[docxpresso file=”https://www.imperialstudy.com/wp-content/uploads/2019/02/ch5.odt” comments=”true” SVG=”true”]

Category: Class 12th

-

Reconstitution of a Partnership Firm — Retirement/Death of a Partner Notes Class 12 Accountancy.

[docxpresso file=”https://www.imperialstudy.com/wp-content/uploads/2019/02/ch4.odt” comments=”true” SVG=”true”]

-

Reconstitution of a Partnership Firm — Admission of a Partner Notes Class 12 Accountancy.

[docxpresso file=”https://www.imperialstudy.com/wp-content/uploads/2019/02/ch3.odt” comments=”true” SVG=”true”]

-

Chapter 3 – Reconstitution of Partnership Firm Notes Class 12 Accountancy.

[docxpresso file=”https://www.imperialstudy.com/wp-content/uploads/2019/02/ch2.odt” comments=”true” SVG=”true”]

-

Notes of Accounting for Not-for-Profit Organisation Class 12 Accountancy.

[docxpresso file=”https://www.imperialstudy.com/wp-content/uploads/2019/02/ch1.odt” comments=”true” SVG=”true”]

-

CBSE Notes of Business Studies Textbook Class 12th

Business Studies Class 12 Revision Notes

- Nature and Significance of Management Business Studies Class 12 Notes

- Principles of Management Business Studies Class 12 Notes

- Business Environment Business Studies Class 12 Notes

- Planning Business Studies Class 12 Notes

- Organising Business Studies Class 12 Notes

- Staffing Business Studies Class 12 Notes

- Directing Business Studies Class 12 Notes

- Controlling Business Studies Class 12 Notes

- Financial Management Business Studies Class 12 Notes

- Financial Market Business Studies Class 12 Notes

- Marketing Business Studies Class 12 Notes

- Consumer Protection Business Studies Class 12 Notes

-

Notes of Consumer Protection Business Studies Class 12

UNIT 12

Protecting consumers from unpair trade practices, adopted by the producers

and/or sellers of goods and services is termed as consumer protection. It not

only includes educating consumers about their rights and responsibilities, but

also helps in getting their grievances redressed.

Importance of consumer protection from consumer s point of view :

- Consumers Ignorance : Majority of consumers are not aware of their rights and reliefs available to them as a result of which they are exploited. In order to save consumers from exploitation, consumer protection is needed.

- Unorganised Consumers : In India consumers are still unorganised and there is lack of consumer organisations also, thus consumer protection is required.

- Widespread exploitation of Consumers : Consumers are exploited on large scale by means of various unfair trade practices and consumer protection is required to protect them from exploitation.

Importance of Consumer Protection from the Point View of Business

- Long term business interest : It is always in the interest of the business to keep its customer satisfied, Global competition could be win only after satisfying customers. Satisfied customers lead to repeat sales and help in increasing customer base of business.

- Moral Justification : It is the moral duty of any business to take care of consumer interest & avoid any form of their exploitation & unfair trade practices like defective & unsafe products, adultration, false & misleading advertising, hoardings black marketing etc.

- Business uses society s resources : Every business uses the resources of the society and thus it is their responsibility to work in the interest of the society.

92 XII – Business Studies

4.

Social Responsibility : A business has social responsibilities towards various groups like owner, workers, government, customers etc. Thus, customers should be provided qualitative goods at reasonable prices.

5.

Government Intervention : If a business engage in any form of unfair trade practices then government take action against it, which adversely affect its goodwill.

CONSUMER PROTECTION ACT, 1986 (CPA, 1986)

Consumer protection Act 1986 was introduced to make consumers aware about their rights and to give them legal protection. According to it consumer is defined as follows.

1.

Any person who buys any goods for a consideration It includes any user of such goods with the approval of the buyer. But it does not include a person who obtains goods for resale or any commercial purpose.

2.

Any person who avails any services for a consideration. It includes any beneficiary of such services but it does not include a person who avails such service for any commercial purpose.

Rights of a Consumer

Consumer protection Act, 1986 has provided six rights to the consumer, which are as follows:

1.

Right to Safety : Consumer has the right to be protected against products, & services which are hazardous to health & life (should use ISI marked electric products)

2.

Right to be informed : Consumer has right to have complete information about the product before buying it.

3.

Right to choose : Consumer has a right to choose any product out of the available products as per his own decision/liking.

4.

Right to be heard : Consumer has the right to file a complaint & to be heard in case of dissatisfaction with goods or services (use of grievance cell)

5.

Right to Seek Redressal : Consumer has the right to get relief in case the product or service falls short of his expectations or is dangerous. He may be provided with replacement / removal of defect / compensation for any loss.

93 XII – Business Studies

6. Right to consumer education : Consumer has right to acquire knowledge & to be well informed consumer throughout life. It make consumer aware all the time.

Responsibilities / Duties of a Consumer

- Consumer must exercise his right : Consumer must be aware of their rights with regard to the product or services they buy from the market.

- Consumer must be a cautions consumer : While buying a product or services, a consumer should read labels carefully to learn about its every minute detail.

- Consumer must file a complaint in a appropriate forum in case of any shortcoming in product / service availed.

- Consumer must insist on cash memo ; i.e. a proof of purchase & required to file a complaint.

- Consumer must be a quality conscious : He should ask / look for ISI mark on electric goods. FPO mark on food products, Hall mark on jewellery etc.

- Consumer must bring the discrepancy in the advertisement to the notice of the sponsor.

THE SALIENT FEATURES AND PROVISIONS OF CONSUMER PROTECTION ACT, 1986

Why was consumer protection act, 1986 enacted

To protect & promote the interests of the cousumers by providing various rights to them.

Under what circumstances complaints can be filed ?

Frandulent practices of traders & manufactures.

Goods are defective

Any deficiency in the services hired.

Redressal agencies under the consumer Protection Act 1986.

District forum State Commission National commission

Within what period the complaint must be filed ?

With in 3 months of purchase & if some testing of goods is required then with in 5 months.

Who can file a complaint.

Any consumer

Any registered consumer association.

Central / State Govts.

Legal heir / representation of a a deceased customer.

Relief Available to Consumers (Remedies)

- To remove the defect in goods or services.

- To replace the defective product with a new one free from defect.

- To refund the price paid for the product/Service.

- To pay compensation for the loss or injury suffered by the consumer due to product/Service.

- To discontinue the unfair trade practice & not to repeat them.

- To withdraw the hazardous goods from sale.

Role and Functions of Consumer Organisation & NGOs.

- Educating the general public about consumer right by organising training programmes, seminars and workshops.

- Publishing periodical & other publications.

- Providing Legal assistance to consumers.

- Producing films or cassettes on food adultration, misuse of drugs etc.

- Filing complaints in appropriate consumer courts on behalf of consumers.

Ways And Means of Consumer Protection.

1. Government : Protcts the interest of consumers by enacting various legislations like CPA 1986, Sale of goods Act 1930, Bureau of Indian Standard 1986 etc. Consumer Protection Act provides for a three-tier machinery at the district, state & national level for speedy & inexpensive redressal of consumer grievances.

- Consumer Organisation : Force business firms to avoid malpractices & exploitation of consumers.

- e.g. Consumer coordination council, Delhi.

- Common cause, Delhi

- Consumers Association, Kolkata.

- Mumbai Grahak Panchyat, Mumbai etc.

- Business Association : The associations of trade, commerce & business like federation of Indian Chambers of commerce (FICCI) & Confederation of Indian Industries (CII) have laid down their code of conduct for their members in their dealings with the customers.

IMPORTANT QUESTIONS :

- What are the two aspect of consumer prolection?

(Hint – Educating consumers & Redressal of their grievances)

- Give one example of consumer exploitation?

(unsafe products / Black marketing)

- Name any two legitalations which provide protection to consumers (Hint : (i) CPA 1986, The Essential Commodities Act 1955)

- Mention any two ways & means of consumer protection.

(Hint – Consumer organisation & Govt.)

- Which mark is issued under the Bureau of Indian Standard Act 1986 ? (Hint : ISI)

- Explain the role of Universities & schools in counsumer protection?

- Explain briefly the silent features of consumer protection Act 1986?

UNIT 13

A project means an activity which has a special purpose and which is performed with absolute devotion and enthusiasm

Project work assigned to the students whether individually or in groups. It has two types as

- Visit of a Industrial unit as Bank, Stock Exchange or a mall.

- Case study of a product as packing, branding and labelling.

Objects of a Project

- Providing deep knowledge to the students

- Developing Creativity in the students

- Developing independent thinking skill in the student.

- To convert theoretical knowledge into practical knowledge.

- Selection of topic or problem

- Define the problem.

- Setting objectives of the problem.

- Preparing questionnaire.

- Conducting enquiry

- Collect information and Data

- Editing the information or data

- Analysing the Data or Information

- Preparing the Report

97 XII – Business Studies

The marks will be allocated on the following head by C.B.S.E.

1.

Inititative, cooperativeness and participation

1 Mark

2.

Creativity in presentation

1 Mark

3.

Context, observation and research work

2 Marks

4.

Analysis of situations

2 Marks

5.

Viva

4 Marks

Total 10 marks

1.

Principles of Management :

1.

Division of work

2.

Unity of Command

3.

Unity of direction

4.

Remuneration to employees

5.

Scalar chain

6.

Functional foremanship

7.

Time study

8.

Motion study

9.

Fatique study.

2.

Business Environment :

1.

Effect of New Industrial Policy

2.

New Trade Policy

3.

Orginisation :

1.

Departmentalization

4.

Staffing :

1.

On the Job Training

2.

Off the Job Training

- Financial Management :

- Stock Exchange

(A) B.S.E. (B) N.S.E.

- Trading procedure on stock exchange.

- Procedure of opening the following A/c, saving A/c, Trading A/c, D Mat A/c

- Marketing Management :

- Branding

- Labelling

- Packaging

- Types or levels of channel of distrubution

- Methods of Sales promotion

- Consumer Protection :

1. Advertisement of the ISI Mark, Hall Mark, Agmark.

-

Notes of Marketing Business Studies Class 12

UNIT 11

Marketing management is an important functional area of business.

– It is the process of planning, organising, directing and controlling the activities related to marketing of goods and services to satisfy customers needs & achieve organisational goals.

In the traditional sense, the market means a place where buyers & sellers gather to enter into transaction involving the exchange of goods & services. But in modern sense, market refers to meeting of buyers and sellers at a place, by telephone or by internet etc.

Markerting is a social process whereby people exchange goods & services for money or for something of vaue to them. Any thing that is of value to the other can be marketed e.g.

1.

Physical Products

– T.V. Mobile phone etc.

2.

Services

– Insurance, education etc.

3.

Person

– Selection for different posts.

4.

Place

– Agra Taj Mahal , etc.

Importance features of Marketing :-

- Need and want : Satisfaction of the needs and wants of individuals and organisations.

- Creating a market offering : Complete offer for a product of service.

- Customer value : greatest benefit or value for the money.

- Exchange mechanism : Exchange of products / services for money / value.

Functions of Marketing / Marketing activities

- Marketing research : Gathering and analysing marketing information i.e. what the customers want to buy, when they are likely to buy in what quantitis do they buy, from where do they buy etc.

- Marketing planning : Specific plan for increasing the level of production, promotion of the products etc and specify the action programmes to achieve these objectives.

- Product designing and development ; Marketer must take decision like, what-product? Which model / size ? brand name? Packaged ? quality level? So that customer needs are satisfied.

- Buying & assembling : e.g. car. Raw material like steel, tyres, batteries, seats, stearing wheels etc are bought & them assembled in the form of a complete product.

