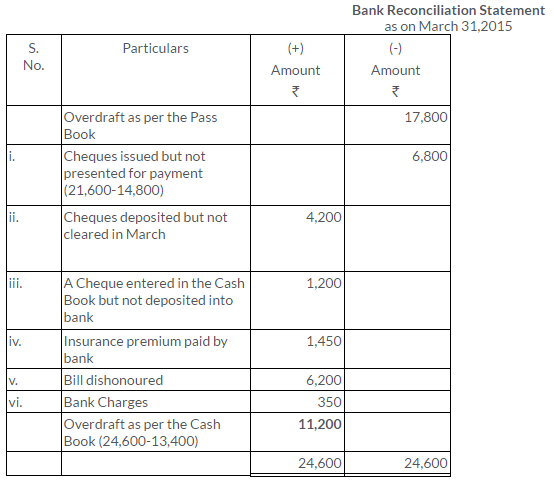

Solution:

Question 36.

Solution:

Question 37.

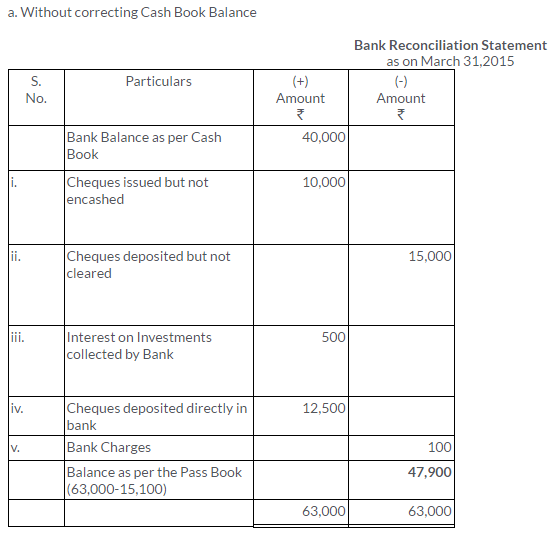

From the following particulars, ascertain the bank balance as per Pass Book 31st March, 2015 (a) without correcting the Cash Book balance and (b) after correcting the Cash Book balance:

i. The bank balance as per Cash Book on 31st March, 2015 Rs. 40,000.

ii. Cheques issued but not encashed up to 31st March, 2015 amounted to Rs.10,000.

iii. Cheques paid into the bank, but not cleared up to 31st March, 2015 amounted to Rs.15,000.

iv. Interest on investments collected by the bank but not entered in the Cash Book Rs.500.

v. Cheques deposited in the bank but not entered in the Cash Book Rs.12,500.

vi. Bank charges debited in the Pass Book but not entered in the Cash Book Rs.100.

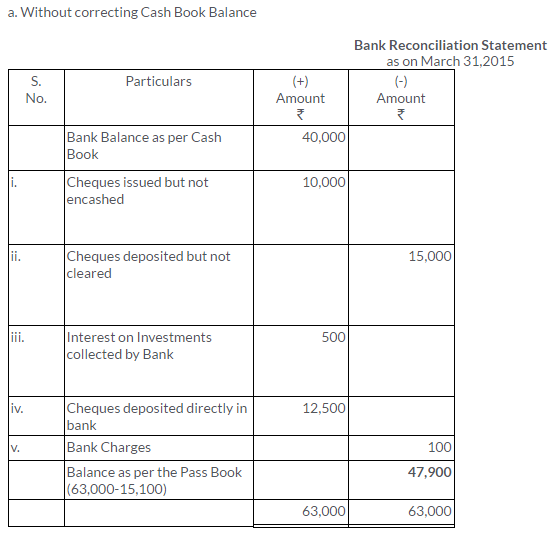

Solution:

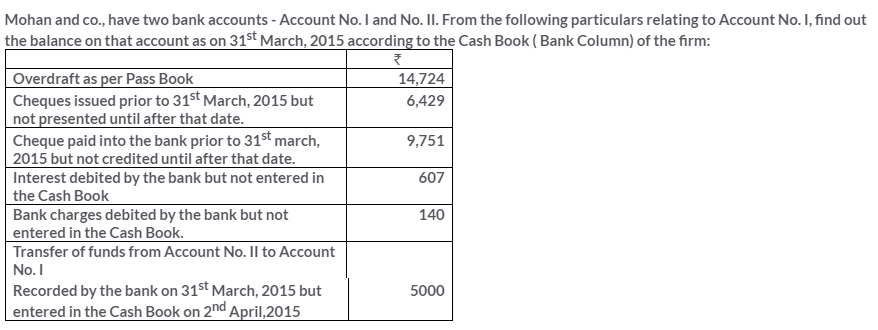

Question 38.

Solution:

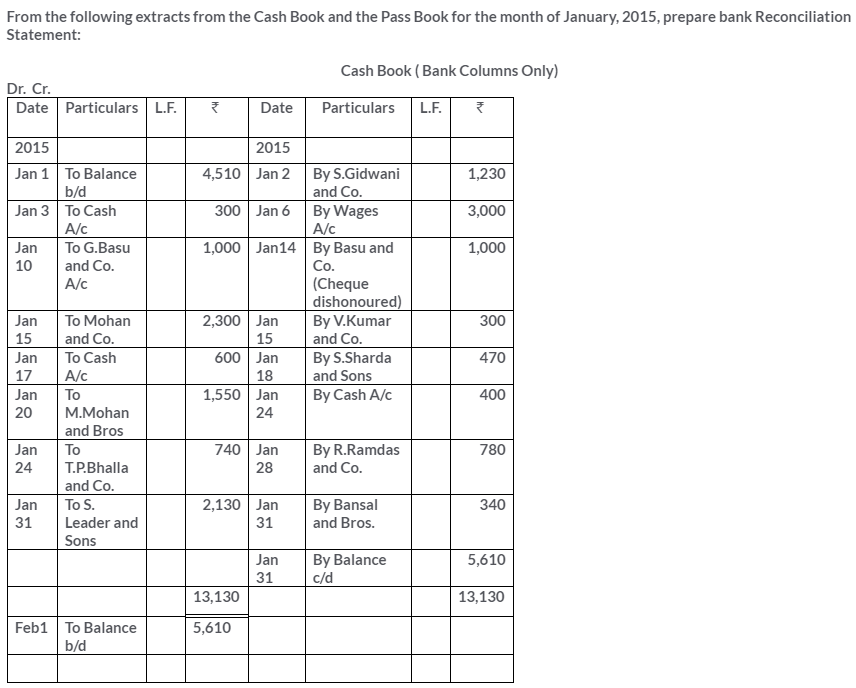

Question 39.

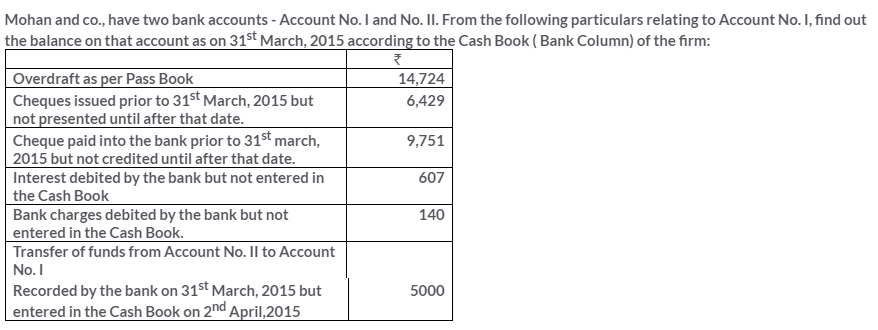

Solution: