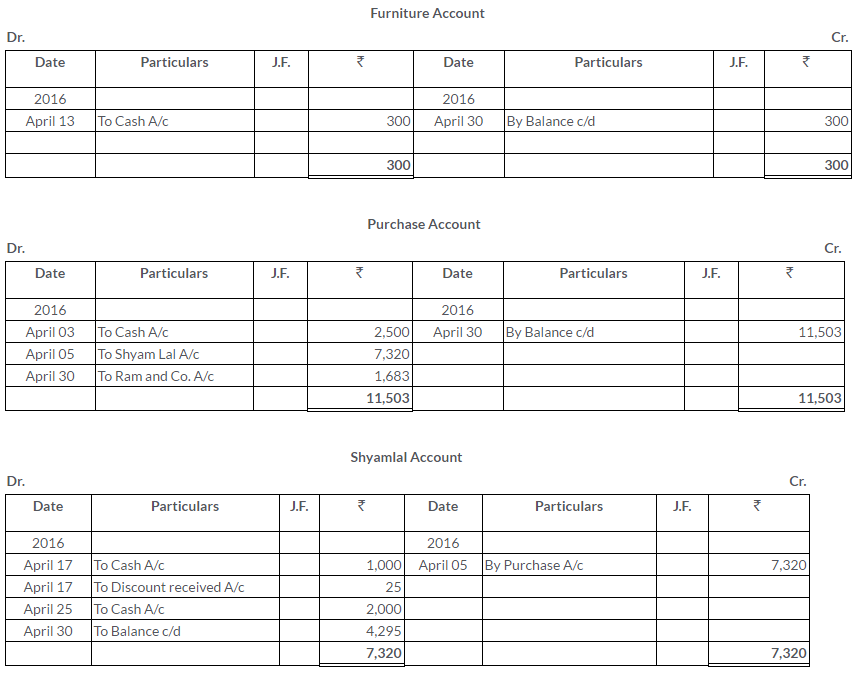

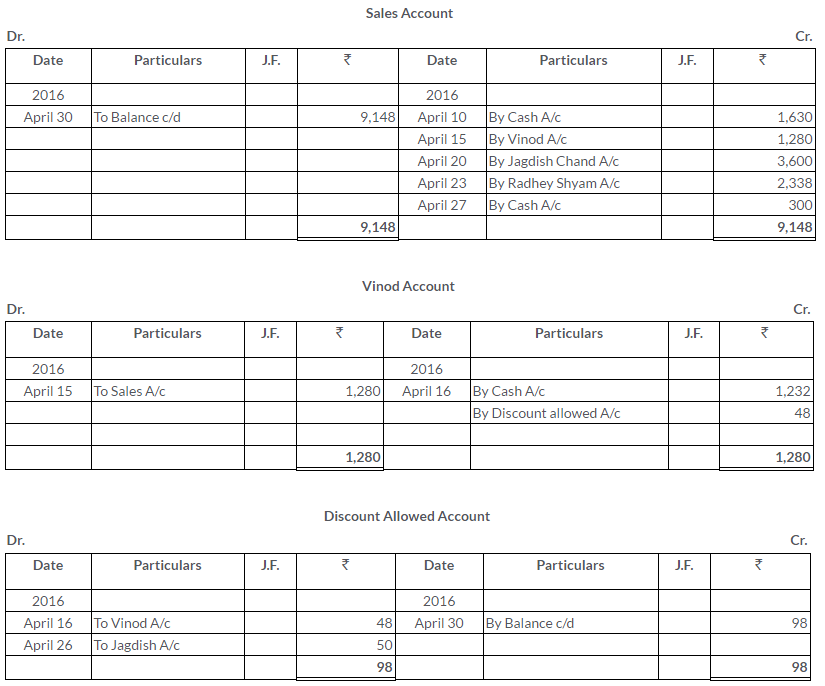

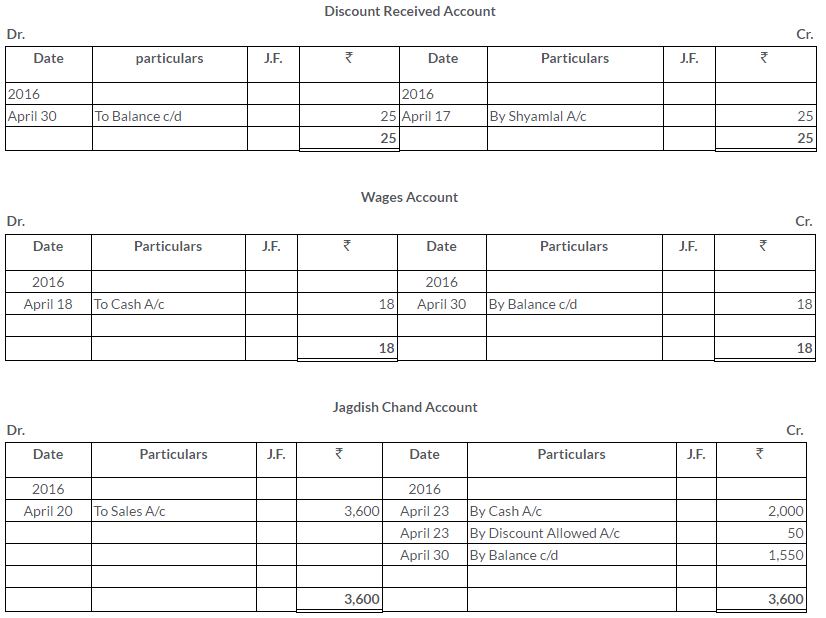

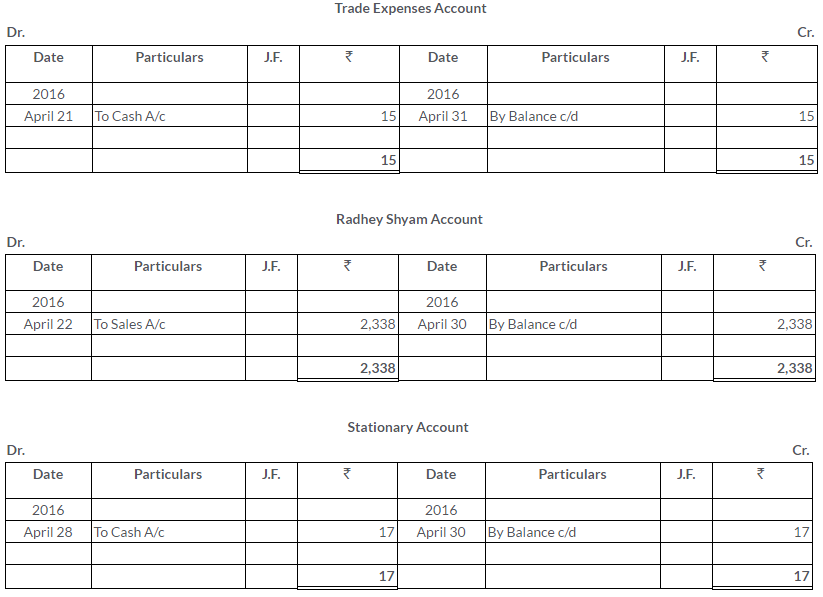

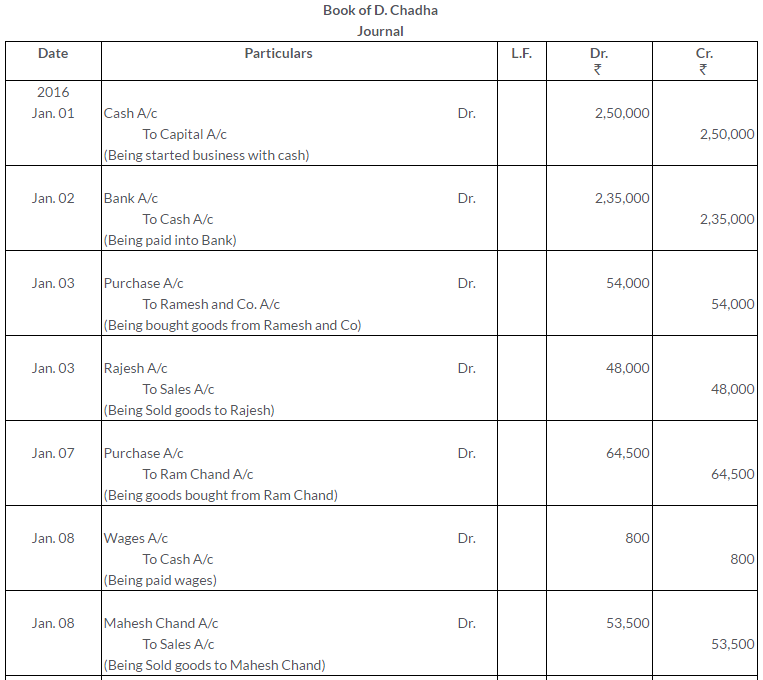

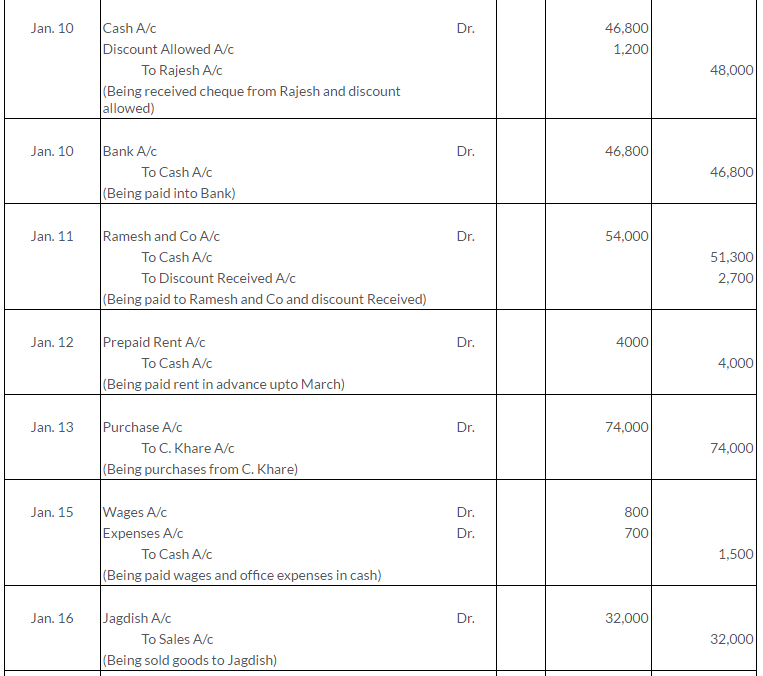

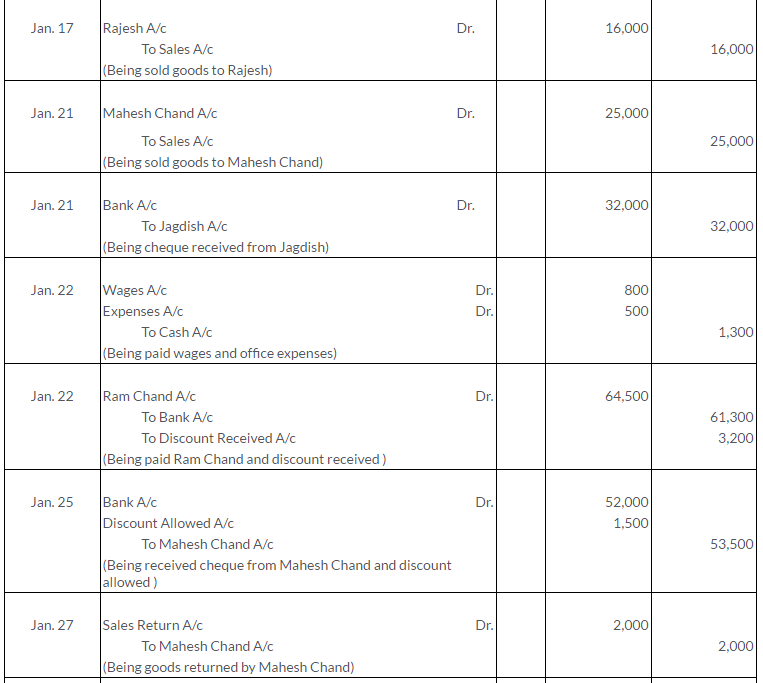

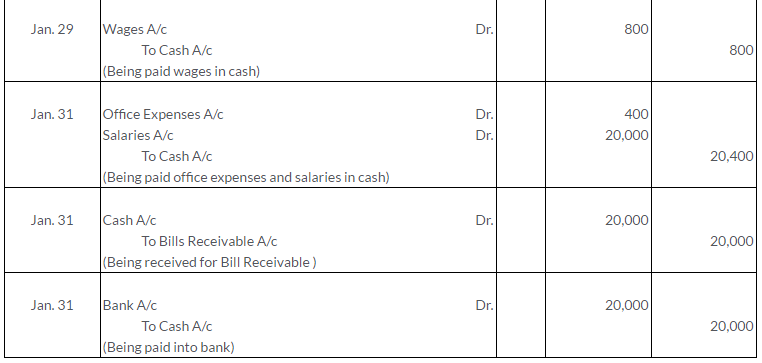

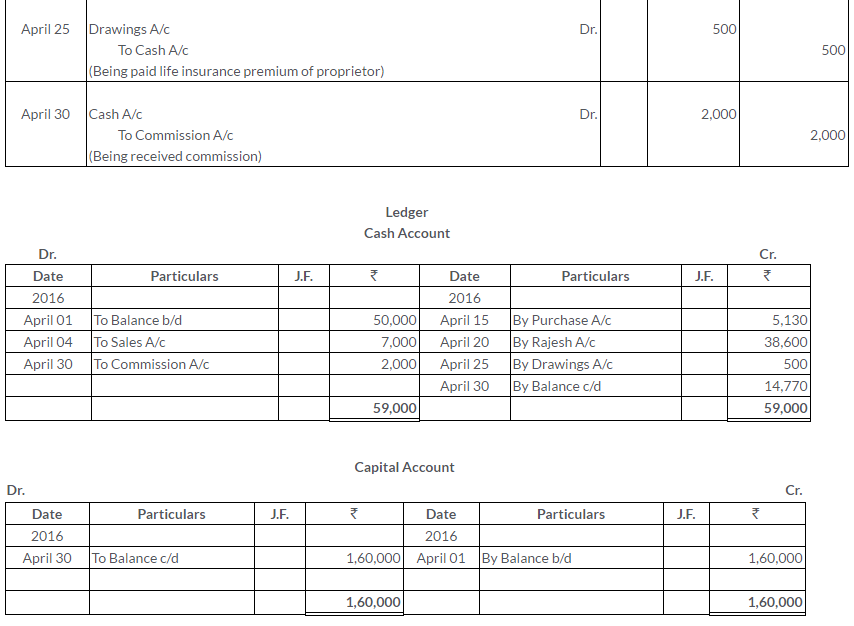

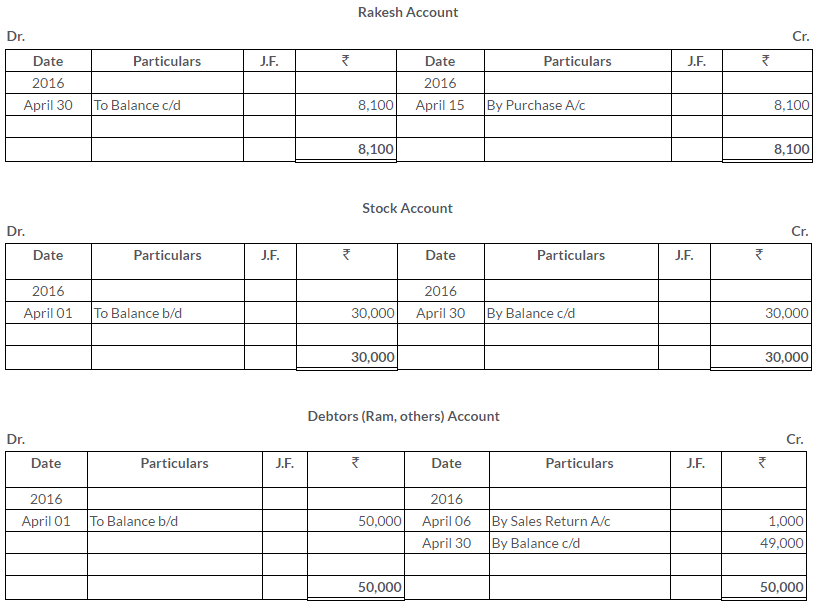

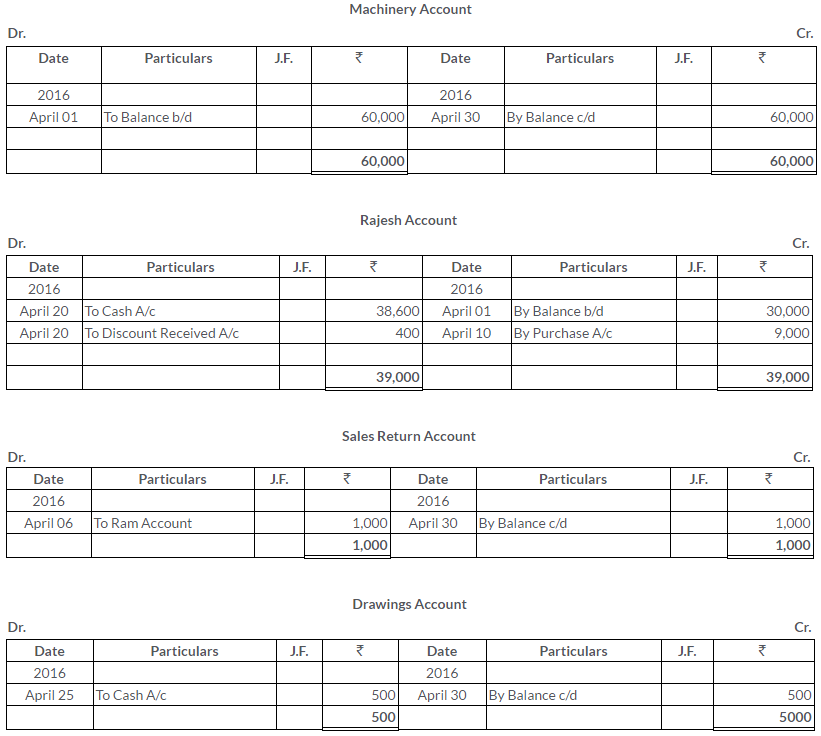

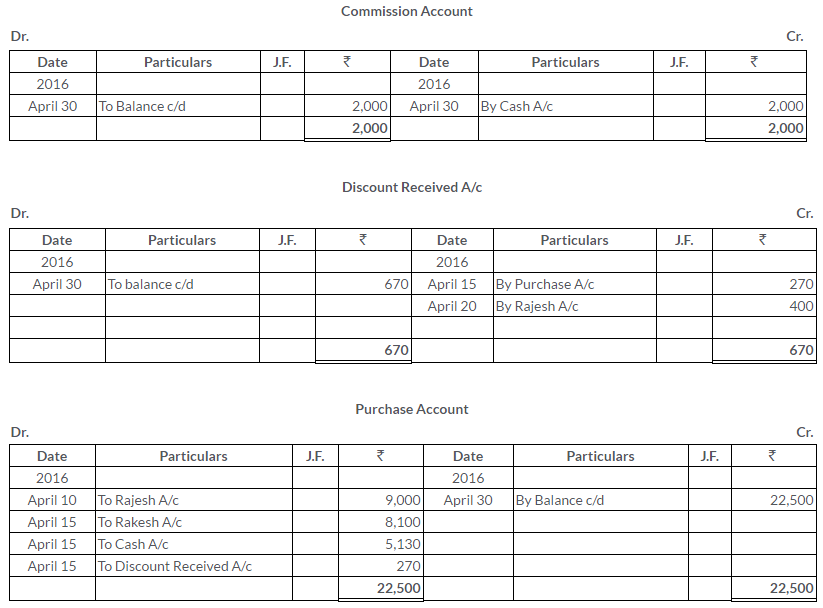

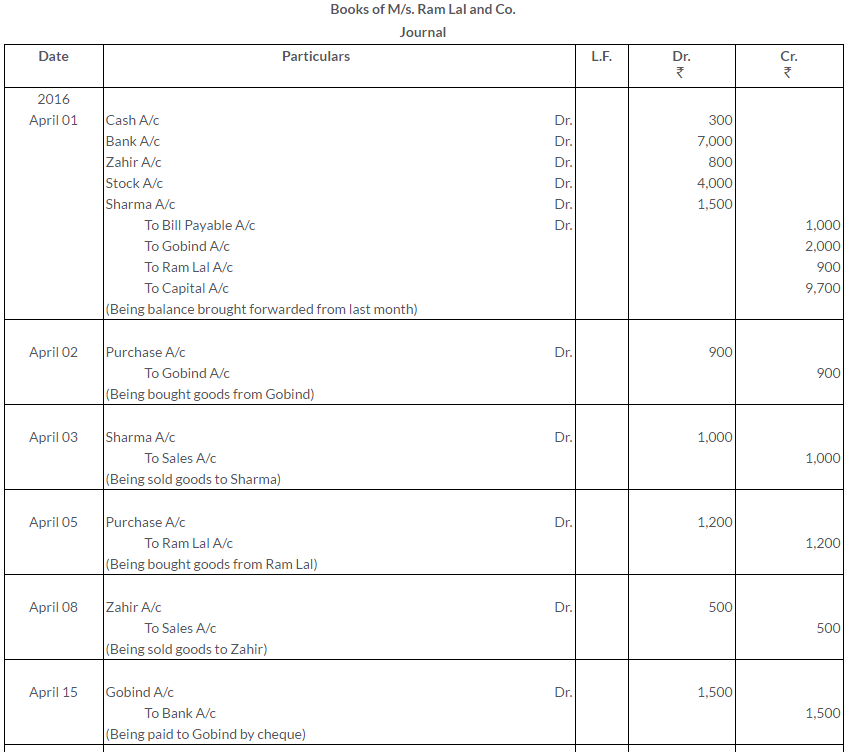

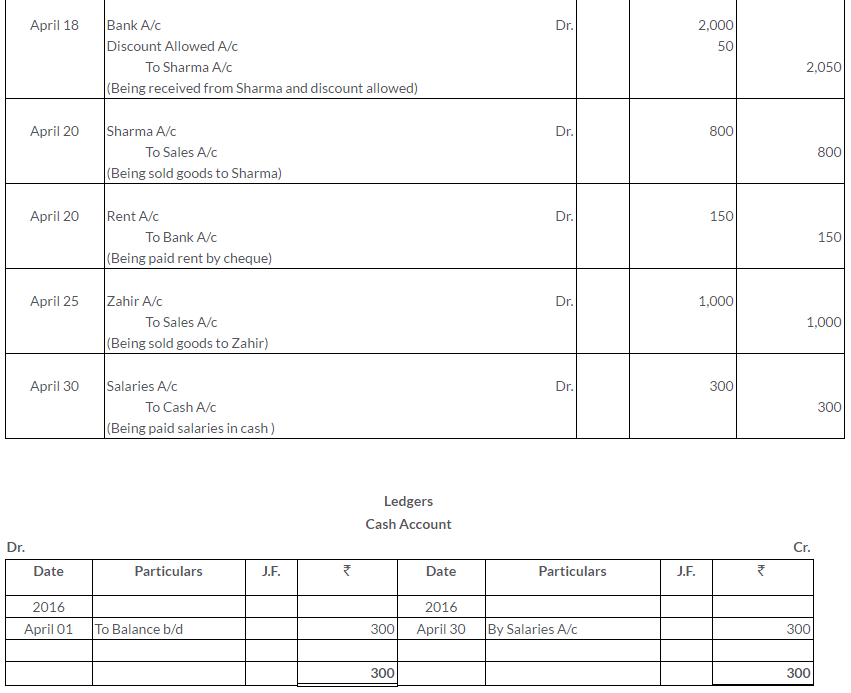

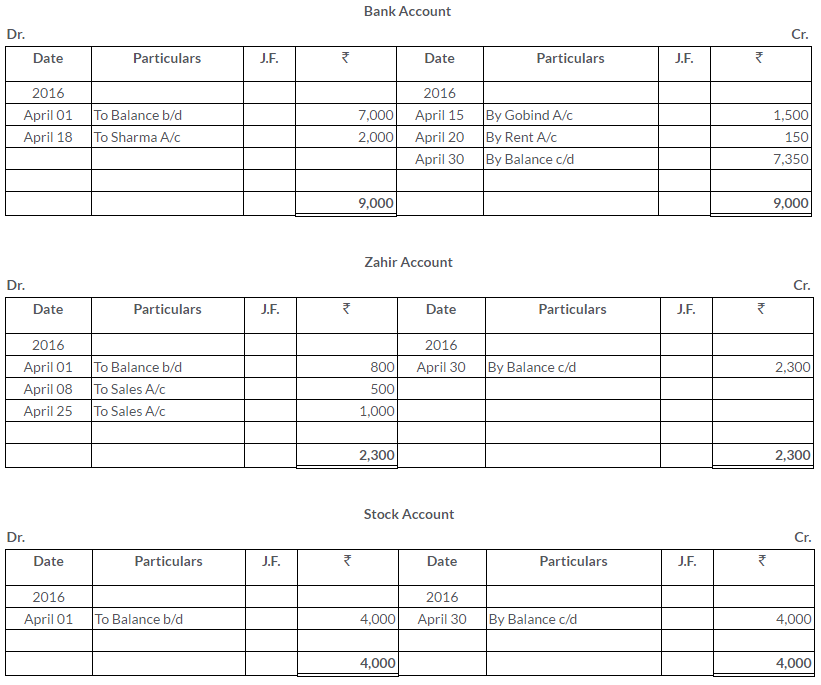

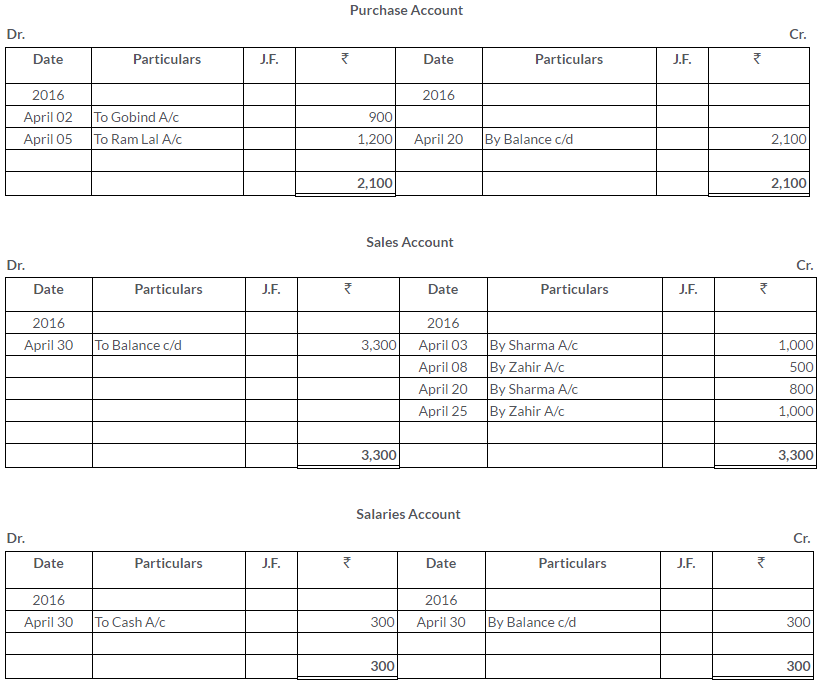

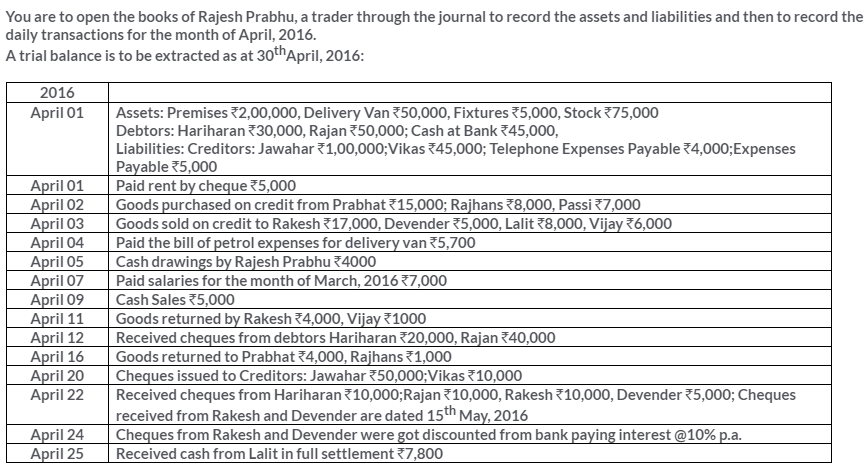

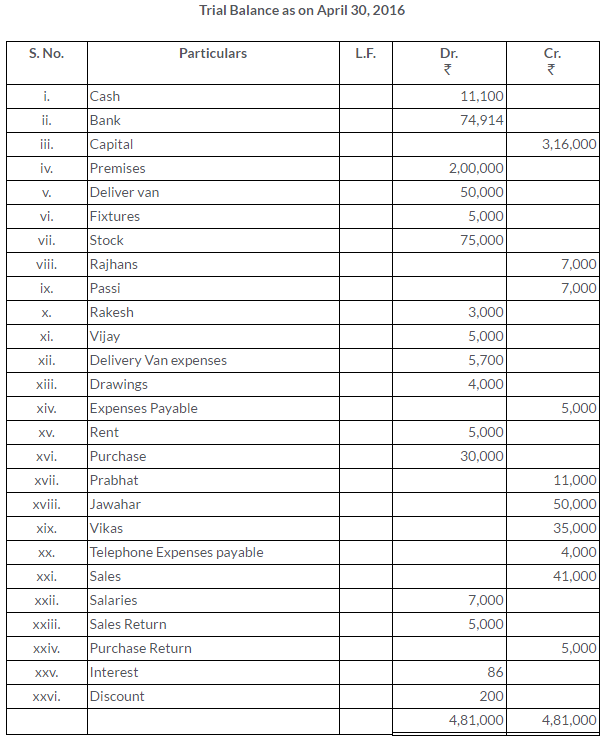

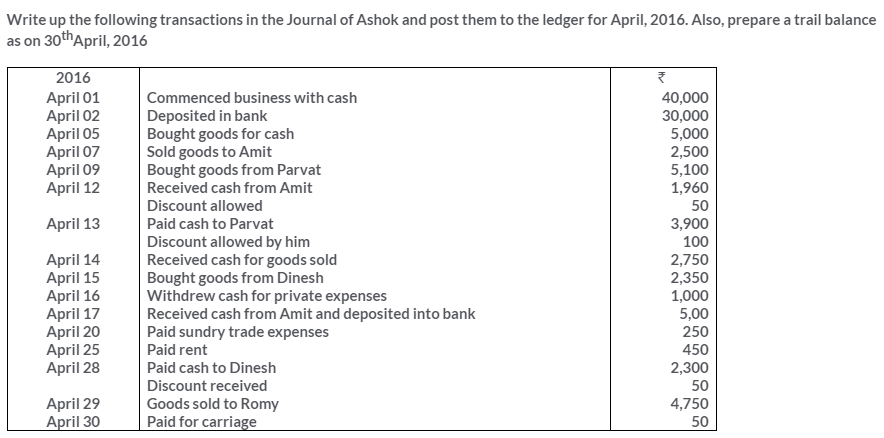

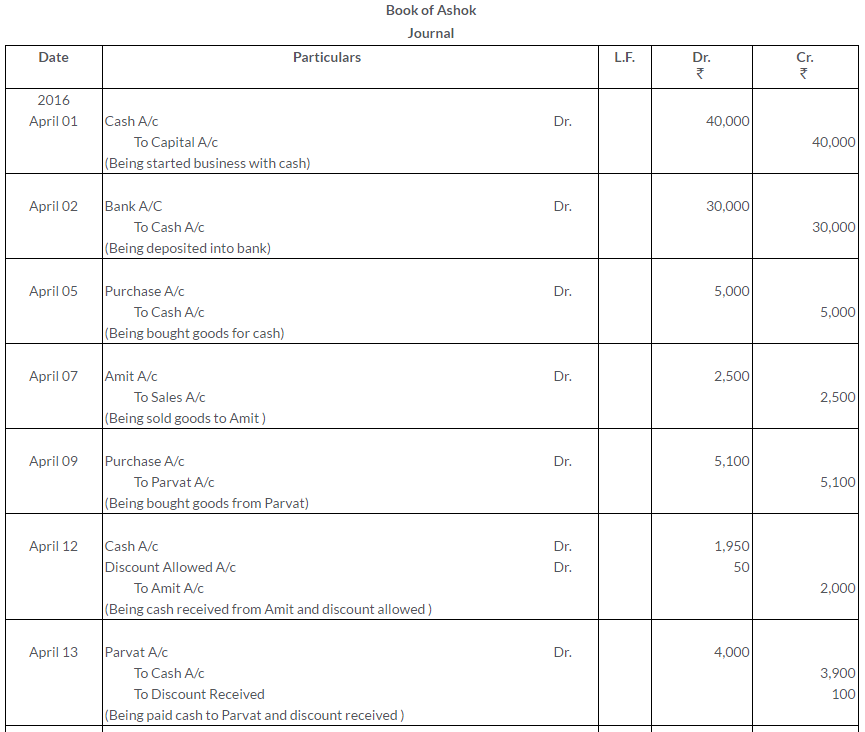

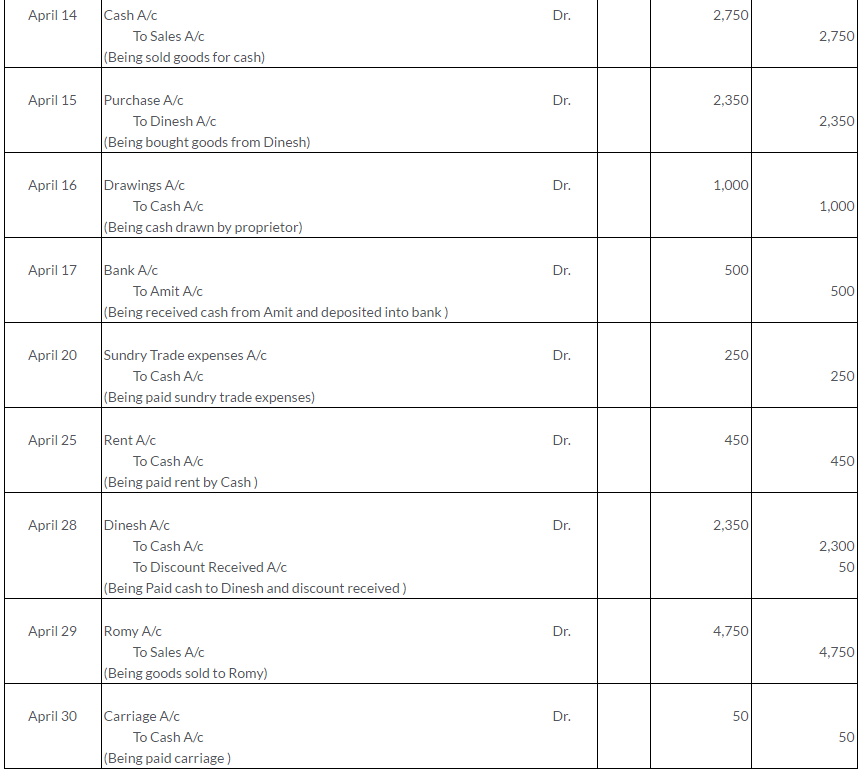

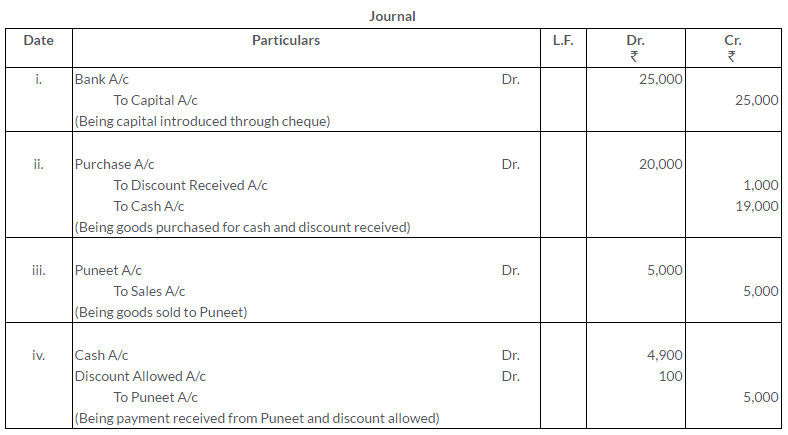

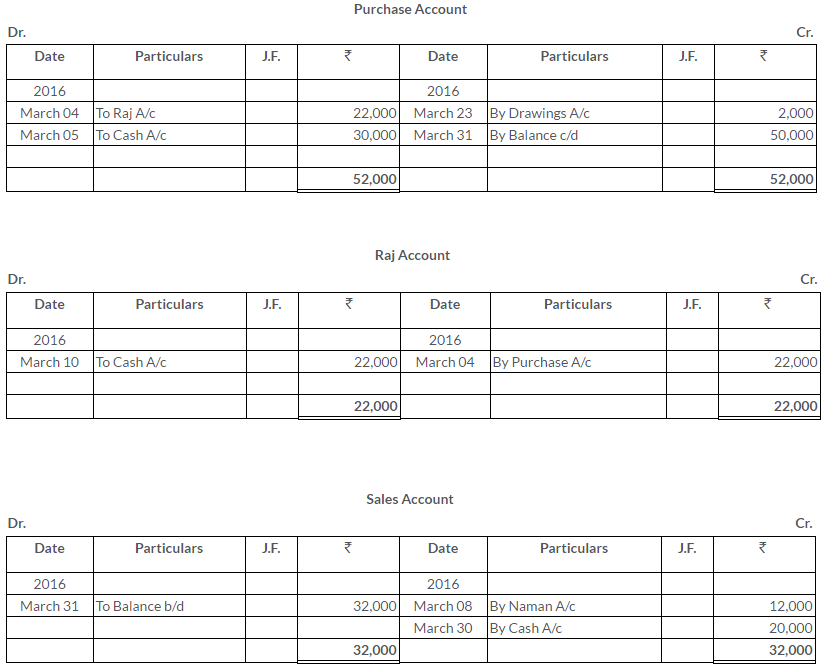

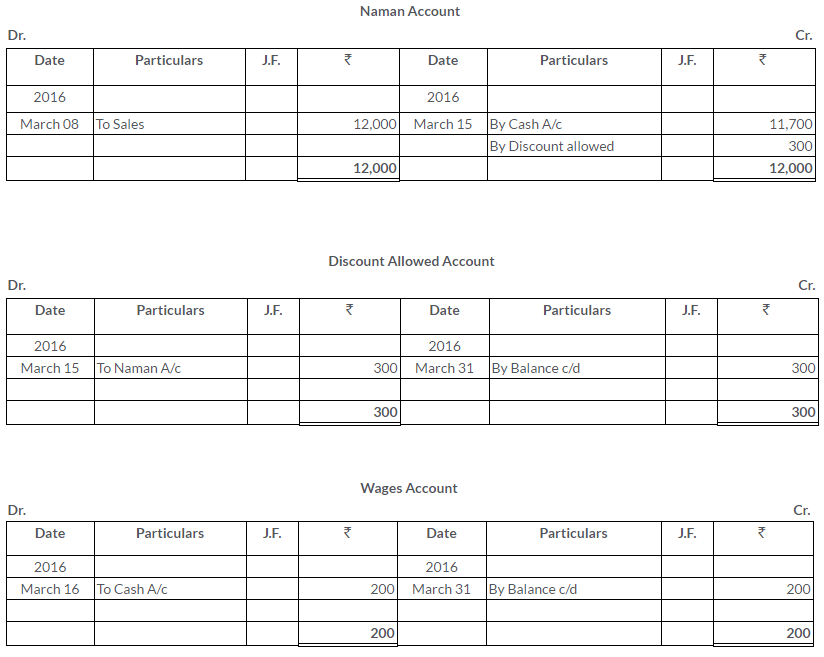

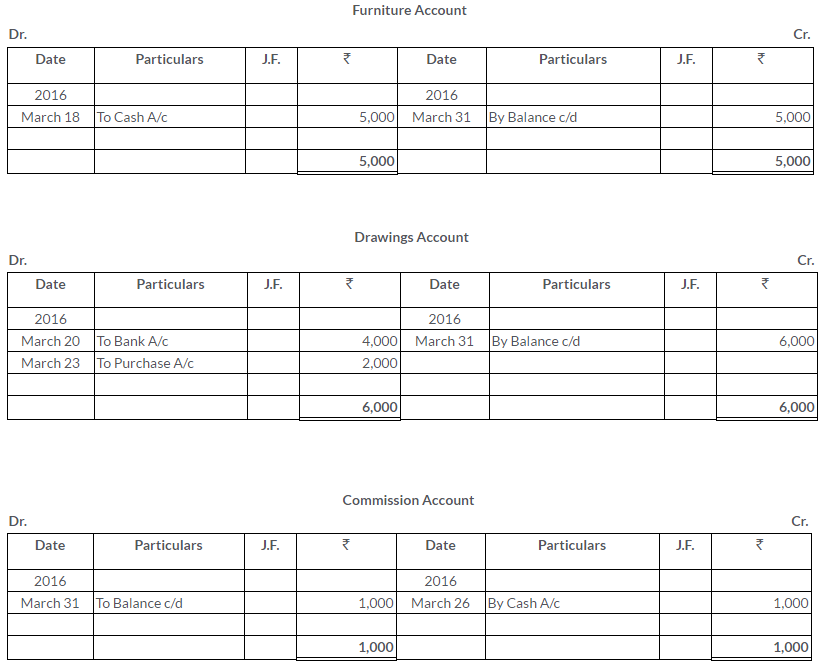

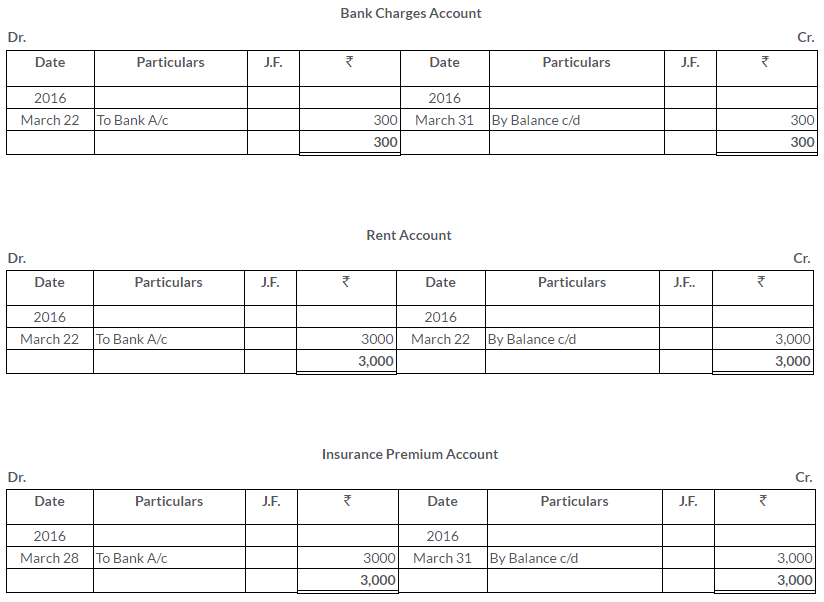