- Packing / Labelling : designing the package & labelling.

- Branding : Creating a distinct identity of the product from that of competitors e.g. Videocon washing machine.

Concepts & Philosophies of Marketing :-

- Production concept : Profits could be maximised by producing products at a large scale, thereby reducing average cost of production.

Drawback : Customer donot always buy inexpensive products.

- Product concept : Business goals lies in making high quality products as customer favour them.

- Sales Concept : Firms must undertake aggresive selling & promotion efforts to make customers buy their products.

Marketing management means management of the marketing function which

are

- Choosing a target market.

- Creation of demand

- Creating, developing & communicating superior value for the customers.

- Market Shares.

- Goodwill

- Planning & controlling marketing activities.

Marketing mix refers to ingredients or the tools or the variables which the markets mixes in order to interact with a particular markets.

Elements / 4 Ps of Marketing mix

1. Product Mix : Product live e.g. Hindustan Lever Limited – Colgate, lifebouy etc.

Elements

Branding Packaging Labelling

2. Price Mix : Value (Money) in lieu of product / Service recieved by seller from a buyer.

3. Promotion mix : informing the customers about the products & pursuading them to buy the same.

4. Place Mix : Physical distribution : Various decision regarding distribution of products.

- Channels of distribution : Whether wholesalers, retailors to be used or not.

- Physical movement of the products from producer to consumers.

- Storage, transportation, managing inventory (stock) etc.

Product is anything that can be offered to a market to satify a want or need.

- Consumer Product : Purchased by the ultimate consumers for personal needs.

e.g. Soap, toothpaste, textile etc.

- Industrial Products : Used as inputs in producing other products eg. raw materials, toots etc.

Detailed Study of 4 P s (Elements) of Marketing Mix :

PRODUCT MIX Three components are

1. i) Branding – giving a name / a sign / a symbol etc to a product eg. :Pepsi –

Nike

Qualities of a good Brand Name :

- Simple and short : A brand name should be simple and short as Tata, Bata.

- Easily Pronunceable : A brand name should be easily pronunceable as Lux, Dalda.

- Suggestive : Brand name should be self explanatory that suggesting the inherent quality of the product as Ujjala suggest more whiteness.

- Distinctive : Brand name should be so distinctive that it highlights itself in the group of other brand name such as : Tide, Perk.

- Brand name helps in advertising in an easier way.

- Brand name establishes permanent identity of the product.

- Branded products can be easily identified by consumers.

- Brand name promotes repurchasing.

2. ii) Packaging : Act of designing and producing the container or wrapper of a product.

– Good packaging often helps in selling the product so it is called a silent salesman.

- Product Identification : Packaging help in identification of the product.

- Product Protection : The main function of the packing is to provide protection to the product from dirt, insect and breakage.

- Convenience : It provides convenience in carriage, stocking and in consuming.

Product Promotion : Packaging simplifies the work of sales promotion.

- Rising standards of Health and Sanitations : The people are becoming health conscious they like to buy packed goods. The reason is that the chances of adulteration in such goods are minimised.

- Innovational Opportunity : With the increasing use of packaging more innovational opportunity becomes available in this area for the researchers.

- Product Differentiation : Packing is helpful in creating product differentiation. The colour, material and size of the package makes differences in the quantity of the product.

3) Labelling – Description of the product, its contents, the manufacturers,

date & time of manufacturing

– Helps in promotion / grading / identifying the product.

Function of Labelling :

- Describe the product and specify its contents.

- Grading of Product

- Identification of the Product or Brand.

- Help in promotion of Product.

- Providing information required by law.

Price, pricing strategies, Price determination.

Price – Amount of money paid by a buyer (or recieved by a seller) in

consideration of the purchase of product or a services.

Pricing Strategies Price skimming – higher prices at initial stages to recover fixed costs.

Penetration pricing – Lower initial price to capture a large market.

Price determination / Factors affecting Pricing decisions

- Pricing objectives : affects price of product / service e.g. maximum profits in short term leads to high price.

- Product cost : Sets lower limits of the price.

- Extent of competition in the market : No competition means complete freedom in fixing its price.

- Utility & demand : More demand – Move price. Sometimes Less price – more demand depends upon the utility of the product.

Place Mix/ Physical Distribution Mix :

Covers all the activities required to physically move goods from manufacturers to the customers. Important activities includes.

- Order processing : Accurate & speedy order processing leads to profit & goodwill & vise versa.

- Transportation : Add value of the goods by moving them to the place where they are required.

- Inventory control : Additional demand can be met in less time, the need for inventory will also be low.

- Ware-housing : Need arises to fill the gap between the time of product is produced & the time it is required for consumption.

Direct Chennal – Manufacturer – Customer Indirect Chennal – Manufacturer – Retailer – customer

Manufacturer – wholesaler – Retailer – customer Manufacturer – Agent – wholesaler – Retailer customer

Factors Determining Choice of Channels of Distribution :-

Choice of appropriate channel of distribution is a very important marketing decision, which affects the performance of an organisation. Whether organisation will adopt direct marketing channels or long channels involving no. of intermediaries is a strategic decision.

Factors Determining Choice of Channels of Distribution

Market related Factor

- Size of the market – no of customers – more customers more intermediates

- Geographical concentration – concentrated buyers – direct selling spread customers – more intermediates

- Size or order – i.e. quantity purchase –

Less – more intermediates More – direct selling

It refers to combination of promotional tools used by an organisation to

achieve its communication objectives.

1. Advertising : Most commonly used tool of promotion. It is an impersonal

form of communication, which is paid by the marketers (sponsors) to

promote goods or services. Common mediums are newspaper ,

magazine , television & radio .

Role or Importance of Advertising :

- Enhancing customer satisfaction and confidence.

- Helpful in increasing the demand of existing product.

- Helpful to increase the Market Area.