TS Grewal Solutions for Class 11 Accountancy Chapter 8 – Journal and Ledger

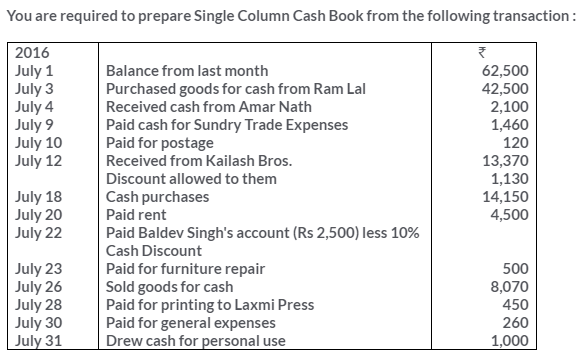

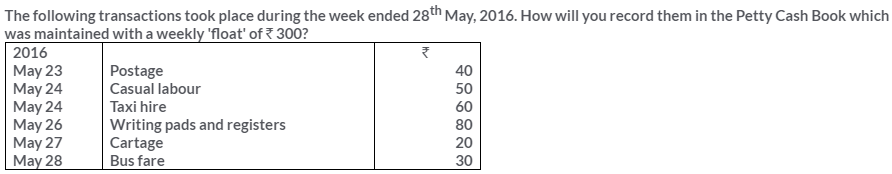

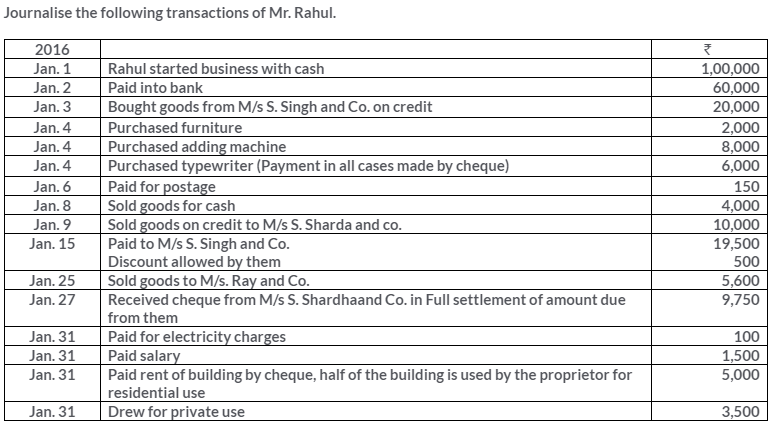

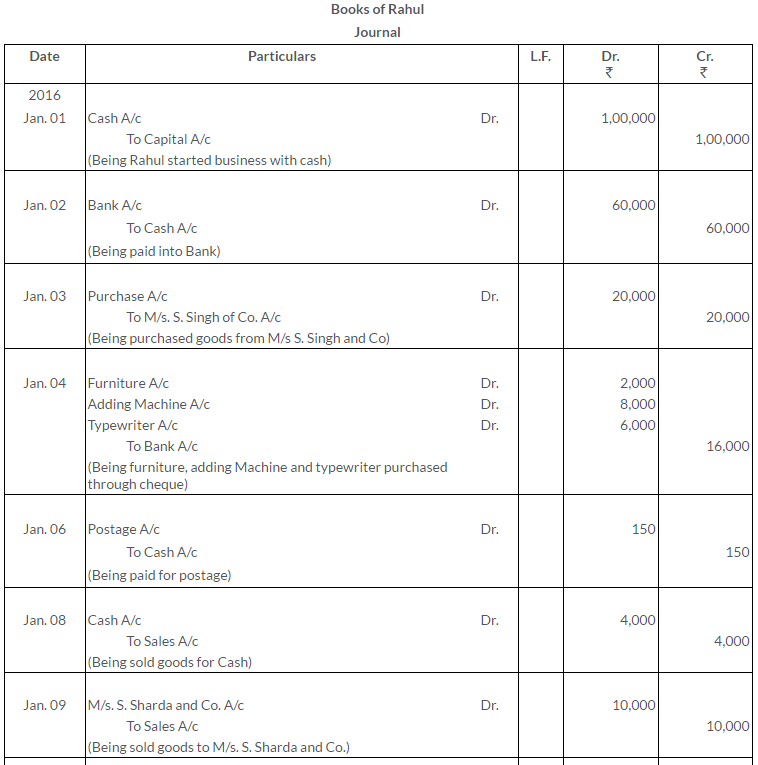

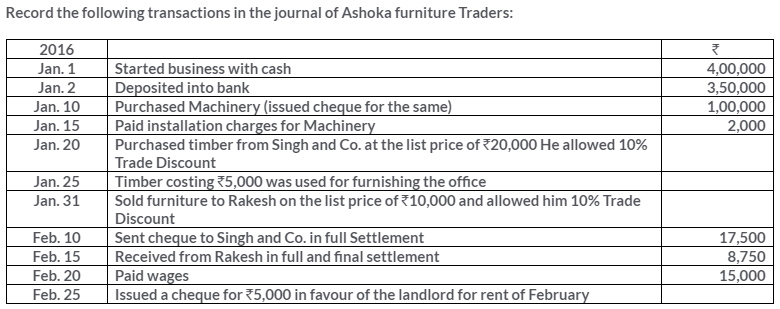

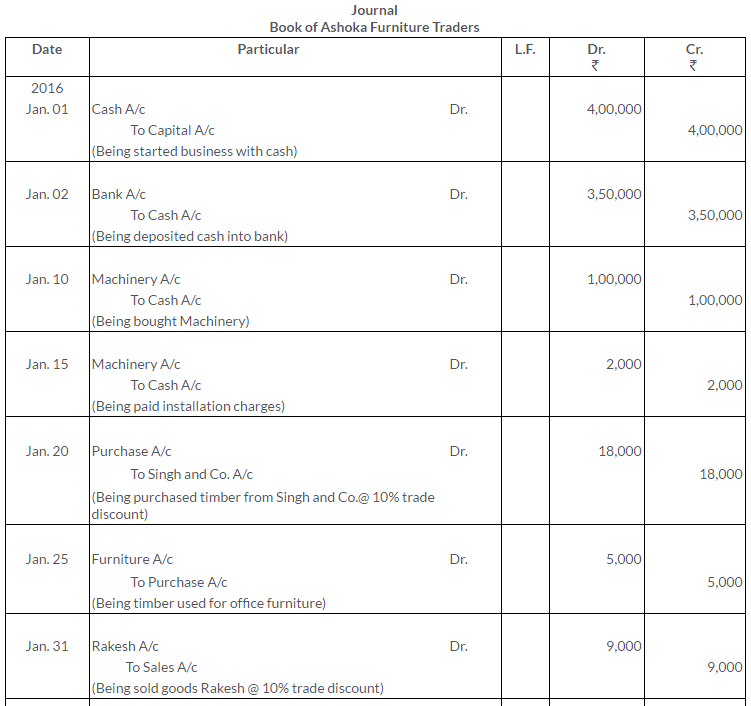

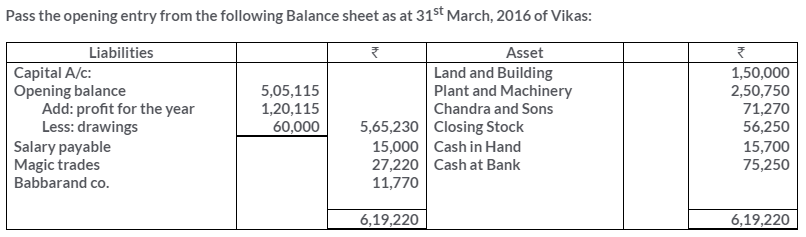

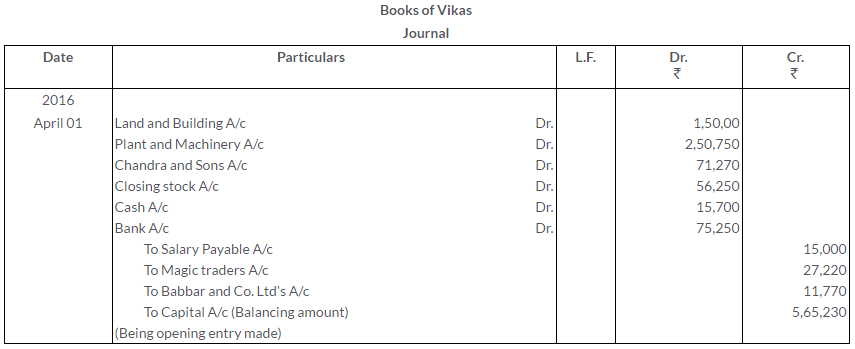

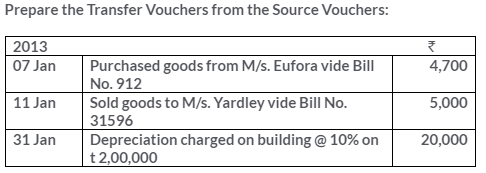

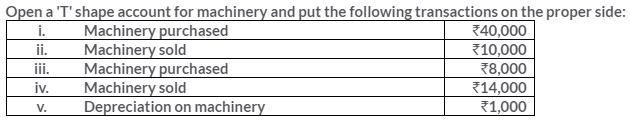

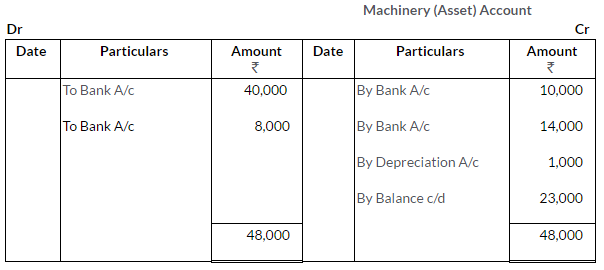

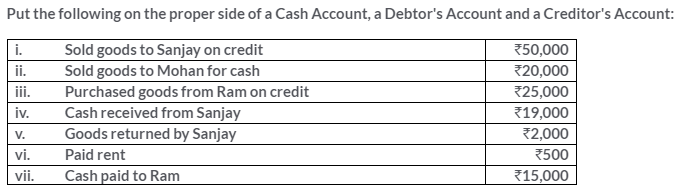

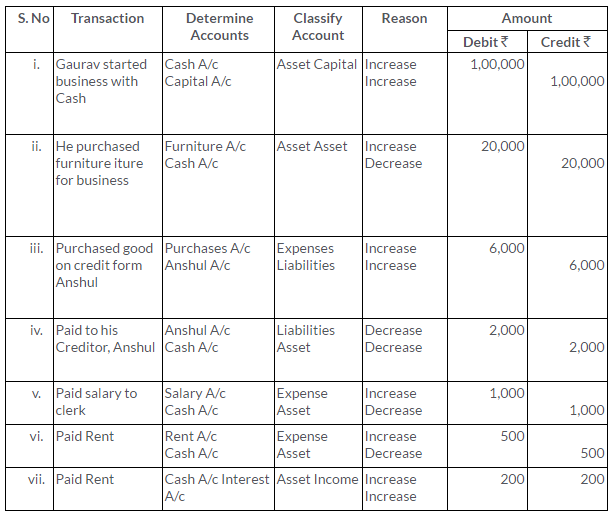

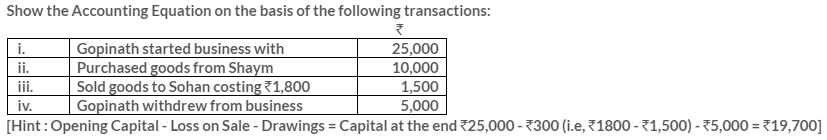

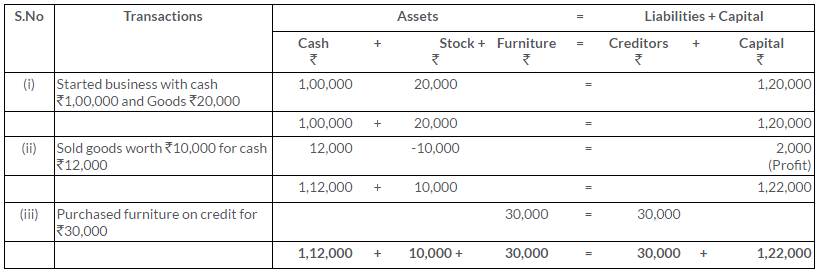

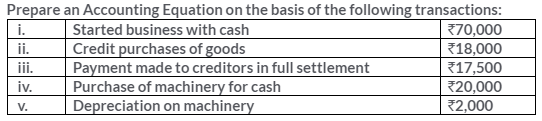

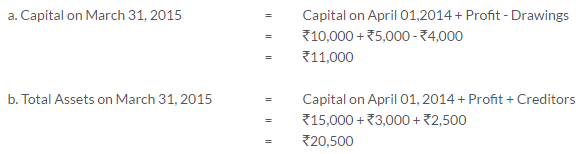

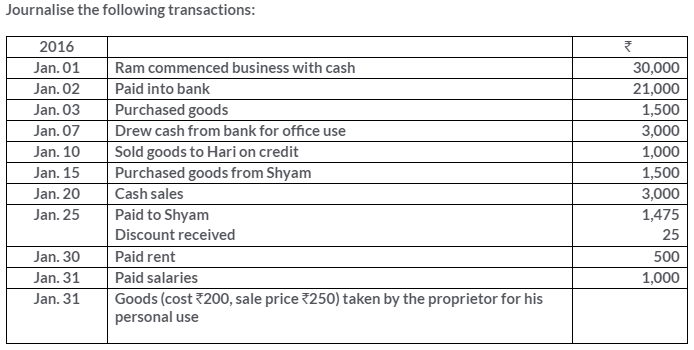

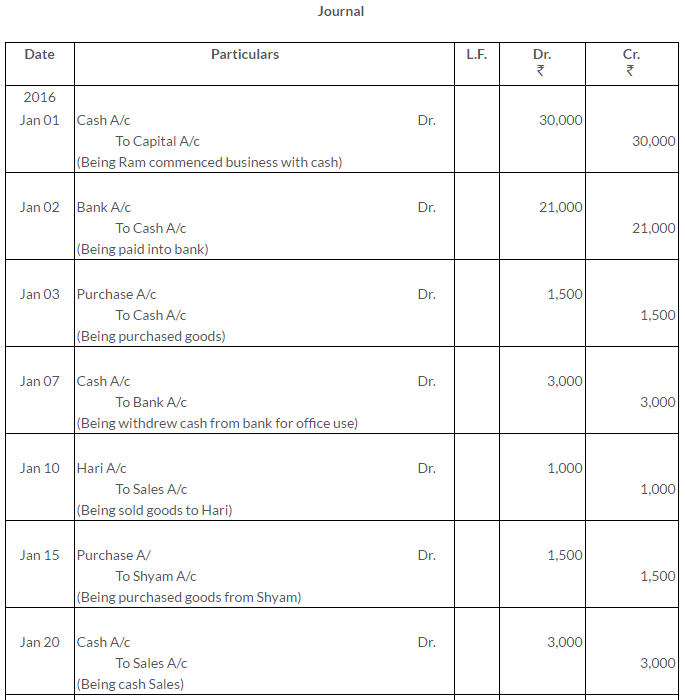

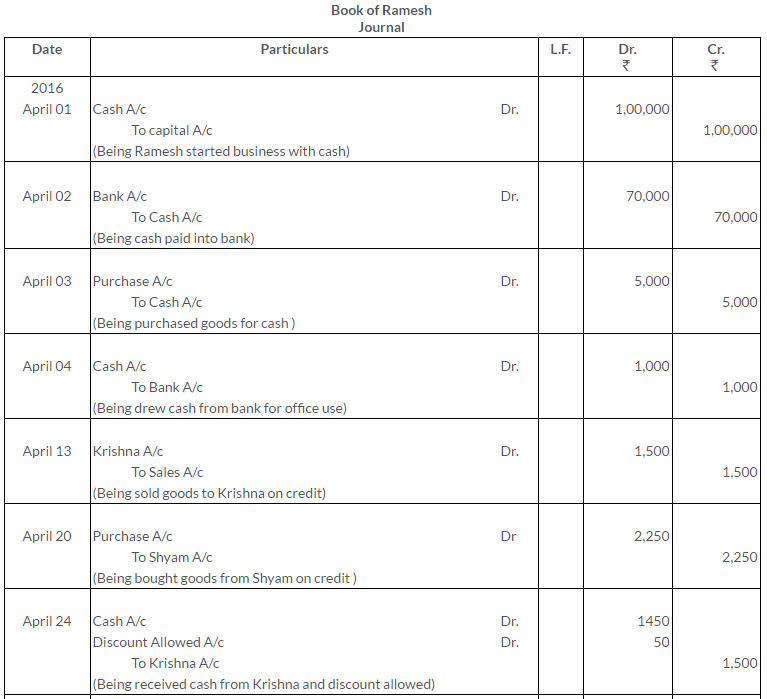

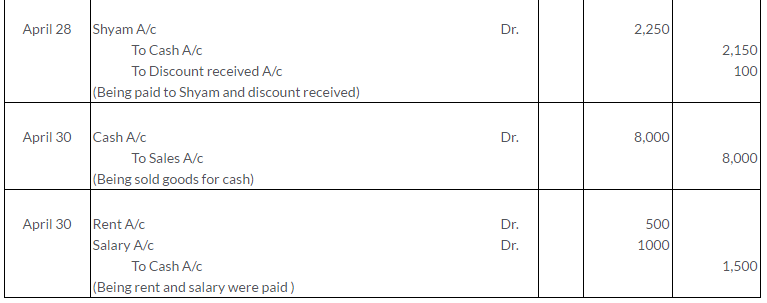

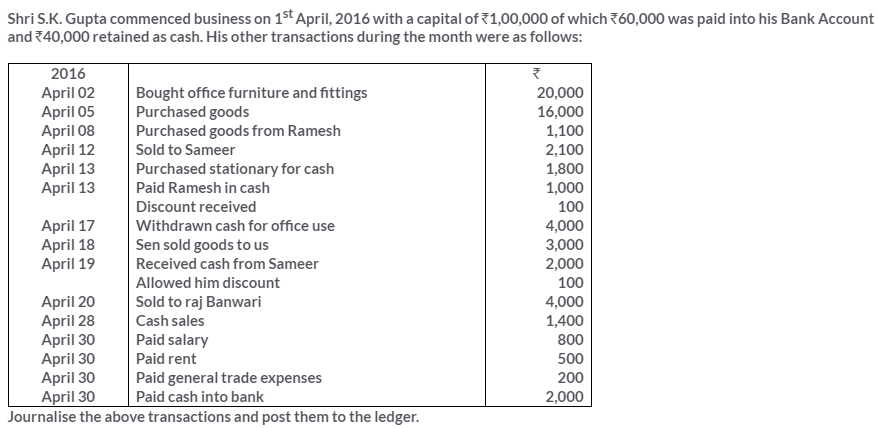

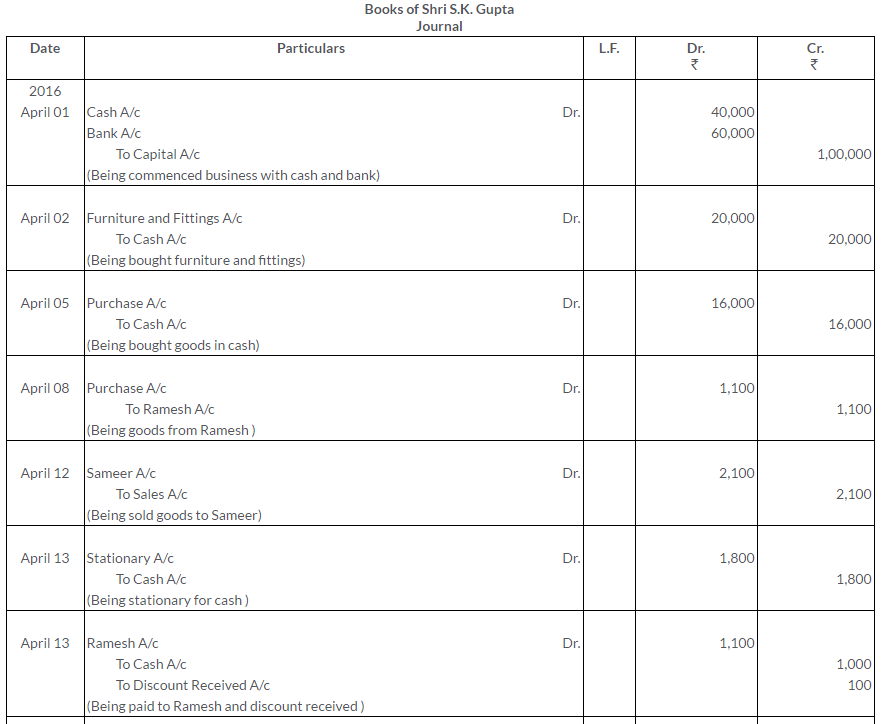

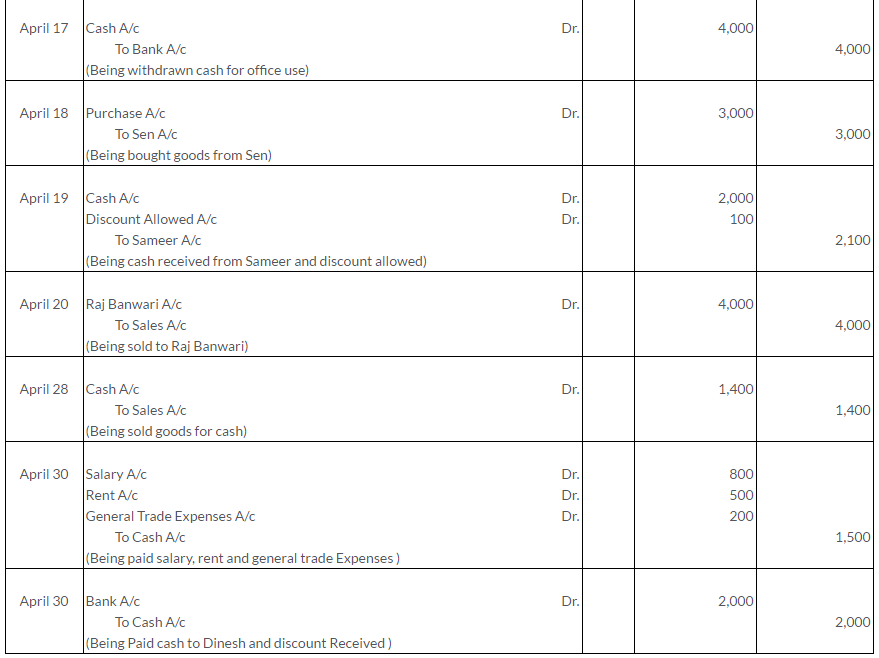

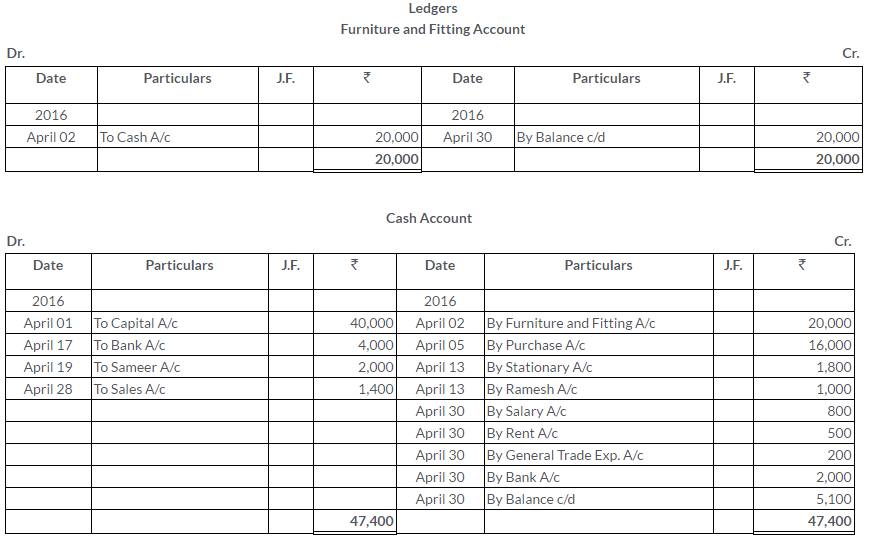

Question 1.

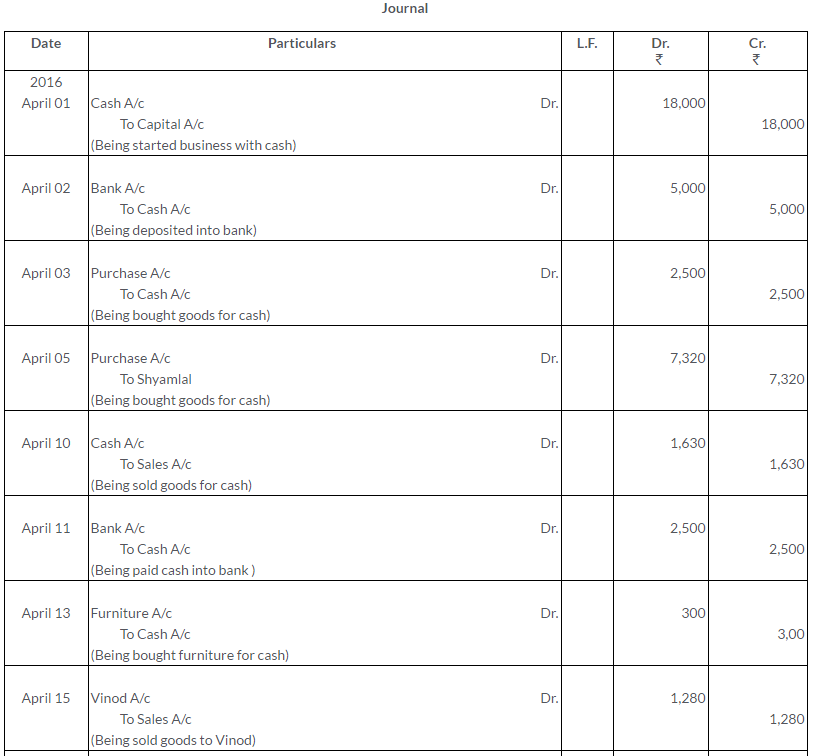

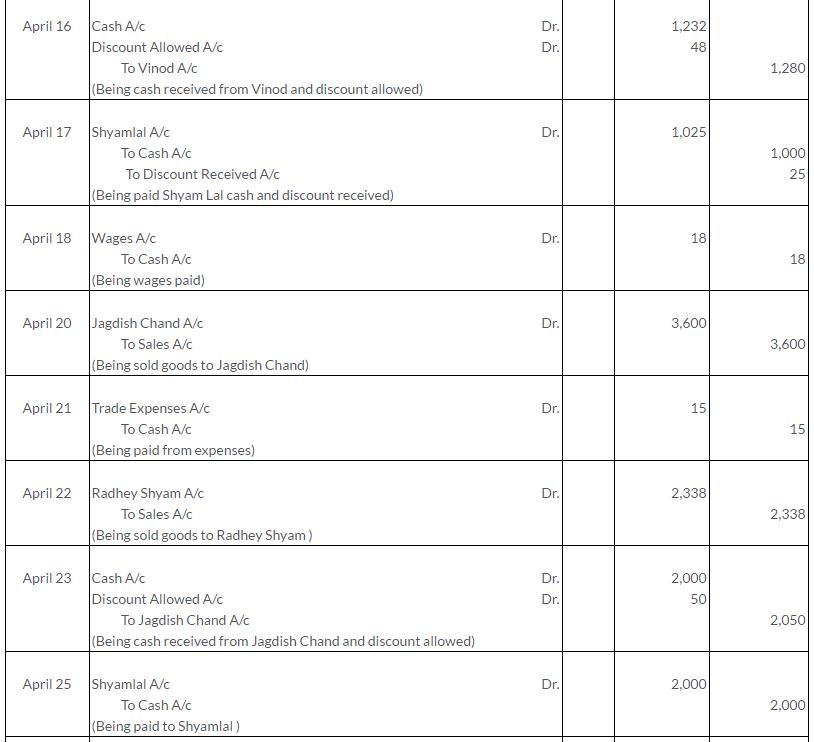

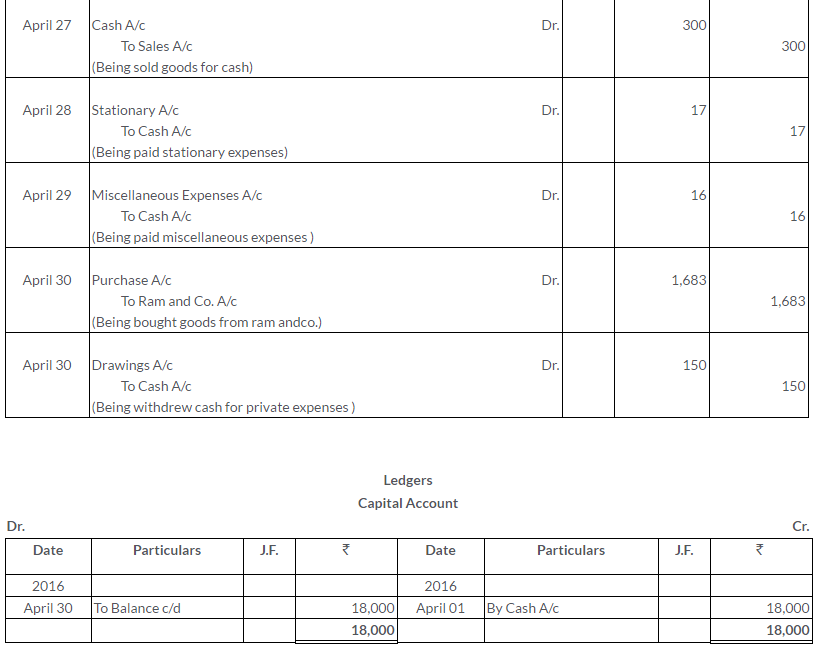

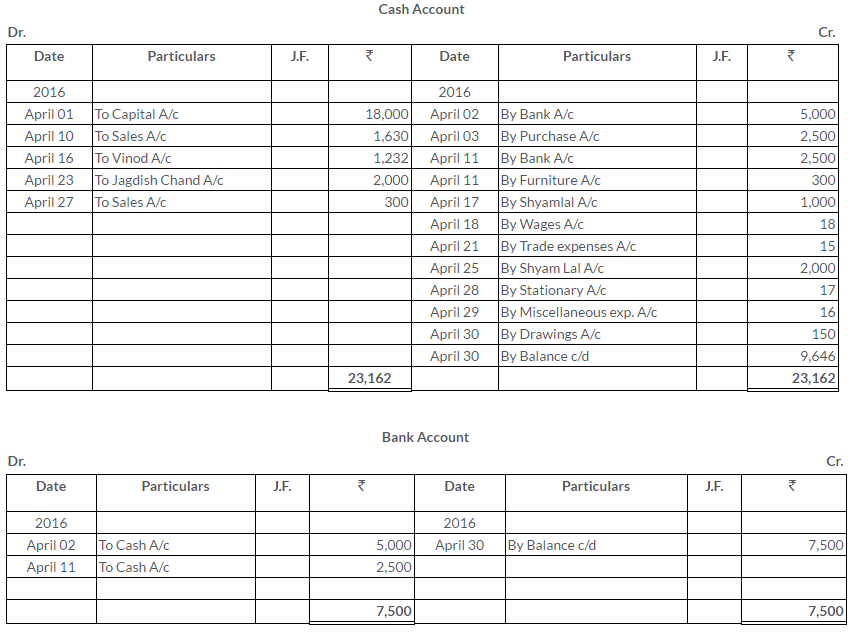

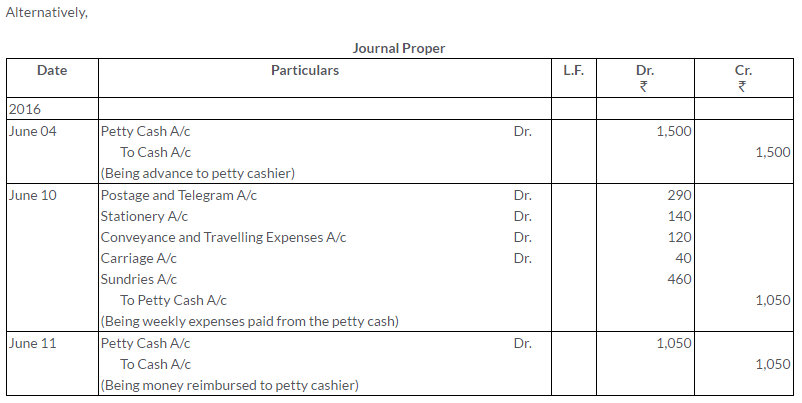

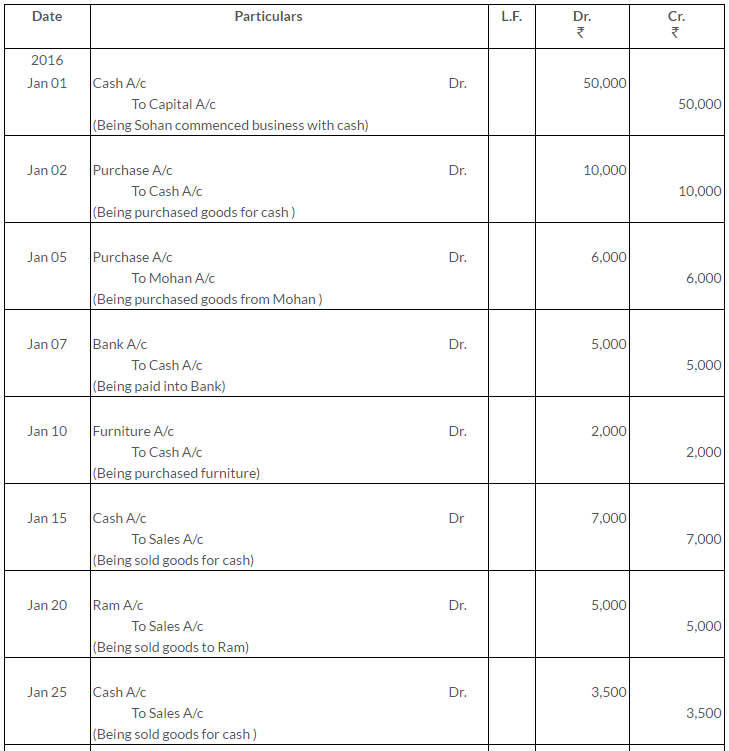

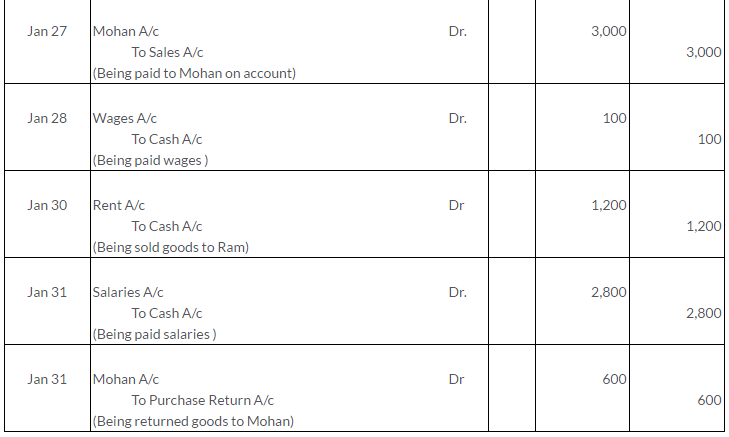

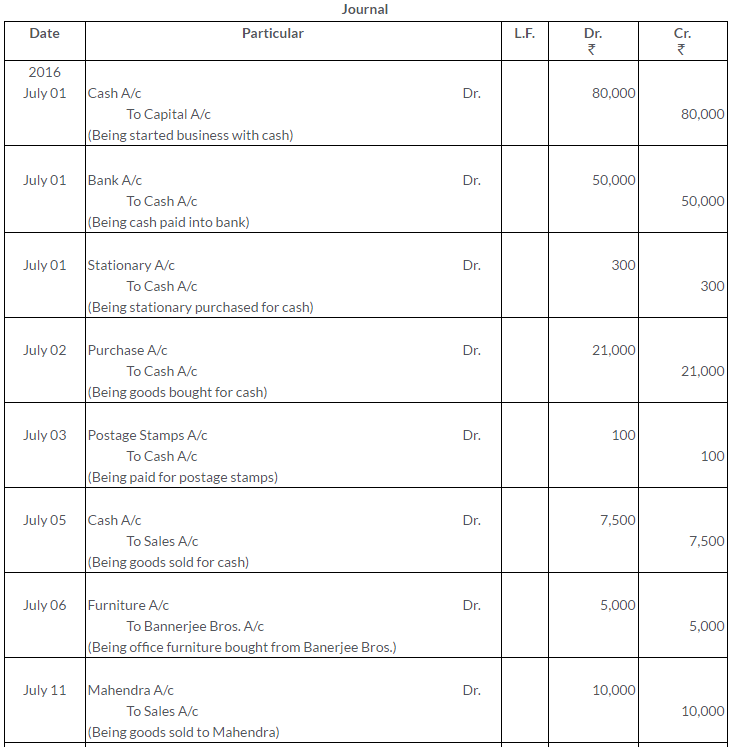

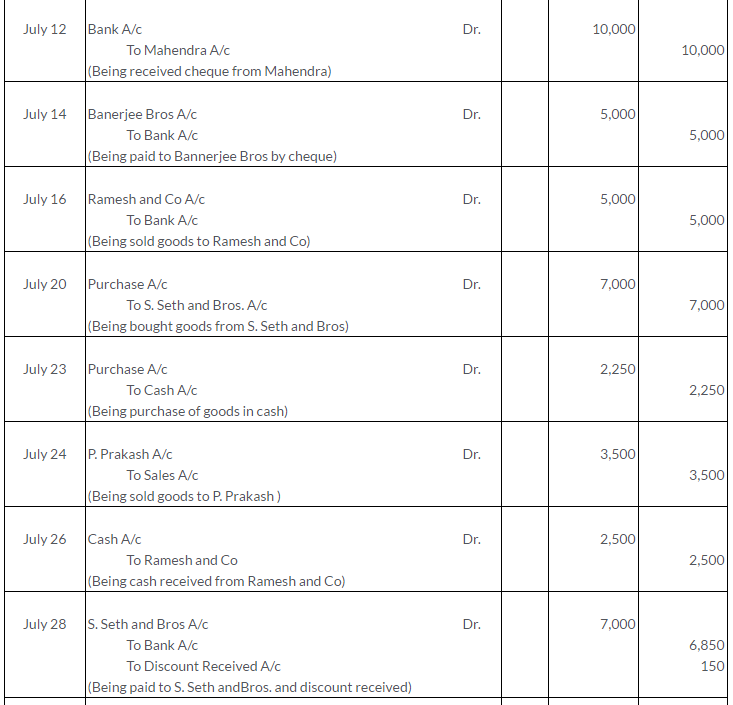

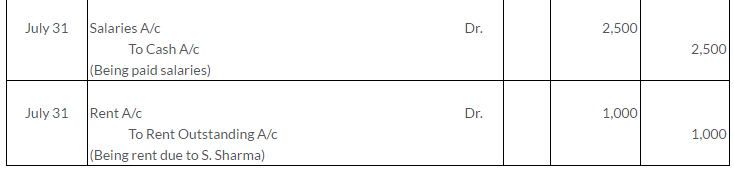

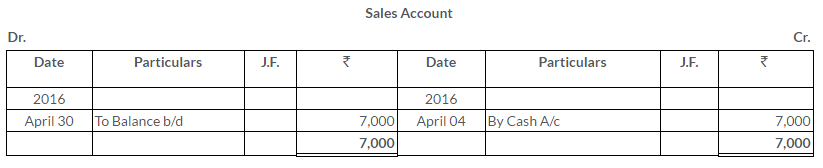

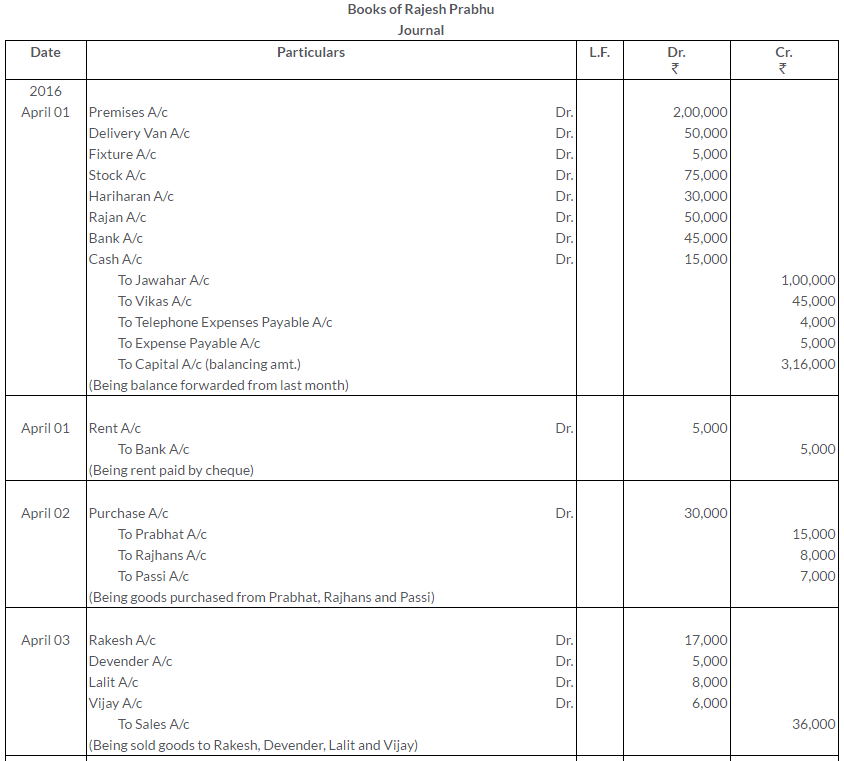

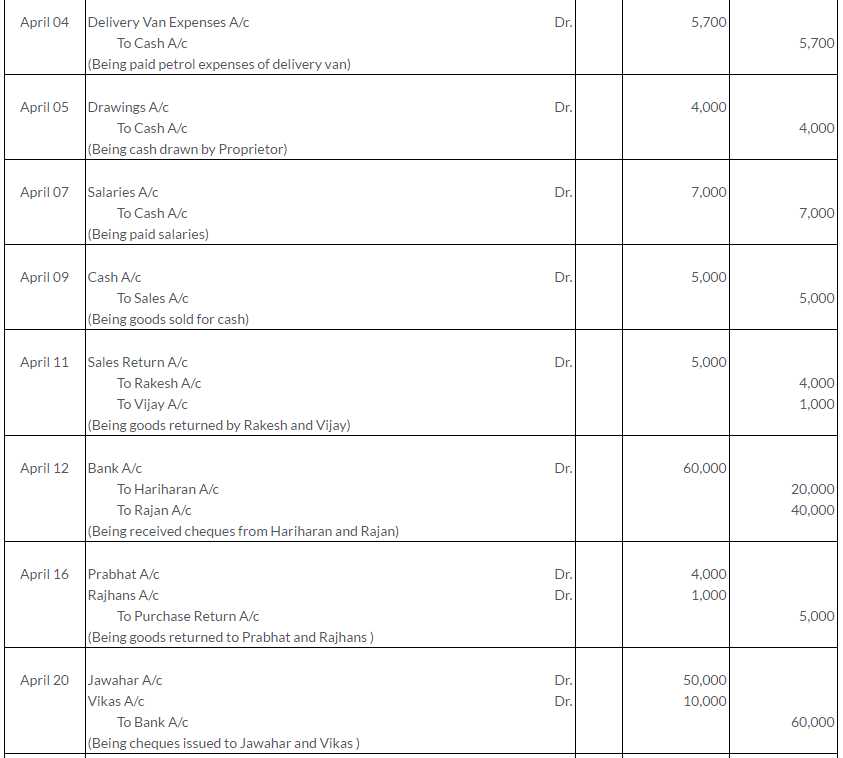

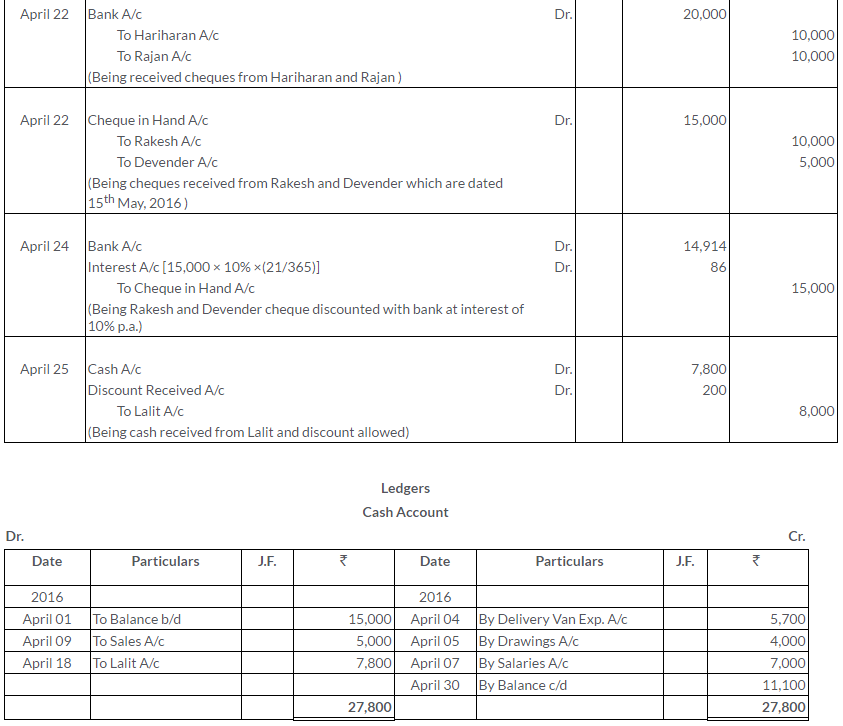

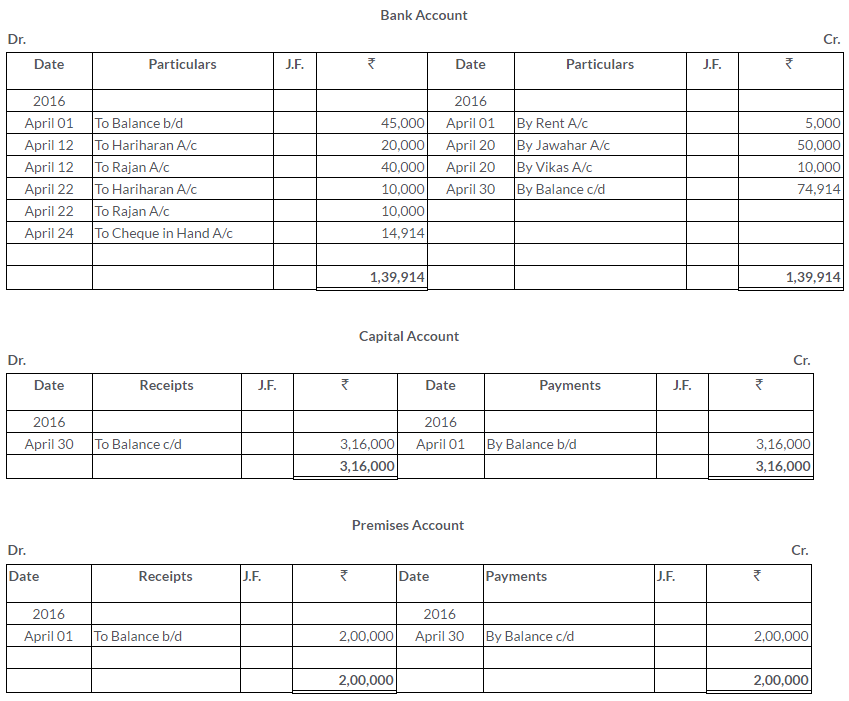

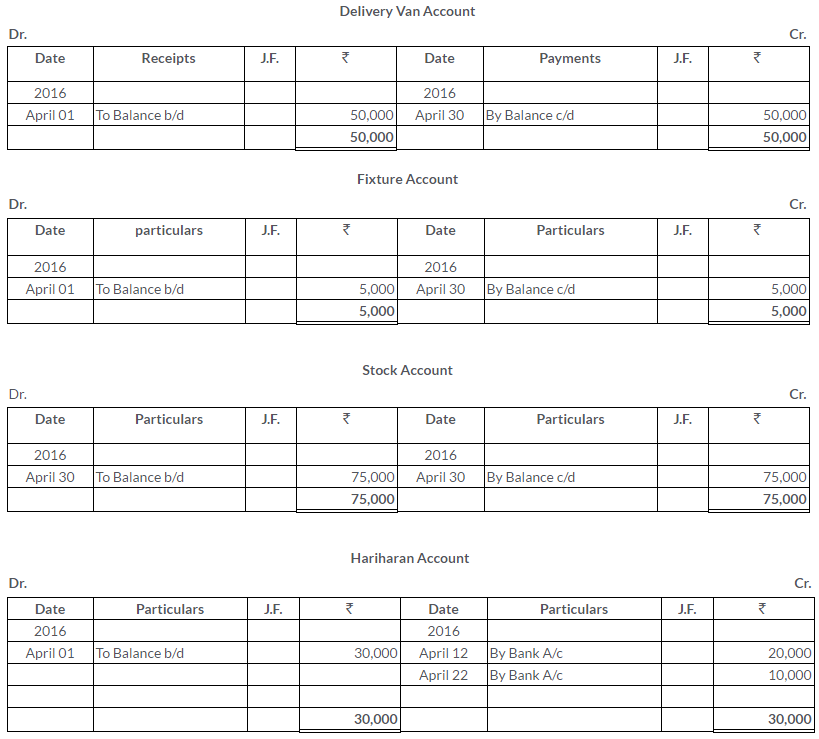

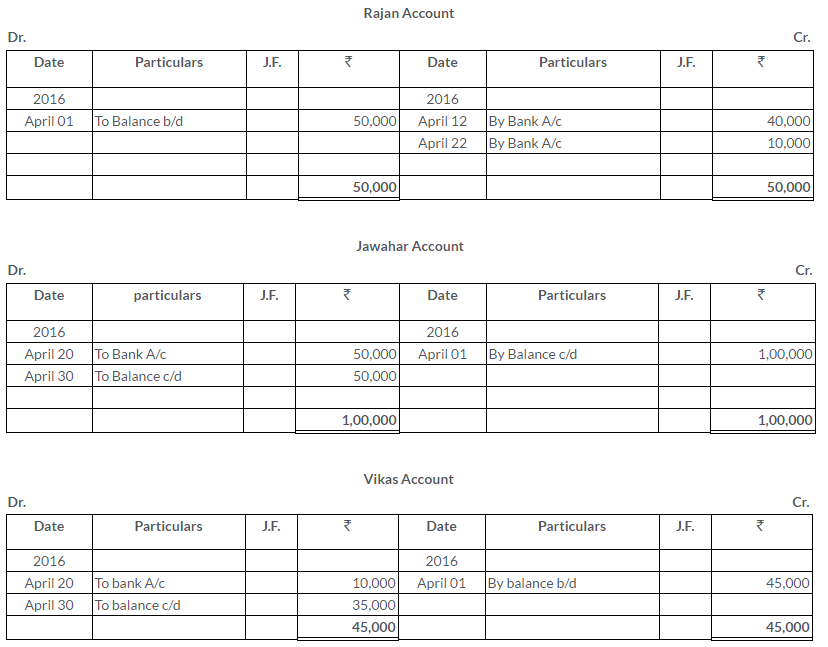

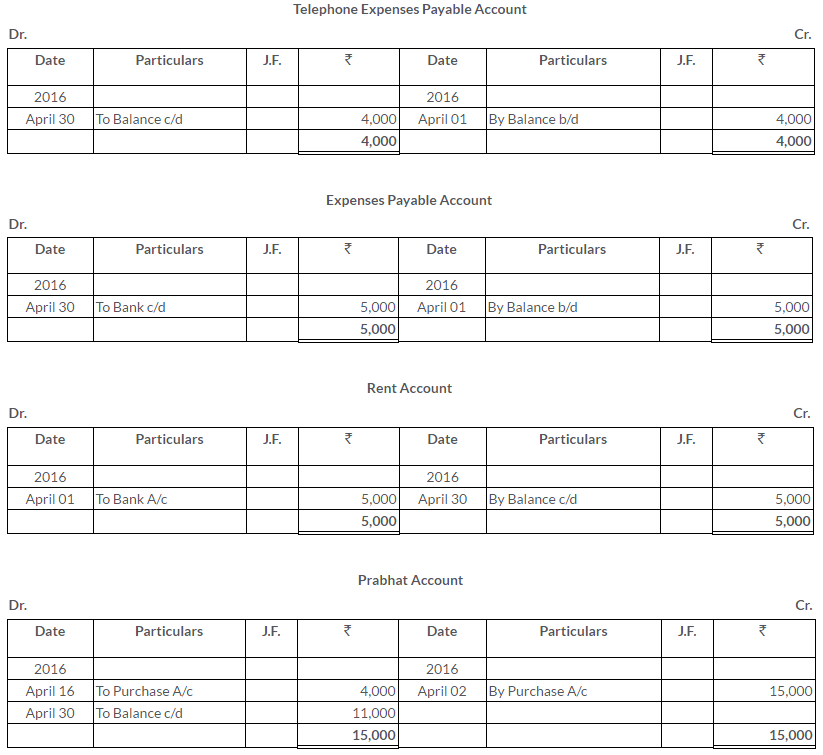

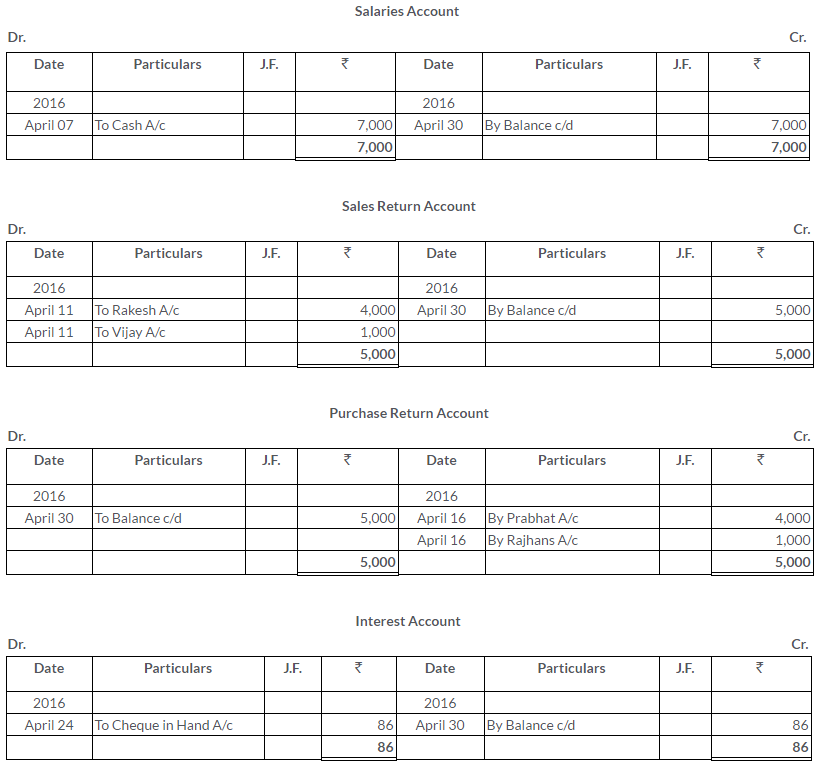

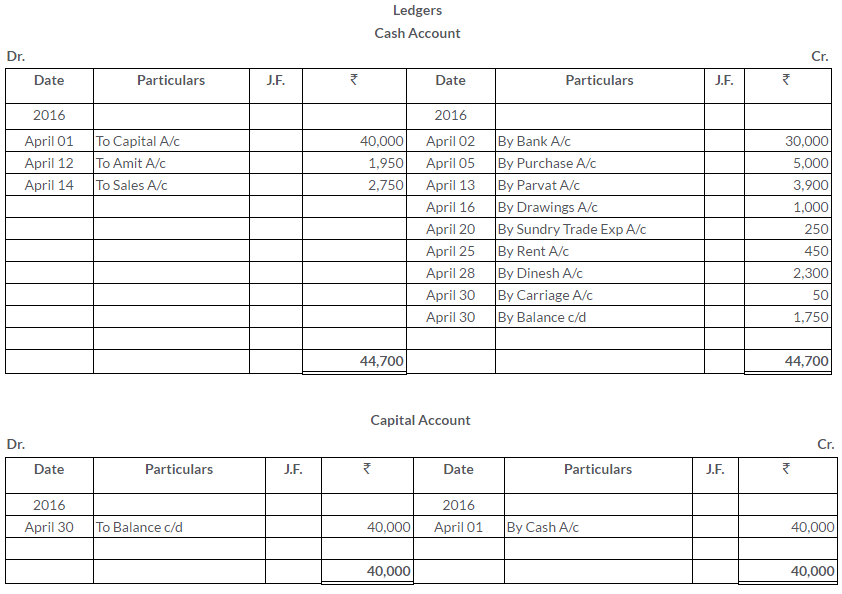

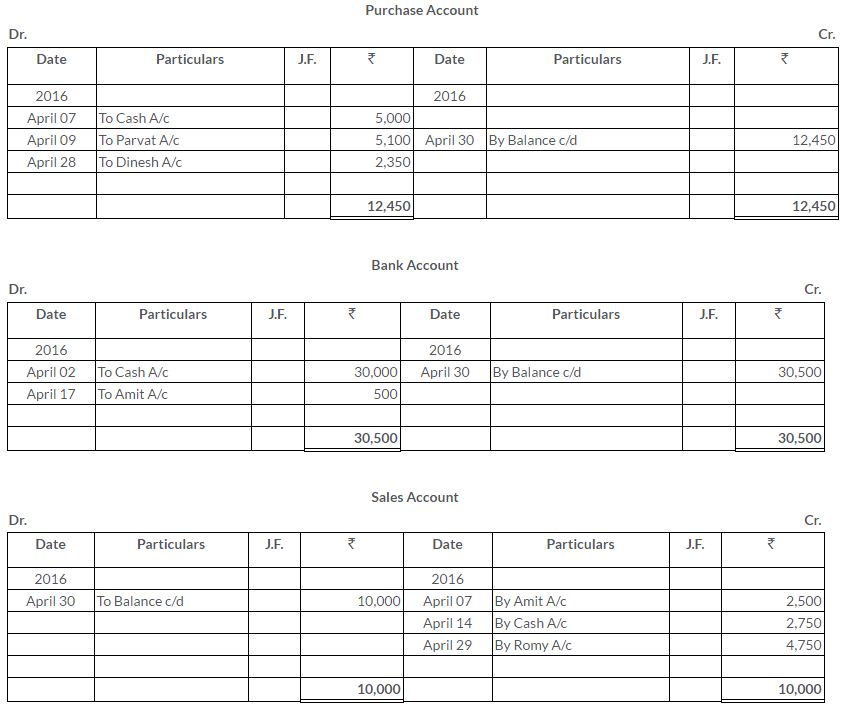

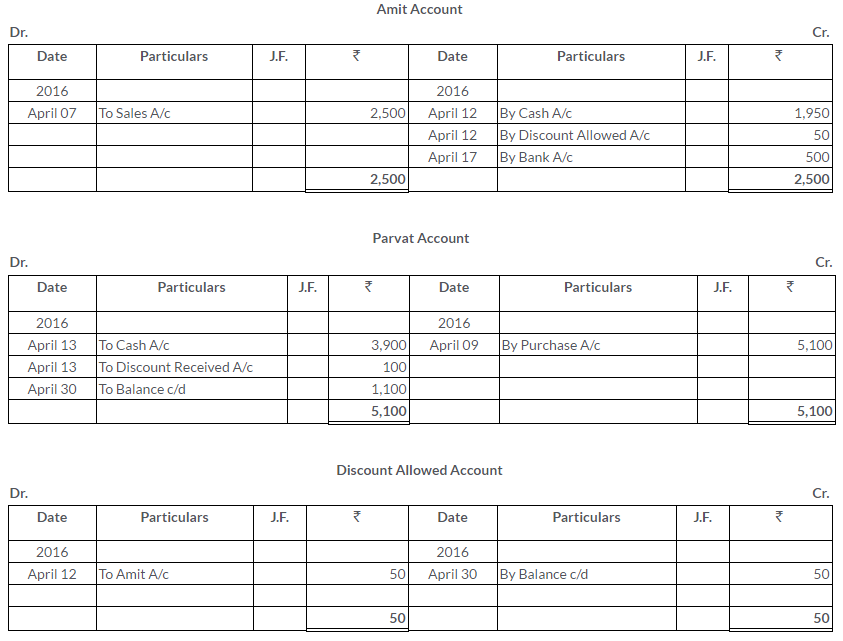

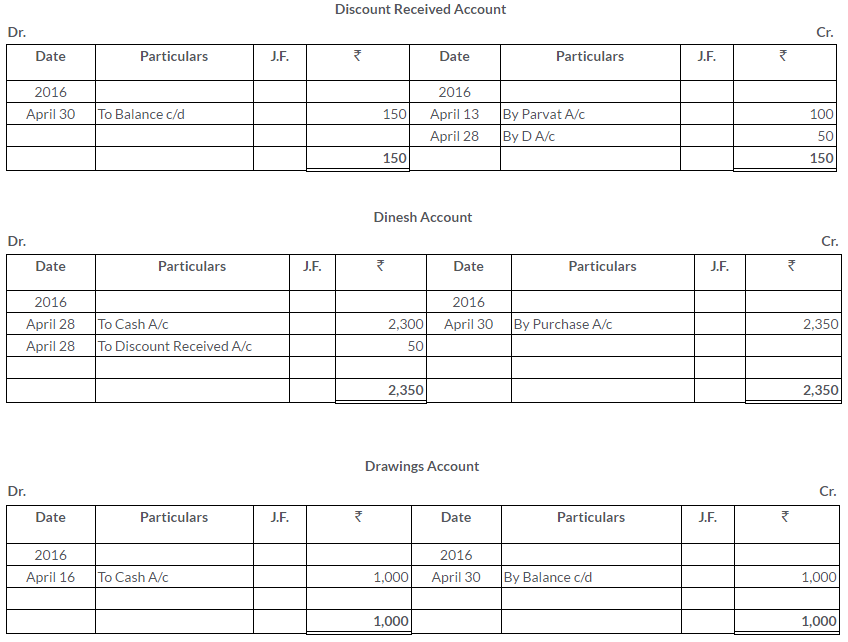

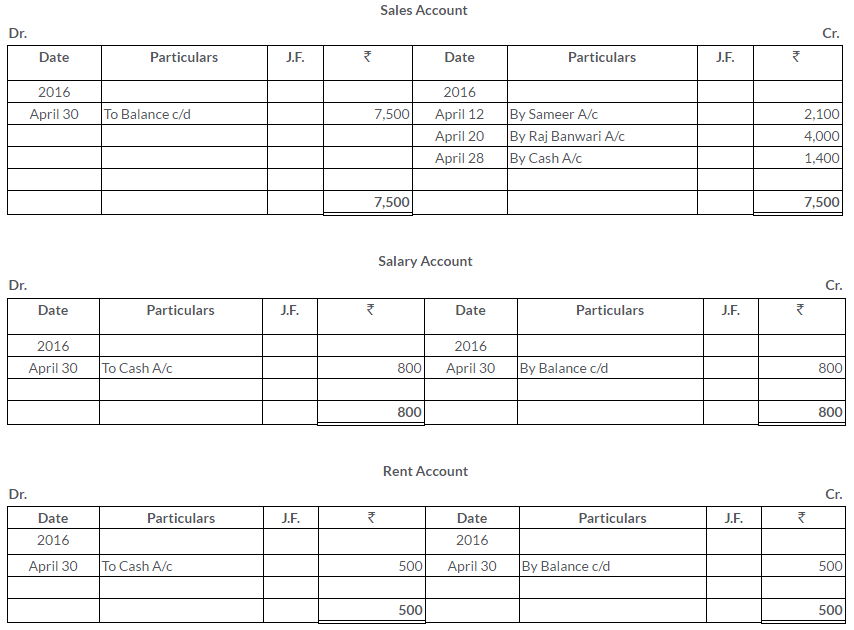

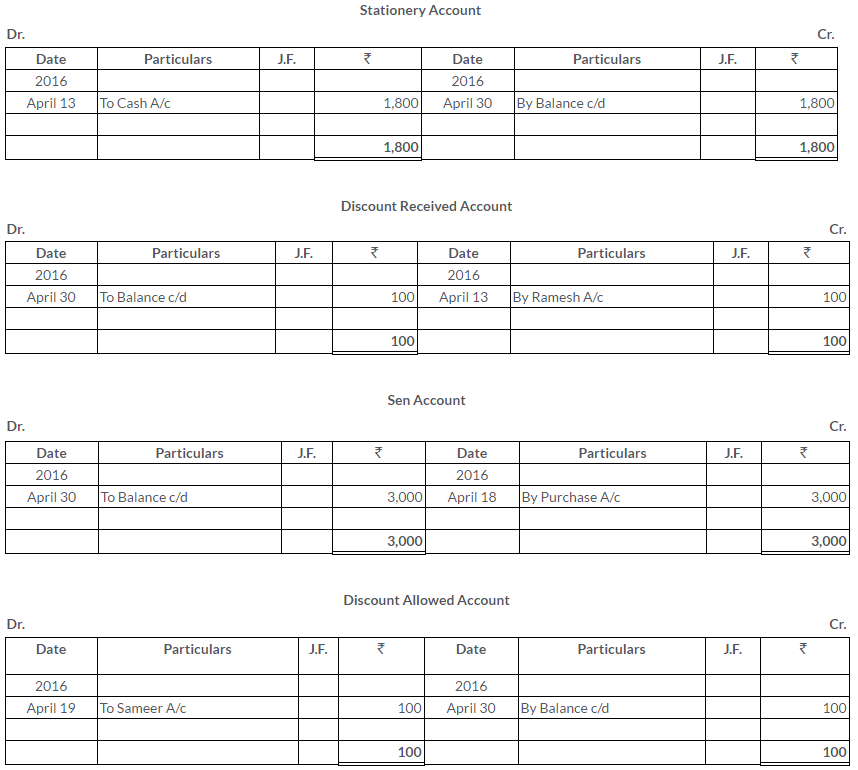

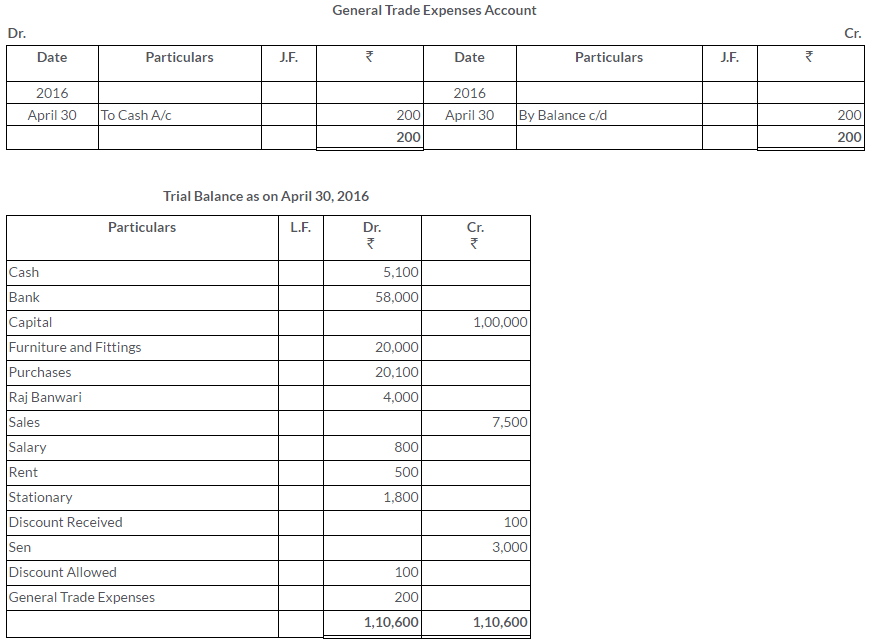