- Helpful in generating more employment.

- Helpful in the economic development of the country.

- Knowledge of various product.

- No fear of exploitation.

Product Related Factor

- Nature of product – technical (made to order) – direct selling

- Penshable (direct / short channels); Non perishable – Long Channels.

- The unit value of the product – costly – direct selling,

- Product Complexity – Complex products – direct selling

Company related factor

- Financial strength of the company

- Strong – direct / own channel

- Weak – middleman required.

- Degree of control – Greater control Short/ direct channel.

- Management – Sufficient knowledge

- direct selling & Vice versa.

- Add to Cost

- Undermines social value.

- Confuses the buyers

- Encourages sale of inferior product.

- Some advertisement are in bad taste.

Short term incentives designed to encourage the buyers to make immediate purchase of a product / service.

1.

Rebate : Special price to clear off excess inventory.

2.

Discounts : Price reduced to induce buyers to buy

more.

3.

Sampling : Free sample of a product to customers to try product & learn about it.

4.

Lucky draw : Lucky draw coupon eg. purchase an win a car. etc.

easy product &

5.

Full Finance @ 0%

6.

Contests.

Personal selling consists of contacting prospective buyers of product personally.

Features of the Personal Selling :

- Personal contact is established under personal selling.

- Oral conversation.

- Quick solution of queries.

- Receipt of Additional Information.

- Development of reletionship.

Qualities of a good Salesman :

- Physical Qualities : Physical qualities include personality health, stamina and tolerance

- Mental Qualities : These include mainly skill, mental alertness, imagination and self confidence.

3. Social Qualities : These include social-abilities tact, sound character, sweet nature.

4. Vocational Qualities : It includes mainly knowledge of product, knowledge of competitive product, training and aptitude.

4.

Publicity : is a non-personal form of communication & against advertising it is a non-paid form of communication e.g. If a manufacturer develops a car engine runs on water instead of petrol & this news is covered by television/ radio/ newspaper, it would be termed as publicity as the manufacturer benefit from it without bearing any cost. Merit : Mass reach, more credibility Limitation : Not with in th control of firm.

Public Relations :

Public relations is the deliberate planned and sustained efforts to establish and maintain mutual under standing between an organisation and its public

Features of Public Relation :

1.

Securing cooperation of Public

2.

Satisfying different group.

3.

Engaging in dialogue

4.

It is ongoing activity.

5.

Succesful relation with public.

Role of Public Relation

1.

This is economical Medium

2.

Boosting sales

3.

Image Building

4.

Easy to attract the public

Tools to Establish Public Relations :

1.

Speech

2.

Printed Materials

3.

Public services Activities

4.

Events

89 XII – Business Studies

QUESTION : MARKETING MANAGEMENT

- Define marketing management in present context.

- Outline one objective of marketing management.

- What is marketing research?

- What is meant by product Mix?

- What is a trade mark?

- Which marketing philosophy gives more importance to consumer welfare instead of consumer satisfaction.

- State any one Pillar of marketing concept.

- Name the channel where in goods are made directly available by the manufacturer to consumers without involving any intermediary.

- A lunch box free with Kissan Sauce is an example of the techniques of sales promotion. Name the technique.

- Write any two brand names available in the market.

- State any one feature of convenience goods.

- Toothpaste is packed in a tube is an example of which type of packing.

- Which concept of Marketing suggests that the organisation should earn profit through volume of production.

- Name any two products which are subject to process of grading.

- Name the element of marketing mix which makes the product available to the target customers.

- Explain any three advantage of labelling to the customers.

- Differentiate between marketing and selling on the basis of :

(i) Meaning (ii) Scope (iii) Objectives.

- Write any four difference between advertising and personal selling.

- State any three advantages of sales promotion.

- Explain any four functions of packing.

- Advertising confuses rather than helps Do you agree? Give reasons.

- Explain the various functions of marketing management.

- Explain four important elements of marketing mix.

- Explain any four factors on which the choice of channels of distribution depend.

- Advertising encourges sale of inferior products Do you agree? Give reasons.

- Why public relations are important for an organisation.

- Explain four qualities of a good brand.

- Explain three methods of sales promotion.

-

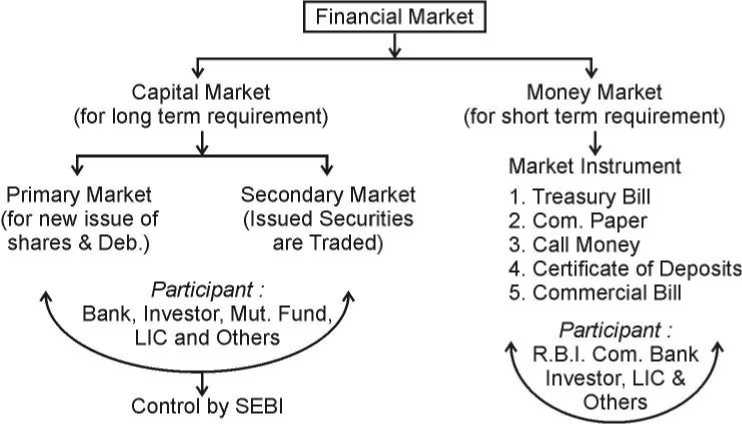

Notes of Financial Market Business Studies Class 12

UNIT 10

Introduction :

Financial Market is a market for creation and exchange of financial assets like share, bonds etc. It helps in mobilising savings and channelising them into the most productive uses. It helps to link the savers and the investors by mobilizing funds between them. The person / Institution by which allocation of funds is done is called financial intermediaries.

Functions of Financial Market.

- Mobilisation of Savings and channeling them into the most productive

uses: Financial market facilitates the transfer of savings from savers to investors and thus helps to channelise surplus funds into the most productive use.

- Help in Price Determination : Financial Market helps in interaction of savers and investors which in turn helps in the determination of prices of the financial assets such as shares, debentures etc.