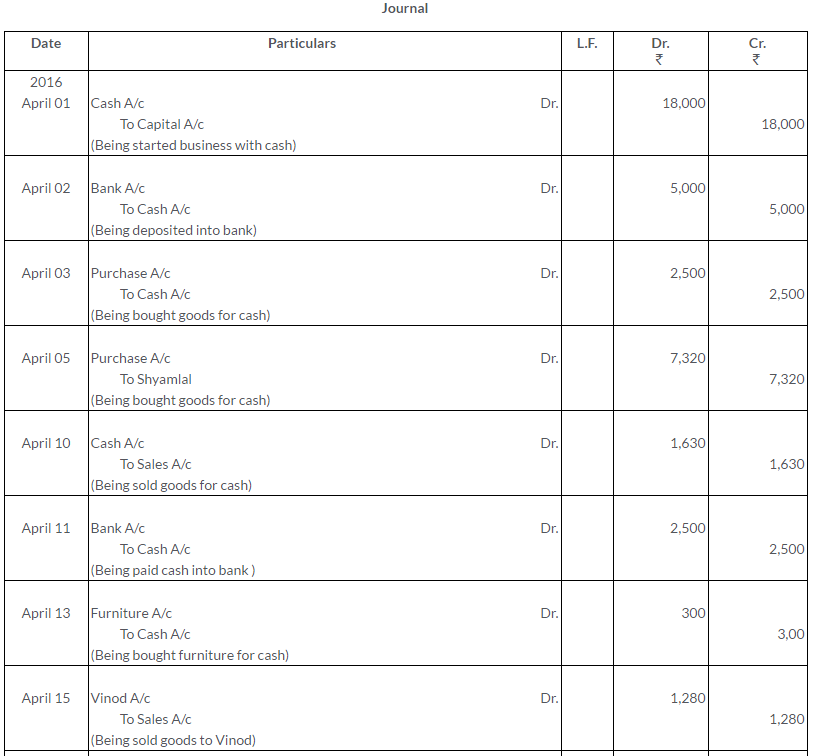

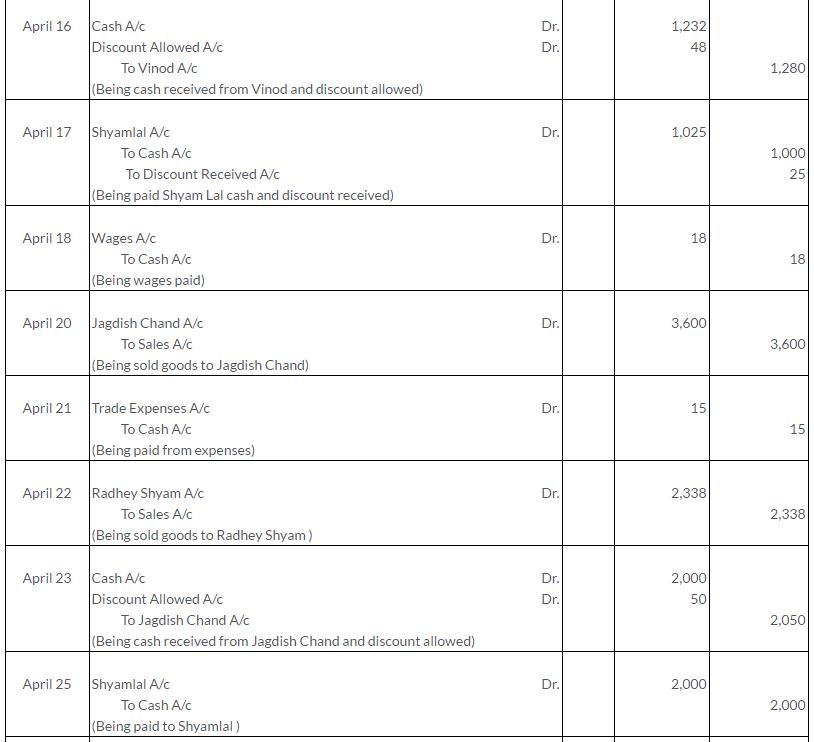

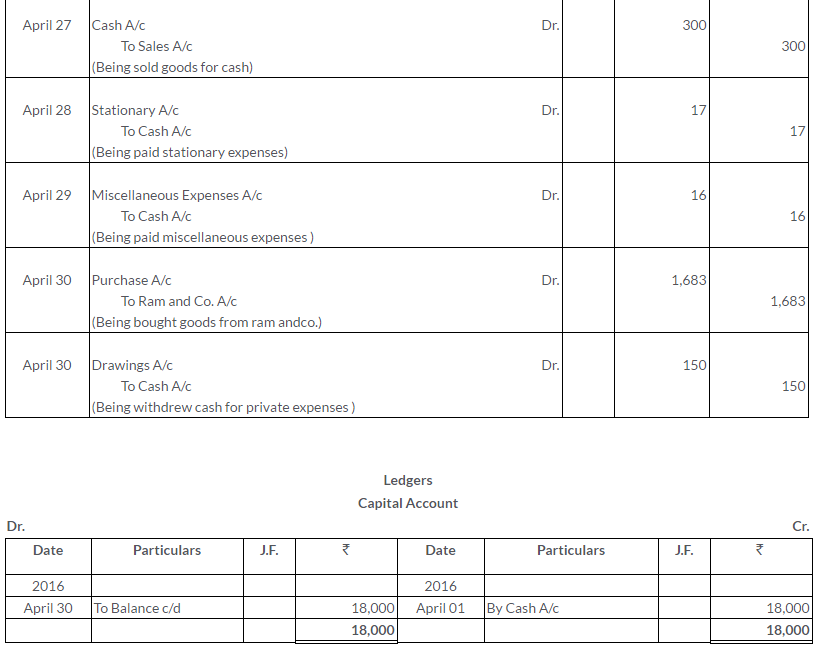

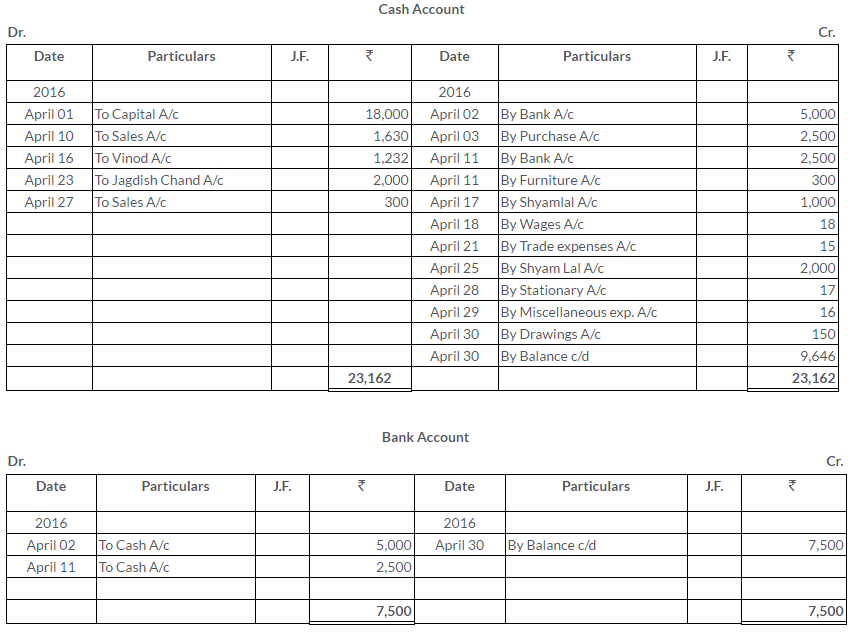

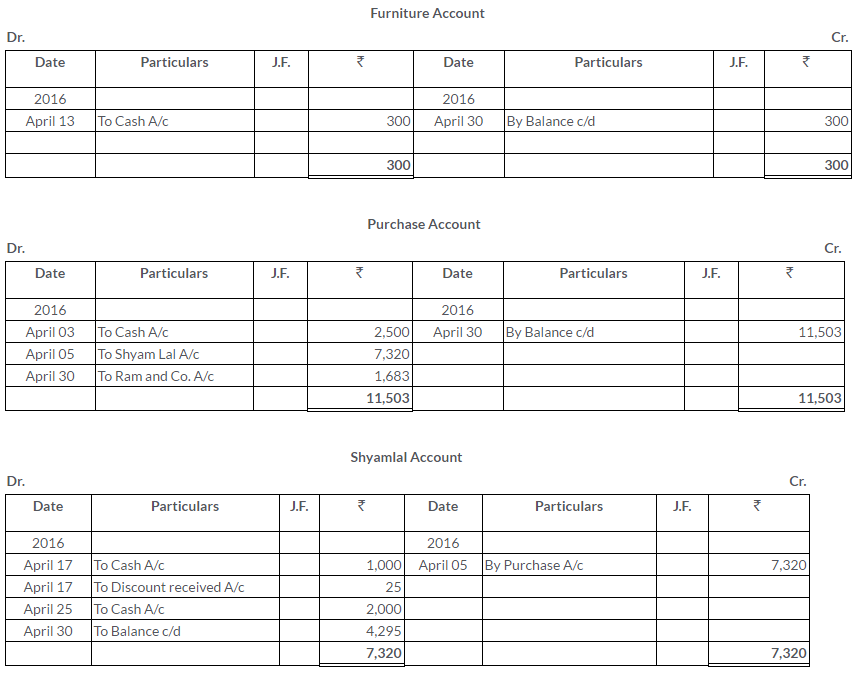

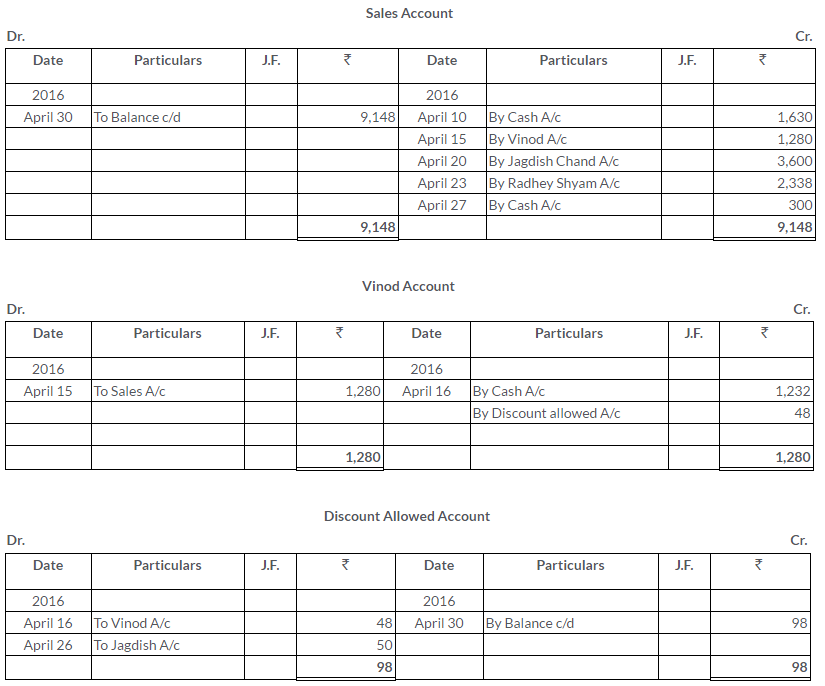

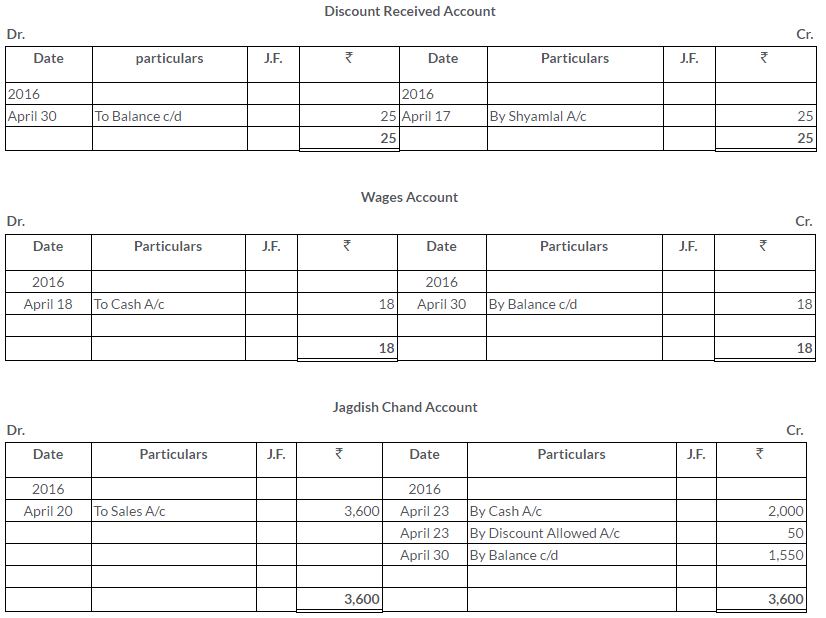

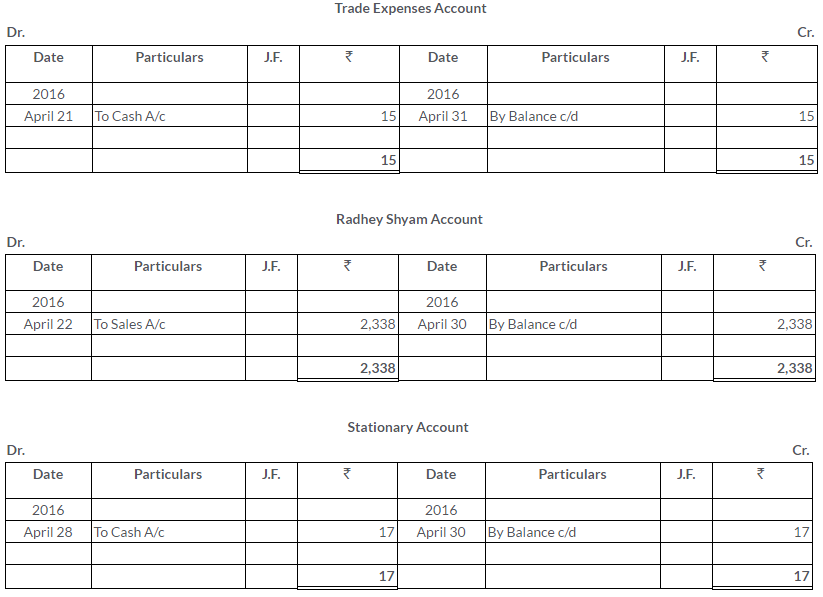

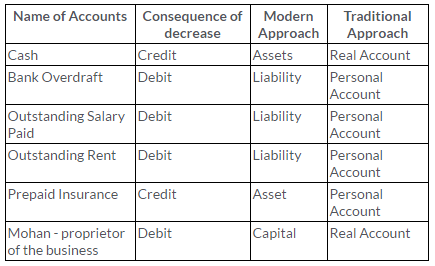

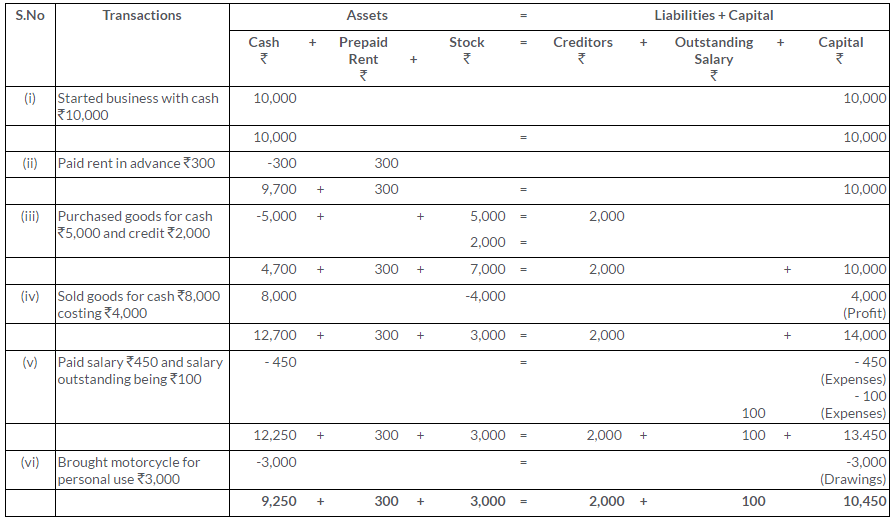

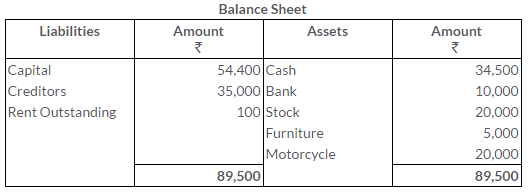

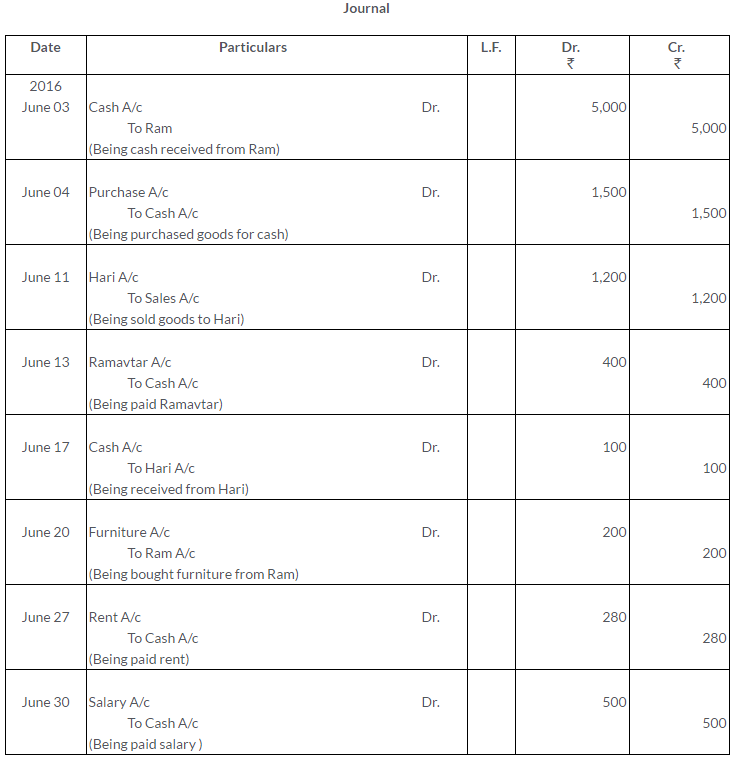

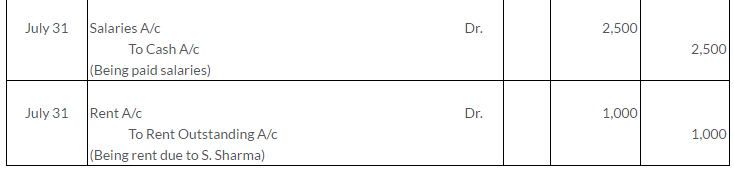

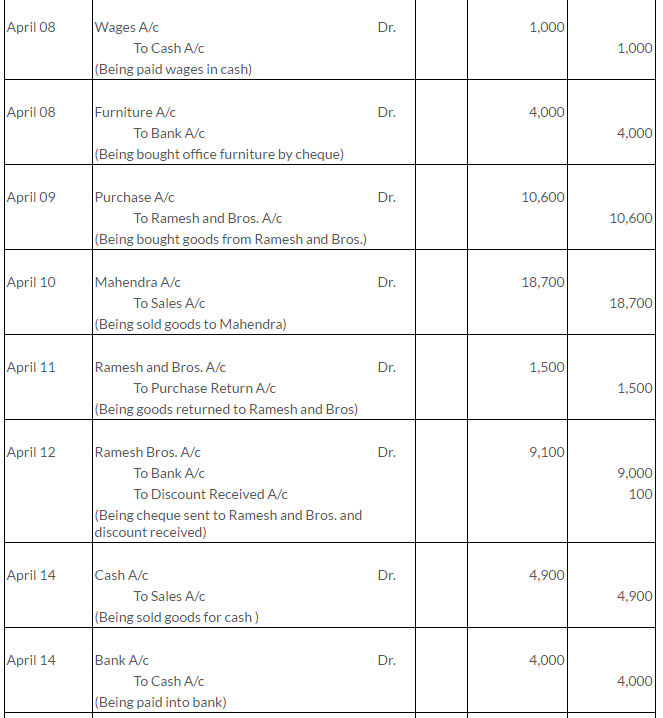

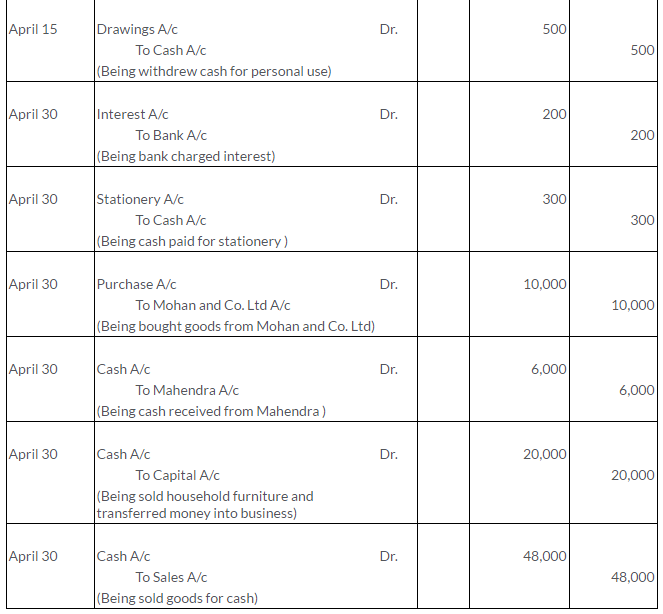

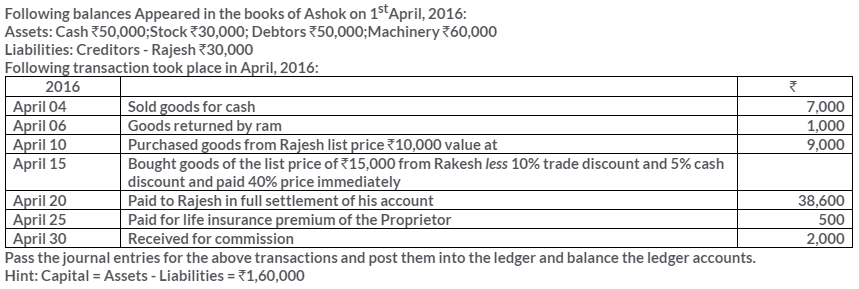

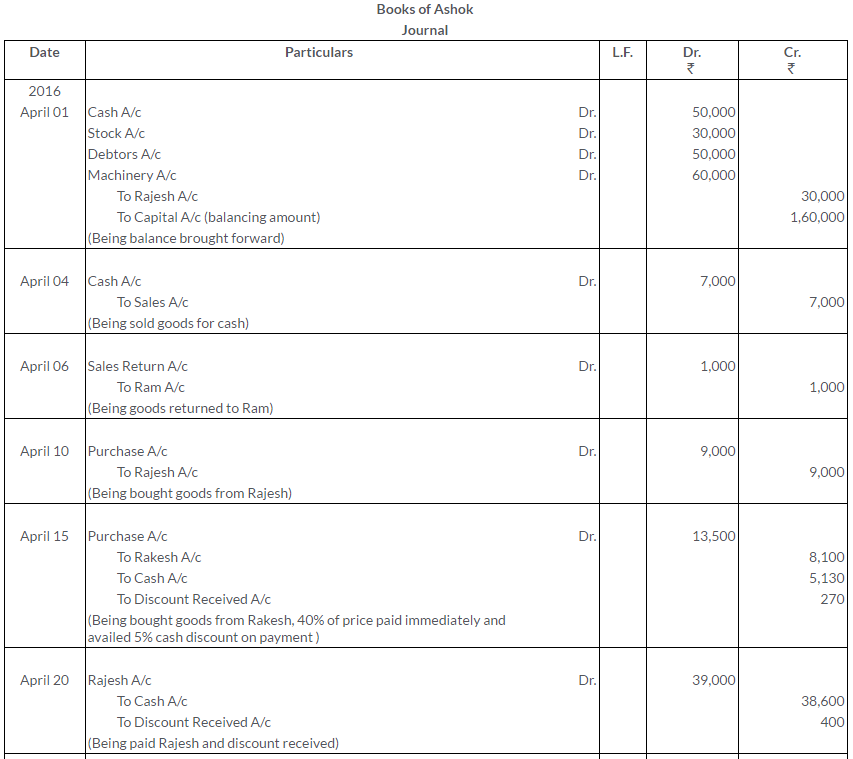

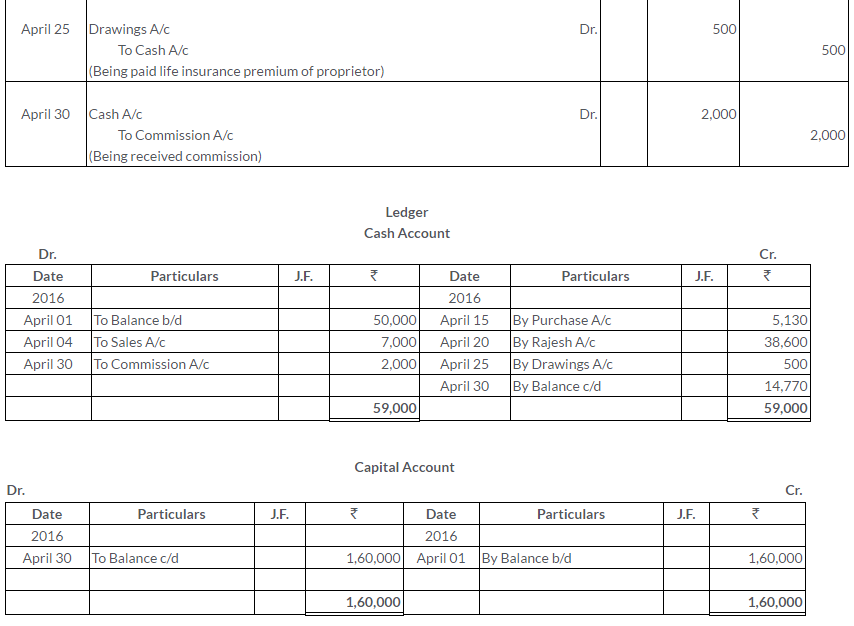

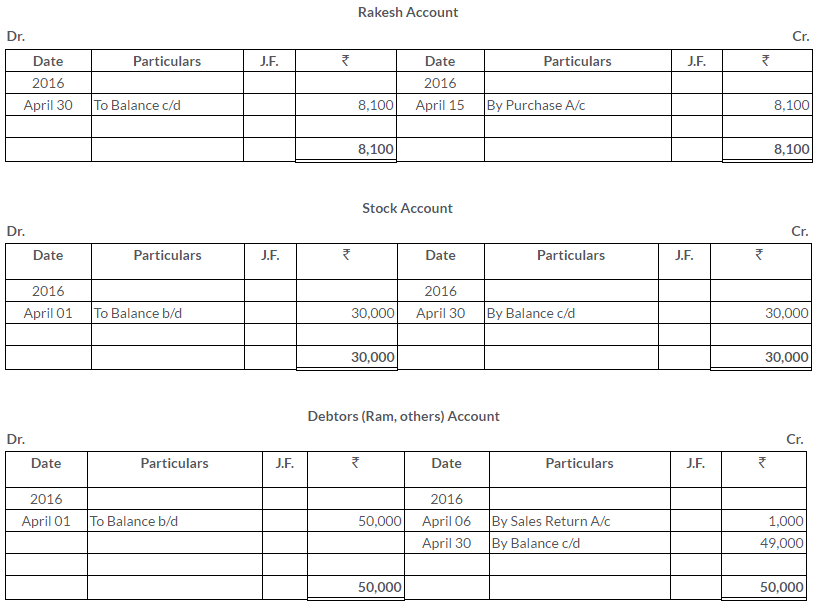

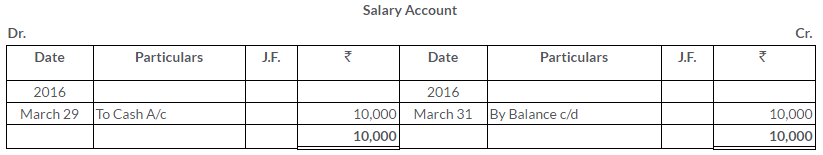

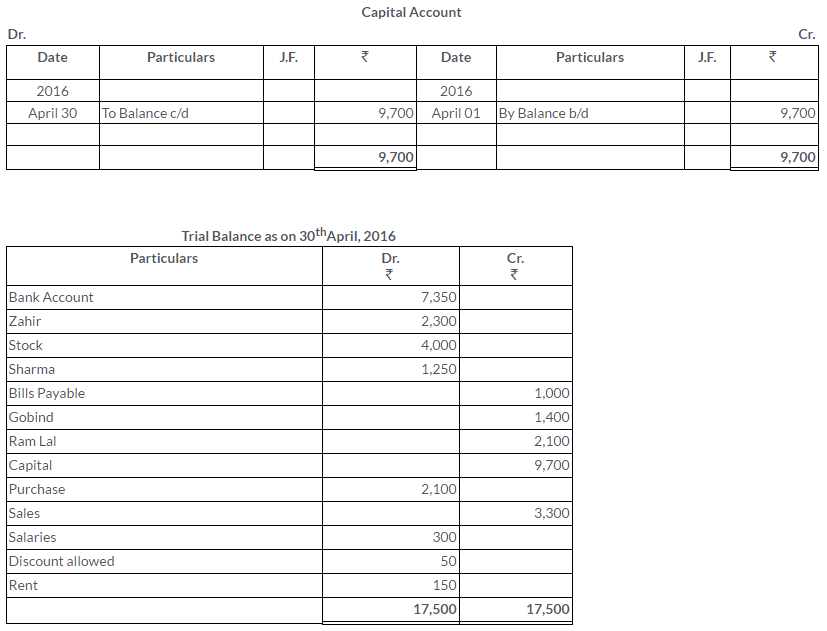

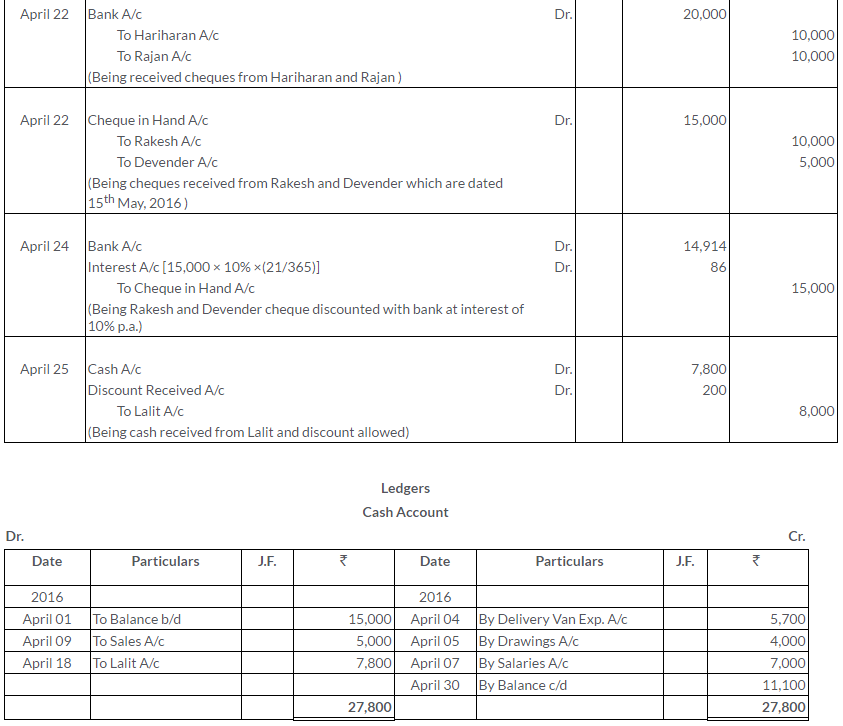

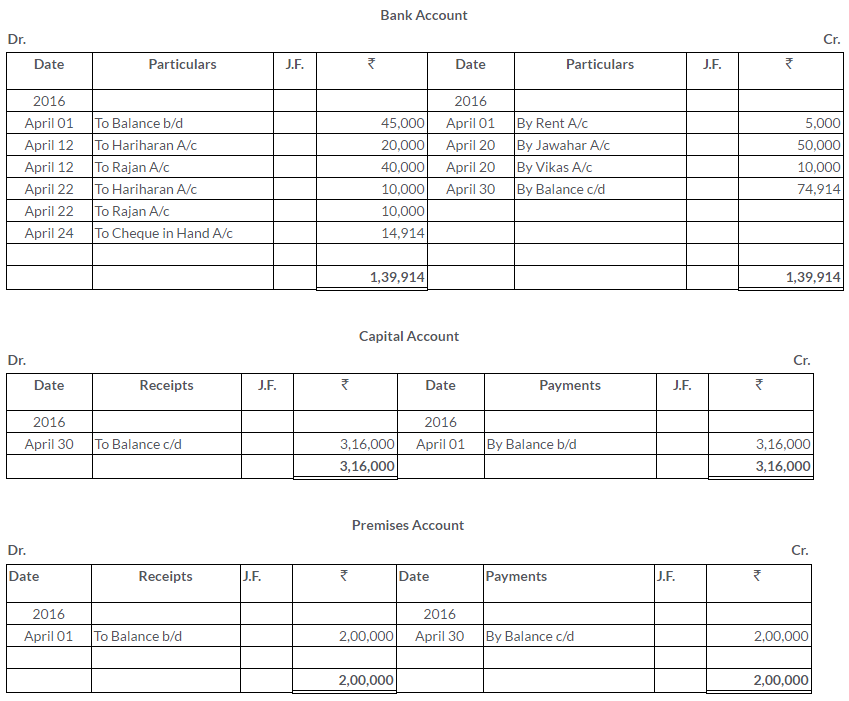

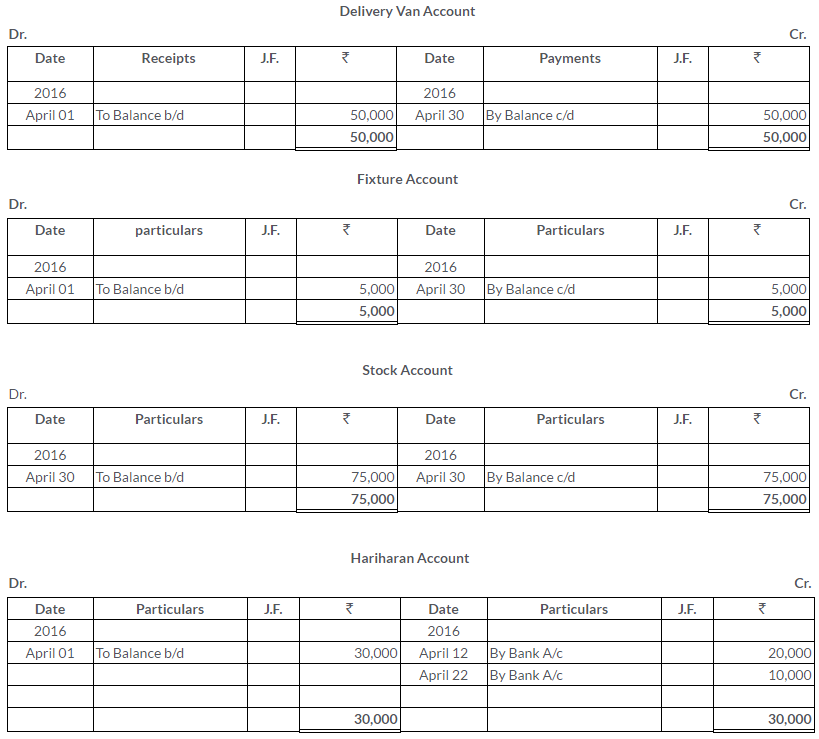

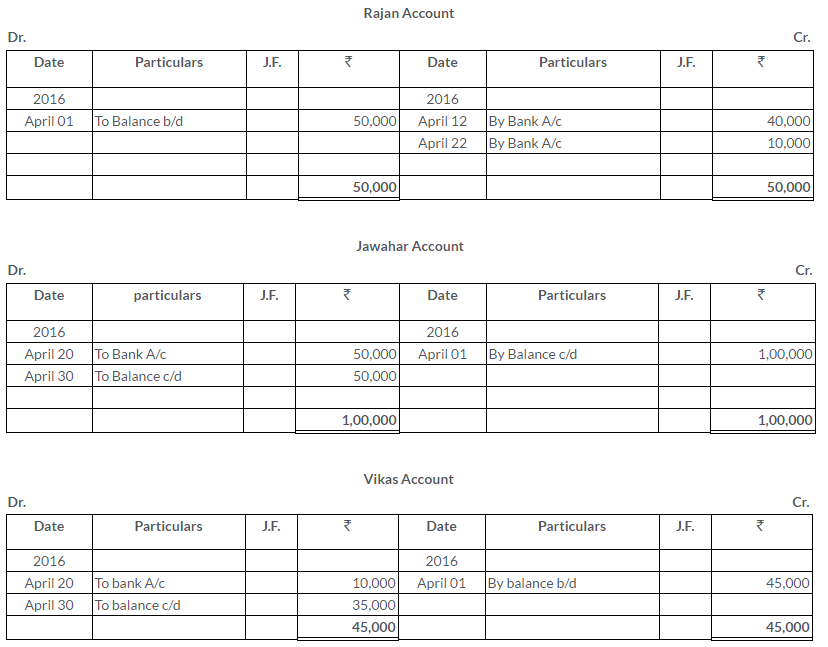

Solution:

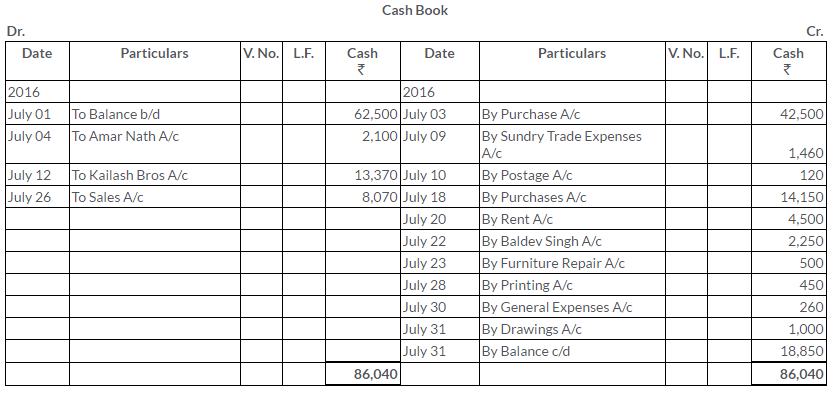

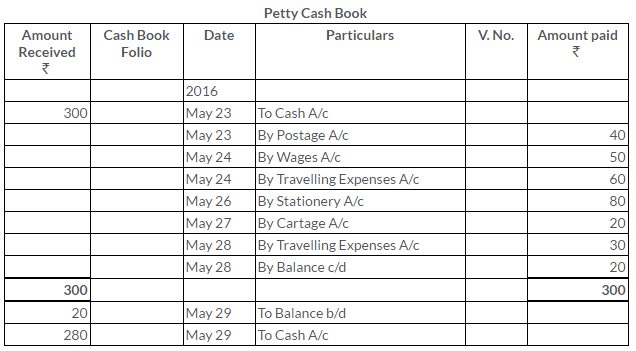

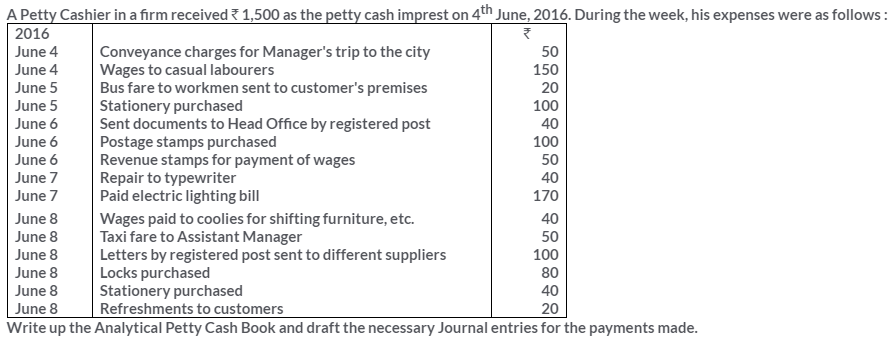

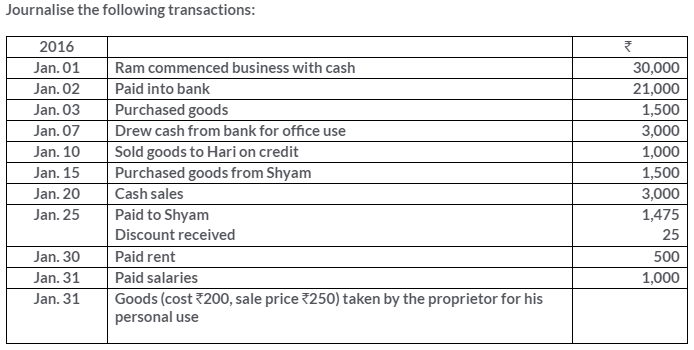

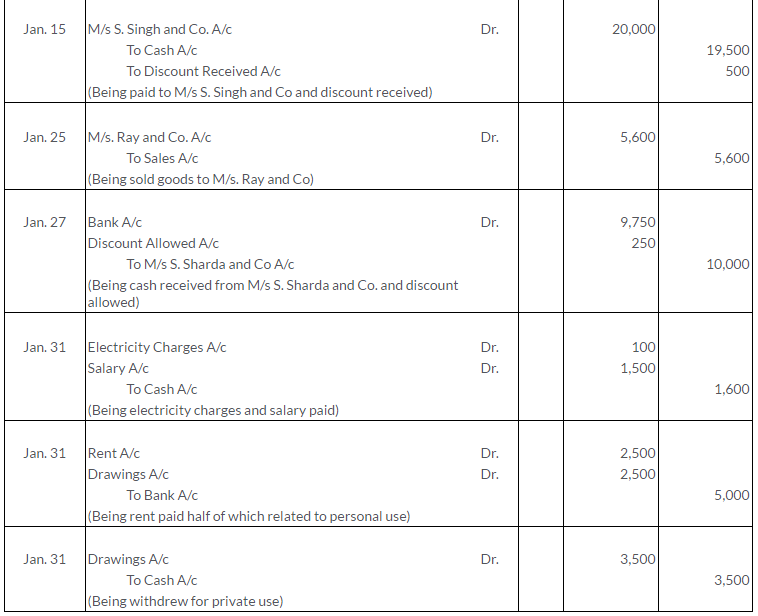

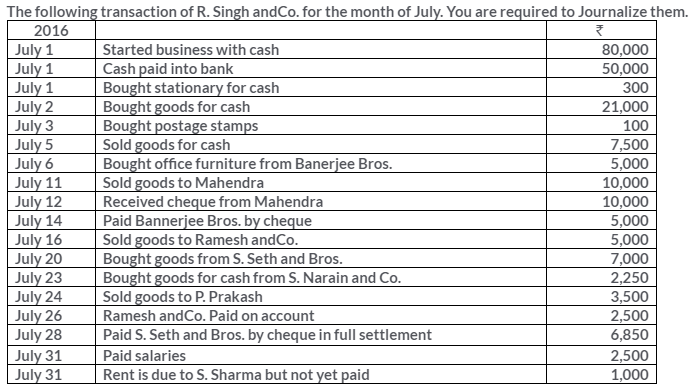

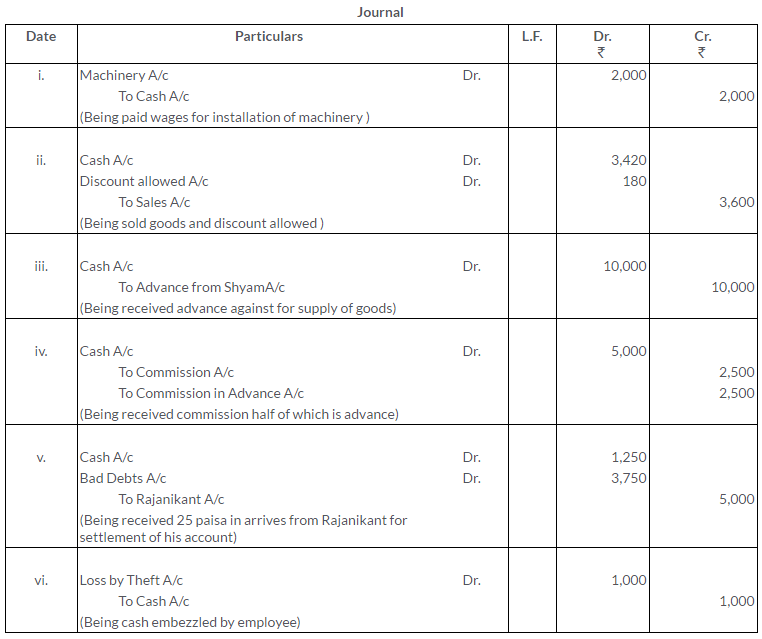

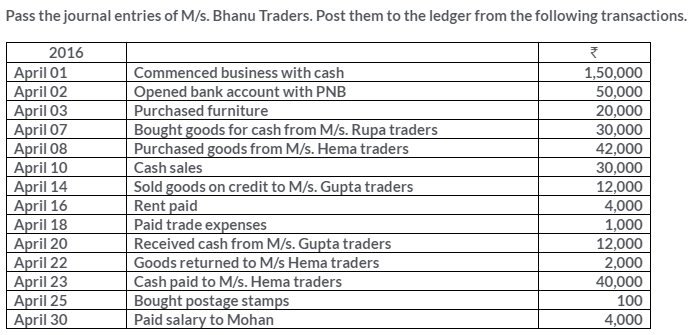

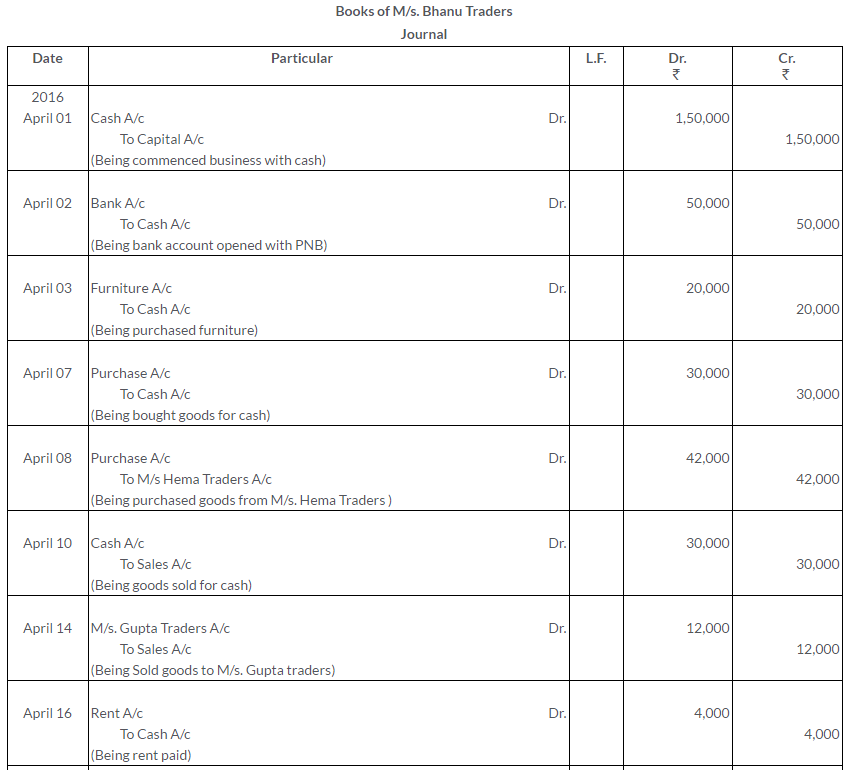

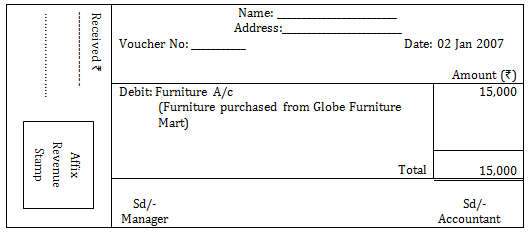

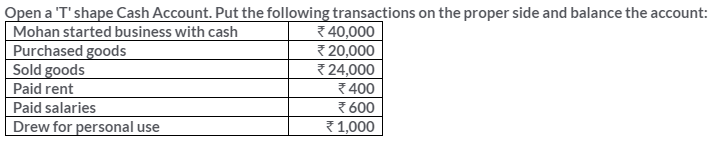

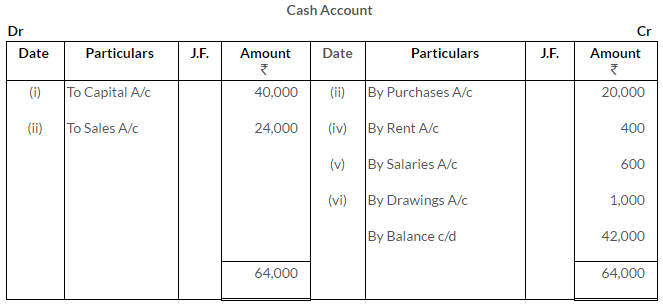

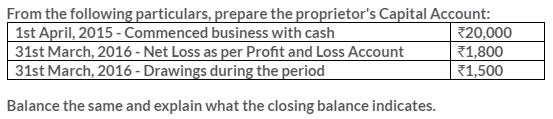

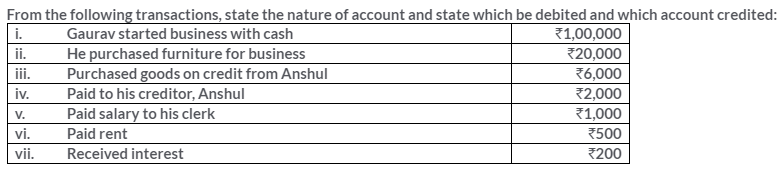

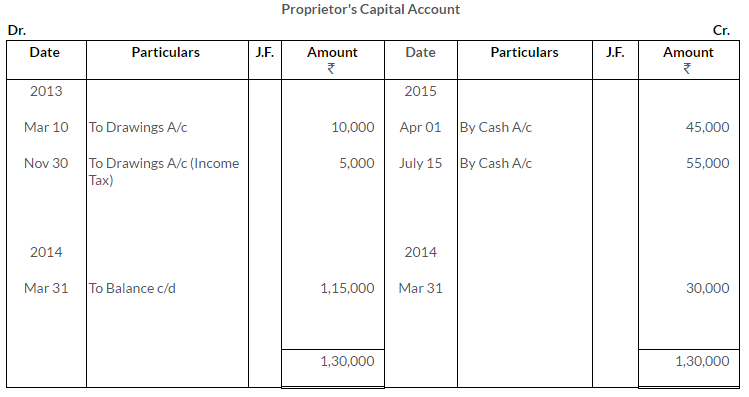

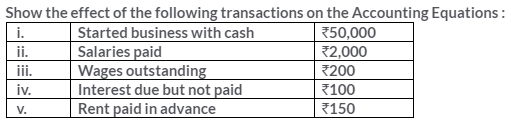

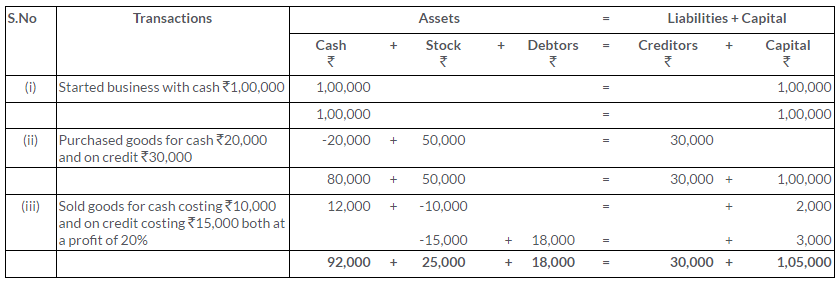

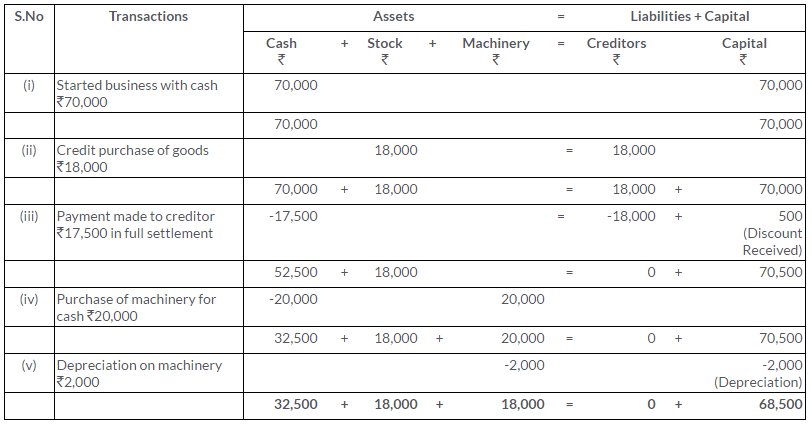

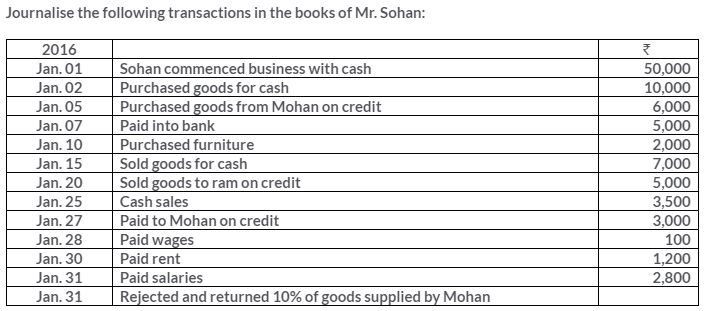

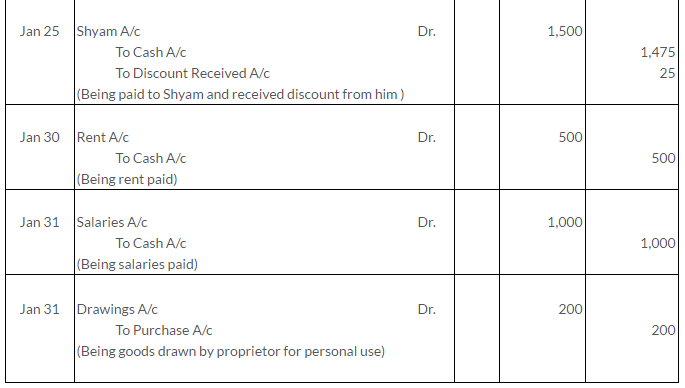

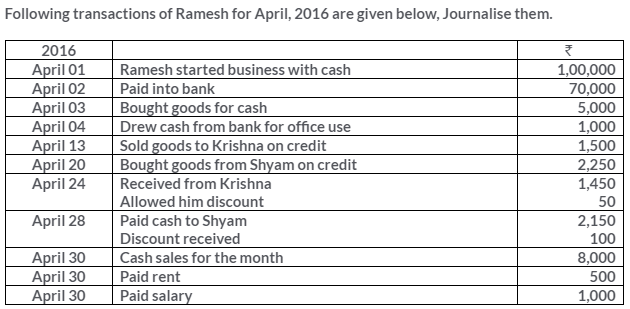

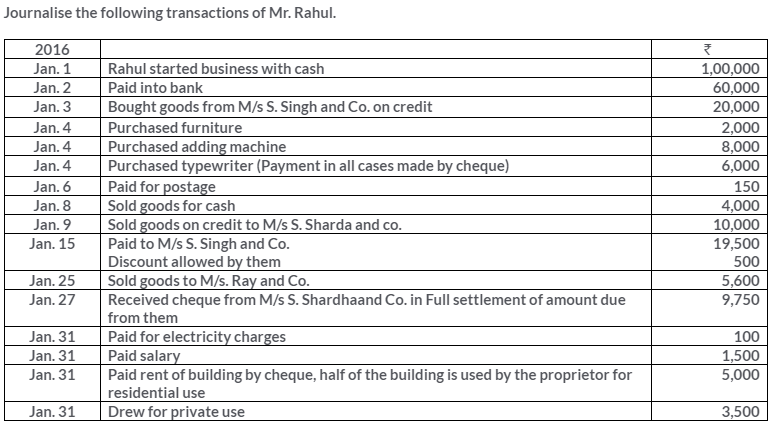

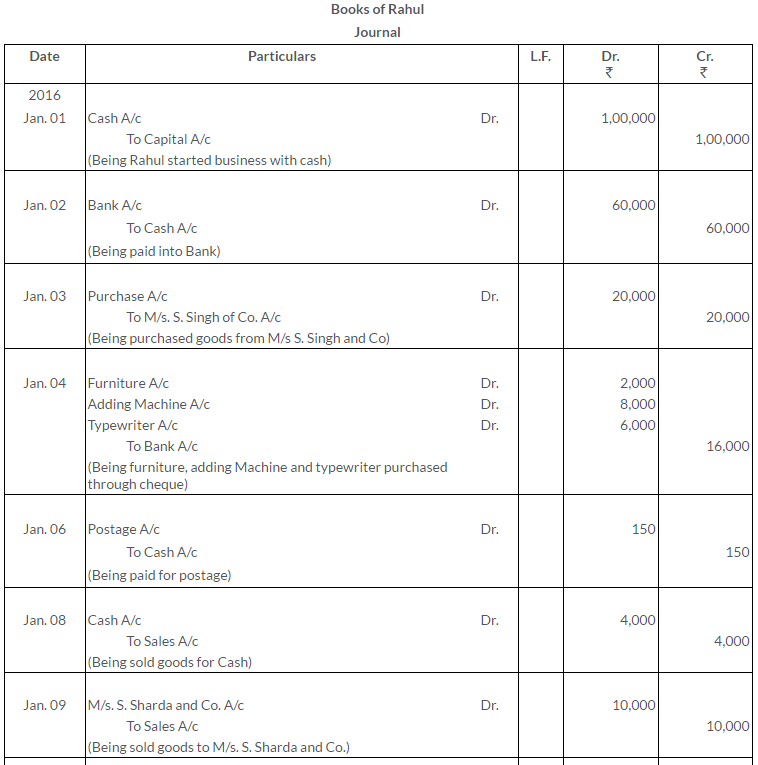

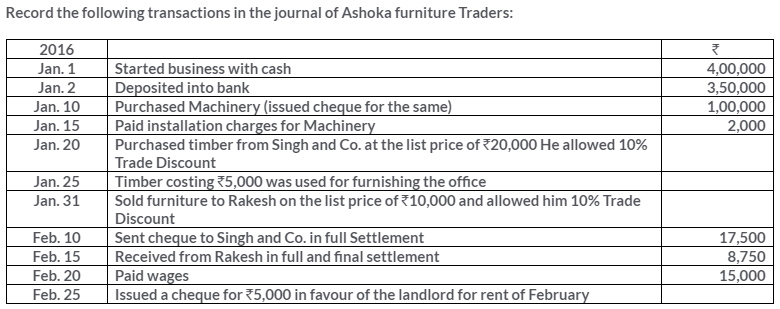

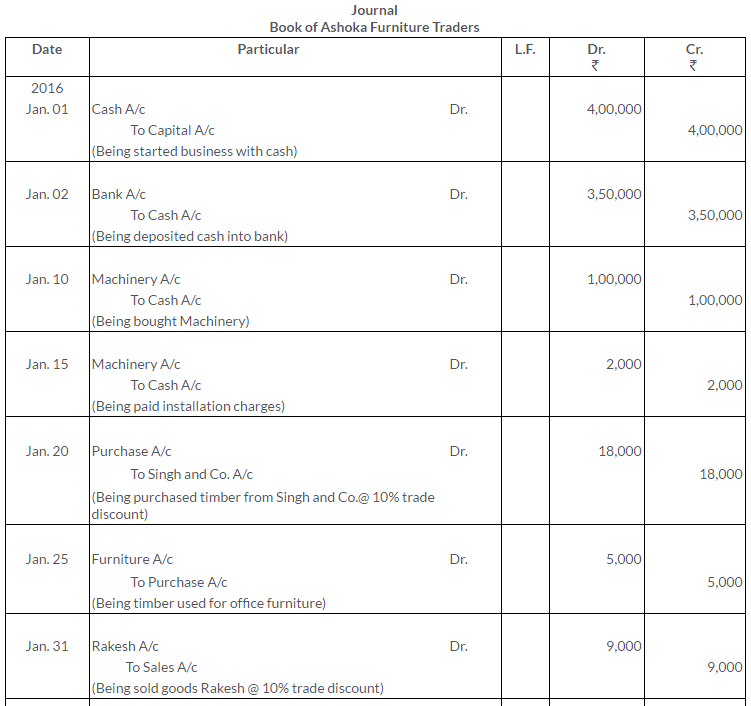

Question 2.

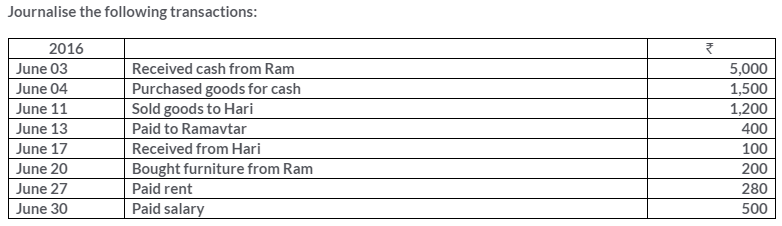

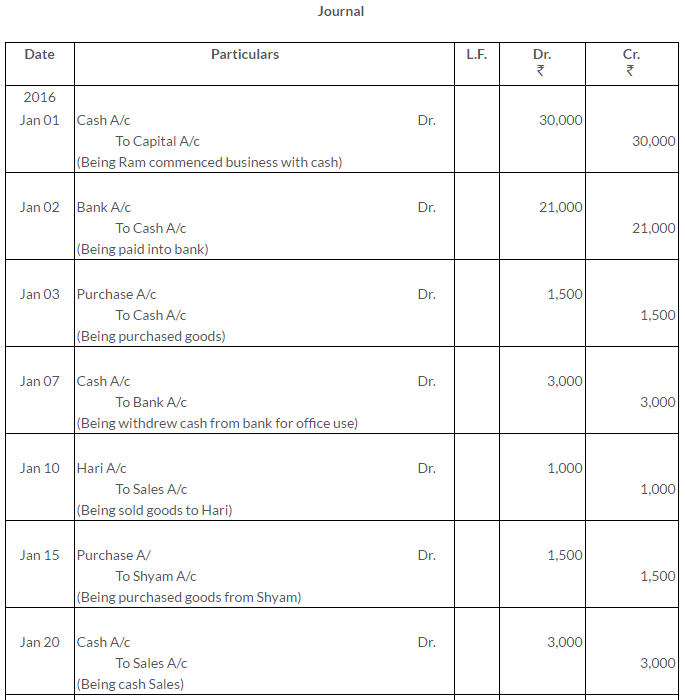

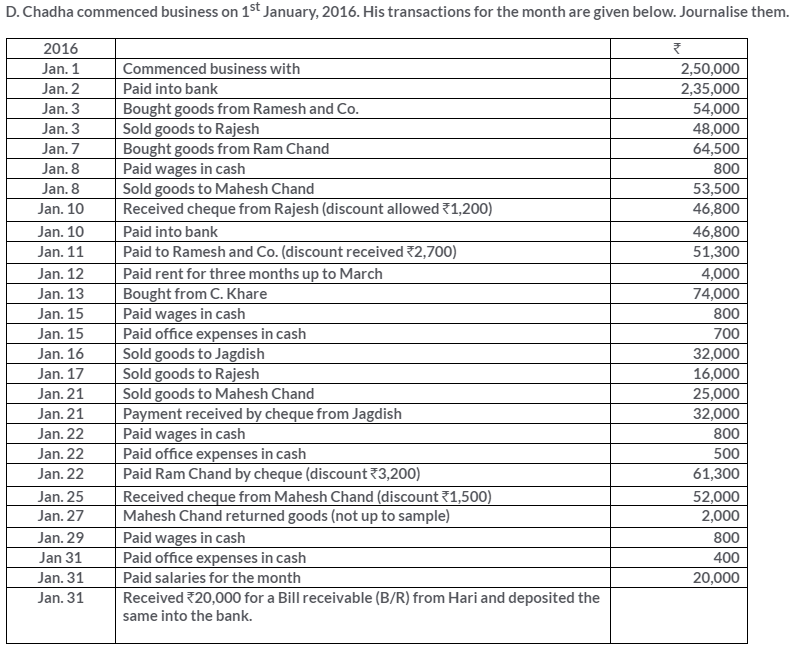

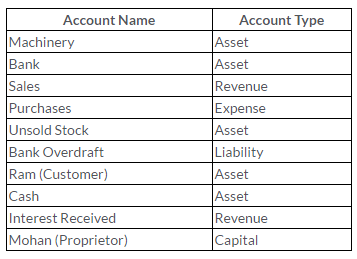

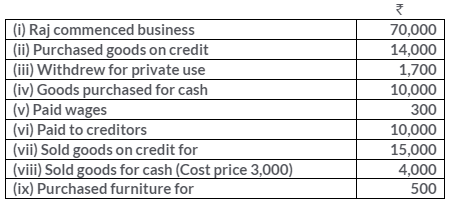

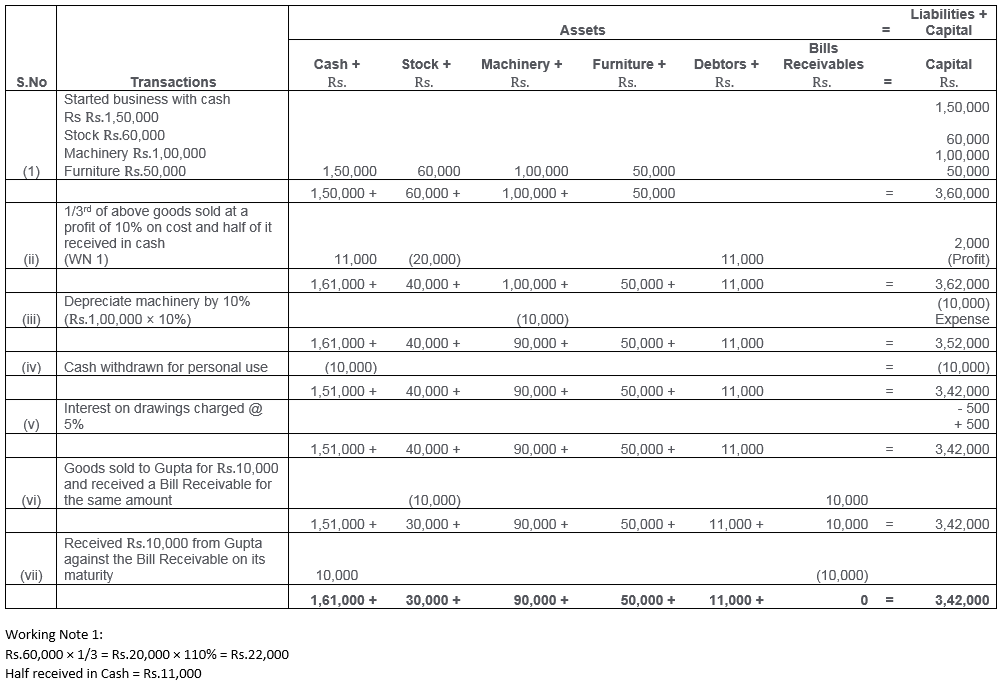

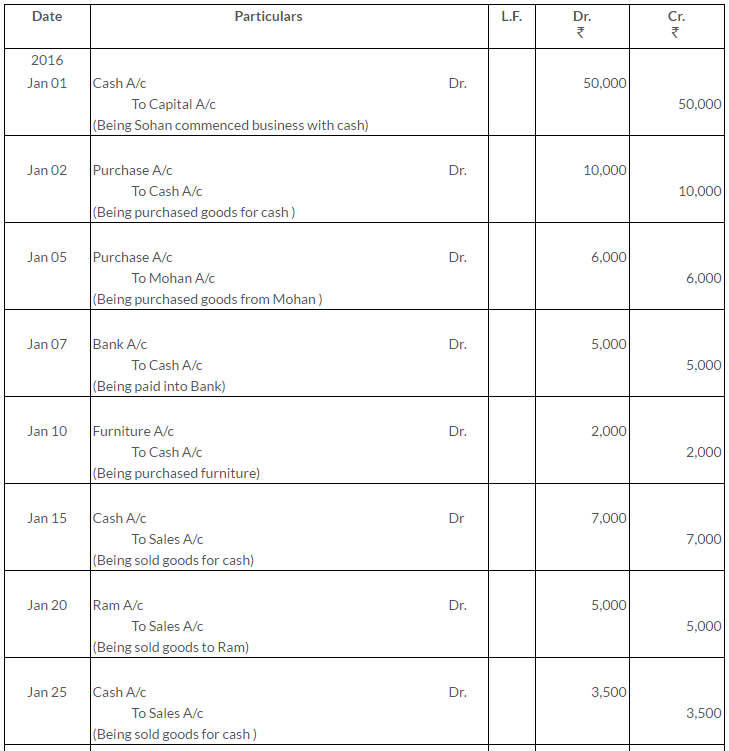

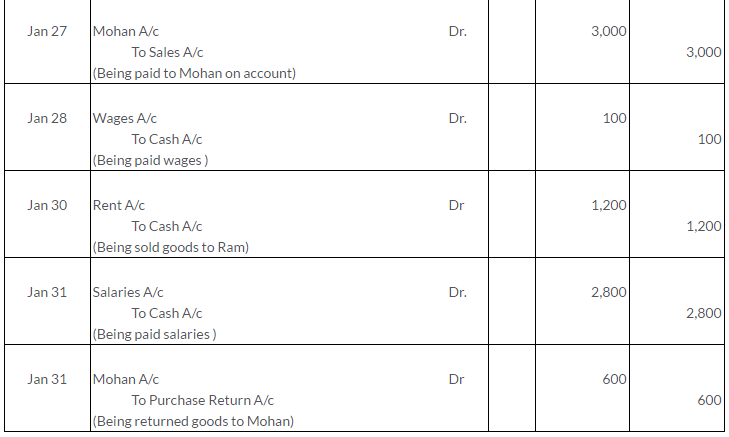

Solution:

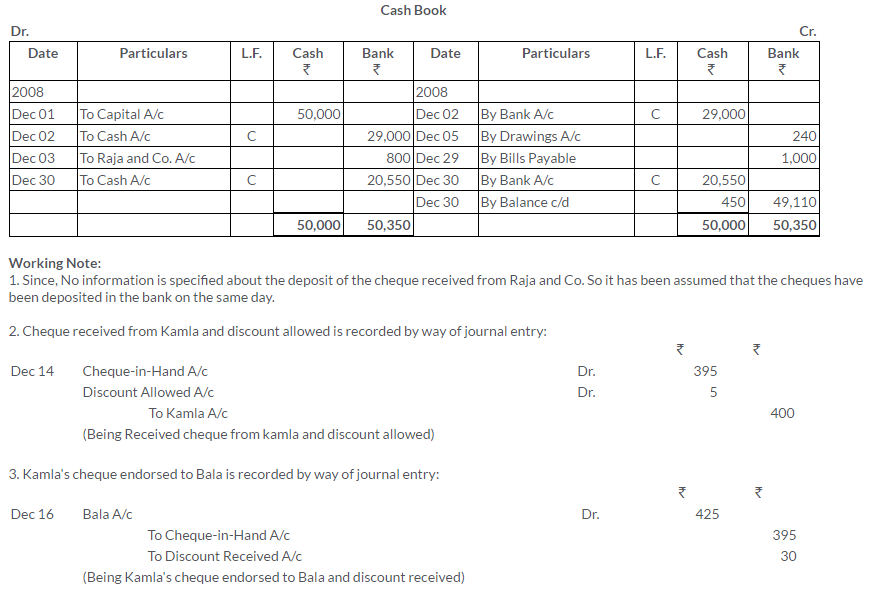

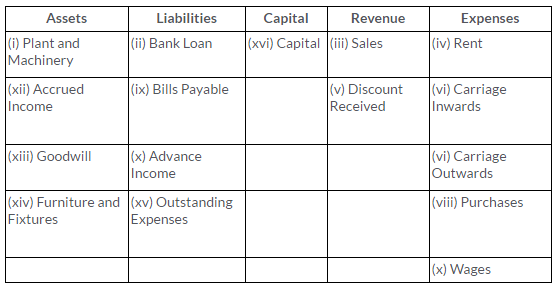

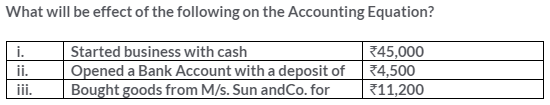

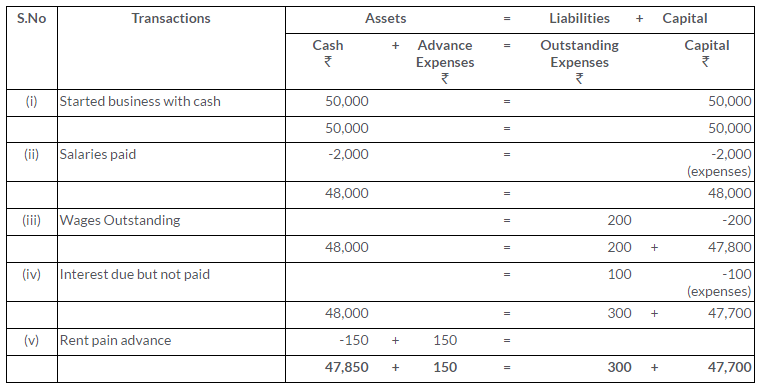

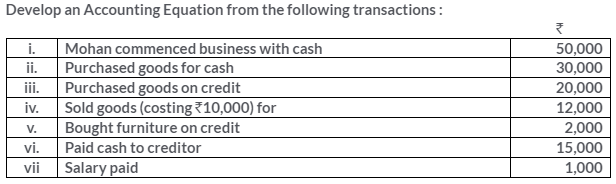

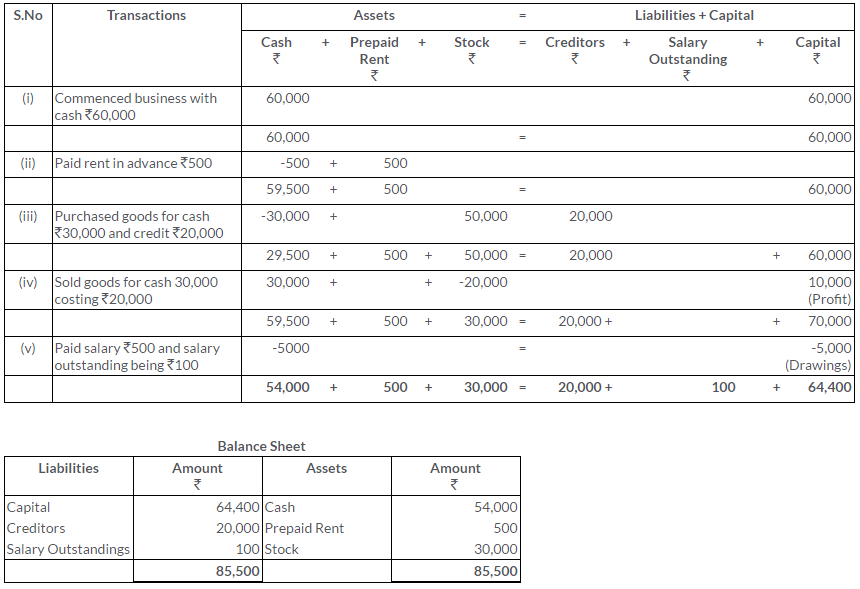

Question 3.

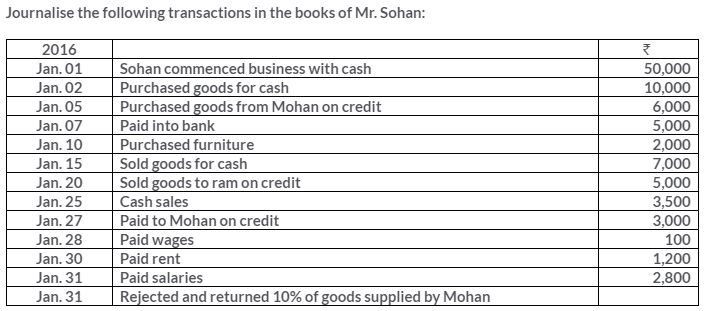

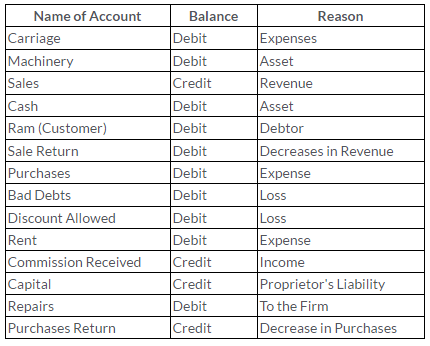

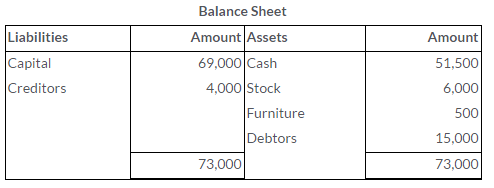

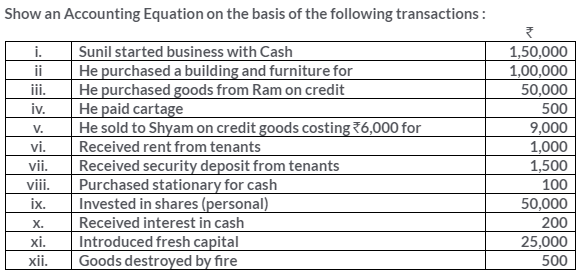

Solution:

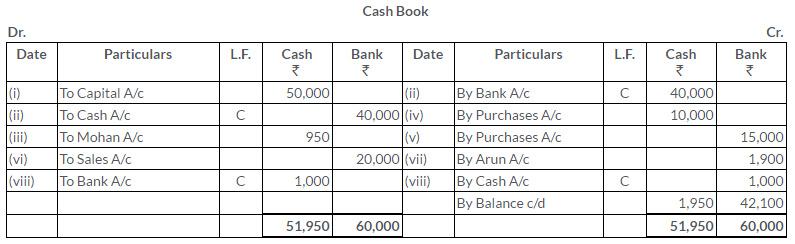

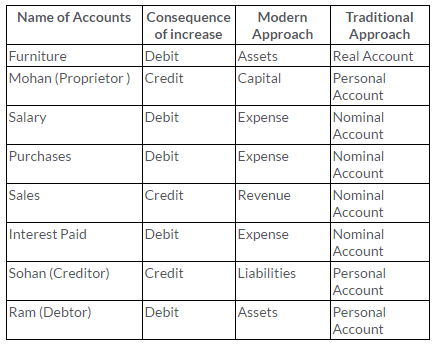

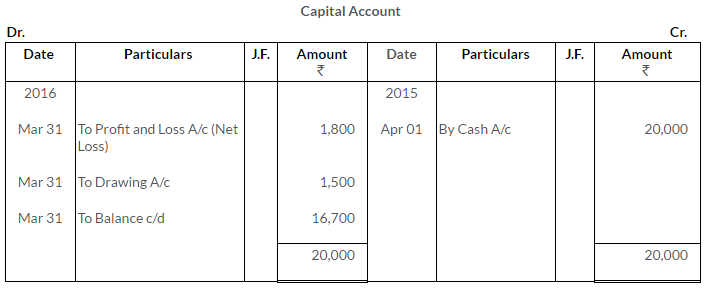

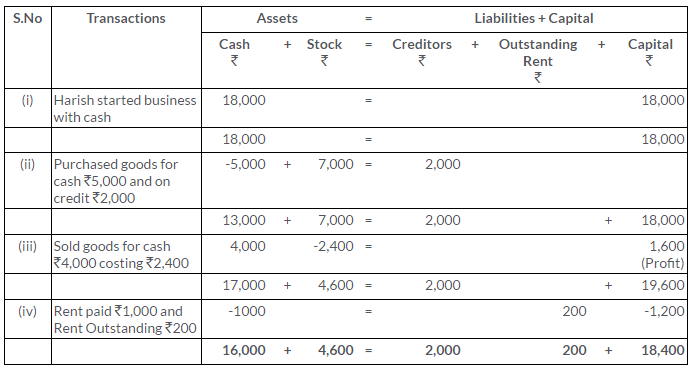

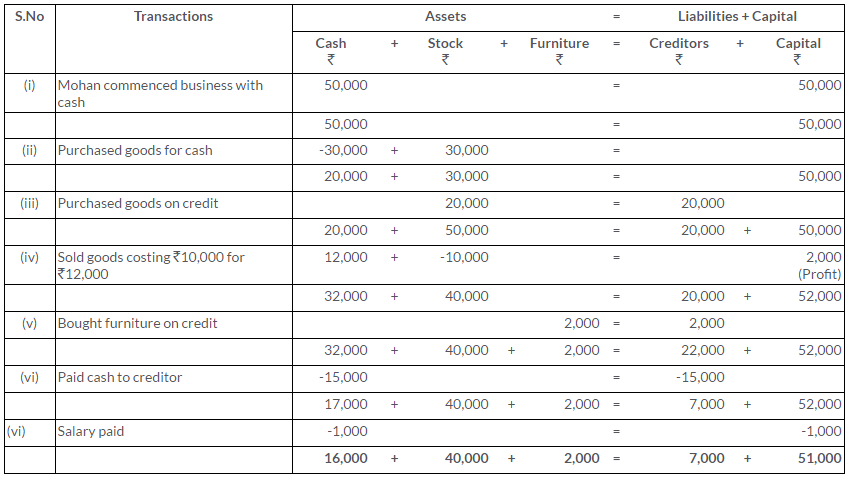

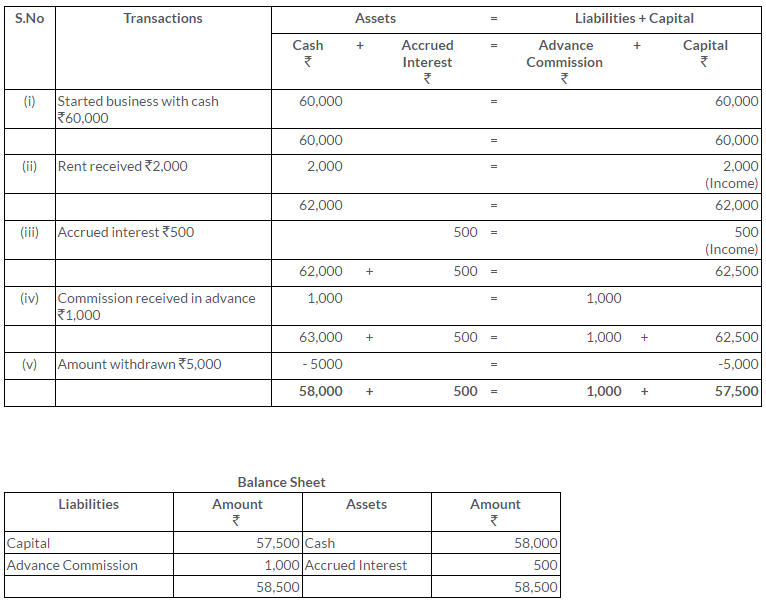

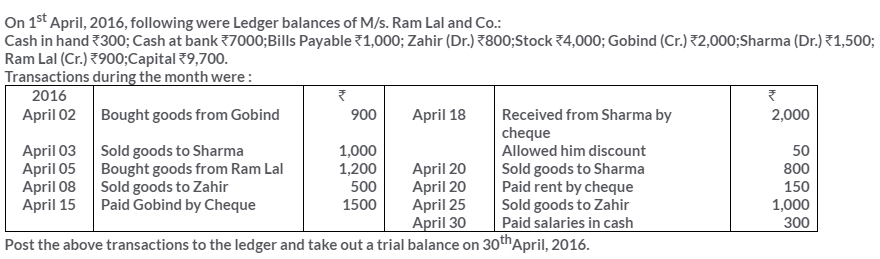

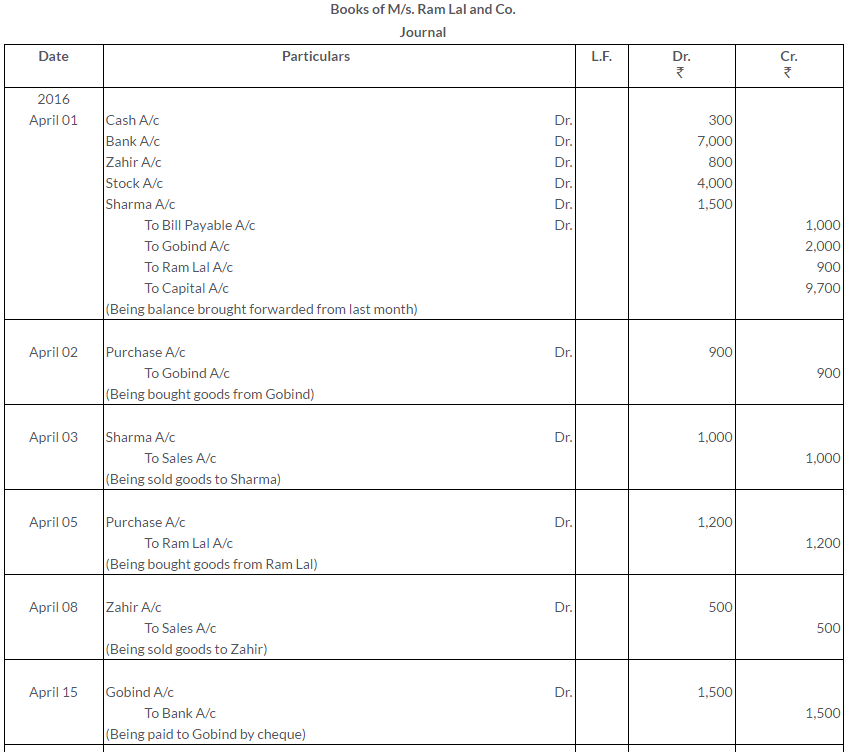

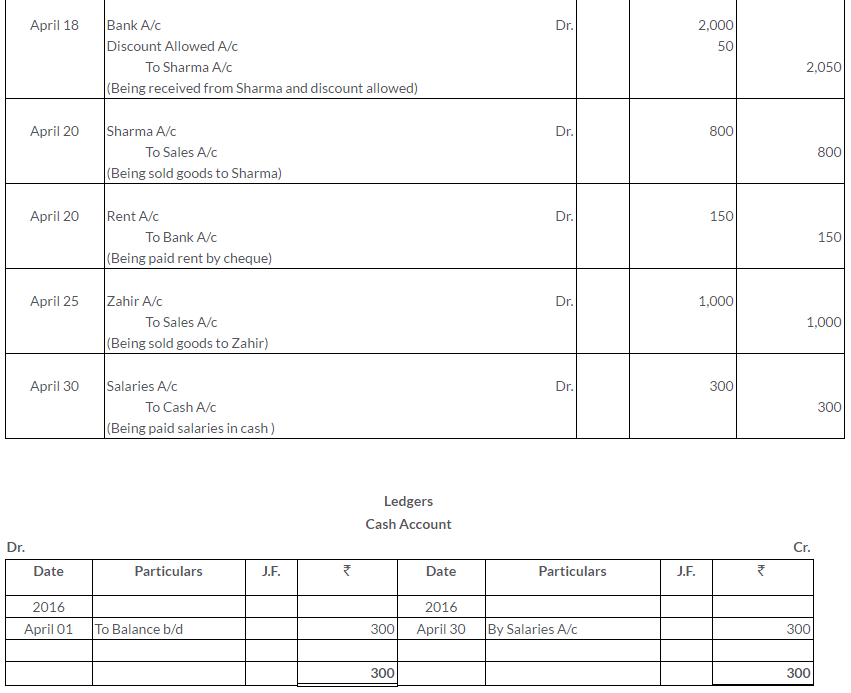

Question 4.