- Provide Liquidity to Financial Assets : Financial market ficilitate easy purchase and sale of financial assets. Thus, it provide liquidity to them so that they can be easily converted into cash whenever required.

- Reduce cost of transactions : Financial market provide valuable information about securities which helps in saving time, efforts and money and thus it reduces cost of transactions.

Money Market

It is a market for short term funds / securities whose period of maturity is upto one year. The major participants in the money market are RBI, Commercial Banks, Non-Banking Finance Companies, State Government, Large Corporate Houses and Mutual Funds. The main instruments of money market are as follows.

- Treasury Bills : They are issued by the RBI on behalf of the Central Government to meet its short-term requirement of funds. They are issued at a price which is lower than their face value and repaid at par. They are available for a minimum amount of Rs. 25,000 and in multiples thereof. They are also known as Zero Coupon Bonds.

- Commercial Paper : It is a short term unsecured promisory note issued by large and credit worthy companies to raise short term funds at lower rates of interest than market rates. They are negotiable instrument transferable by endorsement and delivery with a fixed maturity period of 15 days to one year.

- Call Money : It is short term finance repayable on demand, with a maturity period of one day to 15 days, used for interbank trasactions. Call Money is a method by which banks borrow from each other to be able to maintain the cash reserve ratio as per RBI. The interest rate paid on call money loans is known as the call rate.

- Certificate of Deposit : It is an unsecured instrument issued in bearer form by Commercial Banks & Financial institutions. They can be issued to

individuals, Corporations and companies for raising money for a short period ranging from 91 days to one year.

5. Commercial Bill : It is a bill of exchange used to finance the working capital requirements of business firms. A seller of the goods draws the bill on the buyer when goods are sold on credit. When the bill is accepted by the buyers it becomes a marketable instrument and is called a trade bill. These bills can be discounted with a bank if the seller needs funds before the bill maturity.

Capital Market :

It is a market for long term funds where debt and equity are traded. It consists of development banks, commercial banks and stock exchanges. The capital market can be divided into two part.

- Primary Market.

- Secondary Market

Primary Market :

It deals wth the new securities which are issued for the first time. It is also known as the new issues market. The investors in this market are banks, financial institutions, insurance companies, mutual funds and individuals. It has no fixed geographical location and only buying of securities take place in the primary market.

Secondary Market :

It is also known as the stock market or stock exchange where purchase and sale of existing securities take place. They are located at specified places and both the buying as well as selling of securities take place.

Methods of flotation of New Issues in the Primary Market

- Offer through Prospectus : It involves inviting subscription from the public through issue of prospectus. A prospectus makes a direct appeal to investors to raise capital through an advertisement in newspapers and magazines.

- Offer for sale : Under this method securities are offered for sale through intermediaries like issuing houses or stock brokers. The company sells securities to intermediary / broker at an agreed price and the broker resell them to investors at a higher price.

3.

Private Placements : It refers to the process in which securities are allotted to institutional investor and some selected individuals.

4.

Rights Issue : It refers to the issue in which new shares are offered to the existing shareholders in proportion to the number of shares they already possess.

5.

e-IPOs :- It is a method of issuing securities through on-line system of stock exchange. A company proposing to issue capital to the public through the on-line system of the stock exchange has to enter into an agreement with the stock exchange. This is called an e-initial public offer. SEBI registered brokers have to be appointed for the purpose of accepting applications and placing orders with the company.

Difference between Capital and Money Market.

Basis

Capital Market

Money Market

1.

Participants

Financial Institutions, Banks Corporate Entities, foreign investors and individuals

RBI, Banks, Financial Institutions & finance companies

2.

Instruments

Traded

Equity shares, bonds preference shares and debentures

Treasury Bills, trade bills, commercial paper, call money etc.

3.

Investment

outlay

Does not necessarily require a huge financial outlay

Entail huge sums of money as the instruments are quite expensive.

4.

Duration

Deals in medium & long term securities having maturity period of over one year.

Deals in short term funds having maturity period upto one year.

5.

Liquidity

Securities are less liquid as compared to money market securities.

Money market instruments are highly liquid.

6.

Expected

Return

High return

Low return

7.

Safety

Capital Market instruments are riskier both with respect to return and repayment.

Money market instrument are generally much safer with a minimum risk of default.

73

XII – Business Studies

Difference between Primary and Secondary Market

Basis

- Securities

- Price of Securities

- Purchase & Sale.

- Place of Market

- Medium

Primary Market

Only new Securities are traded.

Prices of securities are determined by the management of the company.

Securities are sold to investors directly by the company or through intermediary.

There is no fixed geographical location

Only buying of securities takes place

Secondary Market

Existing securities are traded.

Price are determined by the forces of demand and supply of the securities.

Investors exchange ownership of securities.

Located at specified places.

Both buying & the selling of securities can take place.

Stock Exchange / Share Markets

A stock Exchange is an institution which provides a platform for buying and selling of existing securities. It facilitates the exchange of a security i.e. share, debenture etc. into money and vice versa. Following are some of the important functions of a stock Exchange.

- Providing liquidity and Marketability to Existing Securities : Stock Exchange provide a ready and continuous market for the sale and purchase of securities.

- Pricing of Securities : Stock Exchange helps in constant valuation of securities which provide instant information to both buyers and sellers and thus helps in pricing of securities which is based on the forces of demand & supply.

- Safety of transaction : The members of a stock exchange are well regulated, who are required to work within the legal framework. This ensures safety of transactions.

- Contributes to Economic Growth : Stock exchange provide a platform by which saving get channelised into the most productive investment proposals, which leads to capital formation & economic growth.

- Spreading of Equity cult : Stock exchange helps in educating public about investments in securities which leads to spreading of Equity culture.

6. Providing scope for speculation : Stock exchange provides scope within the provisions of law for speculation in a restricted and controlled manner.

Trading Procedure on a Stock Exchanges.

- Selection of Broker : In order to trade on a stock Exchange first a broker is selected who should be a member of stock exchange as they can only trade on the stock exchange.

- Placing the order : After selecting a broker, the investors specify the type and number of securities they want to buy or sell.

- Executing the order : The broker will buy or sell the securities as per the instructions of the investor.

- Settlement : Transactions on a stock exchange may be carried out on either cash basis or a carry over basis (i.e. badla). The time period for which the transactions are carried forward is referred to as accounts which vary from a fortnight to a month. All transactions made during one account are to be settled by payment for purchases and by delivery of share certificates, which is a proof of ownership of securities by an individual.

Earlier trading on a stock exchange took place through a public outcry or aution system which is non replaced by an online screen based electronic trading system. Moreover, to eliminate, the problems of theft, forgery, transfer delays etc an electronic book entry from a holding and transferring securities has been introduced, which is called process of dematerialisation of securities.

National Stock Exchange of India (NSE)

NSE was set up by leading financial institutions, banks, insurance companies and other financial intermediaries in 1992 and was recognised as a stock exchange in April 1993. It has provided a nation wide screen based automated trading system with a high degree of transparency and equal access to investors irrespective of geographical location. NSE was set up with the following objectives.

- Establishing a nation-wide trading facility for all types of securities.

- Ensuring equal access to investors all over the country through an appropriate communication network.

- Enabling shorter settlement cycles and book entry settlements.

- Providing a fair, efficient and transparent securities market using electronic trading system.

- Meeting international bench marks & standards.

NSE provides trading in following two segments :

- Whole sale Debt Market Segment which provide platform for a wide range of fixed income securities such as Government Securities, treasury bills, state development loans, PSU bonds etc.

- Capital Market Segment which provide platform for equity shares, preference shares, debentures etc. as well as retail Govt. securities.

Over the Counter Exchange of India (OTCEI)

OTCEI was promoted by UTI, ICICI, IDBI, IFCI, LIC, GIC, SBI Capital Markets and can Bank Financial Services. It is a place where buyers seek sellers and vice-versa and then attempt to arrange terms and conditions for purchase / sale acceptable to both the parties. It is fully computerised, transparent, single window exchange which provide quicker liquidity to securities at a fixed and fair price, liquidity for less traded securities. Following are the advantages of OTC Market.

- It provides a trading platform to smaller and less liquid companies.

- It is a transparent system of trading with no problem of bad or short deliveries.

- Family concerns & closely held companies can go public through OTC.

- Dealer can operate both in new issues & secondary market at their options.

- It is cost effective as there is a lower cost of new issues and lower expenses of servicing the investors.

Difference beteen NSEI and OTCEI

Basis

NSEI

1.

Establishment

1992

2.

Settlement

within 15 days

3.

Security

In whole sale debt

Traded

Market segment Treasury

OTCEI

1990

within 7 days Equity, debentures etc.

bill, PSU Bonds etc & In Capital Market segment equity shares, preference shares, debentures

4. Objectives To provide nation

wide, ringless transparent trading facility for all instruments.

To serve as an exchange for securities of small companies.

5. Size of the Paid up capital Paid up capital

company Rs. 3 Crore & above Rs. 30 Lakh & above.

Depository Services and D mat Accounts :

Keeping in the mind the difficulties to transfer of shares in physical form SEBI has developed a new system in which trading in shares is made compulsory in electronic form Depository services and D Mat Account are very basis of this system.

Depository Services :

Now a days on line paper-less trading in shares of the company is compulsory in India. Depository services is the name of that mechanism. In this system transfer of ownership in shares take place by means of book entry without the physical delivery of shares. When a investor wants to deal in shares of any company he has to open a D Mat account. There are four players who participate in this system.

- The Depository : A depository is an institution which hold the shares of an investor in electronic form. There are two depository institution in India these are NSDL and CDSL.

- The Depository Participant : He opens the Account of Investor and maintains securities records.

- The Investor : He is a person who wants to deal in shares whose name in recorded.

- The Issuing Company : That organisation which issue the securities. This issuing company send a list of the shareholders to the depositories.

D Mat Accounts :

In this process a shares certificates converted its physical form to electronic form and credited the same number of holding to D mat A/c.

Benefits of D Mat Account :

- Reduces of paper work.

- Elimination of problems on transfer of shares such as loss, theft and delay.

- Exemption of stamp duty when transfer of shares.

- The concept of odd lot stand abolished.

- Increase liquidity through speedy settlement.

- Attract foreign investors and promoting foreign investment

Depository System Parallel to Banking System

The depository system in parallel to the Banking System. A bank holds cash in account the depository hold shares in account. The transfer of cash and shares take place with-out the physical handling of cash or shares.

Securities and Exchange Board of India (SEBI)

SEBI was established by Government of India on 12 April 1988 as an interim administrative body to promote orderly and healthy growth of securities market and for investor protection. It was given a statutory status on 30 January 1992 through an ordinance, which was later replaced by an Act of Parliament known as the SEBI Act, 1992.

Objectives of SEBI

- To regulate stock exchange and the securities market to promote their orderly functioning.

- To protect the rights and interests of investors and to guide & educate them.

- To prevent trade malpractices such as internal trading.

- To regulate and develop a code of conduct and fair practices by intermediaries like brokers, merchant bankers etc.

Function of SEBI

Regulatory Functions

- Framing Rule & Regulations

- Registrations of broker & sub-brokers

- Registration of collective investment schemes & mutual funds.

- Regulation of Stock Brokers, portfolio exchanges, underwriters & Merchant Bankers

- Regulation of task over bids by companies.

- Levying fee or other charges as per Act.

1.

2.

3.

4.

5.

Development Functions

Training of intermediaries Conducting Research & Publishing useful information.