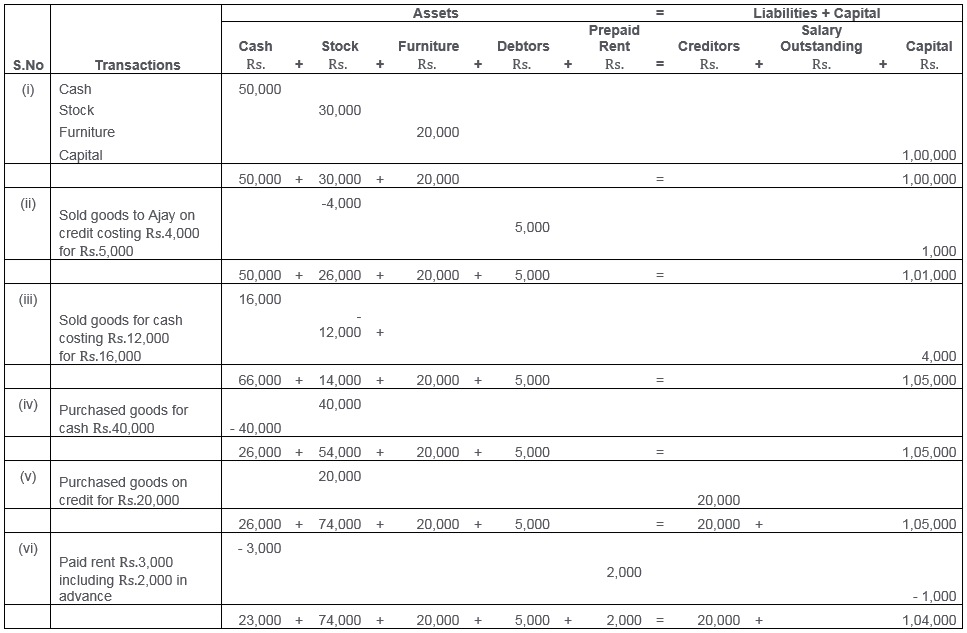

Solution:

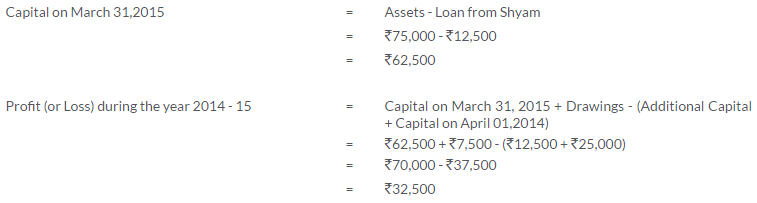

Question 5.

Solution:

Question 6.

Solution:

Question 7.

Solution:

Question 8.

Solution:

Question 9.

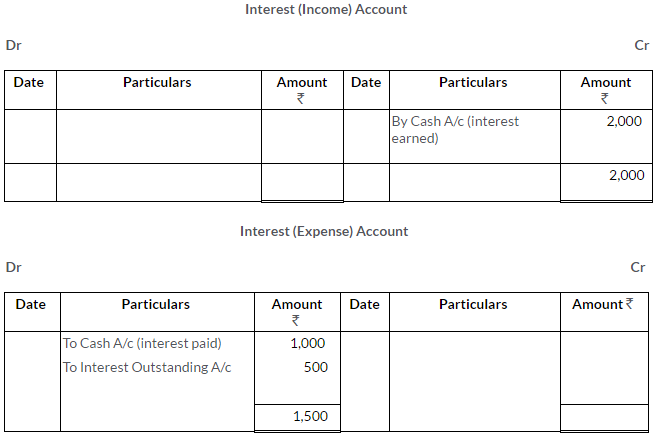

Solution:

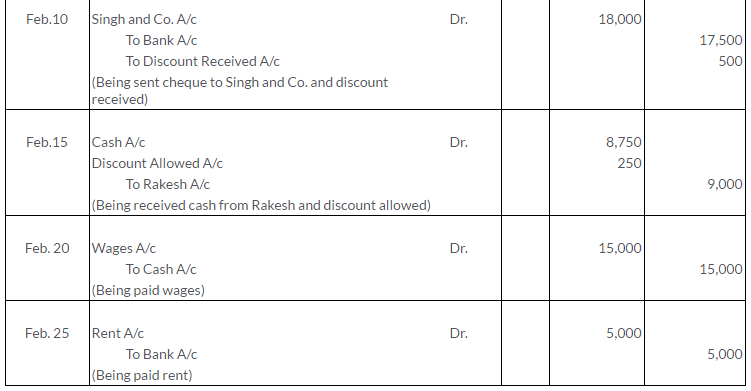

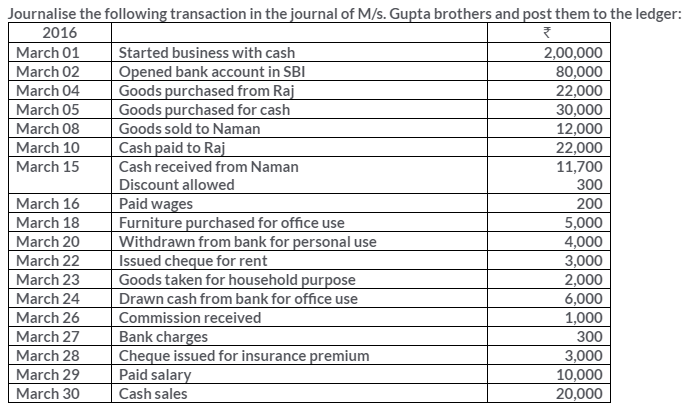

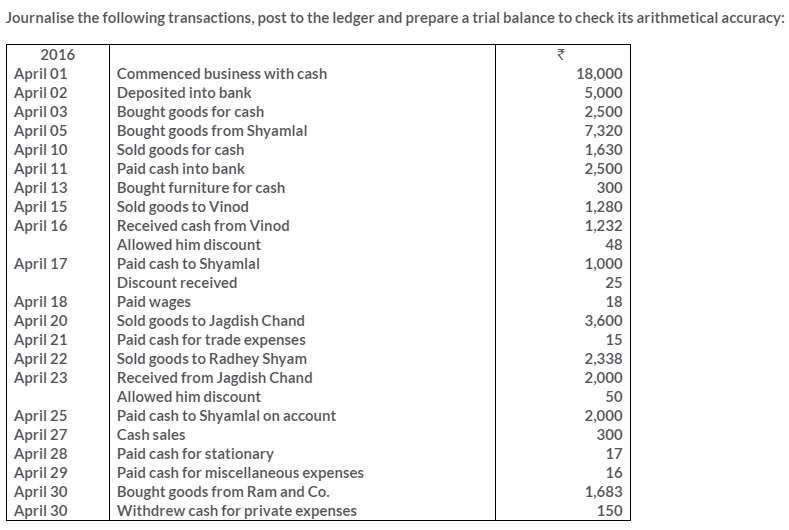

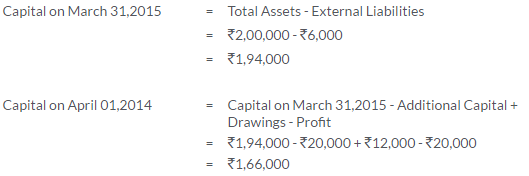

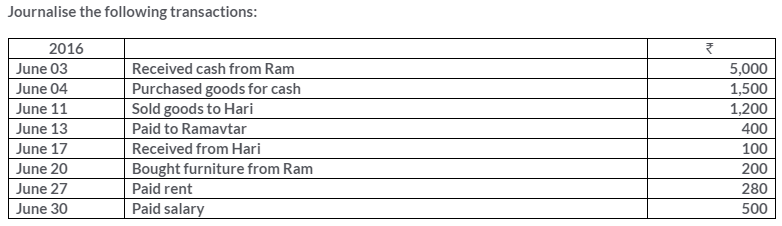

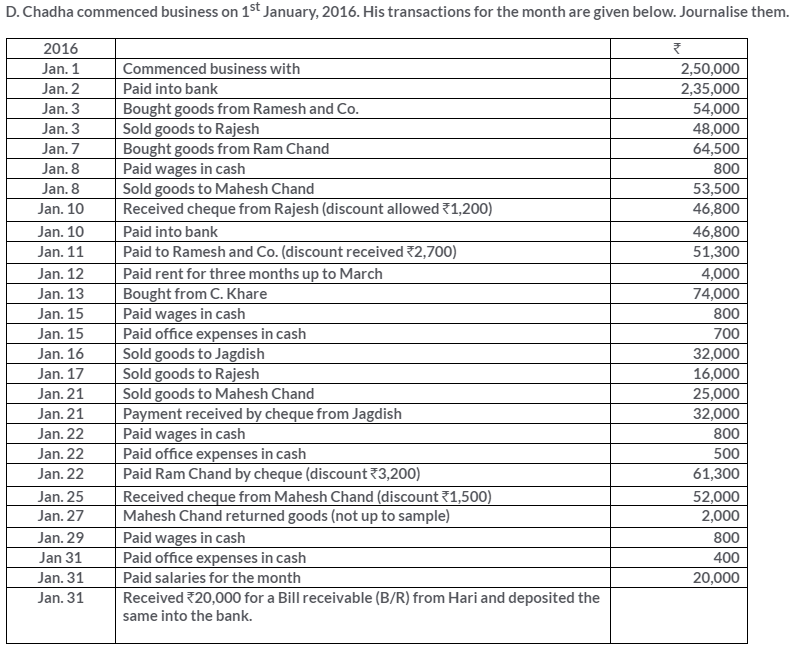

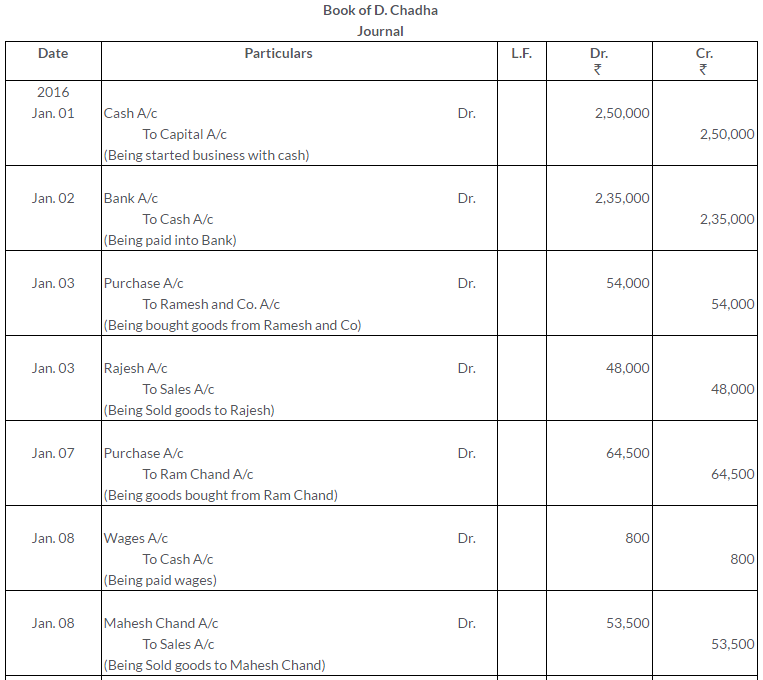

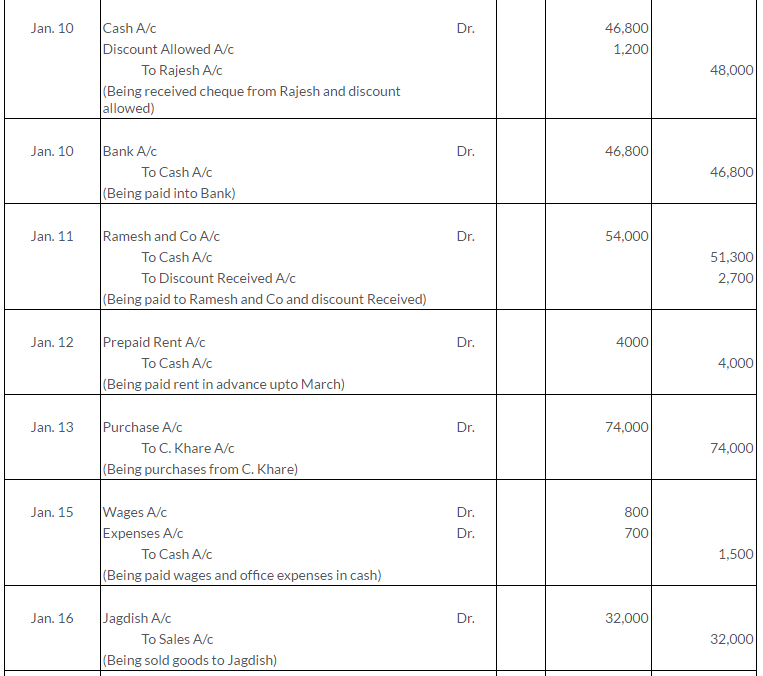

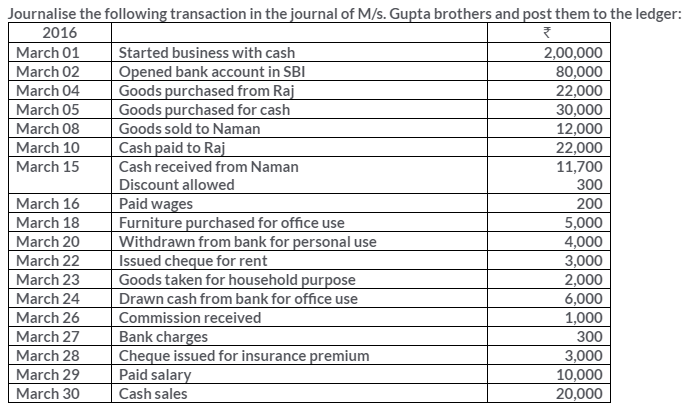

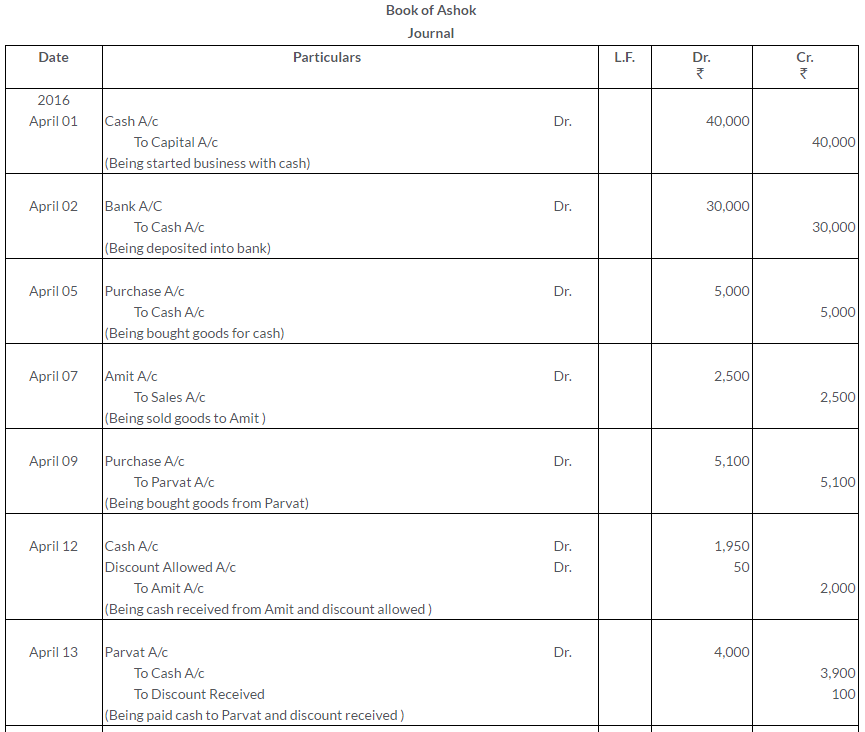

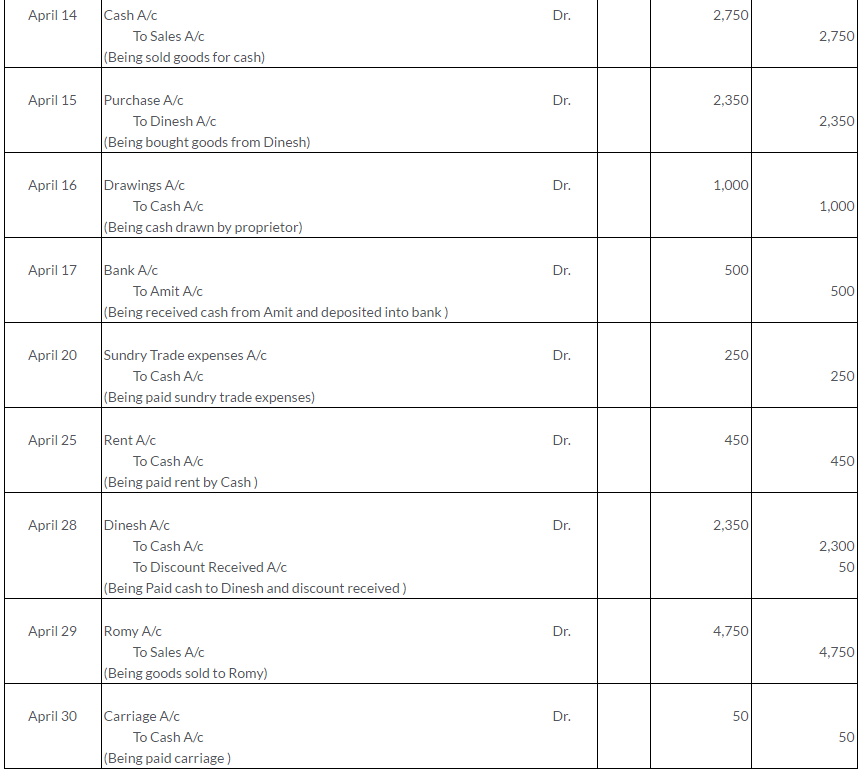

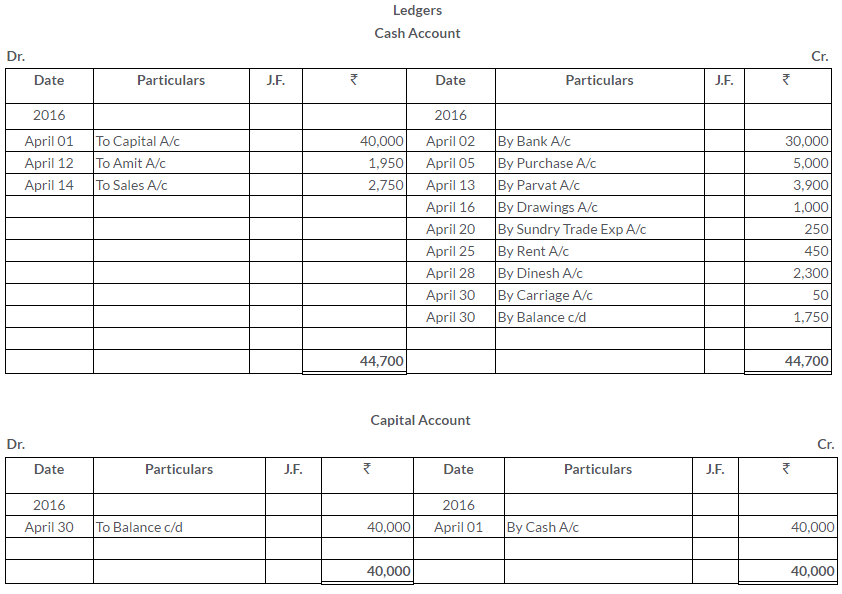

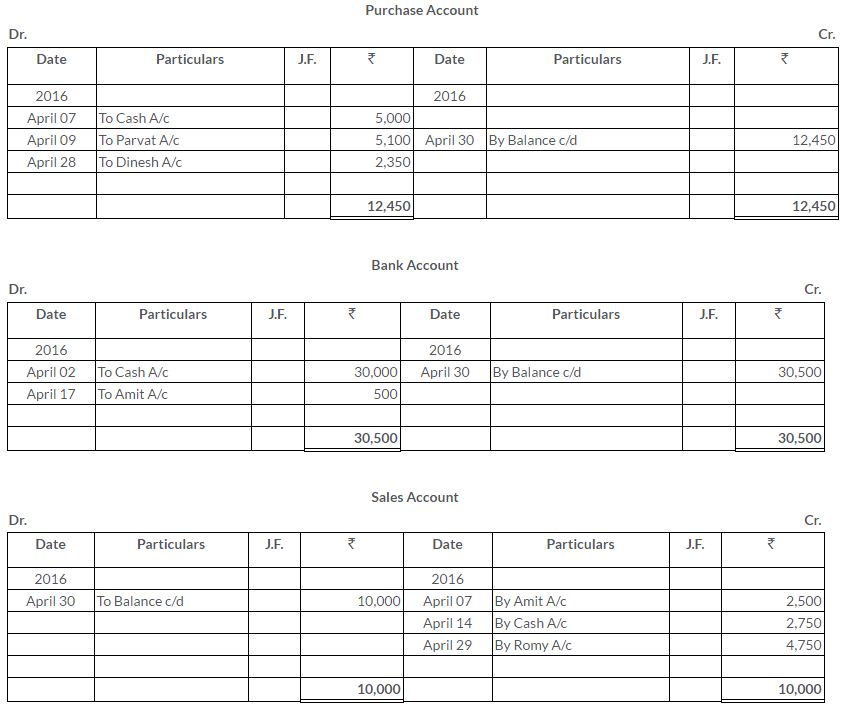

Question 10.

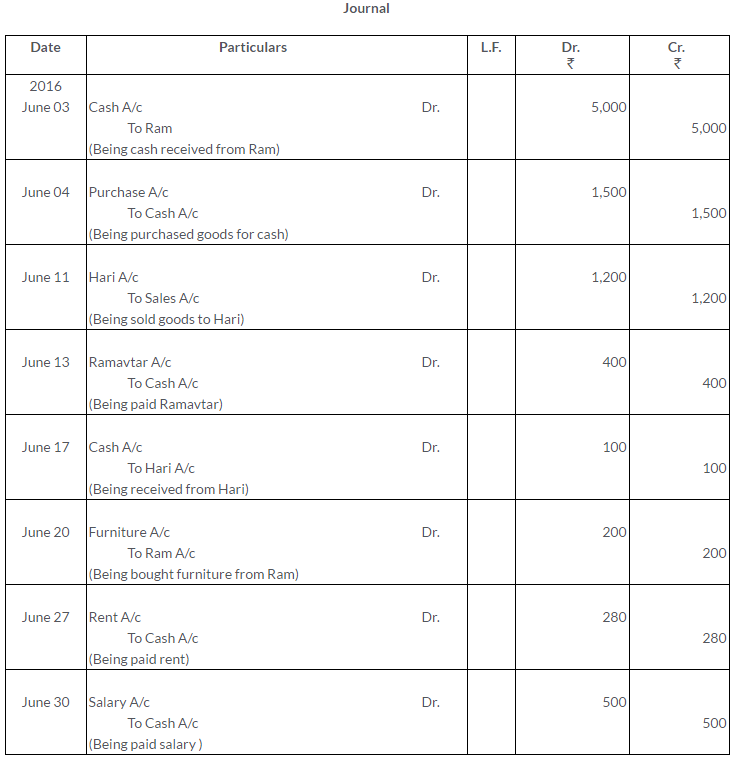

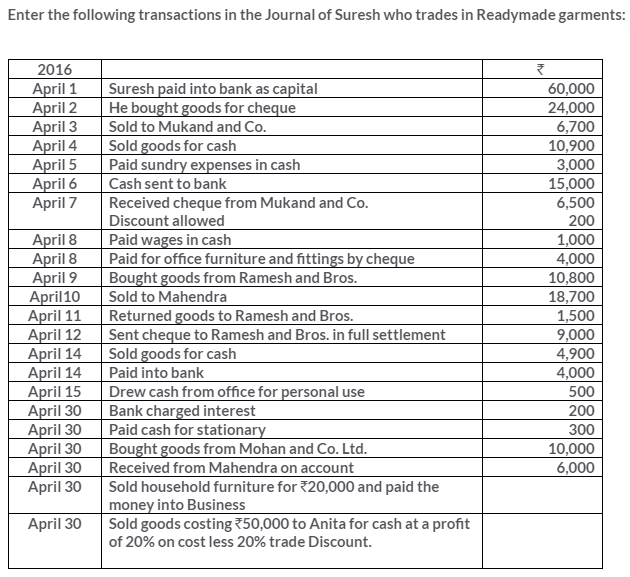

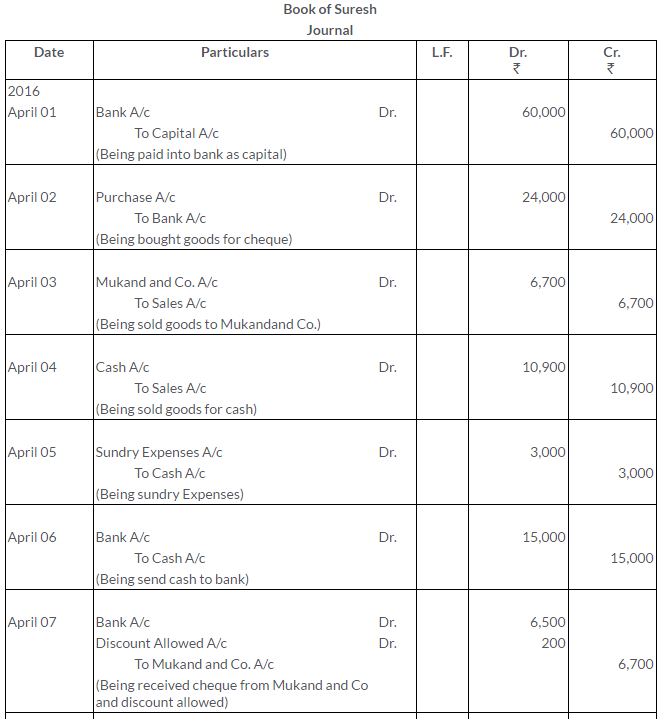

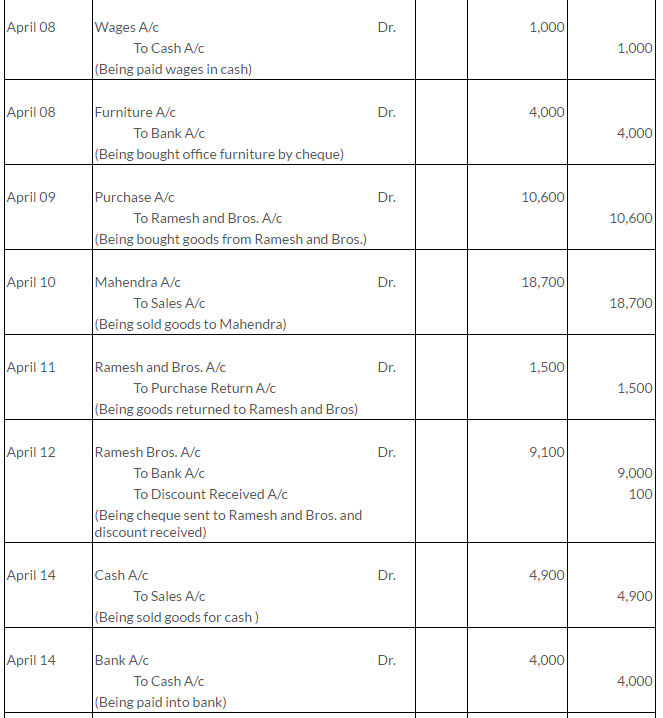

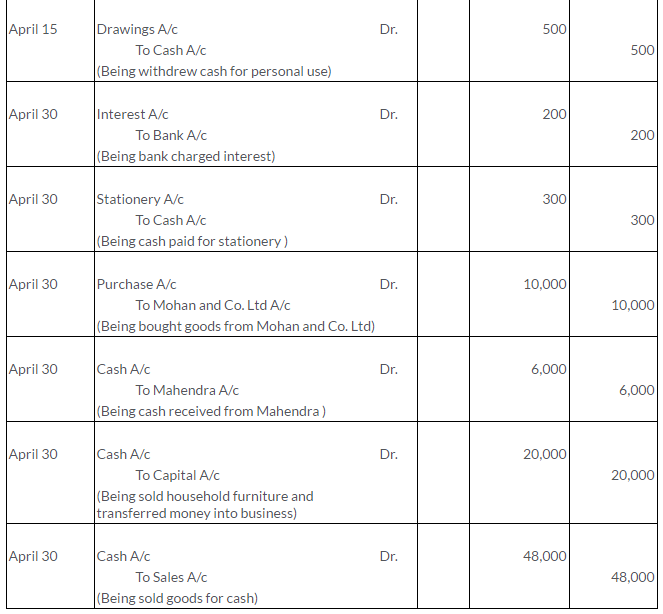

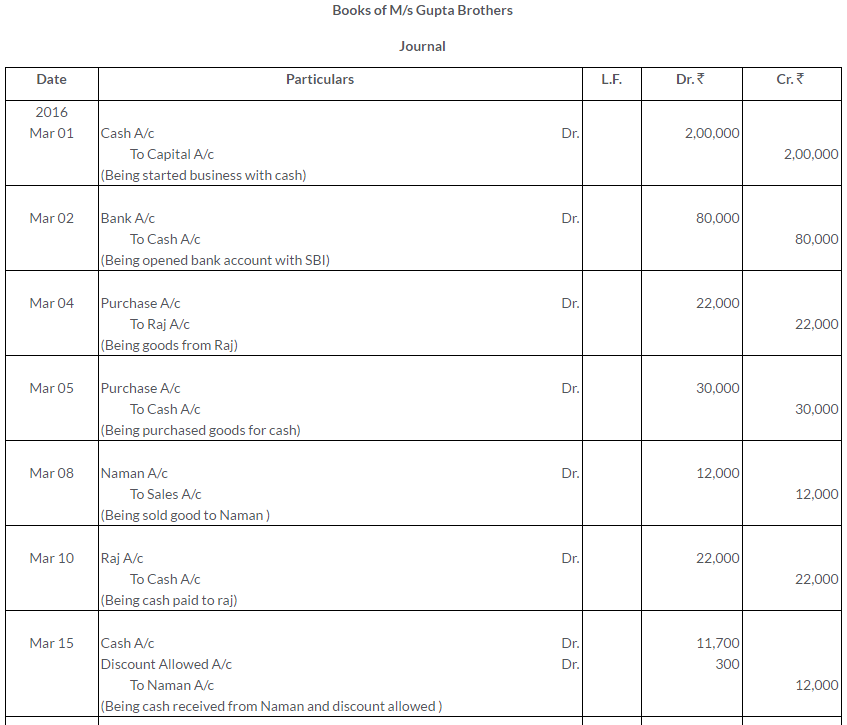

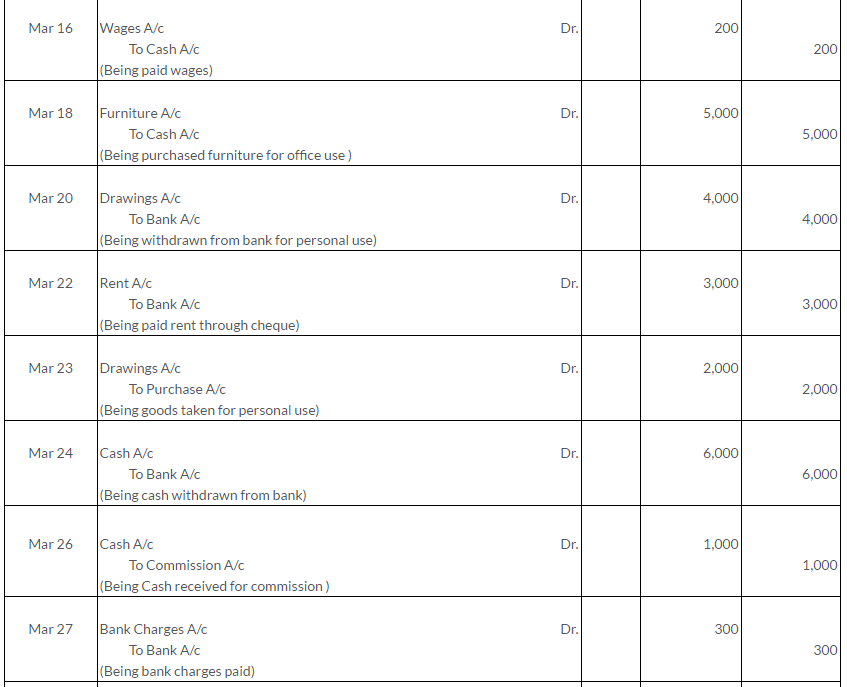

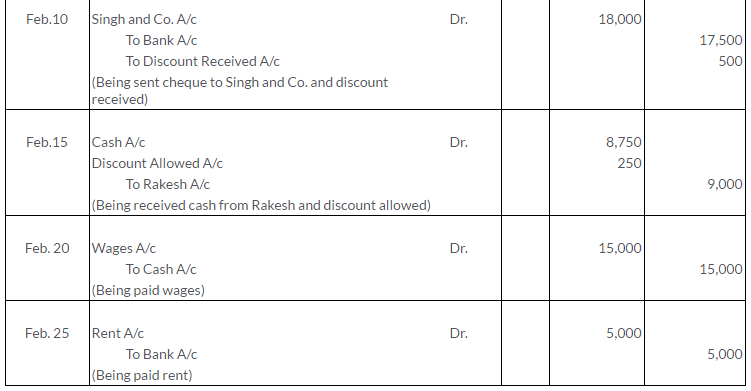

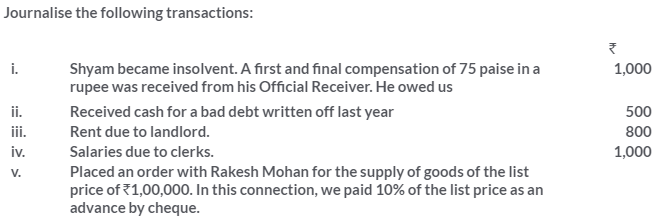

Journalise the following transactions :

i. Paid Rs.2,000 in cash as wages on installation of a machine.

ii. Sold goods to Manohar, list price Rs.4,000, Trade Discount 10% and cash Discount 5% he paid the amount on the same day and availed the cash discount.

iii. Received as order from Shyam for supply of goods of the list price Rs.1,00,000 with an advance of 10% of list price.

iv. Received commission Rs.5,000 half of which is in advance.

v. Rajanikant is declared insolvent. A final compensation of 25 paise in the rupee is received from his estate out of Rs.5,000.

vi. Cash embezzled by an employee Rs.1,000.