Undertaking measures to develop capital market by adapting flexible approach. Educating Investors to broader their understanding Permitting internet trading through registered stock brokers

Protective Functions

- Prohibiting of frandulent & unfair trade practices.

- Check on insider trading.

- Ensure investors protection.

- Promote fair practice & code of conduct in securities market.

- Check on price rigging.

- Check on preferential allotment.

One Marks Questions :

1.

What is the maturity period of a commercial Paper?

2.

What is a Treasury Bill?

3.

AB Ltd. has sold 1 lakh equity shares of Rs. 10 each at Rs. 12 per

share

to an investment banker, who offered them to the public at Rs. 20 Identify the method of flotation.

each.

4.

State any two instruments of Capital Market.

5.

Who act as the watchdog of Security Market in India?

6.

Who is the Borrowers of call money?

7.

What is the other name of Zero coupon Bodn?

8.

Who issues the treasury Bill?

9.

What is the other name of Primary Market?

10.

What is a Prospectus?

11.

What is Dematerialization?

12.

What is the minimum amount of Treasury Bill?

13.

What is D Mat A/c?

14.

Write one benefit of D Mat Account?

Three / Four Marks Questions

1.

State the various protective functions of SEBI.

2.

What is money market? Explain its three instruments.

3.

What is meant by commercial paper & certificate of Deposit?

4.

Distinguish between NSEI and OTCEI on following basis.

- Size of the company

- Securities traded.

- Settlement

- Objective.

5.

State any four regulatory functions of the SEBI.

6.

Make difference between Primary and Secodary Market.

79 XII – Business Studies

Five/ Size marks Questions.

- Explain any five / six functions of stock exchange.

- Why was SEBI set up? State its development functions.

- Explain any five methods of floating new issues in the primary market.

- Explain the trading procedure on a stock exchange.

- Distinguish between capital market and money market on the following

basis.

a)

Participants

b)

Instruments Traded.

c)

Duration of Securities Traded.

d)

Expected Return

e)

Safety

f)

Liquidity.

- Primary Market contribute to capital formation directly Secondary Market does so indirectly Explain.

- You are finance expert. Your father feels that there is no difference between Primary Market and Secondary Market. Where do you differ with him. How would you convince him. Give reasons in support of your answer.

- What are the benefits of depository services and D Mat Account.

- Explain the constituents of depositry services.

- Mohan wants to sell 50 shares of Tata Motor. Explain the trading procedure of shares.

-

Notes of Financial Management Business Studies Class 12

UNIT 9

Money required for carrying out business activities is called business finance. Finance is needed to establish a business, to run it, to modernise it, to expand or diversify it.

Finanicial management is the activity concerned with the planning, raising controlling and administering of funds used in the business. It is concerned with optimal procurement as well as usuage of finance. It aims at ensuring availability of enough funds whenever required as well as avoiding idle finance.

The Main Objective of Financial Management is to maximise shareholder s wealth, for which achievement of optimum capital structure and proper utilisation of funds is a must.

Every company is required to take three main financial decisions which are as follow:

It relates to how the firm s funds are invested in different assets. Investment decision can be long-term or short term. A long term investment decision is called capital budgeting decisions which involve huge amounts of investments and are irreversible except at a huge cost while short term investment decisions are called working capital decisions, which affect day to day working of a business.

It relates to the amount of finance to be raised from various long term sources. The main sources of funds are owner s funds i.e. equity / share holder s funds and the borrowed funds i.e. Debts. Borrowed funds have to be repaid at a fixed time and thus some amount of financial risk (i.e. risk of default on payment) is there in debt financing. Morever interest on

borrowed funds have to be paid regardless of whether or not a firm has made a profit. On the other hand shareholder funds involve no commitment regarding payment of returns or repayment of capital. A firm mixes both debt and equity in making financing decisions.

Dividend refers to that part of the profit which is distributed to shareholders. A company is required to decide how much of the profit earned by it should be distributed among shareholders and how much should be retained. The decision regarding dividend should be taken keeping in view the overall objective of maximising shareholder s wealth.

The process of estimating the fund requirement of a business and specifying the sources of funds is called financial planning. It ensure that enough funds are available at right time so that a firm could honour its commitments and carry out, its plans.

Importance of Financial Planning

- To ensure availbility of adequate funds at right time.

- To see that the firm does not raise funds unnecessarily.

Factors affecting Investment Decisions / Capital Budgeting decisions

- Cash flows of the project : The series of cash receipts and payments over the life of an investment proposal should be considered and analysed for selecting the best proposal.

- Rate of Return : The expected returns from each proposal and risk involved in them should be taken into account to select the best proposal.

- Investment Criteria Involved : The various investment proposals are evaluated on the basis of capital budgeting techniques. Which involve calculation regarding investment amount, interest rate, cash flows, rate of return etc.

Factors Affecting Financing Decision

- Cost :- The cost of raising funds from different sources are different. The cheapset source should be selected.

- Risk :- The risk associated with different sources is different, More risk is associated with borrowed funds as compared to owner s fund as

interest is paid on it and it is rapaid also, after a fixed period of time or on expiry of its tenure.

3.

Flotation Cost :- The cost involved in issuing securities such as broker s commission, underwriters fees, expenses on prospectus etc is called flotation cost. Higher the flotation cost, less attractive is the source of finance.

4.

Cash flow position of the business :- In case the cash flow position of a company is good enough then it can easily use borrowed funds.

5.

Control Considerations : In case the existing shareholders want to retain the complete control of business then finance can be raised through borrowed funds but when they are ready for dilution of control over business, equity can be used for raising finance.

6.

State of Capital Markets : – During boom, finance can easily be raised by issuing shares but during depression period, raising finance by means of debt is easy.

Factors affecting Dividend Decision :

1.

Earnings : – Company having high and stable earning could declare high rate of dividends as dividends are paid out of current and past earnings.

2.

Stability of Dividends : Companies generally follow the policy of stable dividend. The dividend per share is not altered/changed in case earning changes by small proportion or increase in earning is temporary in nature.

3.

Growth Prospects : In case there are growth prospects for the company in the near future them it will retain its earning and thus, no or less dividend will be declared.

4.

Cash Flow Positions : Dividends involve an outflow of cash and thus, availability of adequate cash is foremost requirement for declaration of dividends.

5.

Preference of Shareholders : While deciding about dividend the preference of shareholders is also taken into account. In case shareholders desire for dividend then company may go for declaring the same.

6.

Taxation Policy : A company is required to pay tax on dividend declared by it. If tax on dividend is higher, company will prefer to pay less by way of dividends whereas if tax rates are lower then more dividends can be declared by the company.

65 XII – Business Studies

Capital structure refers to the mix between owner s funds and borrowed funds. It will be said to be optimal when the proportion of debt and equity is such that it results in an increase in the value of the equity share. The proportion of debt in the overall capital of a firm is called financial Leverage or capital gearing. When the proportion of debt in the total capital is high then the firm will be called highly levered firm but when the proportion of debts in the total capital is less then the firm will be called low levered firm.

Factors affecting Capital Structure.

- Cash flow position : In case a company has strong cash flow position then it may raise finance by issuing debts.

- Interest Coverage Ratio : It refers to the number of times earning before interest and taxes of a company covers the interest obligation. High Interest coverage ratio indicate that company can have more of borrowed funds.

- Return on Investment : If return on investment is higher than the rate of interest on debt then it will be beneficial for a firm to raise finance through borrowed funds.

- Flotation Cost : The cost involved in issuing securities such as brokers commission, under writers fees, cost of prospectus etc is called flotation cost. While selecting the source of finance flotation cost should be taken into account.

- Control : When existing shareholders are ready to dilute their control over the firm then new equity shares can be issued for raising finance but in reverse situation debts should be used.

- Tax Rate : Interest on debt is allowed as a deduction, thus in case of high tax rate debts are prefered over equity but in case of low tax rate more preference is given to Equity.

In addition, cost of debt, cost of equity, flexibility, risk consideration etc are other factors affecting capital structure.

Fixed Capital and Factors affecting Fixed Capital

Fixed capital refers to investment in long-term assets. Investment in fixed assets is for longer duration and they must be financed through long-term sources of capital. Decisions relating to fixed capital involve huge capital/ funds and are not reversible without incurring heavy losses. The factors affecting the requirement of fixed capital are as follows.

- Nature of Business : Manufacturing concern require huge investment in fixed assets & thus huge fixed capital is required for them but trading concern needs less fixed capital as they doesn t require to purchase plant and machinery etc.

- Scale of Operations : An organisation operating on large scale require more fixed capital as compare to an organisation operating on small scale.

- Choice of Technique : An organisation using capital intensive techniques require more investment in plant & machinery as compare to organisation using labour intensive techniques.

- Technology upgradation : Organisations using assets which become obsolete faster require more fixed capital as compare to other organisations.

- Growth Prospects : Companies having higher growth plan require more fixed capital. In order to expand production capacity more plant & machinery are required.

- Diversification : In case a company go for diversification then it will require more fixed capital to invest in fixed assets like plant and machinery.

Working Capital and Factors affecting working capital

Working Capital refers to the capital required for day to day working of an organisation. Apart from the investment in fixed assets every business organisation needs to invest in current assets, which can be converted into cash or cash equivalents within a period of one year. They provide liquidity to the business. Working capital is of two types : Gross working capital and Net working capital Investment in all the current assets is called gross working capital whereas the excess of current assets over current liabilities is called net working capital. Following are the factors which affect working capital requirements of an organisation.

- Nature of Business : A trading organisation needs a lower amount of working capital as compared to a manufacturing organisation as trading organisation undertake no processing work.

- Scale of operations : – An organisation operating on large scale will require more inventory and thus, its working requirement will be more as compared to small organisation.

3.

Business Cycle ; In the time of boom more production will be undertaken and so more working capital will be required during that time as compared to depression.

4.

Seasonal Factors : During peak season demand of a product will be high and thus high working capital will be required as compared to lean season.

5.

Credit allowed : If credit is allowed by a concern to its customers than it will require more working capital but if goods are sold on cash basis than less working capital is required.

6.

Credit availed : If a firm is able to purchase raw material on credit from its suppliers then less working capital will be required.

In addition to above growth prospects, operating efficiency, inflation, level of competition etc also affect working capital requirement.

Trading on Equity :

It refers to the increase in profit earned by the equity shareholders due to the presence of fixed financial charges like interest. Trading on equity happen when the rate of earning of an organisation is higher than the cost at which funds have been borrowed and as a result equity shareholders get higher rate of dividend per share.

One Mark Questions

1.

Name the concept which increases the return on equity shares with a change in the capital structure.

2.

A company wants to establish a new unit in which a machinery of worth Rs. 10 lakhs is involved. Identify the type of Decision involved in financial management.

3.

What is the primary aim of financial management?

4.

What is financial risk?

5.

Why service-industry require less working capital?

Three / Four Marks Questions

1.

What are capital budgeting Decisions? Explain three factors affecting capital budgeting Decisions.

2.

What is meant by fiancial planning? Explain its objectives.

3.

Explain the meaning and objectives of financial management.

68 XII – Business Studies

- Explain financial Leverage and Trading on Equity.

- Explain the various financial decisions taken by an organisation.

- Define capital structure. Explain five factors affecting it.

- Explain six factors affecting fixed capital of a concern.

- Give the meaning of working capital. Explain any five factors determing working capital requirements.

- What is meant by Divident Decision? State & Explain five factors affecting the Dividend Decision.

- Suggest working capital requirement for following manufacturing concern:

a)

Bread

b)

Sugar

c)

Coolers

d)

Motor Car

e)

Locomotive

f)

Furniture on Specific order.