Solution:

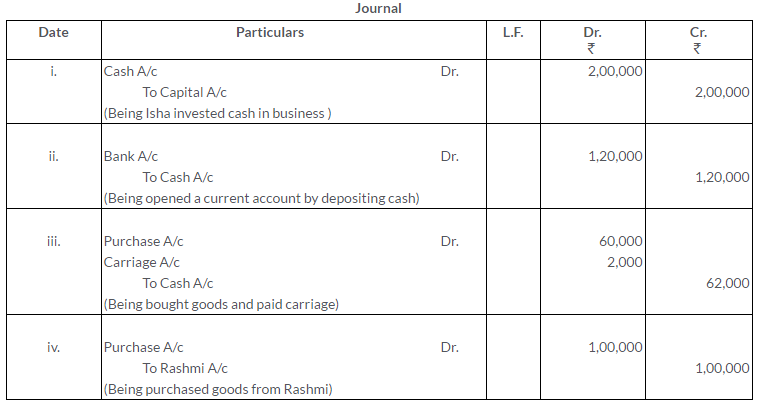

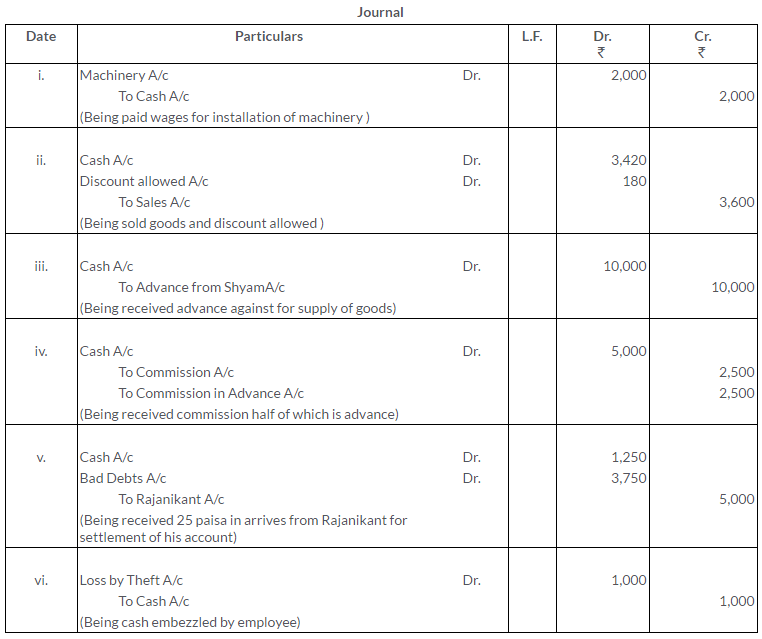

Question 11.

Journalise the following :

i. Isha invested Rs.2,00,000 in business.

ii. Opened a current account in bank Rs.1,20,000.

iii. Purchased goods for Rs.60,000 and paid Rs.2,000 for arrange.

iv. Purchased goods for Rs.1,00,000 from Rashmi.

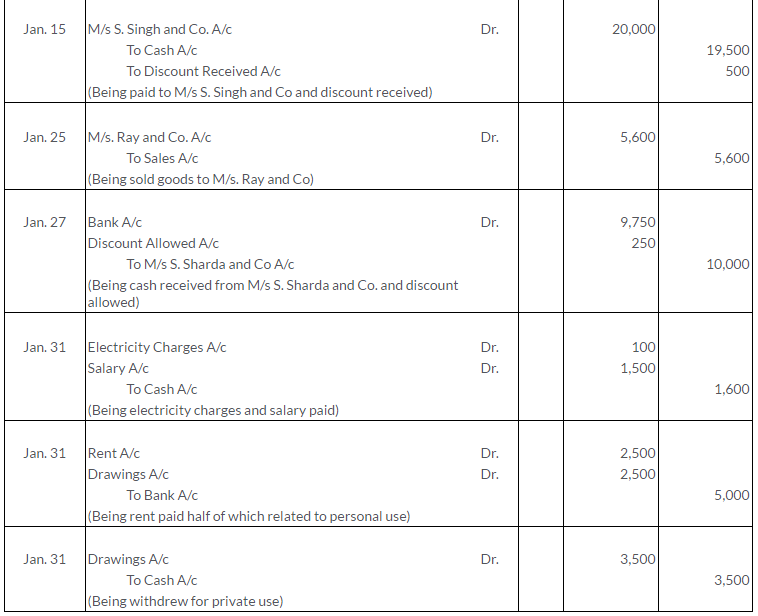

Solution:

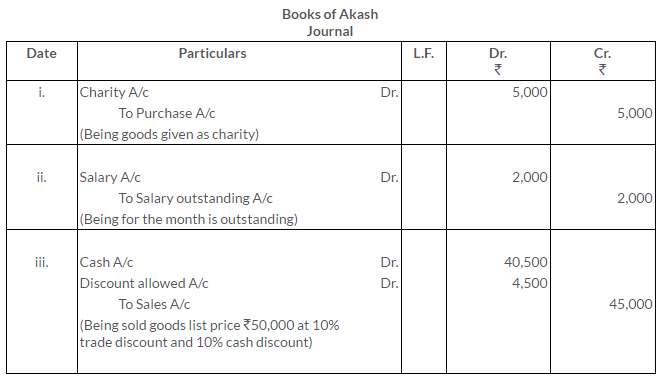

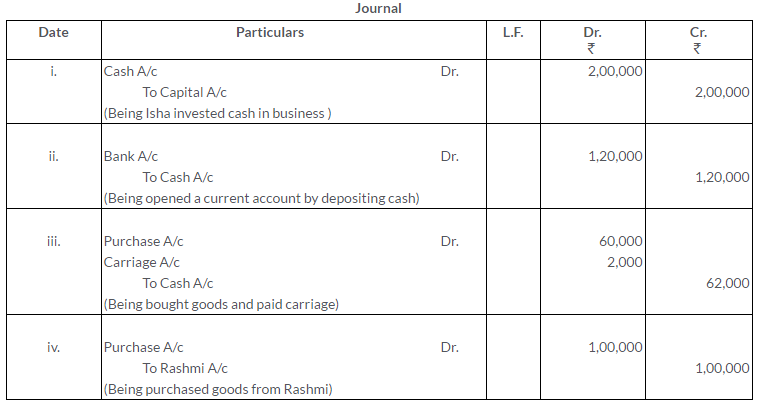

Question 12.

Journalise the following transactions in the books of Akash :

i. Goods given as charity Rs.5,000.

ii. Salary for the month is outstanding Rs.2,000.

iii. Goods sold for a list price of Rs.50,000; trade discount allowed 10%, cash discount allowed 10%.

Solution:

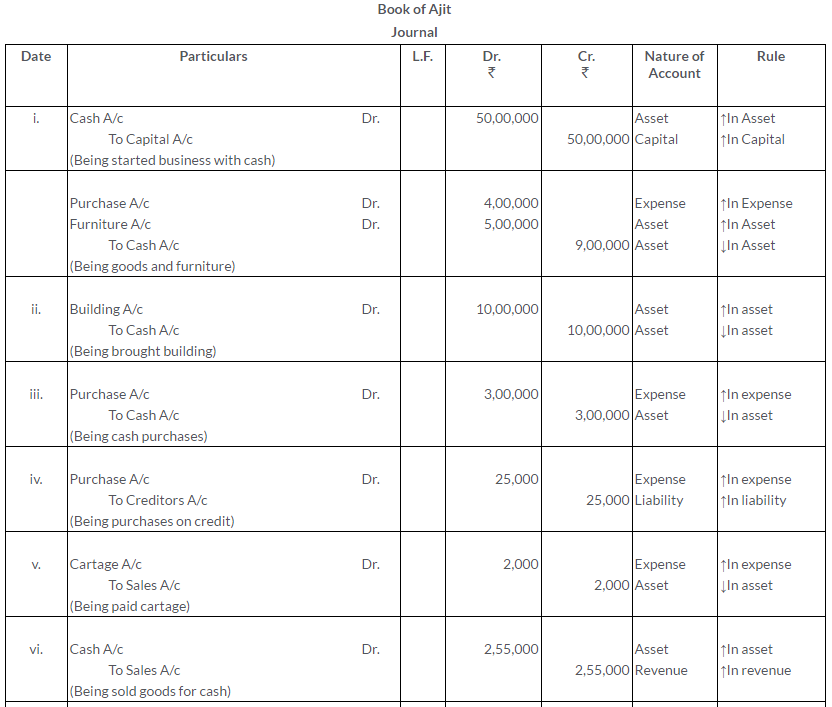

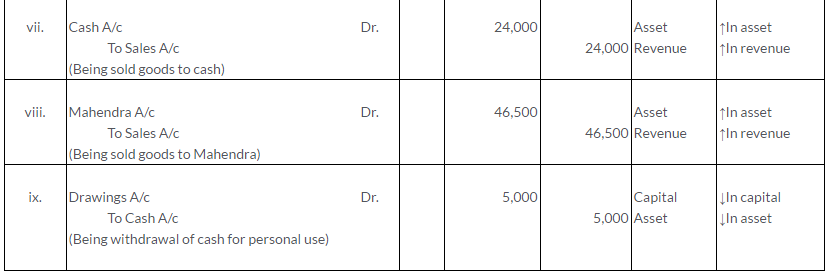

Question 13.

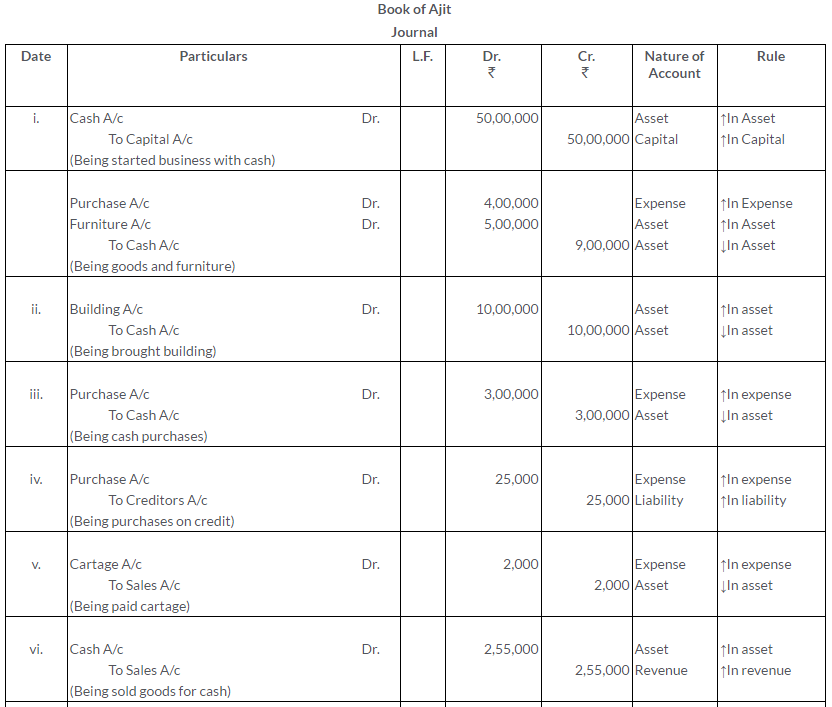

Give journal entries for the following transactions giving in each case the nature of account (whether asset, liability, capital, expenses or revenue) and the rule applicable:

i. Ajit started business by investing cash Rs.50,00,000. He bought goods old Rs.4,00,000 and furniture of Rs.5,00,000.

ii. Purchased building for Rs.10,00,000.

iii. Purchased goods for cash Rs.3,00,000.

iv. Purchased goods on credit from Chandler Rs.25,000.

v. Paid cartage Rs.2,000.

vi. Sold goods for cash Rs.2,55,000.

vii. Sold goods for cash to Rs.24,000.

viii. Sold goods to Mahendra on credit Rs.46,500.

ix. Cash withdrawn by Ajit for personal use Rs.5,000.

Solution:

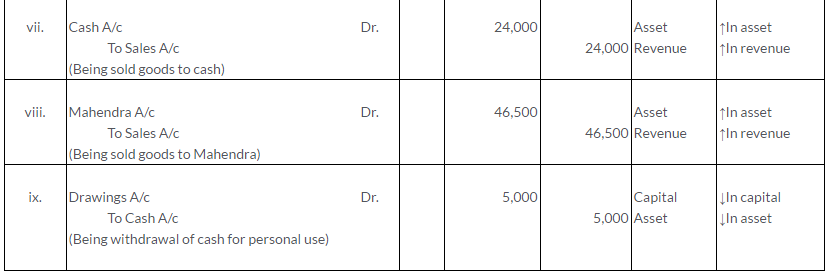

Question 14.

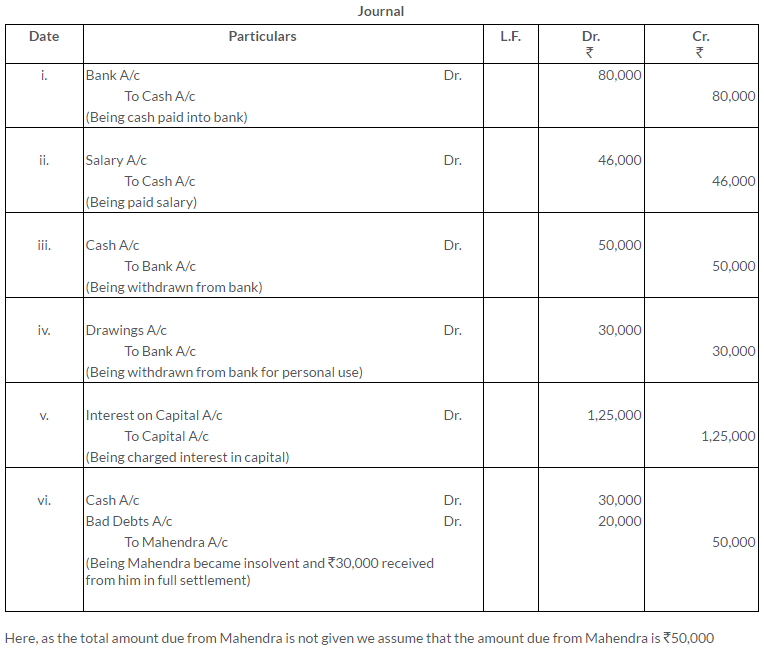

Journalise the following transactions :

i. Deposited cash into bank Rs.80,000.

ii. Paid salary Rs.46,000.

iii. Withdrew from the bank Rs.50,000 for office use.

iv. Withdrew from the bank Rs.30, 000 for private use.

v. Charged interest on capital Rs.1,25,000.

vi. Mahendra became insolvent. Only Rs.30,000 could be realised from him.

Solution:

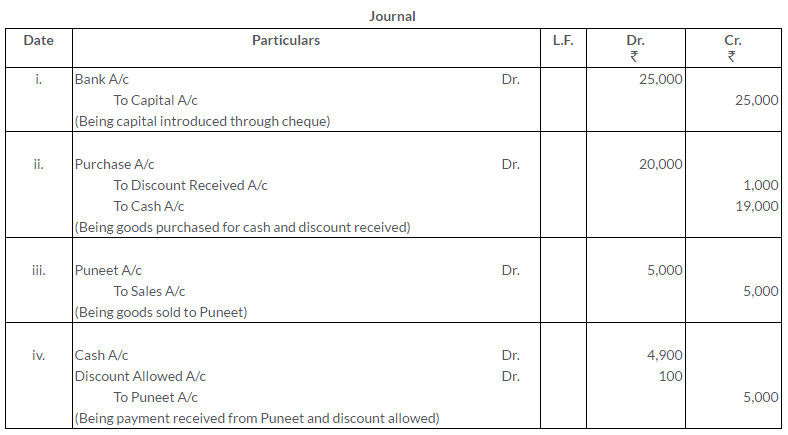

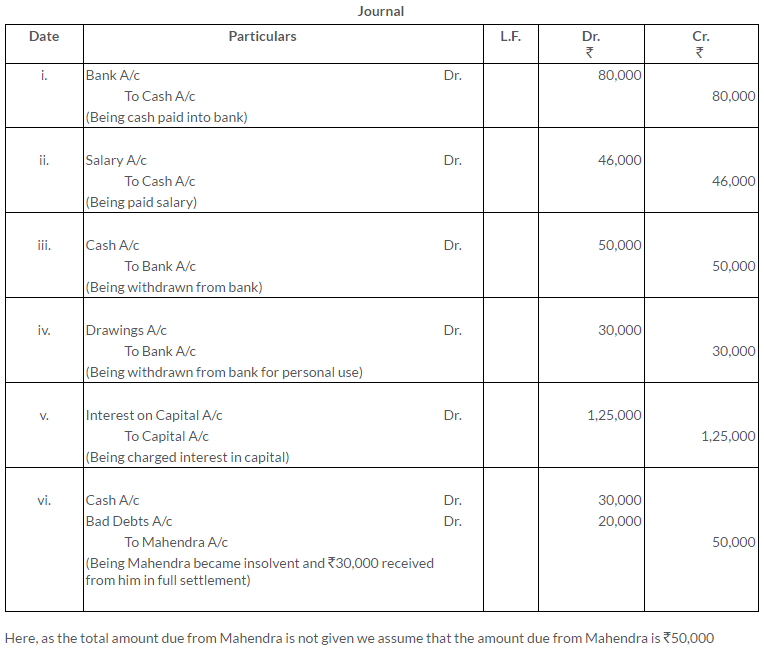

Question 15.

Journalise the following transactions:

i. Tarun introduced capital by cheque Rs.25,000.

ii. Purchased goods for Rs.20,000 and availed discount Rs.1,000.

iii. Sold goods to Puneet for Rs.5,000.

iv. Puneet paid cash and availed discount Rs.100

Solution:

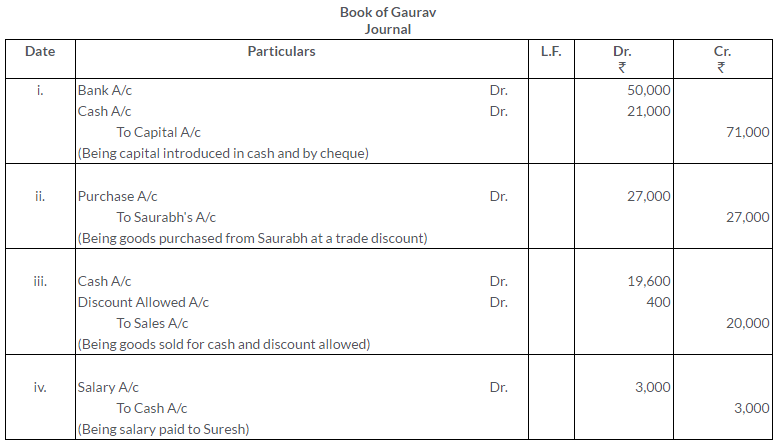

Question 16.

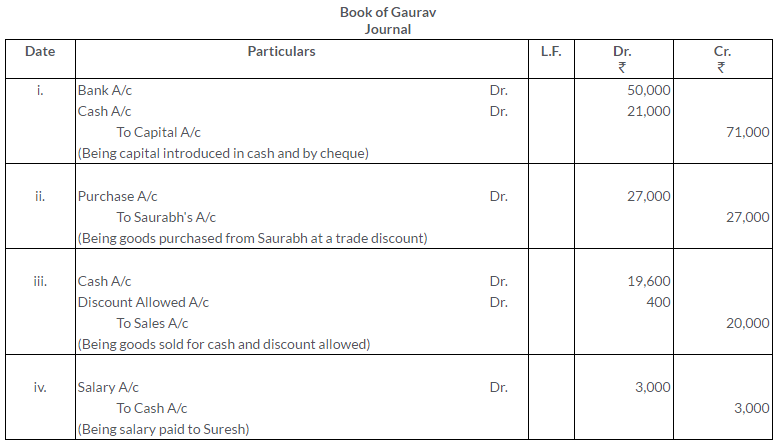

Journalise the following transactions:

Gaurav commenced business by introducing capital in cash Rs.21,000 and by cheque Rs.50,000.

Gaurav purchased goods from Saurab for Rs.30,000 and Saurab allowed him Trade Discount of Rs.3,000.

He sold goods to Ramesh against cash Rs.20,000 and allowed him Cash Discount of Rs.400.

Paid salary to Suresh Rs.3,000.

Solution:

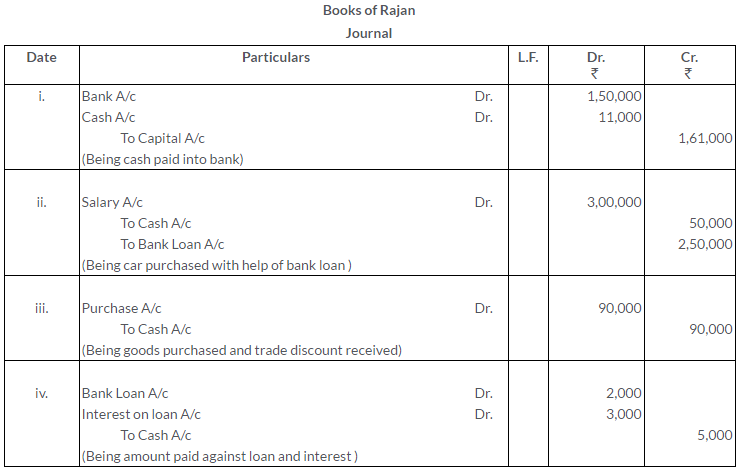

Question 17.

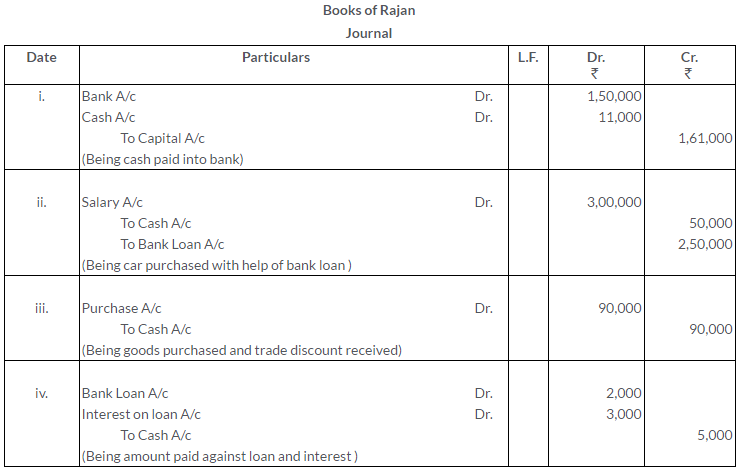

Journalise the following transactions:

Rajan commenced business by introducing capital in cash Rs.11,000 and by cheque Rs.1,50,000.

Purchased car for Rs.3,00,000 by taking loan of Rs.2,50.000 from bank.

Purchased goods for Rs.1,00,000 and availed Trade Discount of Rs.10,000.

Paid Rs.5,000 to bank as installment, Rs.2,000 towards principal and Rs.3,000 as interest.

Solution:

Question 18.

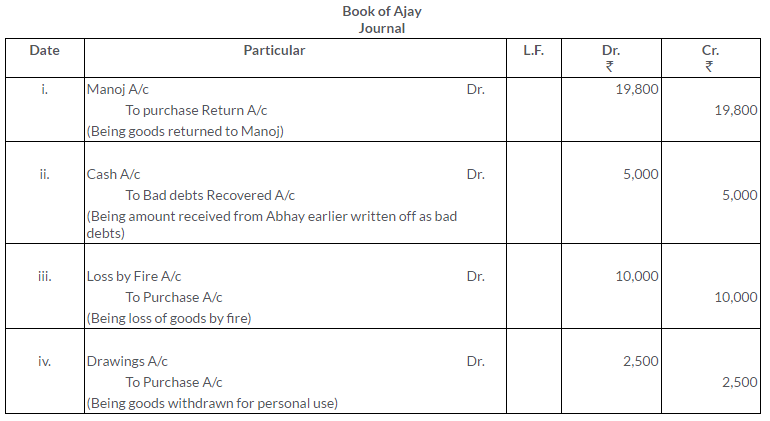

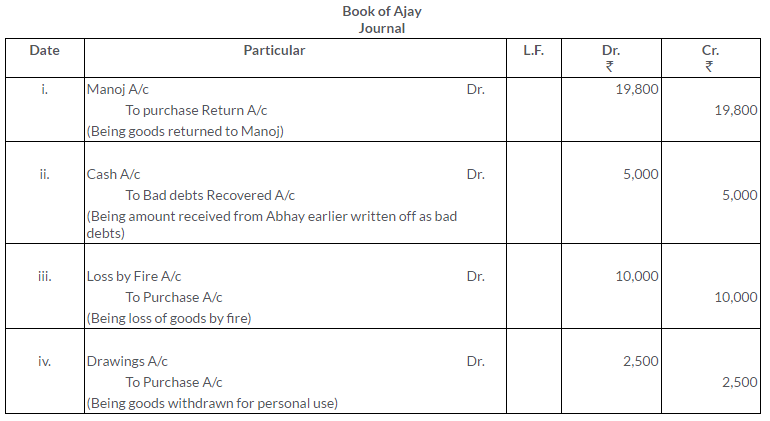

Journalise the following transactions in the books of Ajay:

Ajay returned goods purchased from Manoj Rs.22,000. He had availed Trade Discount of Rs.2,200 on the goods returned.

Ajay received Rs.5,000 from Abhay which he had earlier written off as Bad Debts.

A fire occurred in the godown of Ajay and he lost goods worth Rs.10,000. The stock was not insured.

Ajay took goods worth Rs.2,500 (Cost) for his personal use.

Solution:

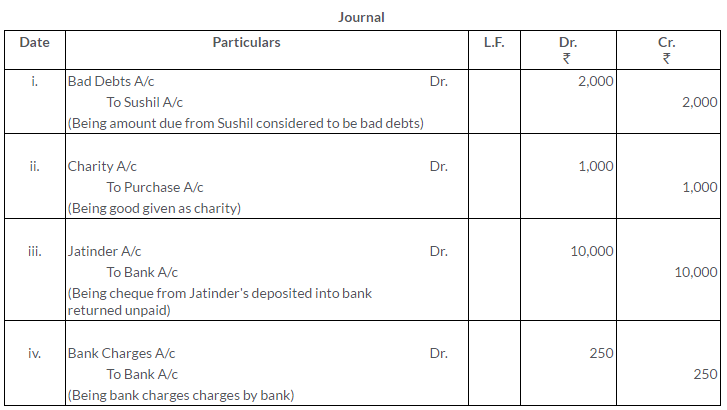

Question 19.

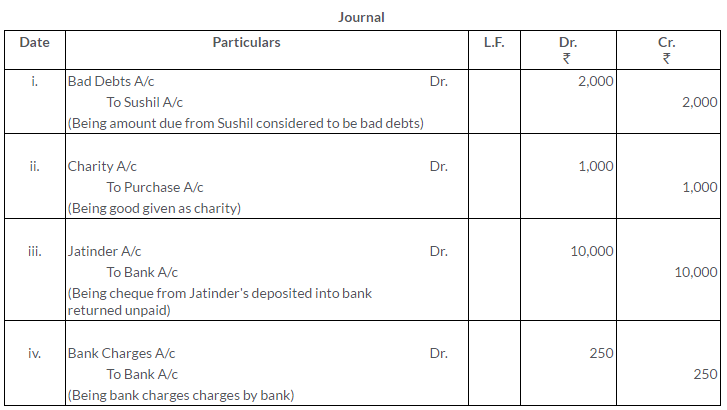

Journalise the following transactions in our books:

i. Amount due from Sushil Rs.2,000 is not recoverable.

ii. Goods purchased for Rs.1,000 given as charity.

iii. Cheque of Jatinder of Rs.10,000 deposited, returned unpaid.

iv. Bank charges charged by bank Rs.250.

Solution:

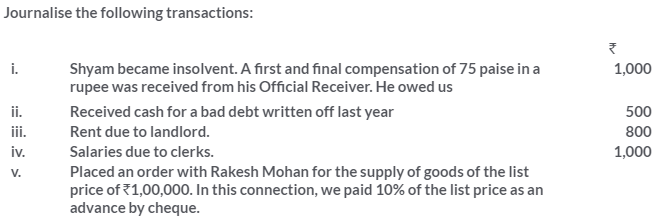

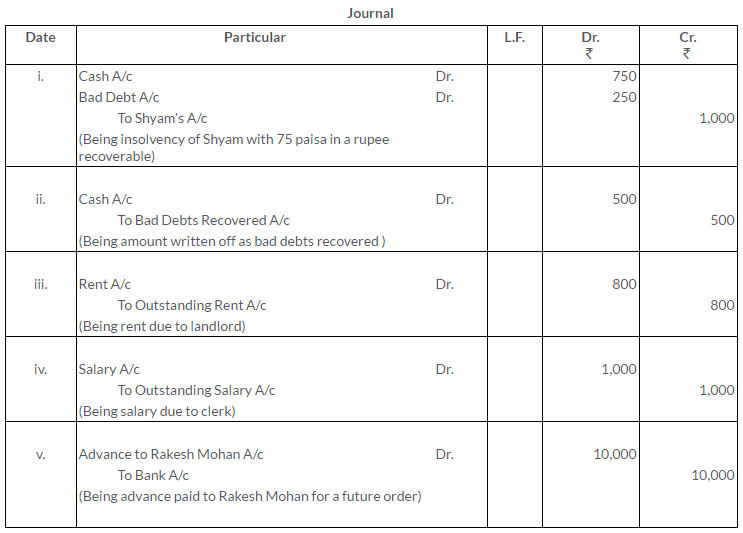

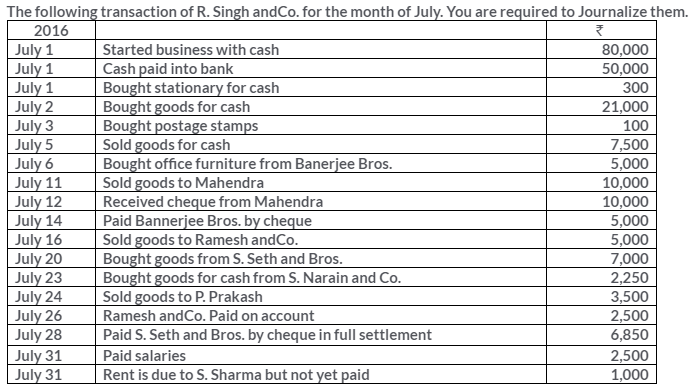

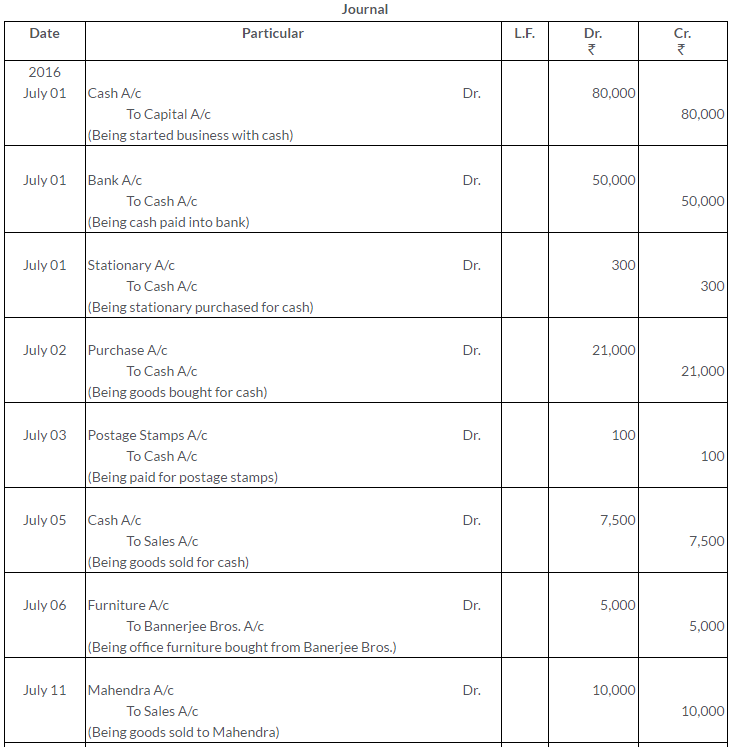

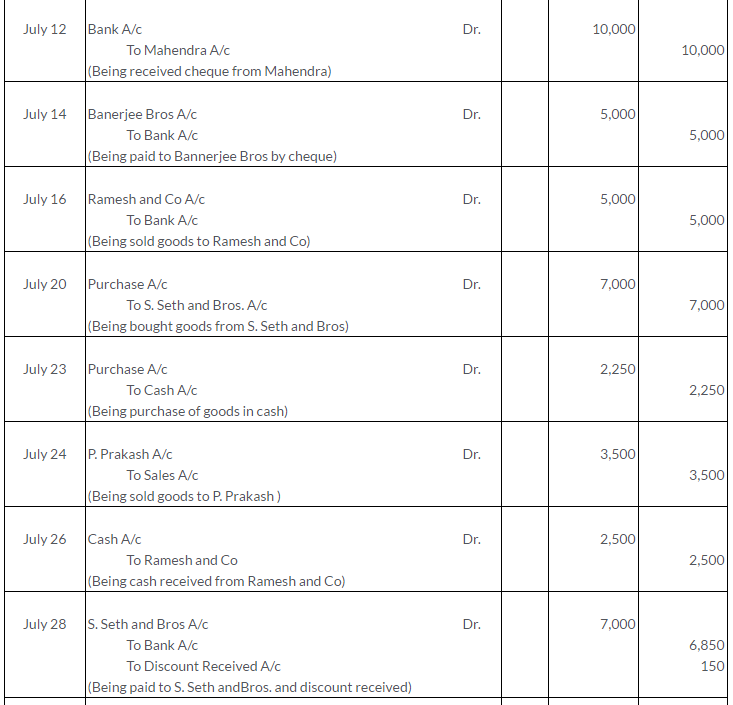

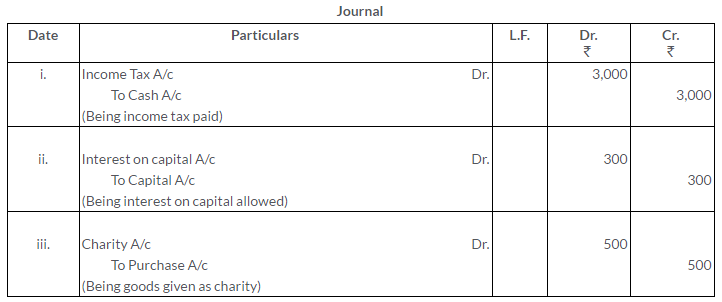

Question 20.

Solution:

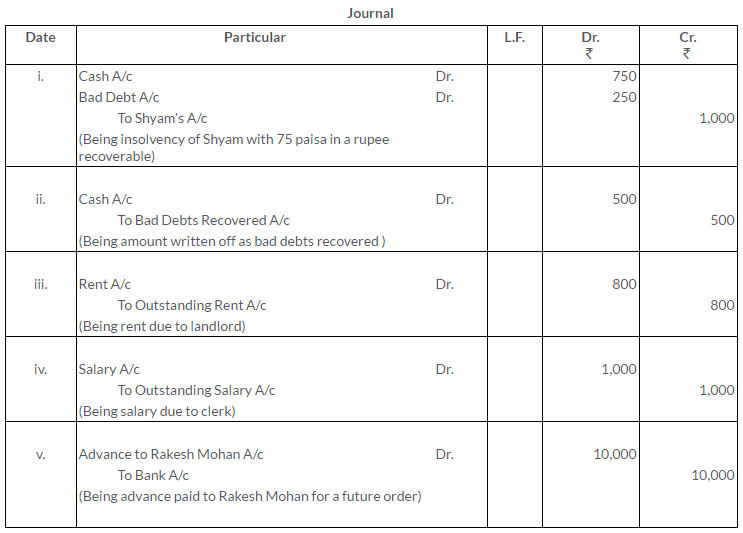

Question 21.

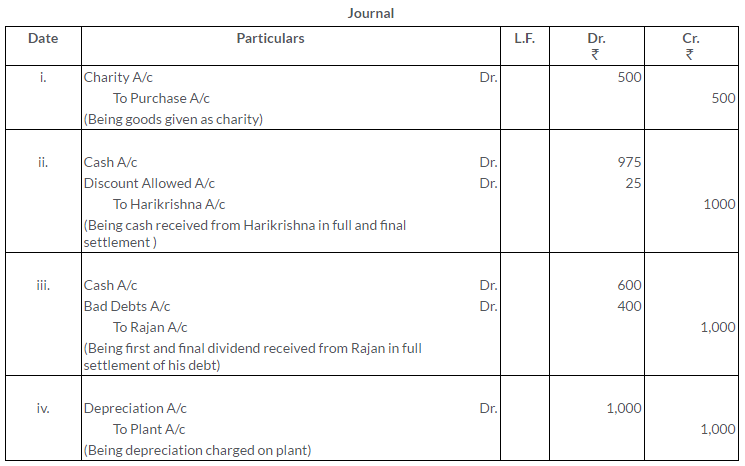

Journalise the following entries:

Goods worth Rs.500 given as charity.

Received Rs.975 from Harikrishna in full settlement of his account for Rs.1,000.

Received a first and final dividend of 60 paise in a rupee from the Official Receive Rajan, who owed us Rs.1,000.

Charged depreciation on plant Rs.1,000.

Solution:

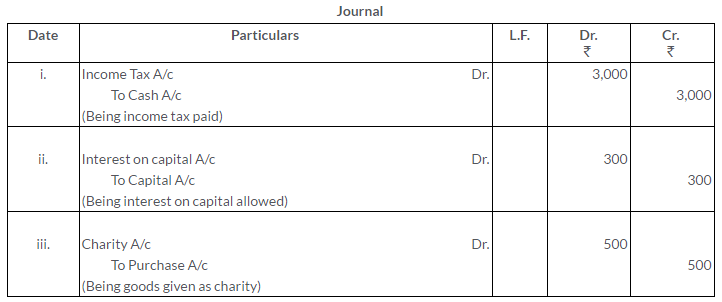

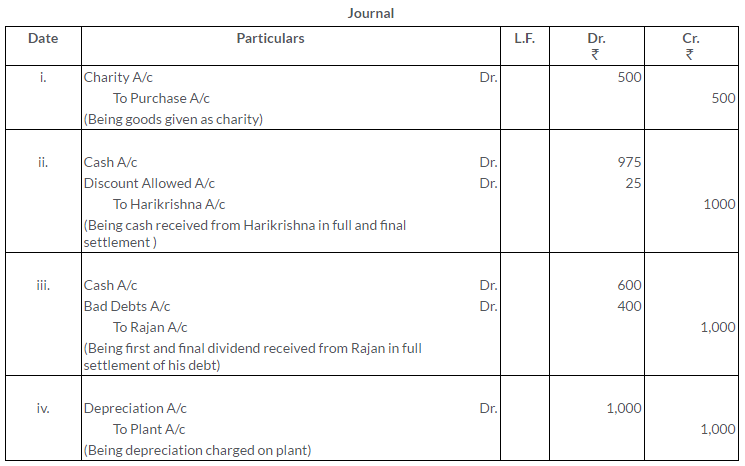

Question 22.

Journalise the following transactions with narration:

i. Paid Income Tax Rs.3,000.

ii. Interest on Capital Rs.300.

iii. Goods worth Rs.500 given as charity.

Solution:

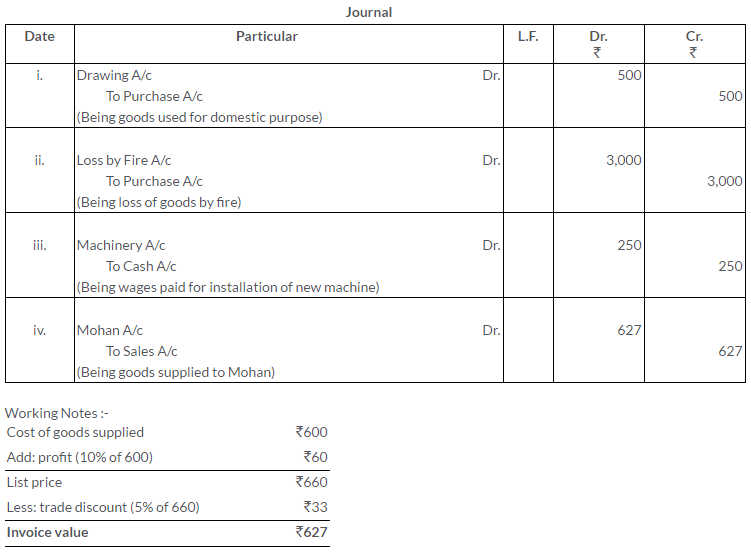

Question 23.

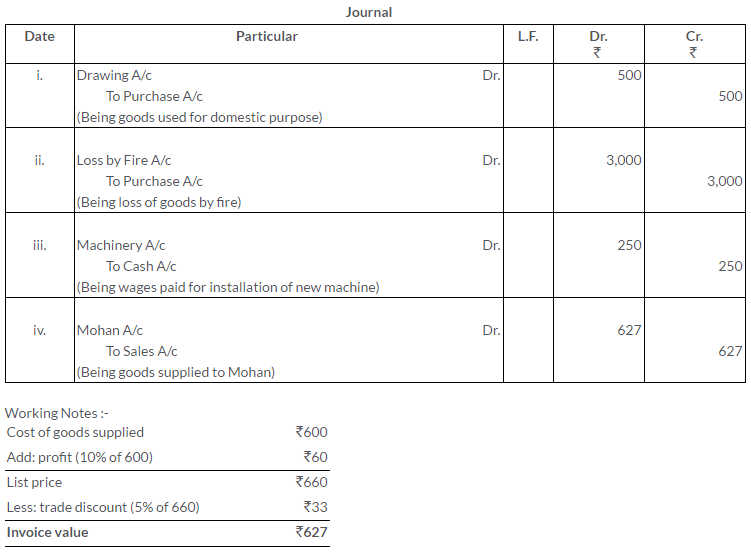

Journalise the following:

i. Goods worth Rs.500 were used by the proprietor for domestic purposes.

ii. Goods uninsured worth Rs.3,000 were destroyed by fire.

iii. Paid Rs.250 as wages on installation of a new machine.

iv. Supplied goods costing Rs.600 to Mohan issued at 10% above cost less 5% Trade Discount.

Solution:

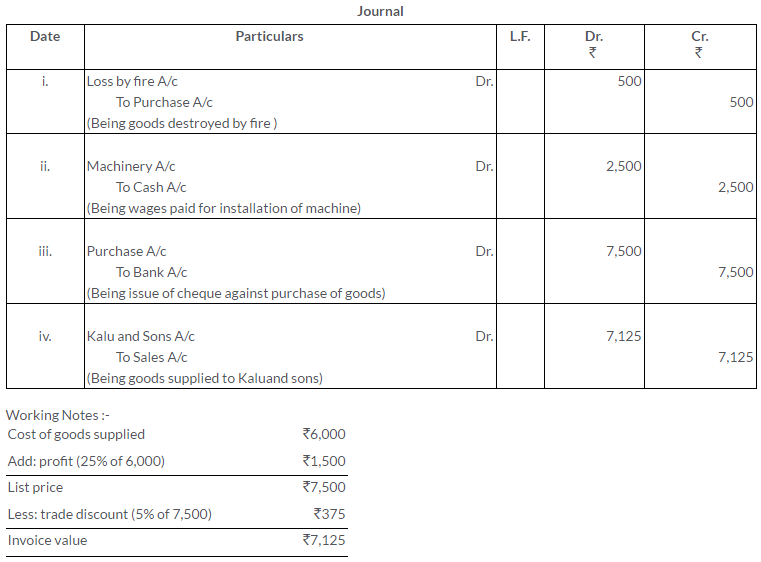

Question 24.

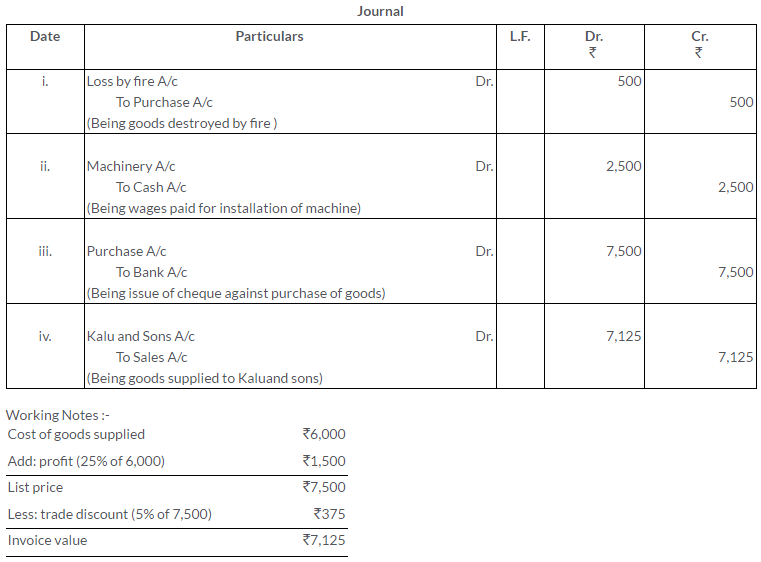

Journalise the following transactions:

Goods destroyed by fire Rs.500.

Paid Rs.2,500 in cash as wages on installation of a machinery.

Issued a cheque in favour of M/s. Parmatma Singh and Sons on account of purchase goods worth Rs.7,500.

Goods sold costingRs.6,000 to M/s Kalu Sons at an invoice price 25% above cost less 5% Trade Discount.

Solution:

Question 25.

Prepare the journal from the transactions given below:

i. Rent outstanding Rs.5,000.

ii. Received interest on loan from the debtor Rs.25,000.

iii. Provided interest on capital (Rs.50,000) at 6% for six months.

iv. Received Rs.780 from Surinder in full settlement of debt to his account for Rs.800.

Solution:

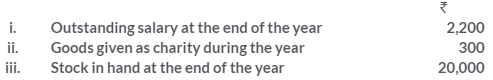

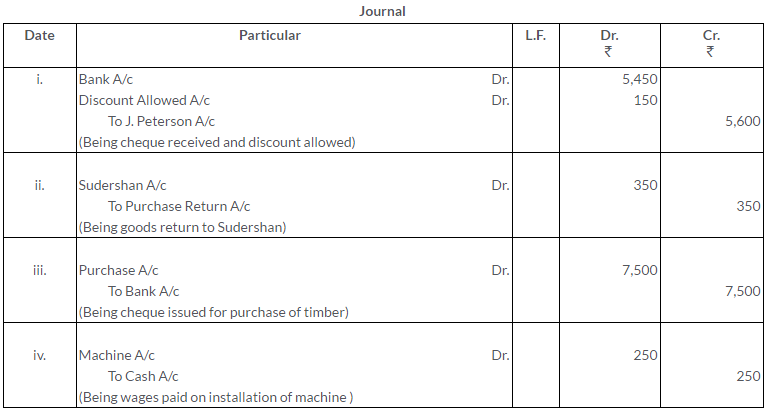

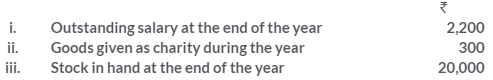

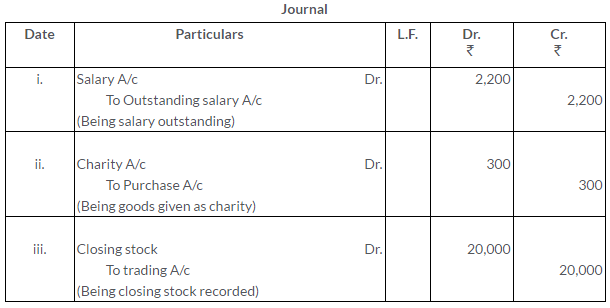

Question 26.

At the end of an accounting year, a trader finds that no entry has been passed in the books of account in respect of the following transactions:

Solution:

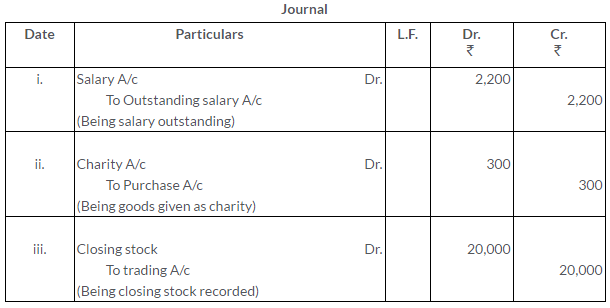

Question 27.

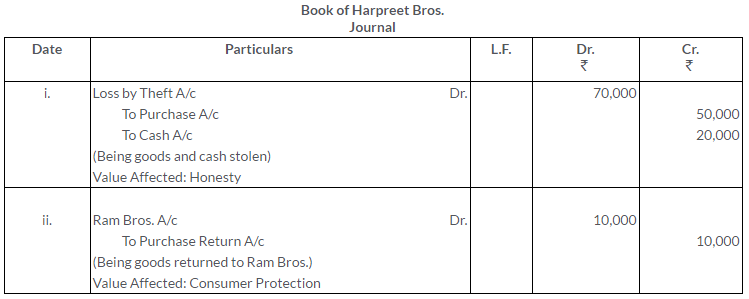

Journalise the following transactions in the books of Harpreet Bros:

i. Goods worth Rs.50,000 and Cash Rs.20,000 were stolen by an employee.

ii. Goods costingRs.10,000 were returned to Ram Bros. as the goods were hazardous for the health of the consumers.

Also give value affected in each of the above case.

Solution:

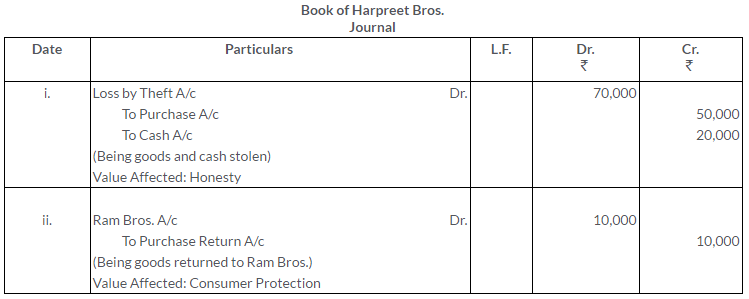

Question 28.

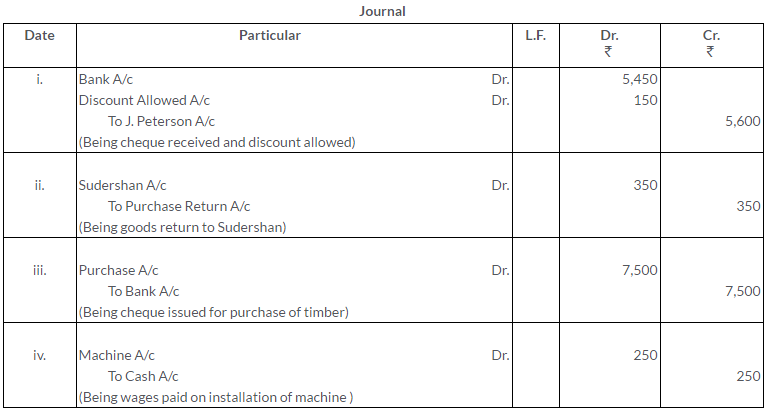

Journalise the following:

i. Received a cheque from J. Peterson Rs.5,450. Allowed him discount of Rs.150.

ii. Returned goods to Sudershan of the value of Rs.350.

iii. Issued a cheque in flavor of M/s Karanvir Timber Company on account of the purchase of timber worth Rs.7,500.

iv. Paid Rs.250 in cash as wages on installation of a machine.

Solution:

Question 29.

Journalise the following transactions in the books of M/s. Hari Ram:

i. Rahul who owned Rs.5,000 was declared insolvent and 60 paise in a rupee are received as final compensation.

ii. Out of insurance paid this year, Rs.3,000 is related to next year.

iii. Provide depreciation @10% on furniture costing Rs.10,000 for 9 months.

Solution:

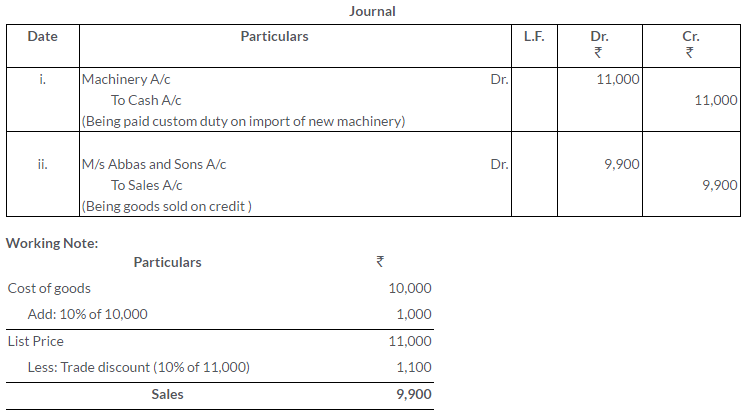

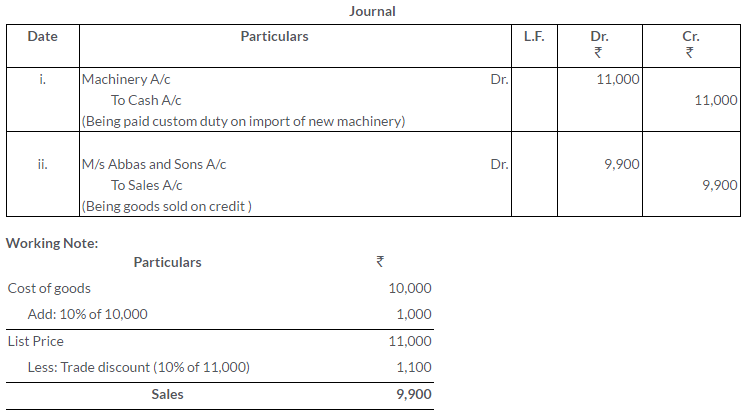

Question 30.

Journalise the following transactions:

i. Paid customs duty Rs.11,000 in cash on import of a new machinery.

ii. Goods sold costing Rs.10,000 to M/s Abbas and sons at an invoice price 10% above cost less 10% trade discount.

Solution:

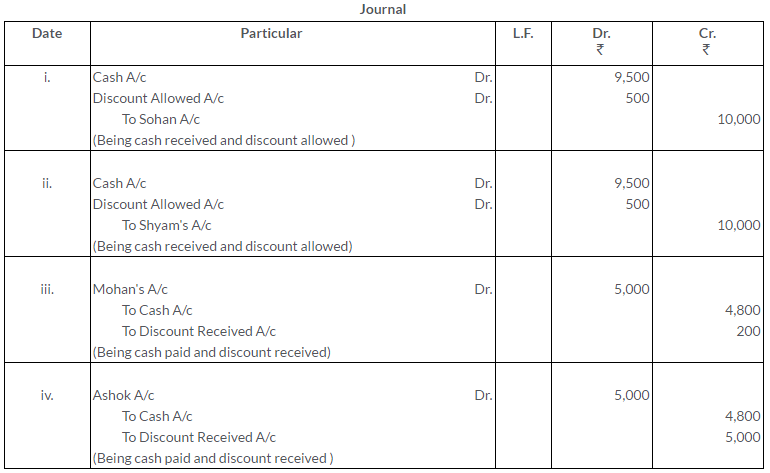

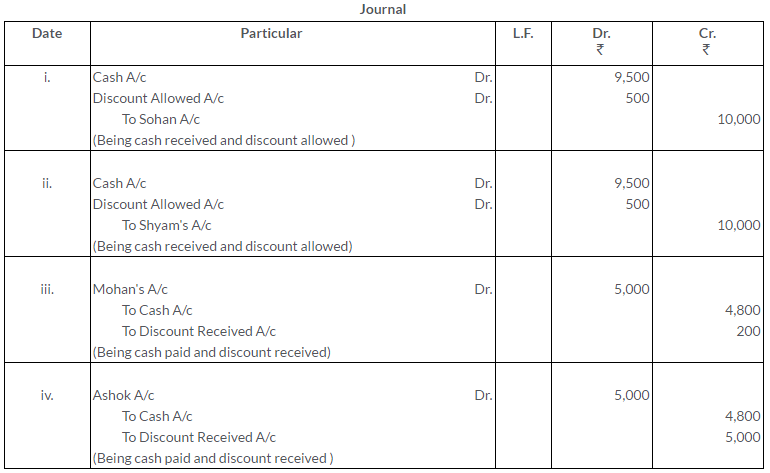

Question 31.

Journalise the following transactions in the books of Gaurav:

i. Received Rs.9,500 from Sohan in full settlement of his account for Rs.10,000.

ii. Received Rs.9,500 from Shyam on his account for Rs.10,000.

iii. Paid Rs.4,800 to Mohan in full settlement of his account for Rs.5,000.

iv. Paid Rs.4,800 to Ashok on his account for Rs.5,000.

Solution:

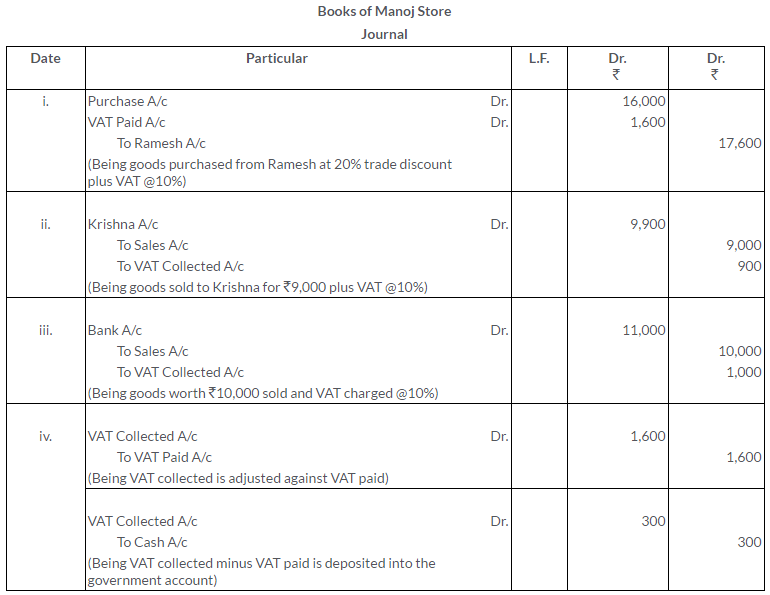

Question 32.

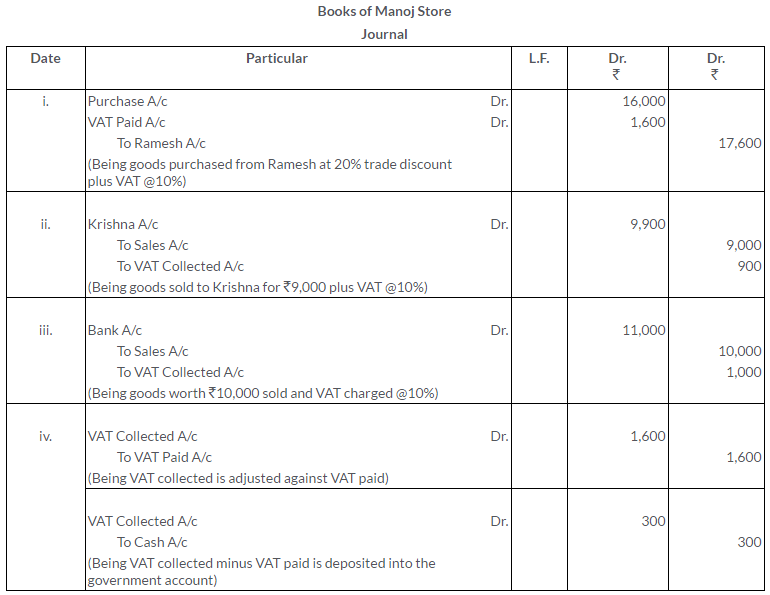

Journalise the following transactions in the books of Manoj Store:

i. Purchased goods from Ramesh Rs.20,000 less trade discount at 20% plus VAT @10%

ii. Sold goods costing Rs.7,000 to Krishna for Rs.9,000 plus VAT @10%

iii. Sold goods for Rs.10,000 and charged VAT @10% against cheque.

iv. VAT was deposited into government account on due date.

Solution:

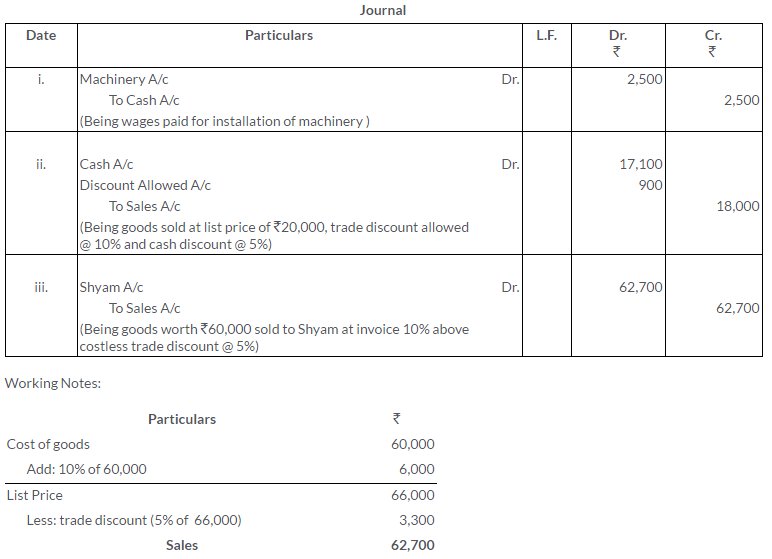

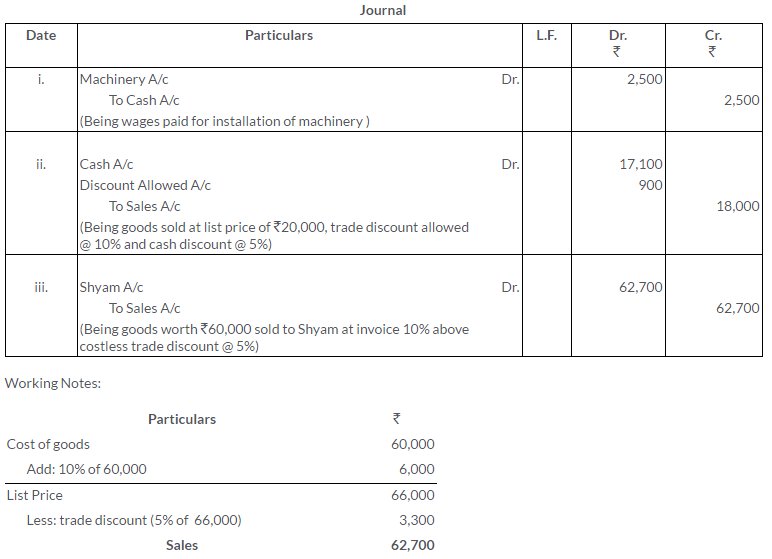

Question 33.

Journalise the following transactions :

i. Paid Rs.2,500 in cash as wages on installation of a machine.

ii. Sold goods to kitty at a list price of Rs.20,000. Sales subject to 10% trade discount and 5% cash discount if payment is made immediately. Kitty availed cash discount.

iii. Supplied goods costing Rs.60,000 to Shyam. Issued invoice at 10% above cost less 5% trade discount.

Solution:

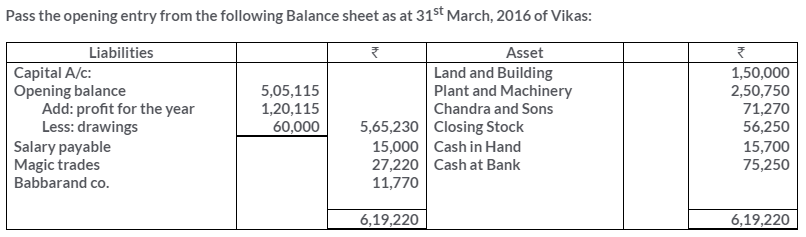

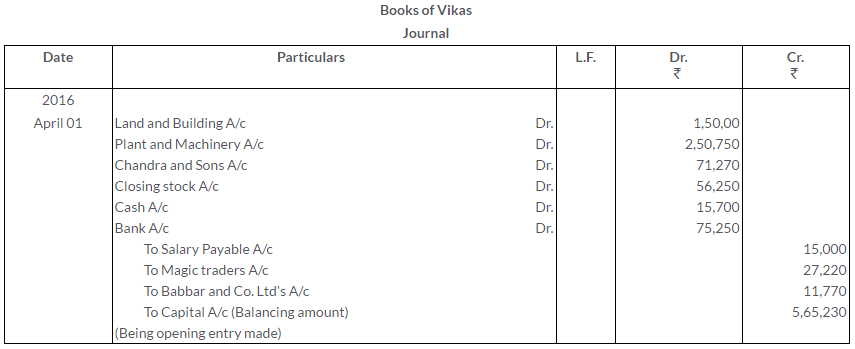

Question 34.

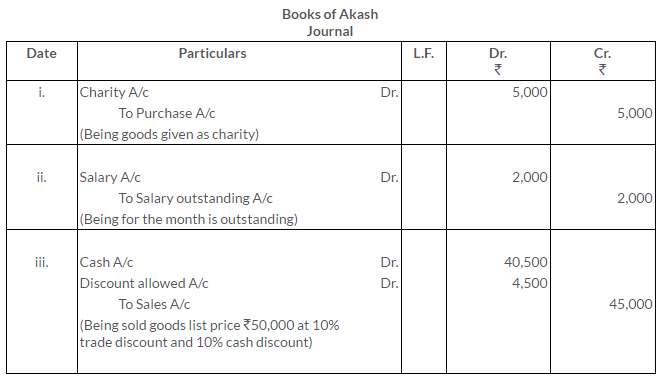

Solution:

Question 35.

Solution:

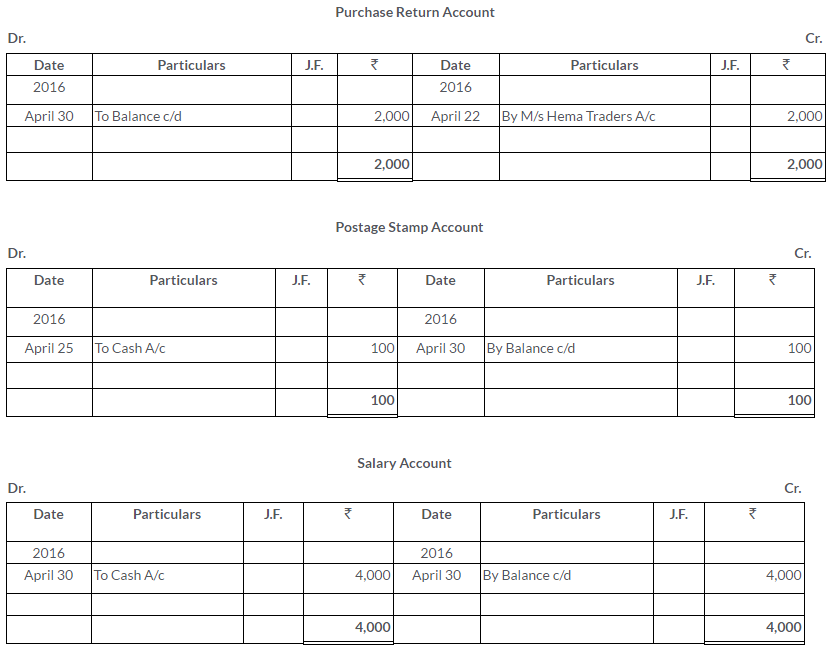

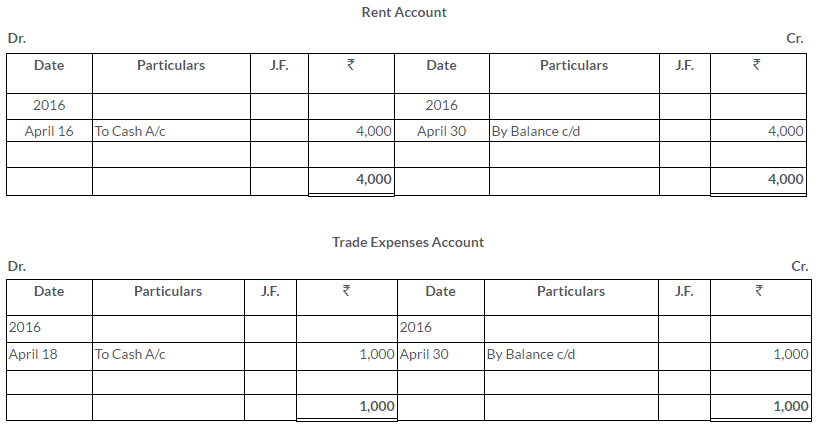

Question 36.

Solution:

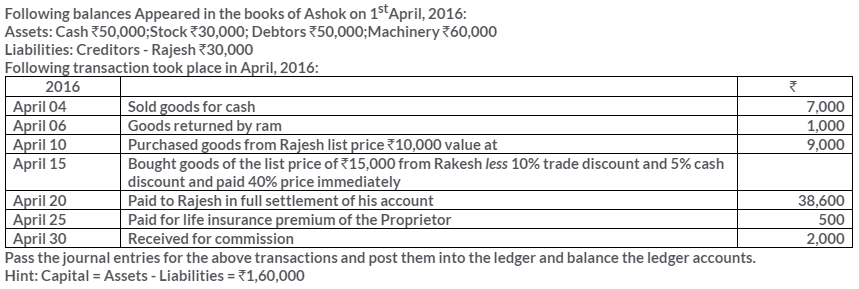

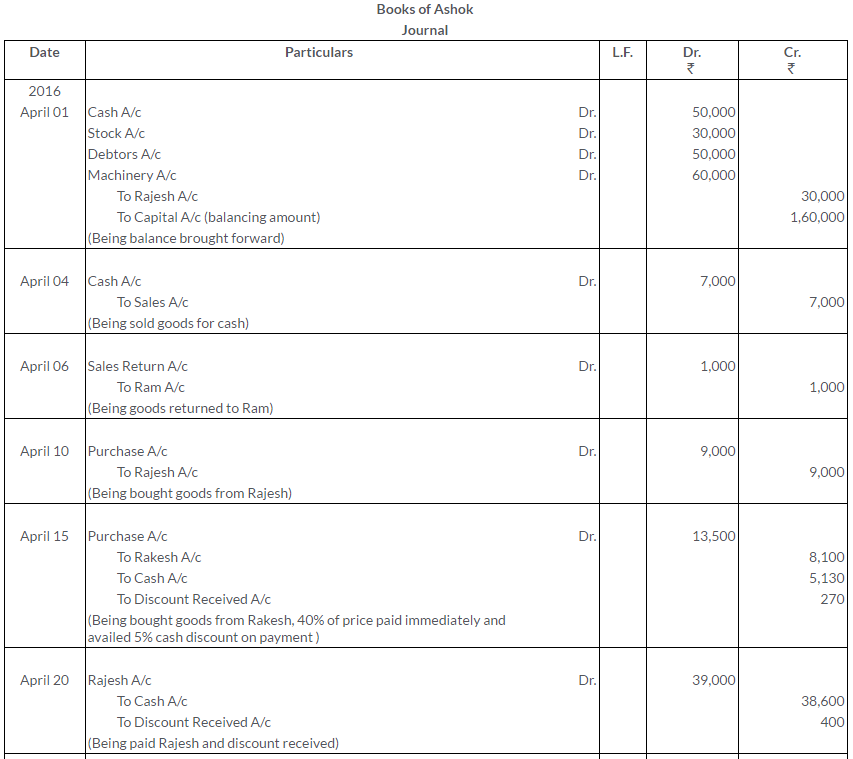

Question 37.

Solution:

Question 38.

Solution:

Question 39.

Solution:

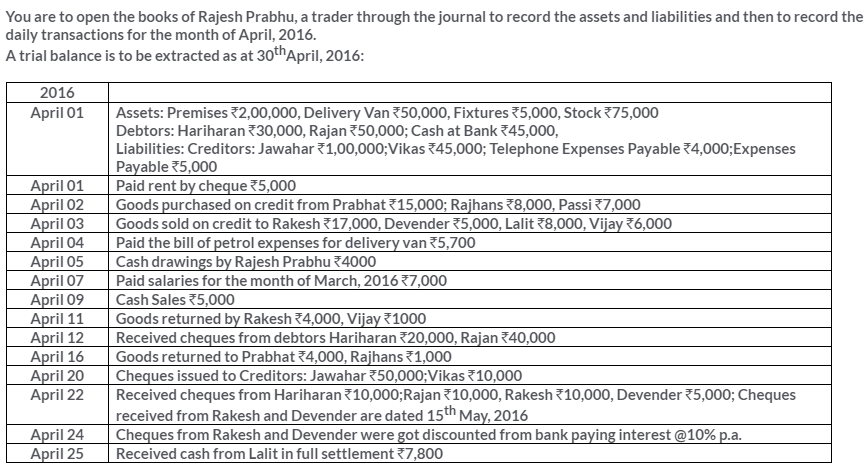

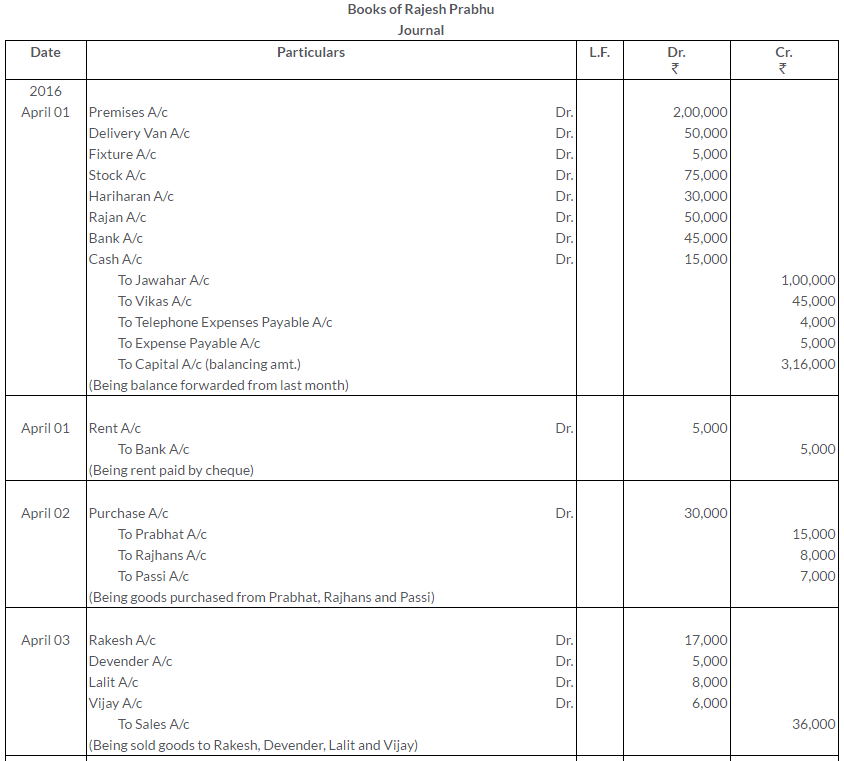

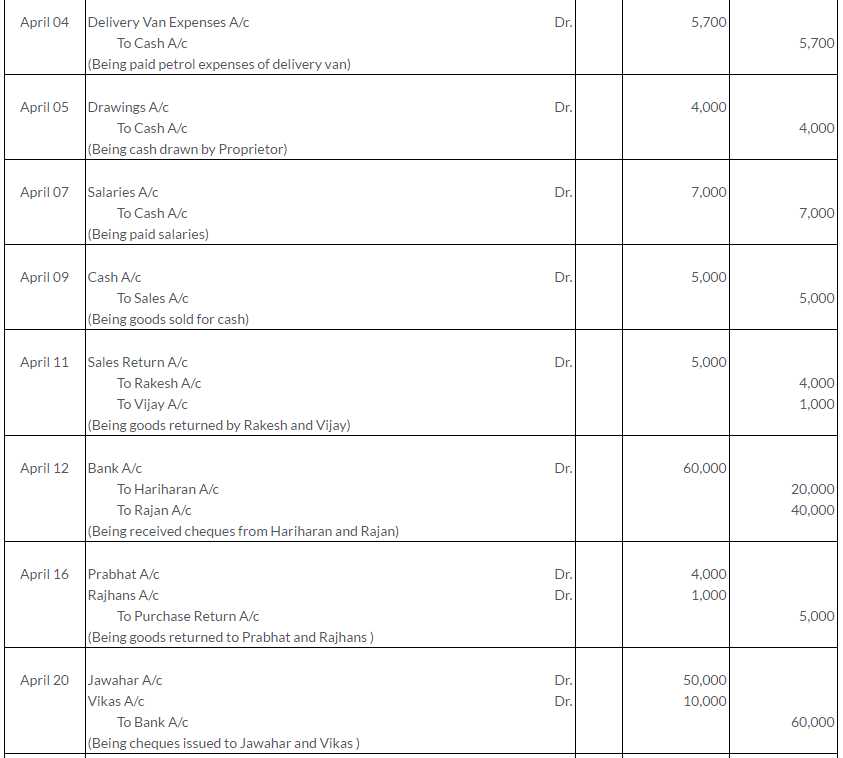

Question 40.

Solution:

Question 41.

Solution:

Question 42.

Solution: